Introducing a Bitcoin strategy which uses on-chain investor flows to outperform Bitcoin.

Introduction

In issue 23 of the Capriole Newsletter we introduced a new Bitcoin on-chain metric, SLRV Ribbons. This article dissects this strategy and shows the benefits of on-chain analysis for Bitcoin investing.

Based on backtests over the past 5 years, a simply long-or-cash portfolio using SLRV Ribbons would have generated 3X the returns of Bitcoin buy-and-hold and had 30% less drawdown.

What is SLRV?

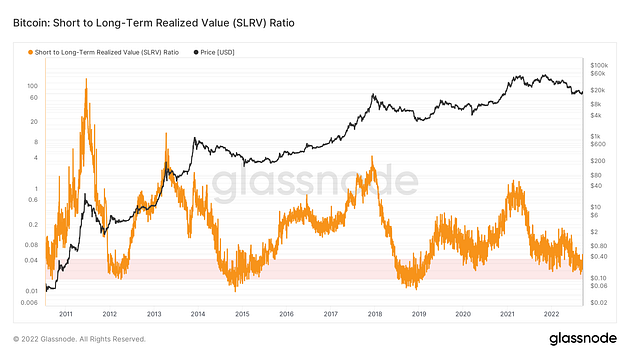

David Puell’s SLRV Ratio shows the percentage of Bitcoin in existence that was last moved within 24 hours, divided by the percentage that was last moved between 6–12 months ago.

When the ratio is high, it suggests there is a lot of short-term transactional activity versus long-term holding. This can be indicative of relative hype/adoption in the near-term.

Conversely, when the ratio is low it suggests there is little short-term activity and interest in Bitcoin and/or a growing base of larger than normal longer-term holders. Historically, readings below of 0.04 have coincided with the accumulation zone of prior Bitcoin bear markets.

Introducing SLRV Ribbons

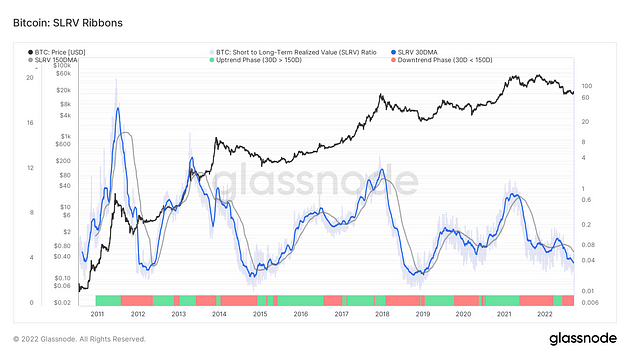

As a strategy, SLRV Ribbons is about as simple as it gets. SLRV Ribbons is the application of two 30- and 150-day moving averages (DMA) to the SLRV Ratio.

When the SLRV Ribbons has a bullish crossover (the 30DMA of SLRV Ratio > 150DMA of SLRV Ratio), it suggests we are exiting a period dominated by long-term holder activity, and are starting to see increased grassroots adoption.

Periods where Bitcoin’s long-term holders are relatively more active than short-term holders, have been associated with accumulation zones in the past. At the later stages of these accumulation zones, we start to see increasing short-term holder activity which often signals the beginnings of a new adoption cycle, as growing short-term holder activity is also associated with the creation of new Bitcoin wallets.

SLRV Ribbons help to solve the issue of changing relative value in metrics over time. While SLRV Ratios less than 0.04 have been great Bitcoin accumulation zones in the past, that may not necessarily be the case into the future as changing macroeconomic landscapes can shift value zones and render static historic levels redundant.

SLRV Ribbons allows for dynamic changes in fundamental value over time. It is possible that we see deeper discounts, or conversely shallower bottoms, in fundamental readings in the future. For this reason, the use of ribbons should provide a more robust way of identifying entry points on the SLRV Ratio in a changing, complex macroeconomic environment.

SLRV Ribbons can be tracked live on Glassnode here.

Performance

A simple strategy is to long Bitcoin at the SLRV Ribbon bullish crossover (30DMA > 150DMA), and go to cash at the bearish crossover (30DMA < 150DMA). We modelled this SLRV Ribbon strategy over the last 5 years ending 15 September 2022 and assumed a conservative combined slippage and trading fee figure of 0.5% per trade.

The 5-year backtest of SLRV Ribbons outperforms Bitcoin buy-and-hold with about 3X the cumulative returns, generating 1560% versus Bitcoin’s 440%. SLRV Ribbons also had about 30% less downdraw, with maximum downdraw of -59% versus Bitcoin -83%.

Limitations

This is a very simple, single metric on-chain strategy. As with all trading strategies there is no silver bullet. SLRV Ribbons won’t time perfect tops and bottoms. It will leave money on the table.

This article is not intended to provide a comprehensive trading and investment solution, but rather show that there is great value in using on-chain analytics in investing.

The world of on-chain analytics has advanced significantly over recent years, and a comprehensive approach should consider more than just one metric and use more advanced methods than outlined here. One example of a comprehensive on-chain strategy is our Bitcoin Macro Index.

Summary

A simple long-or-cash SLRV Ribbon strategy outperforms Bitcoin Buy-and-hold, with significantly improved risk-reward ratios.

SLRV Ribbons shows the ability of on-chain investment strategies to outperform Bitcoin.

Pure fundamentals-only approaches can work very well in crypto.

Live Indicator on Glassnode.

Disclaimer on Backtests

Any Backtest performance returns presented represent hypothetical returns and are meant to simulate how a strategy would have performed during the period shown had the strategy been implemented during that time. Backtested/simulated performance returns are hypothetical and do not reflect trading in actual accounts. Backtest returns are provided for informational purposes only to indicate historical performance had the strategy been implemented over the relevant time period. Backtested performance results have inherent limitations as to their relevance and use. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading, such as the ability to withstand losses or to adhere to a particular trading program in spite of trading losses, all of which can also adversely affect actual trading results. There are numerous other factors related to the markets in general and to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results, all of which can adversely affect actual trading results. Any and all of these factors mean that no representation is being made that strategies presented here will achieve performance similar to that shown, and in any case, past performance is no guarantee of future performance.