And why the Shiller PE Ratio is broken.

Look back metrics for valuing markets say that the stock market is overvalued. But there is a big problem with lagging metrics like Shiller PE (the CAPE Ratio), the growth rate of company earnings has quadrupled over the last three decades.

If we allow for the fact earnings growth rates have significantly increased as a result of technology, stocks are not as overvalued as you might think.

Shiller PE says we are overvalued

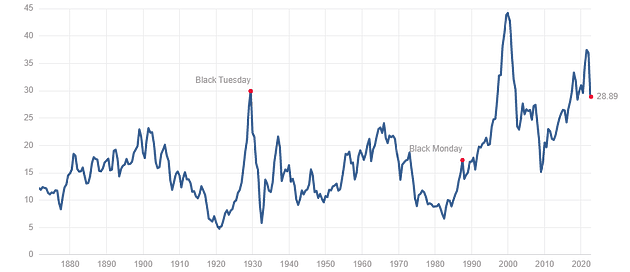

The Shiller PE (also known as the CAPE Ratio) is a market price-earnings ratio often used as a yardstick to assess relative over- and under-valuation of equities. It takes the ratio of the S&P500 to its inflation-adjusted earnings from the previous 10 years.

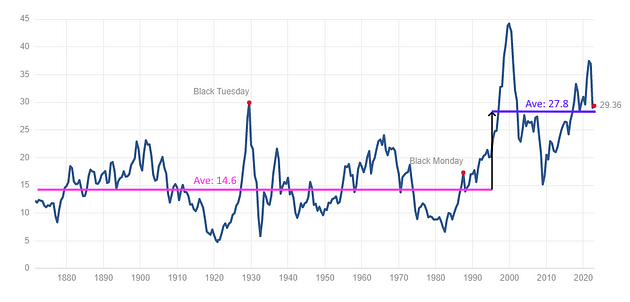

With a value of 29, the Shiller PE is still measuring higher valuations today than the peak of 1929 and 2008. A simplistic conclusion here would be that a 50% drop in the Shiller PE would not be out of the ordinary for stocks to reach equilibrium. Such a PE compression to the mean would likely require stock prices to collapse by a comparable order of magnitude. That sounds like bad news for stock investors.

But it’s not that simple.

Since 1995, for the last 27 years, the average Shiller PE has been 27.8.

But for the 100 years before that, the average Shiller PE was 14.6.

What happened in 1995?

There are only two ways to explain this doubling in valuations for the last three decades. Either the markets have been growing in an ever inflating bubble, or there was drastic economic change over that period.

The reality lies somewhere in the middle.

Technology + Metcalf’s Law = the game changer

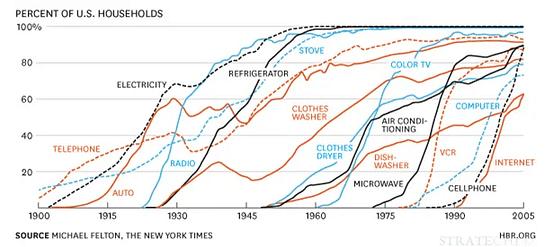

The last 50-years has not only been incredibly peaceful, but we saw globalization and technology take a giant leap forward. We had the invention of modern day computers and the internet; the latter of which went exponential in the mid-90s and drove the world closer together.

A logical argument can be made that technology (the internet especially) has created new network effects that result in higher earnings of businesses (think Amazon, Google, Microsoft) and people (solopreneurs, podcasters, dropshippers and more). This is a result of the exponential benefits associated with network growth, also known as Metcalf’s law.

In short — Metcalf’s law says the value of a network grows with the square of each additional node (user/connection) added. In layman’s terms, the internet has shrunk economic boundaries and exponentially increased the potential impact and value any individual person or entity can derive in business today.

Under such a massive technological revolution, business earnings have also been moving along an S-curve.

As a result, one could argue that the trailing 10 years of earnings that the Shiller PE Ratio uses is too lagging and is not representative of current and future profits that modern businesses generate.

And there is quantifiable evidence for this.

Baseline Growth is 4X higher now

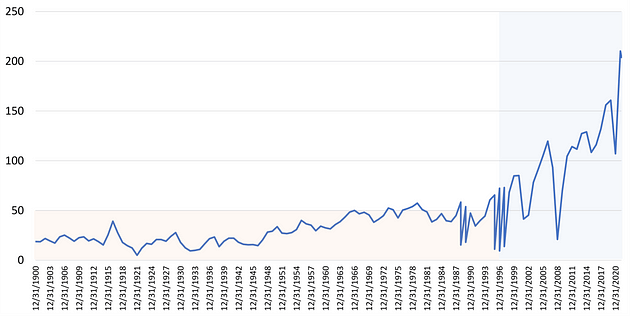

Since 1995, real earnings per share have increased over 400%.

It took almost 100 years to achieve that same growth rate in earnings before the mid-90s. This generation has indeed seen S&P500 earnings grow 300% faster annually compared to the prior century.

This completely explains the higher Shiller PE scores over the last three decades. By definition, Shiller PE uses data which is on average 5 years old, but earnings have been growing at an astounding 15% p.a., versus just 4% p.a. for the prior century. This isn’t just a one off phenomenon, this is how baseline growth has been for the last three decades.

By simple math: compounding 15% p.a. over 5 years results in a 100% increase. In other words, the average earnings used in the Shiller PE ratio should be expected to be almost 50% lower than actual earnings today.

Not overvalued after all

So the denominator of Shiller PE (earnings) is using a value half of what businesses were actually earning at any point in time in the last three decades.

The implication?

Shiller PE values are effectively double what they would be if earnings were not lagged and therefore the market is not nearly as overvalued as the Shiller PE would suggest.

Therefore for the post 1995 era, we should expect stocks to show valuations double their prior long-term average.

Put another way, if asset prices and current earnings stayed exactly the same for the next decade, the Shiller PE would fall by about half, as the divisor (10 year average earnings) slowly increases each year and plays catch up to reality.

When you think about it that way, equities don’t sound so overvalued after all.

Summary

Markets are not as overpriced as you may think. In fact, they are fairly valued.

The internet brought an era of 300% higher average annual earnings growth rates over the last three decades, which is skewing lagging valuation metrics like Shiller PE and CAPE Ratio and presenting an erroneous picture.

A Shiller PE of 28 today means equities are fairly valued based on historic growth.

Now it’s up to you to determine if you think historical growth rates are relevant going forward.