Mass Capitulation

This issue we deep dive into the many Bitcoin and macro metrics showing signs of capitulation. The raw count of evidence for cyclical capitulation today is immense. Each occurrence of these metrics is a rare event in itself. Together, they add to the increasing probability that we are in a high value Bitcoin accumulation zone.

Simply put, the Bitcoin fundamentals we have seen the last month are a rare gift.

July Highlights

Most of the bad news this month is simply a hangover of last month’s liquidations. We are starting to see the regulation hammer drop following the recent wave of blowups and surprisingly poor industry-wide risk management.

Perhaps the most exciting news this month is the Bank of International Settlements allowing banks to hold Bitcoin as a reserve asset. It’s Bitcoin’s first step to accessing traditional finance reserve asset rails. While 1% may not sound like much, with crypto it has always been “slowly, slowly; then all at once”.

Here’s this month’s crypto highlights:

The Good

- Bank for International Settlements is now allowing banks to hold up to 1% of their reserve assets in Bitcoin (source)

- Variant raises $450M for two new venture funds (source)

- Barclays snaps up stake in $2B cryptocurrency firm Copper (source)

- FTX in talks to buy South Korea’s Bithumb exchange (source)

- Hyosung America partners with DigitalMint to bring crypto transactions to their 175K ATMs in the US (source)

- Multicoin Capital announces new $430M venture fund (source)

- BlockFi agreed to an option to be acquired by FTX for up to $240M (source)

The Bad

- Tesla sells 75% of their Bitcoin holdings (source)

- Lender Babel Finance lost over $280M by trading customer funds (source)

- Lender Vauld owes $363M to retail investors after halting withdrawals (source)

- Hedge fund Three Arrows files for Chapter 15 bankruptcy (source)

- Broker Genesis files a $1.2B claim against Three Arrows Capital (source)

- Broker and lender Voyager filed for Chapter 11 bankruptcy protection (source)

- Lender Celsius files for Chapter 11 bankruptcy (source)

Regulation is Coming

- Crypto exchange Coinbase faces SEC probe over securities trading (source)

- Kraken under investigation for possible violation of US sanctions (source)

- G20 watchdog to propose first global crypto rules in October (source)

- EU agrees to tame cryptos ‘wild west’ with new rules including requirements to protect wallets and liability for lost assets (source)

- US Treasury develops framework for international crypto regulation (source)

- Singapore regulators considering more restrictive crypto policies (source)

- Putin bans digital asset payments for goods and services in Russia (source)

Invest in the Capriole Fund

The Capriole Fund is open to high net worth investors globally and accredited U.S. investors (including IRAs).

We accept new investors once a month.

Find out more.

Fundamental Overview

The Bitcoin Macro Index, Capriole’s autonomous fundamentals-only trading strategy, pivoted to Recovery in mid-July. This month, we exited a deep value region in Bitcoin. Such a value opportunity happens around just 1.6% of the time each cycle.

In other words, historically you only get roughly 23 days every 4 years to pick up Bitcoin at the prices we saw last month. This month also saw the single biggest recovery in on-chain fundamentals since 2021.

Macro Recovery. Bitcoin fundamentals are trending positively from a region of deep value. Source: Capriole Investments

The Macro Index Oscillator. Source: Capriole Investments

These rare value opportunities are one of the reasons Capriole increased its position in the Capriole Fund by 60% in June and we will increase it again by 25% this month.

The Macro Index profile and depth looks strikingly similar to January 2019, when Bitcoin was just $3.5K. Such a profile is indicative of a cyclical capitulation event for Bitcoin.

Signs of Capitulation

In Bitcoin, “Capitulation” is a broadly used term. It is generally associated with large price downdraws (50%+); a wipe out of leverage (and long positions generally) and a sharp decline in on-chain fundamentals to historically rare lows. Typical of these times are individuals and entities “giving up”, selling at a loss and walking away from Bitcoin temporarily or for good.

There’s a lot of pain across the market in capitulations. Sentiment is awful. Twitter goes radio silent (relatively). But capitulations flush out the excess and build the base for the next sustainable major advance. While we note many signs of Capitulation this month, things can always get worse before they get better. Markets can ‘base’ (trend sideways after a capitulation) for many months.

As investors we try to weigh the probabilities. Today those probabilities look very skewed to one side. Let’s take a look:

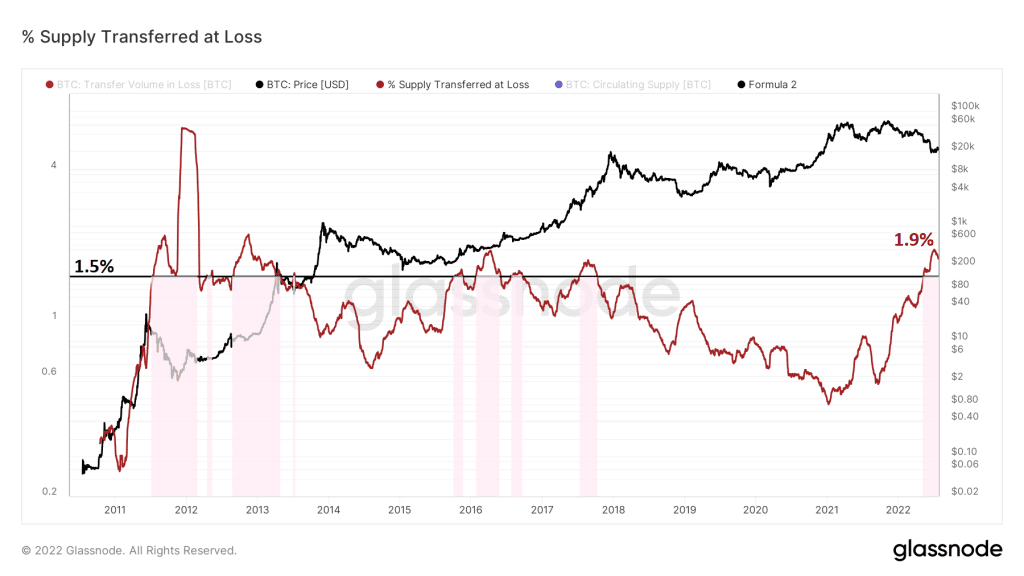

(1) Supply transferred at a loss peaks

The percentage of total supply transferred at a loss hit 1.9% last month. Historically, when this metric breaches 1.5% it demonstrates that a sizable portion of the market is experiencing pain. Most were also great accumulation zones.

The percentage of supply transferred at a loss breached 1.9% in July. Source: Capriole’s Glassnode Workbench

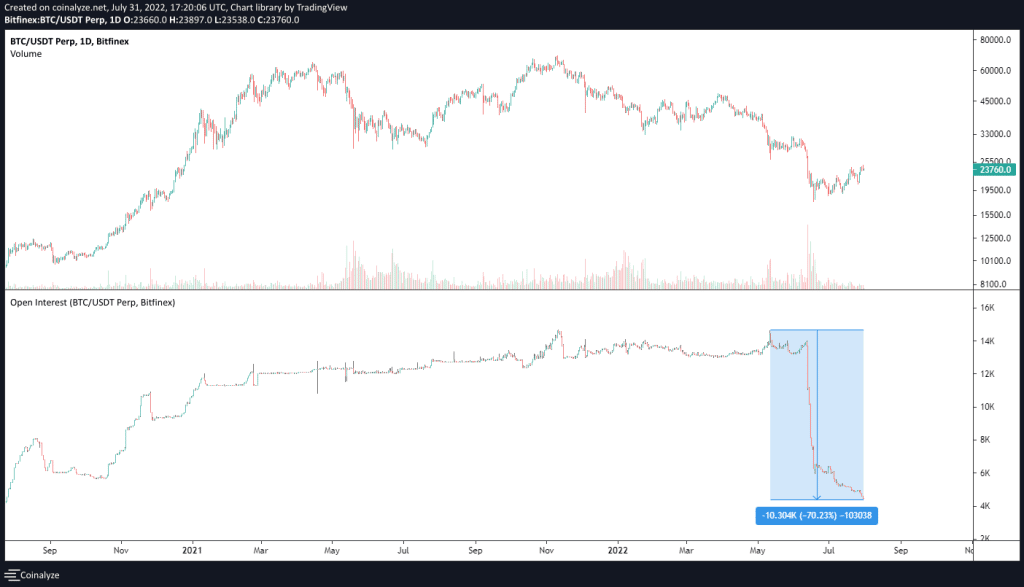

(2) BitFinex whales are dead

BitFinex, historically known as the home of whale traders, has seen its Bitcoin perpetual futures contracts Open Interest drop over 70% in the last 2 months. BitFinex whales have been wiped out.

BitFinex Open Interest is down a whopping 70% in 2 months. Source: Coinalyze

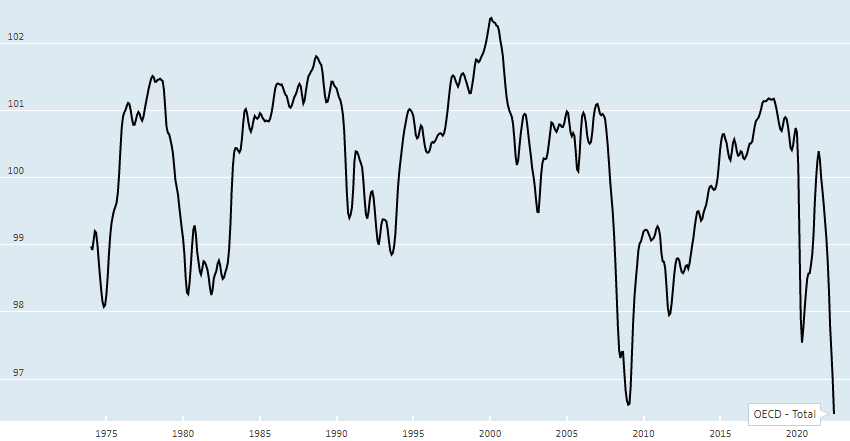

(3) Consumer confidence at an all time low

The Consumer Confidence Index (CCI) is a measure of consumer sentiment, expected household consumption and savings. CCI just hit an all time low. Lower than the March 2020 Corona Crash, lower than the 2008 Global Finance Crisis and lower than the high inflation period of the 1970s and 1980s.

Consumer Confidence Index (CCI) has hit an all time low. Source: OECD

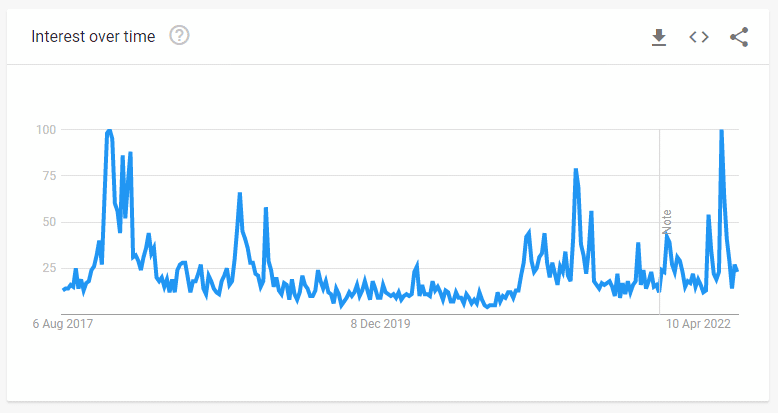

(4) Bitcoin is Dead

Worldwide google search volume for “Bitcoin dead” has hit its highest level on record this June. Like CCI above, such search volumes are a useful barometer for broader market sentiment. It was also around this time that we had the golden trio of Nouriel, Schiff and Cramer dump on Bitcoin. This trio has an uncanny ability to push bearish posts near Bitcoin bottoms.

Google trends for “Bitcoin Dead” hit a maximum. Source: Google

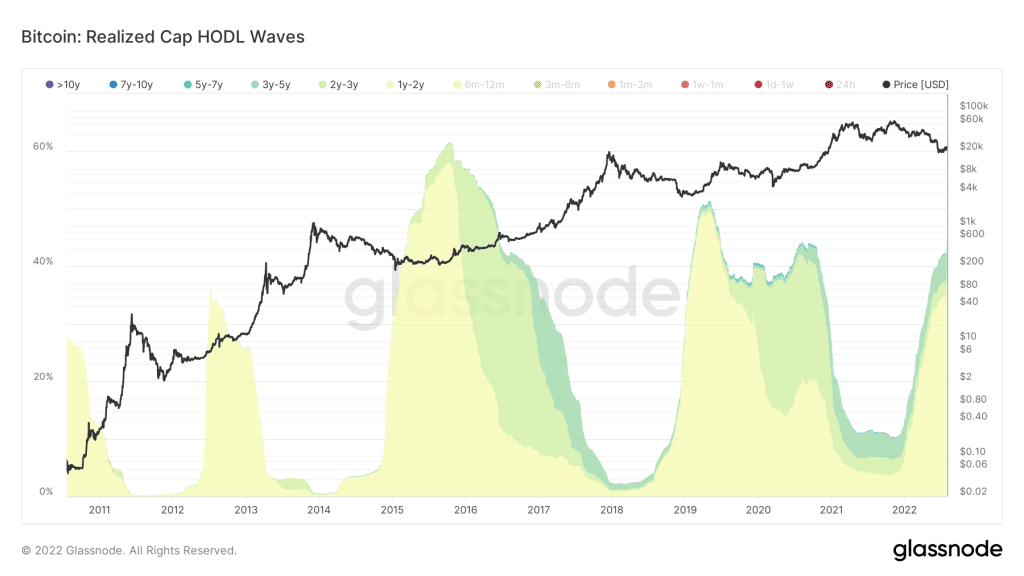

(5) Short-Term Holder Capitulation

In November 2021, 90% of the market was short-term holders. They had held Bitcoin for less than a year. Today these short-term holders represent just 58% of the market. The capitulation of short-term holders, and growing relative base of long-term holders, has historically built out the base of the bear-market.

Short-term holders have capitulated. Source: Glassnode

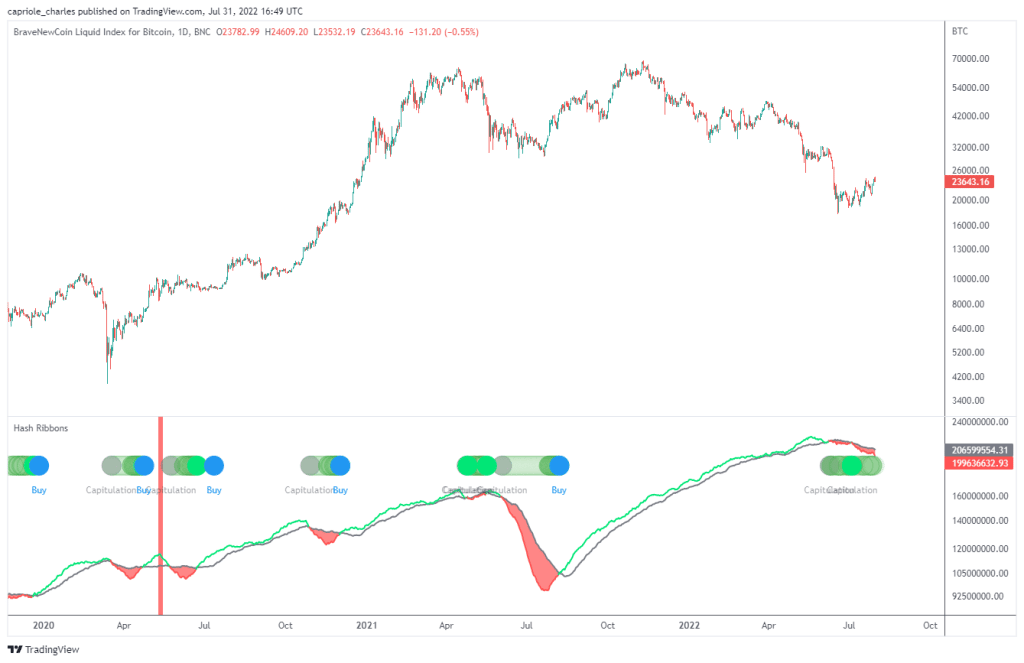

(6) Miner Capitulation

Our Hash Ribbon indicator shows that the current miner capitulation has been going for 53 days, and looks set to breach the two month mark in August. There have only been 3 other miner capitulations of longer duration:

- November 2011 – Bitcoin Price: $3

- December 2018 – Bitcoin Price: $3,500

- July 2021 – Bitcoin Price: $35,000

Extended mid-cycle miner capitulations (like today) have historically been some of the best times to accumulate Bitcoin.

We are in the 4th longest Bitcoin miner capitulation ever. Source: Capriole’s Hash Ribbon Indicator

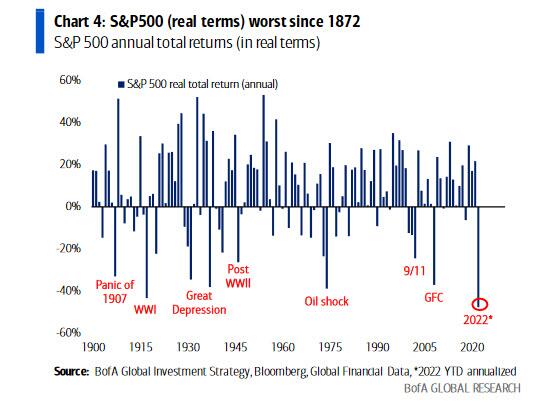

(7) The Worst Stock Market Real-Returns in 250 Years

We have just seen some of the worst inflation-adjusted downdraws in traditional markets in the last eight generations. Enough said.

The first half of 2022 saw the worst real returns for the S&P in 250 years. Source: BofA Global Research

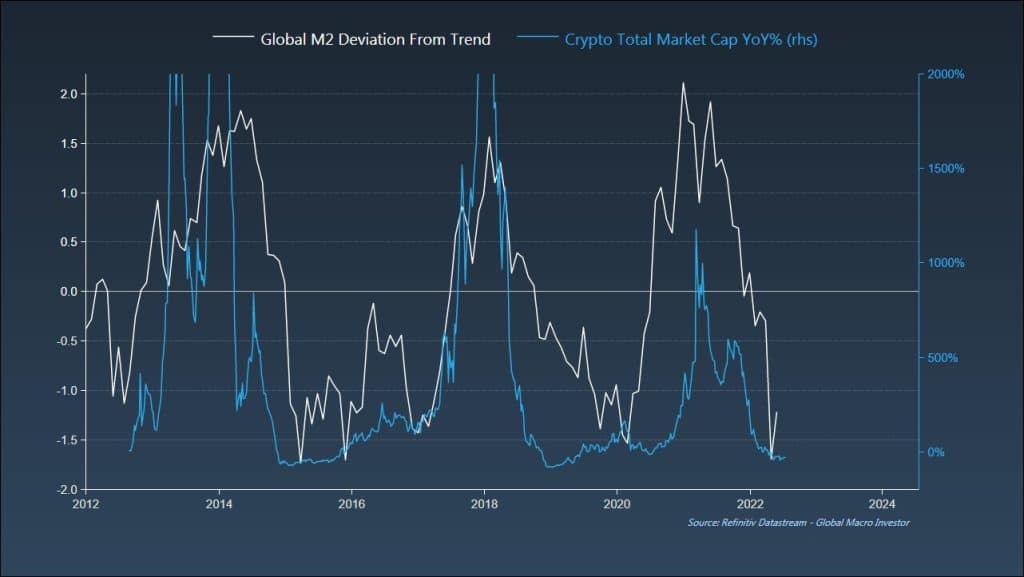

(8) Capitulation in Money Supply Growth

The growth rate of US M2 Money Supply is now approaching the lows of the last decade. Given the massive amount of debt in global systems, it’s not unreasonable to expect the current rate of tightening to start to decline here. As Raoul Pal notes, manufacturing is a leading indicator and also suggests a turn is now occurring.

Year-on-year growth in money supply has a strong correlation with the Crypto market cap. Source: Raoul Pal

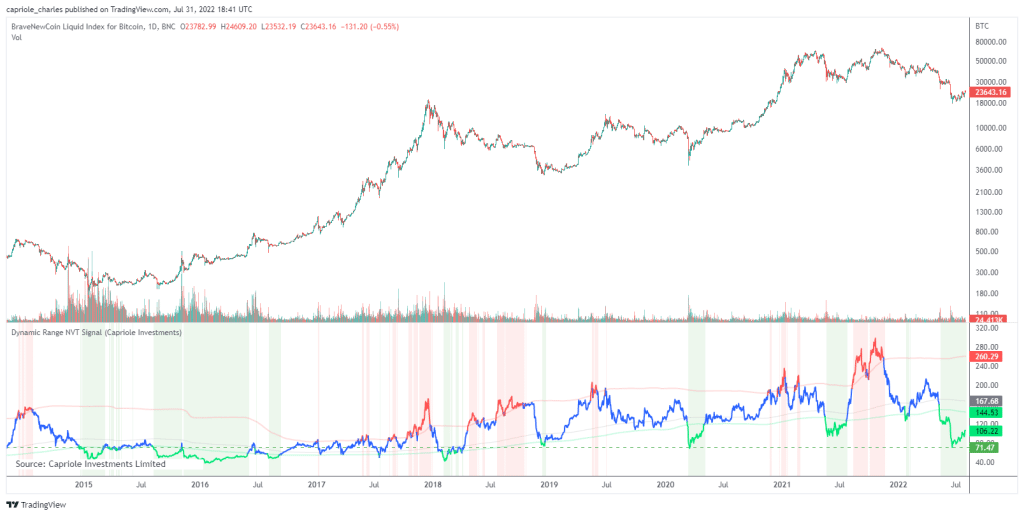

(9) Capitulation: DNVT

Dynamic Range Network Value to Transaction Value (NVT), Bitcoin’s “PE Ratio”, has capitulated to March 2020 levels, and levels lower than the December 2018 low. Most notable is the recent sharp up-tick. A sign of positive growth in a value region which can suggest a macro turning point.

Dynamic Range NVT has hit March 2020 lows and is now in recovery. Source: Capriole Investments / TradingView

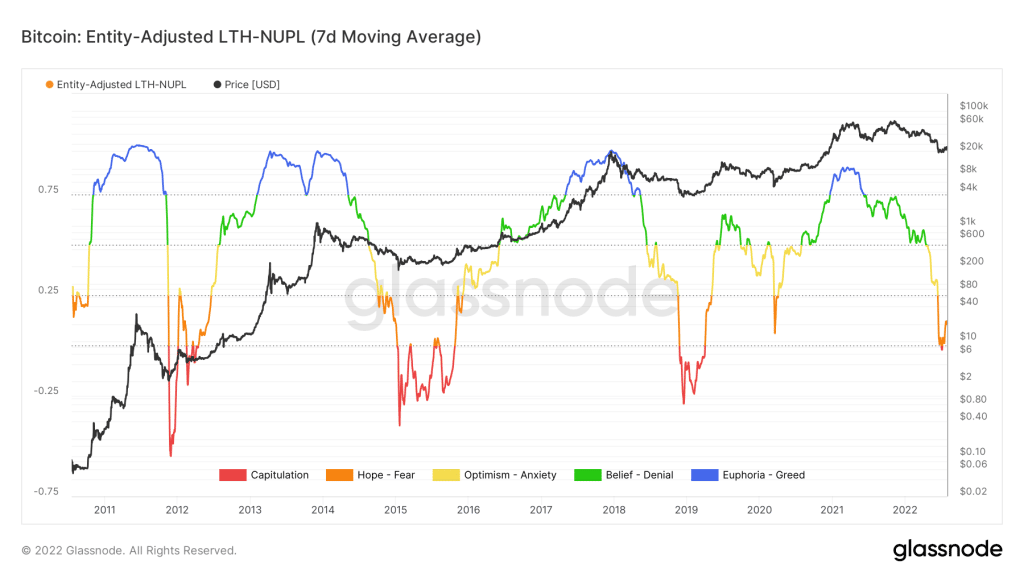

(10) More Capitulation: Entity Adjusted LTH-NUPL

Long-Term Holder Net Unrealized Profit and Loss (LTH-NUPL) hit the reset button this month. NUPL briefly went into negative territory, suggesting a high ratio of losing positions in the market. A more convincing bottom would see a longer duration of time spent in losses. Nonetheless, the sharp positive bounce in LTH-NUPL this month is classic of a bottom signal, at least locally.

Long-Term Holders saw a capitulation-like spike in losses this month. Source: Glassnode

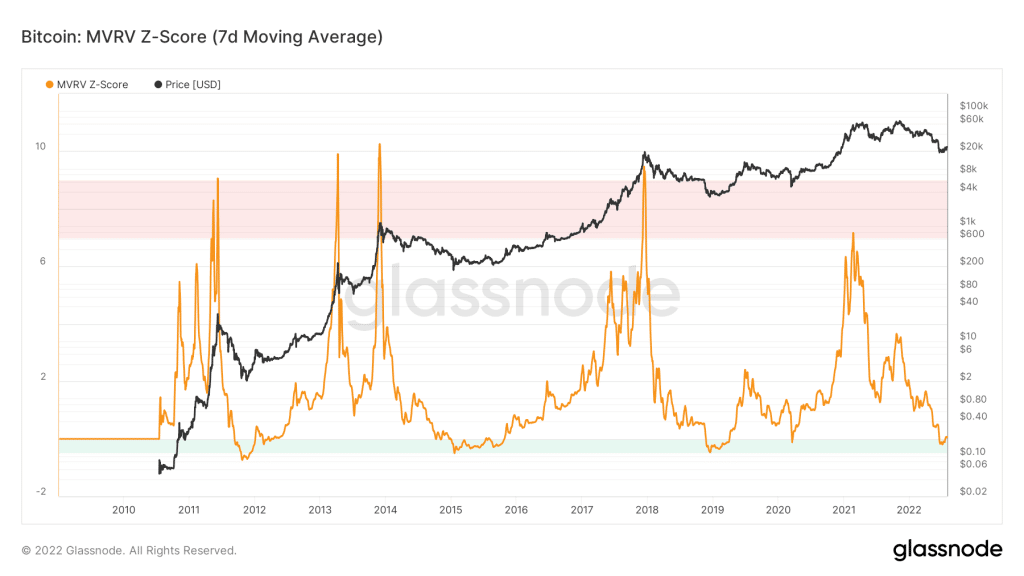

(11) Yet more capitulation: MVRV

Bitcoin’s Market Value to Realized Value (MVRV) entered the Capitulation zone in June but has now already left it (the green zone on the chart below). Like the above two charts, this suggests a strong positive growth out of a region of deep value.

MVRV showing deep value and recovery. Source: Glassnode

(12) The ultimate capitulation: Bankruptcies

Take a look at the July Highlights in the bad column this month. It’s plain to see that we have institutional level capitulation on our hands.

Leverage is one of the best indicators for relative over- and under-valuation in Bitcoin. Since December, retail and on-exchange leverage has been completely flushed out. This is normally a healthy sign for the bulls.

Enter Michael Saylor.

In August 2020, everything changed when Michael Saylor put Bitcoin on the MicroStrategy Balance Sheet. Progressively, MicroStrategy has opened massive leveraged long positions in Bitcoin. Many other entities quickly followed suit in their own way.

The problem with off-exchange leverage is it spreads like a virus causing a compounding effect on third parties. Kind of like how Selena Gomez explains CDOs in The Big Short.

Three Arrows Capital (3ac) took out multi-billion dollar loans and got liquidated in market volatility. Celsius took out customers’ assets as collateral and blew up. Voyager had 3ac debt on their books and subsequently filed for bankruptcy. This is just a sampling of a much bigger web of leverage interactions. Massive leverage unwinds like this create asset mispricing from forced selling. Forced selling from “off-exchange” leverage was a big driver of the 2022 Bitcoin collapse, and consideration for this obscure leverage is increasingly important as Bitcoin is institutionalized.

Nonetheless, we think the high count of bankrupt multi-billion-dollar entities in July is another great example of market capitulation.

The Bottom-line

The message is clear. In the last two months, we have seen capitulation in many of the most important Bitcoin metrics and across many of the largest digital asset institutions. Each sign of capitulation is a rare event in its own right. Together the 12 capitulation metrics shown paint a picture of opportunity.

Investing is a game of probabilities. While the situation can always get worse before it gets better, this confluence of capitulation events today provides a positively skewed outlook in Bitcoin’s long-term risk-reward profile. These are historically great times to allocate into Bitcoin and digital assets.

Remember that Bitcoin cyclical bottoms typically form over many months and this one is still quite young. We expect the next 6-12 months to represent perhaps the best opportunity to allocate into this market.

Content we love

- An update on our Hash Ribbon’s strategy, and what it means today, with Bitcoin Magazine

- Morgan Stanley on why the May lows might be the lows for the year

3 Responses

Thanks a lot

Great content, as usual.

Clear and well stated information. Thank you. Exciting times ahead.