An Estimate of Bitcoin’s Production and Electrical Cost — a Historic Floor in Bitcoin’s Price.

Takeaways

- Bitcoin’s electricity consumption can be used to estimate Bitcoin’s Production Cost

- Bitcoin’s Production Cost can be used to estimate Miner profitability

- Bitcoin Mining has historically been a very profitable business

- 2019 has been the worst year for Bitcoin Miners in all of the last 5 years

- Bitcoin Miners are currently taking on losses from the 4th quarter price drop

- The Bitcoin Electrical Cost has been a concrete price floor in the Bitcoin market price

- A pessimistic price floor for mid-2020 is estimated at $8,000

- However, miner influence on supply and demand is dropping, with Bitcoin’s inflation rate at 3.8% and falling

This article links Bitcoin’s electrical consumption to the cost of Bitcoin production. In doing so we gain insight into the historical profitability of Bitcoin mining and an indication to when Bitcoin mining businesses are struggling. Over the last 5 years, Bitcoin’s Electrical Cost has been a floor in Bitcoin’s exchange traded market price, proving Satoshi’s theory that price gravitates to the cost of production.

Commodity Prices and Production Costs

The relationship between Bitcoin miner production costs and the price of Bitcoin is summarised best by no other than Satoshi himself:

“The price of any commodity tends to gravitate toward the production cost. If the price is below cost, then production slows down. If the price is above cost, profit can be made by generating and selling more. At the same time, the increased production would increase the difficulty, pushing the cost of generating towards the price.

In later years, when new coin generation is a small percentage of the existing supply, market price will dictate the cost of production more than the other way around.”

Knowing this relationship and drawing on detailed investigations into the electrical consumption of Bitcoin, we can estimate the cost of mining Bitcoin.

The Cambridge Bitcoin Electricity Consumption Index (CBECI)

In 2019, Cambridge University published a detailed study estimating Bitcoin’s energy consumption from November 2014 to present.

This study is likely the most detailed bottom-up calculation of Bitcoin’s global electricity consumption to date.

Cambridge estimates Bitcoin’s electrical usage based on the assumption that miners will run the mining hardware as long as it remains profitable in electricity terms. Other key assumptions behind their calculations include:

- The global average Bitcoin miner electricity price is $0.05 USD per kWh. Based on interviews with miners globally and consistent with other research, including CoinShares

- The energy efficiency of over 60 mining hardware models since 2014.

Per manufacturer specifications and refined based on expert advice (to account for actual usage and overclocking) - The global average Power Usage Effectiveness (PUE) of Bitcoin Miners is 1.1. PUE is a measure of the total energy required to operate mining facilities (including cooling) relative to the energy required for server operation. Cambridge came to this figure based on interviews with miners globally. It is also in-line with Google’s average PUE of 1.11

Cambridge’s calculation assumes an equally weighted basket of profitable mining equipment which is perhaps the most thorough approach to assessing mining hardware utilisation, depreciation and therefore energy consumption globally today.

All references to Bitcoin’s electrical consumption in this article refer to Cambridge’s “Best-guess” estimate of Bitcoin’s electricity consumption.

Bitcoin’s Production Cost

Bitcoin’s Production Cost is an estimate of the global average US dollar cost of producing one Bitcoin per day.

Every study into Bitcoin’s mining costs to date has found electricity to be the primary cost of operations, and it is used here as a base from which to estimate the Bitcoin Production Cost.

From Cambridge’s electricity consumption, Bitcoin’s Production Cost can be estimated by:

- Calculating number of Bitcoin Mined Per Day (based on Bitcoin’s Block Reward and block frequency)

- Calculating the Bitcoin Electrical Cost = daily electricity cost to mine a Bitcoin

- Estimating the global average “Elec-to-Total Cost Ratio” = (Bitcoin Electrical Cost) / (Daily Cost of running a Bitcoin Mining Business)

Bitcoin Production Cost is then found as (Daily Electrical Cost) / (Elec-to-Total Cost Ratio)

From Cambridge’s data one additional assumption is required — an estimate of the global average Bitcoin mining Elec-to-Total Cost Ratio (Item 3 above). While electricity is the major factor in Bitcoin mining operations, other costs in operating a Bitcoin mining business include:

- Hardware Capital Expenditure

- Bandwidth

- Wages

- Rent

- Insurance

- Cost of Capital

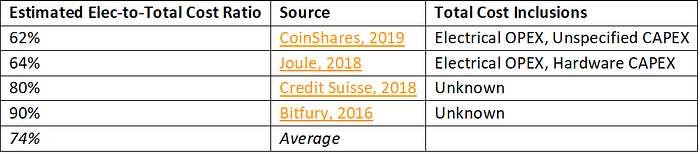

Varying estimates have been made for the Elec-to-Total Cost Ratio and include:

Well-funded businesses in a low-cost country such as China likely have low and negligible wages, rent, insurance and capital costs relative to the total cost of mining. China, for example, accounts for approximately 60% of Global Bitcoin mining in 2019.

Based on the research available to date and noting that a number of the above estimates appear not to consider the general costs of business (rent, wages, etc) outside of electrical operating expenditure (OPEX) and hardware capital expenditure (CAPEX), the Elec-to-Total Cost ratio is estimated here as 60%.

Using Cambridge’s electricity data, this gives 5 years of the Bitcoin Production Cost.

Bitcoin Miner Price

While it is interesting to compare Bitcoin’s price to the Bitcoin Production Cost, as each coin mined can be sold at the prevailing market price, this approach misses on another piece of miner revenue — transaction fees.

As well as each block reward’s freshly mined bitcoins, miners also receive transaction fees in each block. Transaction fees are determined by senders based on supply and demand. Additionally, with time transaction fees will represent a greater portion of miner revenue as block rewards reduce with each halving.

As a result, the Bitcoin Production Cost should be compared to the revenue one Bitcoin provides (Bitcoin’s market price) and the transaction fee revenue.

We term this the Bitcoin Miner Price and it is calculated here as the Bitcoin Price + (Daily Transaction Fees) / (Daily Bitcoin’s mined).

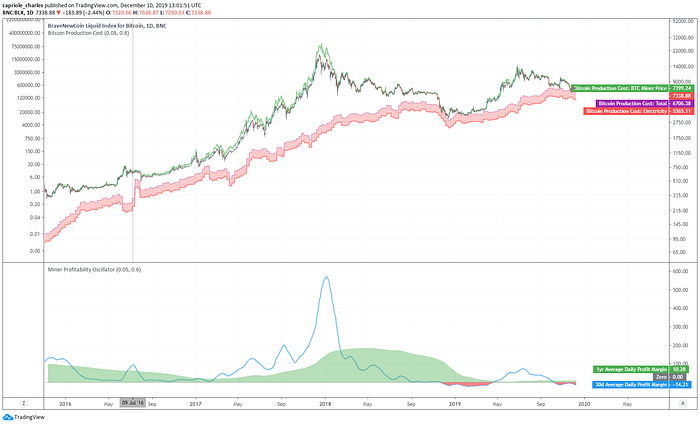

Putting Bitcoin’s Production Cost and Miner Prices together, we can see when Bitcoin Miners are struggling in recent times and potentially taking on short-term loses.

Bitcoin Electrical Cost — A Bitcoin Price Floor

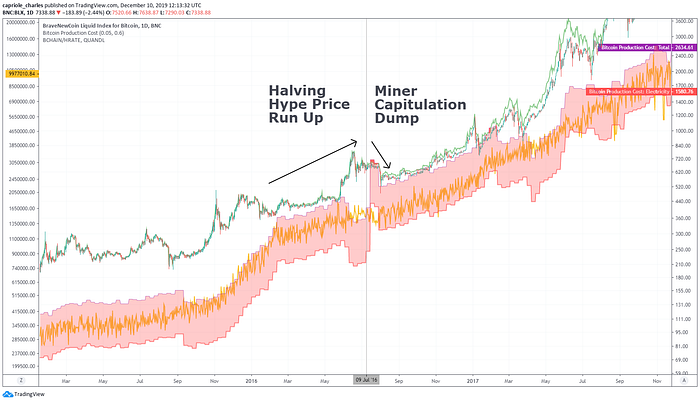

Bitcoin Production Cost provides insight into the profitability of Bitcoin mining businesses. Price drops below the Bitcoin Production Cost tend to be short lived. This makes sense as high-cost miners go out of business, the hash rate plateaus and falls and miners in general are less inclined to sell at a loss.

However, the Bitcoin Electrical Cost offers a stronger price floor.

Over short periods, a number of miner business costs are “sunk” (e.g. already paid for hardware), contractually locked-in (e.g. rent) or can be deferred (e.g. hardware upgrades). This means that Bitcoin miners can operate at a loss over short periods.

This makes sense provided the Bitcoin Miner Price is above the Bitcoin Electrical Cost. If the cost of running your mining hardware is less than or equal to the revenue it generates, you may as well leave it turned on, until such a point that general business losses make this wasted effort unbearable and the opportunity cost too high. However, this scenario cannot continue indefinitely. Losing miner would not have any revenue left over for re-investment in the business (continual capex is required to keep up with generally growing hash rates), ability to pay rental contracts, wages and other business costs.

Using Cambridge’s data from 2014 alone, with no further assumptions, we can see that Bitcoin’s price never quite reaches the Electrical cost to produce a Bitcoin, despite coming very close in November 2018.

Historically, the electrical cost to produce a Bitcoin has represented a price floor in the Bitcoin market price.

In more recent years, the introduction of Bitcoin Futures has also potentially allowed Bitcoin Miners to lock in profits earlier, for example, by shorting when the Bitcoin Price is significantly greater than production cost. However, the effectiveness of such strategies is debateable. The introduction of Bitcoin Options in 2019 will also likely aid Bitcoin miners by providing certainty in their cash flows and the ability to effectively lock in a Bitcoin sale price floor.

Miner Profitability Oscillator

All of the above suggests Bitcoin Miners are struggling at present. Most are operating at a business loss in the short term, with an average daily profitability of 10% for 2019.

Even if the 60% Elec-to-Total Cost Ratio assumption is off by a wide margin, based on Cambridge’s electrical consumption data, 2019 is the least profitable year for Bitcoin Mining in all of the last 5 years.

Outlook

It is worth noting that the Bitcoin Production Cost will double at the next Bitcoin halving (currently estimated for May 2020). When the Block Reward halves, the daily cost of Bitcoin Production is spread across half as many Bitcoins.

From this figure, if Bitcoin’s Hash Rate and mining hardware efficiency were to remain unchanged from today, the Bitcoin Production price at Halving would be $17,800.

Although Hash Rates can fluctuate widely, they are historically much more stable than Bitcoin’s price. The weekly average Hash Rate has never dropped more than 47% from its peak (in 2011). The second largest drop was 37% in December 2018.

The second most varying input into Bitcoins Electrical Price is mining hardware efficiency, which has historically improved every year.

Even if Hash Rates were to drop 40% below todays levels, and mining hardware efficiency were to improve 25% in the next 6 months, Bitcoin’s Electrical Cost would be approximately $8,000. Suggesting a pessimistic case price floor of for mid-2020 of $8,000. 8% higher than today’s Bitcoin price of $7350.

Limitations to this model also include the reducing share of total Bitcoin supply which miners hold. Bitcoin’s inflation rate, and therefore the relative portion of incremental Bitcoins that miners gain control of each year, is currently 3.8% and decreasing exponentially. The influence of each new Bitcoin in 2020 onwards will drop significantly with the Halving. Therefore, as alluded to by Satoshi above, the reliability of the Bitcoin Electrical Cost as a price floor may reduce with time.

- Chinese Translation: https://my.first.vip/shareNews?id=2601&uid=5066

- Indicator on TradingView.

Disclaimer on Backtests

Any Backtest performance returns presented represent hypothetical returns and are meant to simulate how a strategy would have performed during the period shown had the strategy been implemented during that time. Backtested/simulated performance returns are hypothetical and do not reflect trading in actual accounts. Backtest returns are provided for informational purposes only to indicate historical performance had the strategy been implemented over the relevant time period. Backtested performance results have inherent limitations as to their relevance and use. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading, such as the ability to withstand losses or to adhere to a particular trading program in spite of trading losses, all of which can also adversely affect actual trading results. There are numerous other factors related to the markets in general and to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results, all of which can adversely affect actual trading results. Any and all of these factors mean that no representation is being made that strategies presented here will achieve performance similar to that shown, and in any case, past performance is no guarantee of future performance.

One Response

great article