The New Regime

Welcome to Issue 28 of the Capriole Newsletter. We are quantitative investors in Bitcoin and digital assets. We deploy autonomous, risk-managed algorithms that trade 24/7 to outperform Bitcoin.

In our monthly newsletter we share important industry updates, explore major trends and review the technicals and fundamentals as they relate to Bitcoin. Our aim is to help dissect the noise, distill the most relevant data and help expand the field of digital asset analysis. You can read more about our open-source contributions here.

Bitcoin’s deep value is slipping away and in its place a new market structure is emerging.

A momentum driven shift. A new regime.

We’ve been singing the same tune since Bitcoin hit $20K six months ago: it has been trading in a region of deep cyclical and on-chain value. The difference today is we have just witnessed a significant momentum shift to the upside that looks symbolic of a market regime change. The 40% rally in January gives good odds that we have transitioned from a bear market into the early stages of a new bull market which will peak post 2024 halving.

In this issue we break down the weighty confluence of important value and momentum signals we have just seen confirm and why we believe this is the start of a new cyclical bull market.

Let’s dive in.

The Headlines

Here’s the most important news in Bitcoin and crypto this month.

The Good

- First nuclear-powered Bitcoin mining in the US is set to open in 2023. More

- Crypto infrastructure firm Blockstream raises $125M for Bitcoin mining. More

- French senators vote to ease crypto licensing regulation. More

- Swiss bank Cité Gestion became first private bank to tokenize its own shares. More

- Feds seize almost $700M of FTX assets in Sam Bankman-Fried criminal case. More

- FTX has recovered over $5B in cash and liquid cryptocurrencies, plans to sell non-strategic investments that had a book value of $4.B. More

- OKX publishes proof-of-reserves report showing $7.5B in ‘clean assets’. More

- National Australia Bank creates stablecoin called AUDN. More

- HashKey Capital closes Fund III with US$500M in commitments to build web3

- Binance CEO outlines ambitions to grow headcount by up to 30% in 2023. More

The Bad and the Ugly

- FTX-linked Alameda Research sues Voyager Digital for over $445M. More

- Fraudster Sam Bankman-Fried tried to influence witnesses. More

- Crypto Exchange Bithumb Raided in South Korean Price Manipulation Probe. More

- Genesis files for Chapter 11 bankruptcy and DCG parent company responds. More

- DCG owes subsidiary Genesis global over $1.65B. More

- Nexo pays $45M to settle SEC charges for failing to register lending products. More

- Nexo under investigation in Bulgaria for alleged money laundering, tax offenses. More

- Silvergate Capital misses estimates as crypto bank sees $1B quarterly loss. More

- Mass layoffs in crypto businesses: Coinbase cuts 20%, Crypto.com 20%, Gemini 10%, Huobi 20%, MatrixPort 10%, Blockchain.com 28%. More

- Mt. Gox repayment deadline pushed back to September. More

- Signature Bank will not handle transactions of less than $100K for Binance. More

Value Vs Momentum

Value Traps

Deep value is a fickle gift. You never know how long an asset can remain in a trough of bargain basement prices.

If a period of deep value lasts too long, an asset becomes known as a “value trap” – an asset that seems to stay at perpetually discounted prices and multiples. Value traps usually result from changing world conditions and technological advancement that means traditionally strong companies and sectors have a diminished return potential in the “new era”. The tech sector broadly has rendered many once blue chip stocks and sound businesses poor long-term investments. Value traps result from diminishing future growth in revenues/profits or from use of larger valuation discount factors due to increasing business risk. Think of the classic high revenue storefront retailers like Bed Bath & Beyond which has failed to adapt to the new online retail world. Other value traps include perpetually discounted markets due to perceived risk, like Russian oil companies which traded at PEs of 3-5 for many years, well before the Ukrainian war started.

The value trap effect is worsened by the self-fulfilling effect of sentiment. For most investors the pain of loss, stagnating asset prices and the opportunity cost of other appreciating assets causes them to throw in the towel on deep value assets. They can’t take the lack of performance any more. Enter the capitulation phase.

Legitimate Value

If the asset does have a sound growth trajectory and a place in the future world, this is where deep value investors start to lick their lips (think Warren Buffet). These capitulatory moments of extraordinary value are how market bottoms form.

We’ve outlined a few times why we thought Bitcoin was in deep value in Q4 last year. Given Bitcoin has one of the fastest adoption curves of any technology in history (faster than the internet) we do not see a case for a value trap here.

Sell Side Liquidity Crises

When everyone that wants to (or was forced to) has sold, assets with legitimate value can only go one way: up.

After a significant prolonged capitulation, the period of deep value eventually comes to an end. As prices become more and more attractive, the market becomes saturated with long-term holders – those that no longer intend to sell until prices are substantially higher. They recognize the value and are price insensitive. At this point, exchange/broker order books become more and more illiquid as there are fewer and fewer marginal sellers.

Bitcoin is becoming more and more illiquid with an exponential increase in long-term holders (those that have held 2+years shown here) that now represent 49% of the network, a new all time high. We also have a new all time high in ultra long-term holders. Source: Glassnode

The trigger for a violent mean reversion to the upside can be anything.

Once a sniff of demand hits an illiquid order book, deeply undervalued assets rocket up in short squeeze fashion. Because there are very few active sellers in the market, buyers have no sellers to buy from. What happens? A vertical teleportation of price upwards as orders are filled by the nearest available sellers.

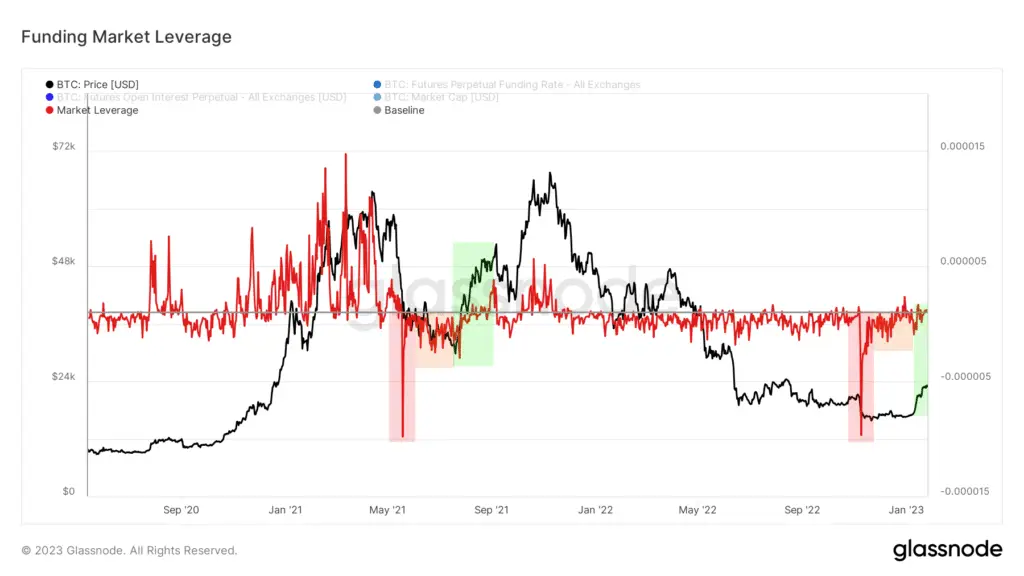

Market leverage ratio, a Capriole measure for aggregate leverage and positioning in the market, suggests an almost identical pattern has occurred in January 2023 to that of mid-2021. The short squeeze structure unfolded as follows:

- A catastrophic event causes a long-side liquidation (China mining ban in 2021, FTX fraud in 2022), followed by

- A period of sideways activity which builds up an excessive short-bias in the market shrouded in negative sentiment; followed by

- A powerful short squeeze and rally to the upside as incremental buyers step into an illiquid sell side orderbook.

We saw the same long liquidation, capitulation and short squeeze structure in mid-2021 as in January 2023. Both lasted 9.5 weeks. Source: Capriole Investments

In crypto, we call this a “sell side liquidity crisis”.

January 2023 was a sell side liquidity crisis which saw a 40% appreciation in Bitcoin.

A Powerful Deviation

The breakdown in price structure from $20K to $16K from the FTX fraud in November followed by a powerful reversion back above $20K two months later has confirmed a powerful “fake out” deviation signal.

Not to mention, it’s incredible that Bitcoin has recovered from the 3rd biggest fraud of all time in just two months. This alone is a very powerful signal from the market.

Trust the Second Move.

When an asset price moves suddenly in one direction, then shortly after moves suddenly in the opposite direction, it’s the second move which tends to “stick” and generate a higher probability of a new trend. The probability of the second move being the correct move is significantly higher than that of the first move. That’s what makes deviation fake out signals like this one so powerful.

Primary Bitcoin technicals: major weekly and monthly order block levels highlight the significance of this two month deviation and the reclaim of $20K. Source: TradingView

Change of Market Structure

When the price breakout is significant enough it causes a momentum shift.

Positive momentum out of a region of deep value triggers a regime change.

We believe this is the first regime change since November 2021 when Bitcoin was $60K.

The $20K breakout has caused price to trade above the 50, 100 and 200 daily moving averages (DMA). The 50DMA has also crossed over the 100DMA. This is a significant momentum shift. There are many ways to assess momentum, regardless of how you slice it, this is a drastic technical shift and regime change. Source: Capriole Investments

The Power of Confluence

Regime changes are arguably the best time to allocate into an asset. You have an extended period of undervaluation (confirming prices are relatively cheap), followed by a new price driven confirmation that demand has re-emerged (diminishing the risk of a value trap). When value and technicals sing together, you have a symphony.

A wealth of research has been done in this space to show the power of confluence in value and momentum in delivering outsized, market-beating returns (“What Works on Wall Street” is a great book for those interested in learning more). This confluence is the very basis for our Bitcoin metric Hash Ribbons which combines hash rate and momentum to generate some of the best long-term Bitcoin buy signals systematically.

So in January 2023, we have:

- Just exited a period of deep value as defined by many on-chain metrics including Bitcoin trading at its Electrical Cost for 2 months ending this January. Historically this is the global price floor for Bitcoin and this was the second longest period spent at the Electrical Cost in Bitcoin’s history (the first was 2016).

- Completely eclipsed the price collapse of the 3rd biggest fraud of all time in just two months. Despite the industry’s great loss of wealth to millions of people; Bitcoin has demonstrated that there are very few marginal sellers left and the level of deep value is too much to maintain prices this cheap for long, regardless of such negative news.

- A major technical price confirmation and confirmed fakeout, at the most important price level on the Bitcoin chart, the $20K all-time-high and point of FTX collapse.

- Witnessed a 40% short-squeeze with identical characteristics to the 2021 China mining ban Bitcoin price bottom.

- Entered a new regime of upward momentum, confirmed across multiple long-term moving averages commonly referenced in major markets.

We can’t overstate the importance of these signals and the current conditions within the crypto industry enough. These are moments in time that happen very rarely. For us are not to be ignored. Bitcoin’s breakout above $20K is like the ultimate Hash Ribbon signal.

What’s more; there was another Hash Ribbon buy signal at $20.8K in January.

Together these signals give greater odds and indication of future trend direction being up from here. The new regime.

Counter-Points

We believe this is a major turning point, the start of a new regime, but it won’t be a straight line up. We expect a positive 2023, but with the more significant returns coming in 2024. Early Bull markets can be somewhat boring and slow moving. Don’t expect the fireworks of January to be consistent throughout the year; it may well be a grind and there will be pull backs.

Our base expectation is that a new trend has just formed which will lead to 2023 being a positive year for Bitcoin. However major trend shifts and short-squeezes usually see measurable near-term volatility.

Bitcoin is locally trading at a monthly resistance level. We don’t expect this to stop such a major trend shift, but we could see some reversion and/or time spent here. Source: TradingView

Possible profit taking

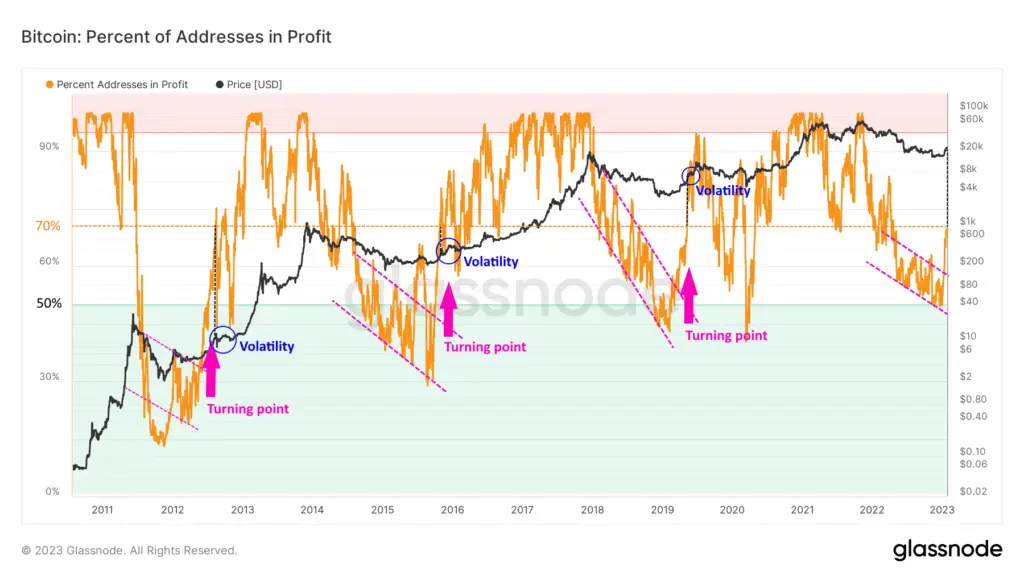

Bitcoin’s Percent Addresses in Profit metric has bounced from typical bear market lows of 50% to 70% today. The typical bear market pattern shows a slow grind down in addresses in profit, as long-term holders see the value of their Bitcoin plummet. At some point this consolidation breaks out with price recovery. We can see a similar pattern today below.

This tells us two things

- It’s a pattern typical of a Bitcoin bear market bottom being confirmed.

- Large jumps in address profitability also see profit taking and subsequent short-term downward volatility in price. If this time is like the prior instances noticed, we can expect some price pull back here.

There’s limited data here, but this pattern is not atypical of other on-chain metrics. Breakdowns, consolidations and breakouts from value are commonplace across many metrics (and, of course, price).

Percent addresses in profit has bounced significantly from 50-70%, a structure which usually sees some profit taking, but also marks a regime change. Source: Glassnode

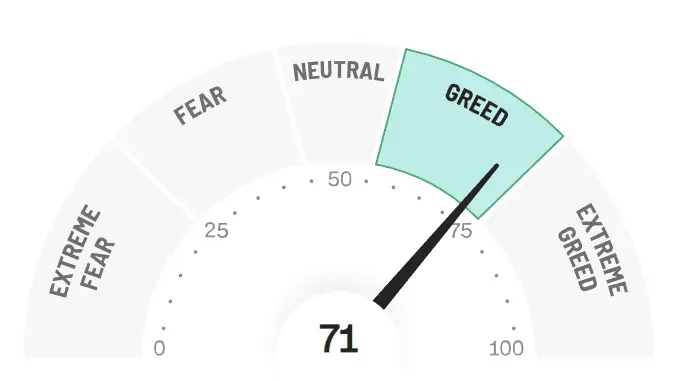

Don’t get too greedy

Another reason we might expect a higher probability of at least a near term pull back, equities markets have re-entered the greed zone. Again not a weighty signal on its own, but it marks a significant change from the most bearish sentiment readings on record just a month ago.

CNN Fear and Greed index is showing signs of near-term overheating. Source: CNN

Bitcoin NVT signal is a valuation metric based on network transaction volume throughput (Bitcoin’s “PE Ratio”) and is showing signs of normalization having left the deep value region. Alone this is not a cause for concern, but rather is another sign of the change in momentum and formation of the new regime. Other times this has occurred are shown by the vertical lines on the below chart. The message is the same further through history and more often than not is good news in the medium to long term. In the short-term, this is a place we typically see volatility and price corrections as shown.

Bitcoins “PE Ratio” (DNVT) is showing indications of value normalization and the start of a new market regime. Vertical lines shown indicate equivalent times we left a period of deep value and saw DNVT normalization. Source: Capriole Investments

DCG Wildcard

The one industry-centric risk on everyone’s lips is DCG. DCG is the parent company of Grayscale, Genesis, Foundry, Coindesk and a swath of other crypto enterprises. They are one of the biggest players in crypto. In early January, a tit-for-tat broke out between the Winklevoss twins (CEO Gemini) and Barry Silbert (CEO of DCG). The long short short is DCG took out a $1B+ loan from Genesis with a 10 year maturity. They don’t need to repay that money for 10 years, but Genesis has since filed for bankruptcy with the fall of FTX. The Winklevii claim Barry used those funds for dubious activities like attempting to prop up the Grayscale trust which has seen its mark to market price fall to 50% that of Bitcoin. From the outside, it’s hard to know what’s true and false here, but the message is not great.

The method of the Twitter interactions between Barry and the Winklevoss twins raises some red flags. If Barry had the funds readily available, you would assume he would just pay down (or share a plan to pay down) the loan to Genesis. Further, DCG has been looking for buyers of its entities like Coindesk, and taking numerous cost cutting activities. Taken alone these are inconsequential actions, but it is their timing and density which rings a few alarm bells. Could funds have been mis-appropriated within Grayscale too? Probably not, but let’s consider the worst case.

The worst case scenario

Grayscale holds 3% of the Bitcoin supply. They are the largest public holder of Bitcoin. Because of the way the Grayscale (GBTC) trust is structured, the Bitcoin inside cannot be sold on the market, only the shares can be. If GBTC goes down, that would mean the unwinding of $15B of Bitcoin.

At current pricing, the liquidation of GBTC would be good for its investors, as it would close the current 45% discount of the GBTC price to the underlying market price of Bitcoin. So they would see a sizable performance benefit.

The length and depth of the GBTC discount to its underlying Bitcoin holdings is incredible. It is likely there is a good dose of risk priced into the discount today given the uncertainties over DCG, in addition to its challenges to convert to an ETF and high ongoing fees. Source: Capriole Investments

It remains unclear how much of the $15B in Bitcoin would be sold onto the market, there’s a possibility that many of these holders would keep their Bitcoin once paid out. On the other end of the spectrum, it’s possible the liquidator would convert to dollars before distribution, or that many large institutions would need to liquidate their Bitcoin as they cannot own digital assets in their investment mandate (or simply do not want to manage the technicalities of it).

The likely reality of a GBTC liquidation is somewhere in the middle. My best guess is the market impact would not be significant at current levels of discount. Perhaps somewhat like the FTX collapse we might see a short-term (weeks/month) market shock – followed by a reversion to the mean and business as usual.

Such an event would also provide a resolution to the great mis-pricing of this asset, which has been a sinkhole and value trap for investors to date. Nonetheless, the Grayscale/DCG risk is the obvious, unknown risk in the room for 2023.

Risk Management

Like all trading and investing signals, it all comes down to probabilities. Just because we have a strong confluence of signals confirming a new regime, it does not mean a new bull market trend will happen. It could definitely be invalidated and we need to be open minded to various outcomes in the short-term.

Because of the significance of the $20K level, risk can be easily defined for a manual, technical trader. Any daily or weekly breakdown of price below $19-20K (and measurable time spent below) would invalidate the current move and trend. This makes long positions in Bitcoin at the $20K region incredibly attractive. A logical target of $25-30K (a $5-10K gain) can be protected at the cost of a potential $1K stop loss.

This is a simple, static way to manage the risk given today’s opportunity. The problem with such approaches is they don’t adapt well to changing data and market conditions. All of which cause risk-return probabilities to change on an hourly and daily basis. That’s why we rely on fully automated quant strategies at Capriole.

The Bottom-Line

We’ve identified a confluence of very important value and momentum signals which are identifying a major turning point in the market.

There are also a number of other factors at play which make the $20K breakout special and which we did not have a chance to discuss here, including:

- Optimal halving cycle timing where Bitcoin typically bottoms (Q4 2022 and Q1 2023).

- Bitcoin cycle drawdown has hit typical -80% levels.

- In November/December, Sentiment was at its worst, and market hedging at its highest on record

- Gold strength in November/December as a lead for Bitcoin in January onward. More in our December Newsletter.

- A likely Fed rate pause and change of policy in 2023.

All of the above suggests that we are at the early stages of a new Bitcoin bull market regime.

Our base expectation for 2023 is a positive year, with the major gains coming in 2024. Cyclical timing would suggest that 2024 will be the year to deliver maximum value in the Bitcoin four-year halving cycle. This is typically the period that Bitcoin and altcoins generate the most returns. And if history repeats for a 4th time – the Bitcoin halving (currently projected to occur in May 2024) – is still not priced in for 2023.

Charles Edwards

Founder

Capriole Investments Limited

January Content Highlights

- Charles discusses the 2023 outlook for Bitcoin and risk assets on the Blockworks Podcast