Welcome to Capriole’s Update #42. Where we consolidate the most important Bitcoin news, technicals and fundamentals into a 3-minute update.

Market Summary

Two major and positive events just unfolded in the Bitcoin space. Binance settled with the SEC, closing out a long period of market fear and pro-Bitcoin candidate Milei won the Argentinian election and vowed to disband their central bank. According to the press release “the closure of the Central Bank of the Argentine Republic (BCRA) is not a negotiable issue.” A country rife with inflation, Argentina is a case in point example of why Bitcoin was created. We are seeing more and more fractures in the fiat banking system globally, the outcomes and long-term consequences of these actions is clear to Bitcoiners. A tidal wave of liquidity is coming.

Technicals

High Timeframe Technicals: the situation remains much the same as last Update, with price continuing to consolidate above the 2021 monthly range support ($35K). Provided this level holds, our high-timeframe technical bias is bullish towards range high ($58K). On Daily timeframes, $42-45K remains the near-term Wyckoff target.

Zooming right in – a possible short-term scenario on the lower timeframes. All else equal, the side with the most tests typically breaks first. The vertical consolidation (diagonal line here) is getting very worn out. It would not be surprising to see it break first at least temporarily. Any closes above $38K will likely see a powerful new trend emerge to the upside.

Fundamentals

Fundamentals and on-chain data help us understand which way the probabilities are skewed at important inflections, and were critical to our navigation of this cycle and identification of the bottom at $16K.

We believe the full picture of fundamentals is best summarized by Capriole’s Bitcoin Macro Index, which we publish live with weekly updates here. This Index includes over 50 of the most powerful Bitcoin on-chain, macro market and equities metrics combined into a single machine learning model. This is a pure fundamentals-only value investing approach to Bitcoin. Price isn’t an input.

Bitcoin fundamentals exploded higher in the last 3 weeks, taking us to levels not seen since November 2020 and November 2016. Both of these historic periods immediately preceded the primary cycle rallies. Is this cycle one year early then? The growth rate in on-chain and macro data today is suggesting we are seeing adoption and value propagation at levels which we would normally expect after the Halving (April 2024).

It is highly likely that the more developed Bitcoin market today has learnt from the last three cycles and is taking action sooner. This is one of the reasons why I expect this cycle to be shorter in duration, with most of the price expansion likely to occur and complete in 2024.

Chart of the Week

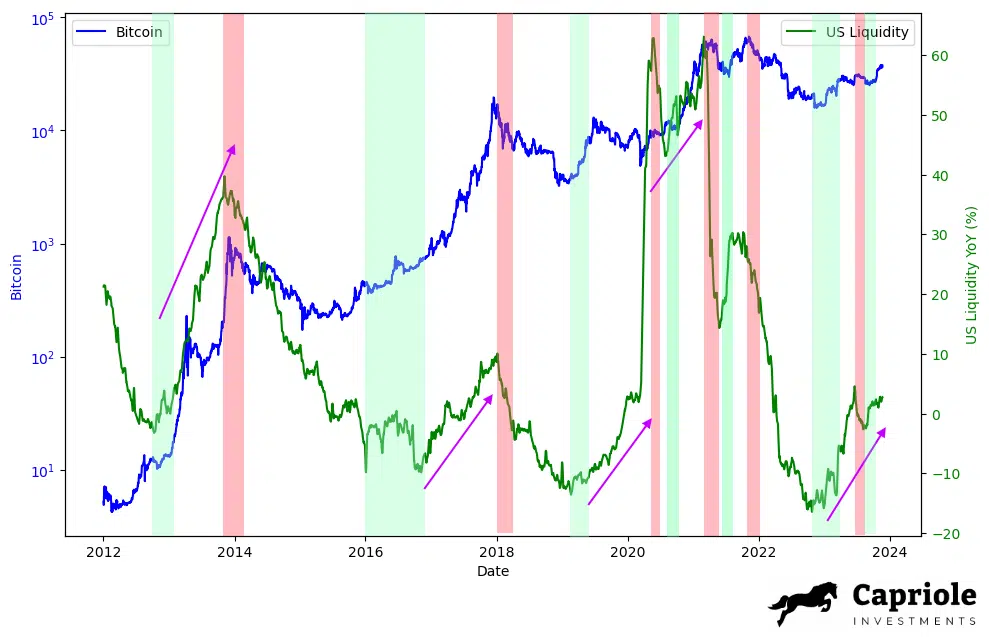

Introducing total US Liquidity to the Capriole Chart suite. Available to track live here.

Total US Liquidity includes the US Federal Reserve Balance Sheet assets, Reverse Repurchase Agreements (RRPs) and the US Treasury General Account (TGA). It can be considered a total measure for the relative Quantitative Easing (QE) versus Quantitative Tightening (QT) in the US economy.

Higher US Liquidity means more capital availability, and is strongly correlated with positive risk asset performance (Bitcoin and equities). When US Liquidity turns and trends down, it often marks a top for Bitcoin. The relationship is incredibly strong, take a look below. Turning points in the annual rate of change in US liquidity mark almost all cycle tops and bottoms.

Despite public appearances of “QT”, US Liquidity bottomed in November 2023 and has been trending up strongly and continues to do so today. Positive for Bitcoin.

Bottom-Line

All-in-all a continued and very positive picture for Bitcoin. Technicals and fundamentals are strongly aligned.

Probable catalysts on the mid-term horizon are very positive and include:

- ETF approvals

- Bitcoin Halving

- Lower interest rates

- Possible recession = more QE

Happy Thanksgiving!

Charles Edwards

Founder

2 Responses

Hi Charles, great article. In case of recession, how’d you position for potential liquidity crunsh scenario? Don’t want to see more than 50% haircut anymore. Thanks.

Thanks Jacob, It would depend on the scenario and data at the time. From the perspective of today though, liquidity is already trending positively per above, and this would increase significantly in any kind of recession/crash. Rates would also ease more than the market is expected at present. So there may be a short-term initial shock (if significant and unforeseen macro issues arise before they are addressed by the Fed); but my base case is that such an event on aggregate will be a significant net positive for Bitcoin, especially from Today’s price/value perspective. You can never know all the unknowns in advance, but for me the risk/reward is clearly skewed.