Bank. Run.

Welcome to Issue 30 of the Capriole Newsletter. We are a quantitative Bitcoin and digital asset hedge fund. We deploy autonomous, risk-managed algorithms that trade to outperform Bitcoin.

In our monthly newsletter we share important industry updates, explore major trends and review the technicals and fundamentals as they relate to Bitcoin. Our aim is to help dissect the noise, distill the most relevant data and help expand the field of digital asset research. You can read more about our open-source contributions here.

We finished the last issue stating “it’s a green light for risk assets”. That conclusion has performed well in March with Bitcoin up 20% and the Nasdaq up 9% to date. While risks remain; that view was based on strong Bitcoin fundamentals, a major trend shift and likely start of a Bitcoin bull market (discussed in the January issue) as well as a late stage macro regime which is supportive of price expansion, including a tipping point for inflation, the end of the rate rise regime and extremely rare bullish technical signals which just fired.

In March, the failures of the Federal Reserve in managing the value of money and the failures of the banking system to safeguard assets has once again been uncovered with the collapse of three US banks and Credit Suisse. In just two weeks, the Federal Reserve has printed back two thirds of the quantitative tightening (balance sheet reduction) they achieved in the last year.

These events have shone a new light on Bitcoin. These events are the exact reasons Satoshi created Bitcoin in 2008. These events are the very reason many investors got into Bitcoin in the first place.

These events have vindicated and bolstered the investment thesis for Bitcoin and decentralized money.

The Headlines

This month’s headlines are dominated by bank failures, renewed Fed QE and US regulatory attacks on crypto businesses, with several unjustified actions taking place against compliant businesses like Signature and Coinbase.

The US Dollar is seeing mounting weakness from inflation, loss of confidence and global Dedollarization. US regulators see the threat that Bitcoin poses to long-term reserve status and have started to act against the interests of 20% of the US population that actively invests in this legal asset class. It is clear that Bitcoin is in the “then they fight you” stage of its adoption curve under the current US administration.

Here’s the most important news in Bitcoin and crypto this month.

The Good

- Fidelity Crypto went live, giving millions of retail customers access to Bitcoin. More

- Stuttgart stock exchange unit secures BaFin license for crypto custody. More

- HK regulators to host meeting to help crypto firms with banking. More

- German dwpbank to offer Bitcoin trading to 1200 affiliate banks. More

- Microsoft testing crypto wallet in its web browser Edge. More

- Kraken is on track to launch a bank ‘very soon’ despite regulatory challenges. More

- Crypto hardware wallet maker Ledger raises $100M. More

- DeFiance Capital completes first close of $100M liquid token fund. More

The Bad and the Ugly

- The Federal Reserve restarts Quantitative Easing (QE) by expanding its balance sheet by 4.7%, eliminating two-thirds of the Quantitative Tightening (QT) conducted over the last year. More

- Global Dedollarization ramps up with new Russia/China trade deals, China and Brazil dealing in their own currencies, and BRICS and ASEAN countries seeking USD alternatives. More

- Silicon Valley Bank collapses, the second largest US bank failure in history. More

- Signature Bank forcibly closed, the third largest US bank ‘failure’ in history. More

- Silvergate Bank collapses. More

- Credit Suisse Bank collapses and is acquired by UBS. More

- Signature Bank’s prospective buyers must agree to give up all crypto business. More

- FDIC tells Signature crypto clients accounts to close by April 5. More

- FED announces it will make available additional funding to eligible depository institutions to help assure banks. More

- Coinbase Global says it got a Wells notice from the SEC, despite collaboration. More

- Tron founder Justin Sun sued by SEC. More

- Binance and CZ sued by CFTC over regulatory violations. More

- Do Kwon arrested in Montenegro and charged with fraud by US prosecutors. More

- The US government sold 9,800 Bitcoin and plans to sell a further 41,500 Bitcoin connected to Silk Road in four batches over the course of the year. More

- Crypto exchange Bittrex to wind down US operations next month. More

- EU lawmakers to vote on limited ban on self-hosted crypto payments. More

- Kraken suspend ACH deposits and withdrawals following Silvergate shutdown. More

- White House blasts digital assets in new report. More

- India and UAE to collaborate on CBDC development. More

- Binance GBP funding on/off-ramp to be suspended in May. More

- Crypto exchange Kucoin sued by New York’s Attorney General, alleges unregistered crypto sales. More

- UK banks ramp up crypto restrictions with new retail limits. More

- Multicoin Capital’s hedge fund lost 91.4% in 2022. More

The Fundamentals

Organic Demand

The significant price appreciation from the lows of the FTX fraud in November 2022 has been driven by organic spot Bitcoin purchasing. The ratio of derivatives to spot volume has never been lower than today since the widespread adoption of Bitcoin Perpetual swaps in 2018. This tells us two things:

- The price appreciation is organic demand.

- We are incredibly early in this bull cycle, as there are no signs of speculation.

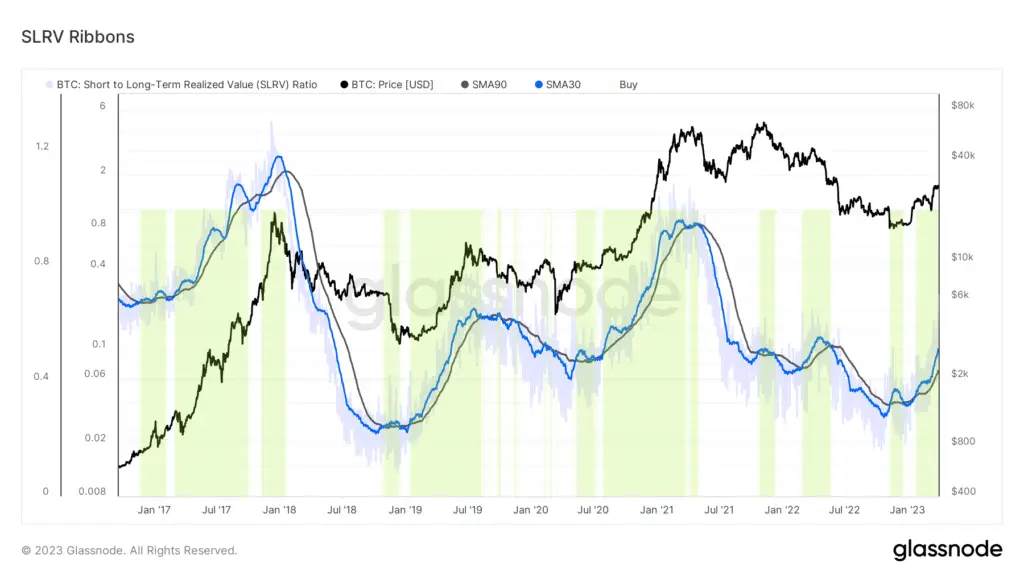

SLRV Ribbons

SLRV ribbons plots the 30- and 150- day moving average of the Short- to Long-Term Realized Value (SLRV) Ratio. When the ratio is high, it suggests there is a lot of short-term transactional activity versus long-term holding. This can be indicative of relative hype/adoption in the near-term. Conversely, when the ratio is low it suggests there is little short-term activity and interest in Bitcoin and/or a growing base of larger than normal longer-term holders. These ribbons help us to identify positive and negative trends which have also historically identified good times for risk-on and risk-off allocations to Bitcoin accordingly.

In Q4 2022, the ribbons bottomed at levels comparable to the 2018 lows, and have since gone exponential into Q1 2023. This is another clear sign of a macro shift in Bitcoin adoption and the start of a new Bitcoin bull run cycle. Right on time with all prior Bitcoin Halvings.

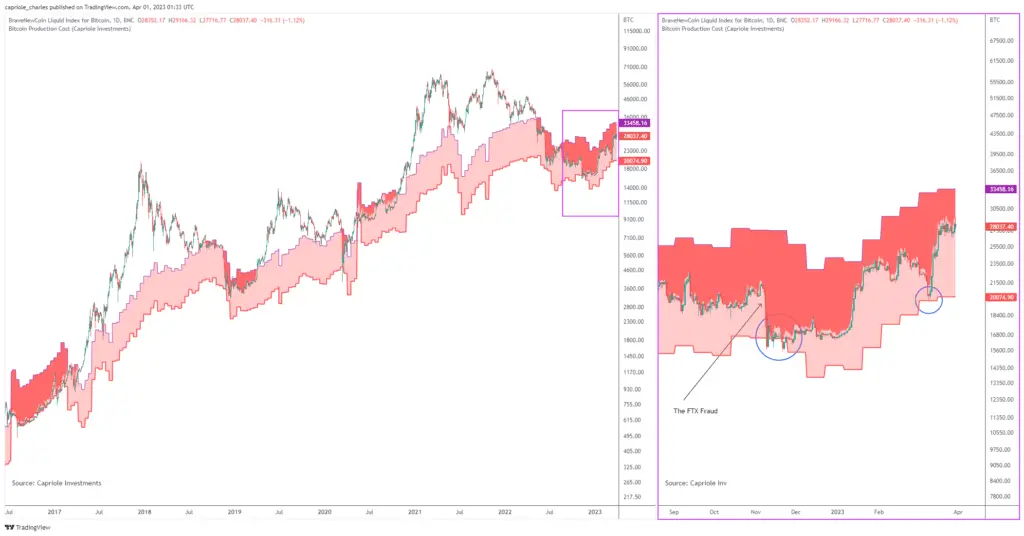

Bitcoin Production Cost

Every time the Bitcoin price has hit its Electrical cost in the past, it has been a generational investment opportunity. Without fail. This is by far my most trusted long-term Bitcoin metric because of this. These events don’t happen often, but when they do it’s magic. We were lucky enough to have over 2 weeks of price below Electrical cost in Q4 2022, a rare event only comparable with 2016.

Bitcoin Electrical cost tracks the floor price for the cost of mining a Bitcoin. This is the organic cost to mine a single Bitcoin based purely on:

- the hash rate used,

- the energy efficiency of mining hardware, and

- the global average cost of electricity for Bitcoin miners.

Generally speaking, Bitcoin is undervalued when it is trading below its Production Cost. Production cost = Electrical Cost + business operating costs. You can read more about how this is calculated on Medium here.

Bitcoin has now spent a full year below production cost, the longest consecutive period of undervaluation in history.

Bitcoin Energy Value

Bitcoin Energy Value is the fair value of Bitcoin as calculated purely on the energy spent to secure the network. A clean, simple equation that values Bitcoin purely on watts of energy used to mine. Today Bitcoin Energy Value is $42K, suggesting Bitcoin is 33% undervalued.

Interestingly, even though Bitcoin is up 70% since December, the relative value gap between Bitcoin’s price and Energy Value has only dropped slightly as both have moved up in tandem. This suggests that Bitcoin is almost as undervalued today at $28K as it was at $17K.

Bitcoin Macro Index

We believe the full picture of Bitcoin’s fundamentals is best consolidated and viewed through the Bitcoin Macro Index. The Bitcoin Macro Index (BMI) is Capriole’s autonomous fundamentals-only trading strategy which uses Machine Learning to value Bitcoin using over 35+ Bitcoin on-chain and equity market metrics. Price is not an input.

The BMI today is in recovery: a positive trend in fundamentals and adoption, while also remaining undervalued.

Bitcoin fundamentals are still undervalued. Source: Capriole Investments

The BMI Oscillator. Source: Capriole Investments

Liquidity Crisis

It would be remiss to not discuss the US banking crisis and the vast impact it has on Bitcoin. In short, the banking events in March are exactly why Bitcoin was created. Bitcoin has perhaps never experienced a better investment narrative in its history than it has today.

We are currently witnessing multiple liquidity crises:

- US bank runs

- Global Dedollarization

- Crypto Choke Point 2.0

1. Bank run liquidity crisis

Bank runs have resulted from banking incompetence in managing debt durations amid aggressive rate rises. As a result, many US banks today are unable to meet the demands of large withdrawals. So far, three US banks have collapsed, two of which were in the top three largest bank failures in all US history. Rational fear has resulted in a capital flight from small US banks to the security of the big four banks; those considered “too big to fail”. At the same time, demand for hard assets like gold and Bitcoin has shot through the roof, with Bitcoin being the best performer by a wide margin.

2. Global Dedollarization

Dedollarization started around 2011 with China shifting trade away from the dollar in favor of the Yuan. Since then, Dedollarization has gone exponential in 2023. In the last two weeks, China and Russia have struck a deal to increase trade away from the US, ditching the dollar. Two days ago, China and Brazil also struck a deal to use their own currencies for trade instead of the dollar. At an official meeting of all ASEAN Finance Ministers and Central Bank Governors on Tuesday, top of the agenda were discussions to move transactions off the dollar and to local currencies. In January, South African Foreign Minister Naledi Pandor said that the BRICS wants to find a way of bypassing the dollar to create a fairer payment system. Saudi Arabia’s finance minister Mohammed Al-Jadaan also said in January that his country is open to discussions about settling oil trade in currencies other than the US dollar. The message is resoundingly clear across the globe. The world is waking up to the damaging nature of inflation, the threats of sanctions and the failures of the Fed to manage systematic risk. The US Dollar is under growing threat of losing its reserve currency status.

3. Operation Choke Point 2.0

Finally, US operation Choke Point 2.0; a targeted attack on the legally operating crypto businesses. Nic Carter first wrote about this in February. Since then the situation has exacerbated with the failure of Silvergate Bank and the FDIC using the broader banking crisis to forcibly shutter Signature Bank.

Signature Bank – the largest crypto banking partner in the world, and the largest USD onramp into the crypto industry – was forcibly shut down by the FDIC despite the bank having full liquidity, Fed wire guarantees and being verified by JP Morgan as “good to go” according to senior Signature Bank leadership. Make no mistake, Signature Bank was shut down cloak and dagger style in the ‘fog of war’ of a broader banking crisis. Once the FDIC had usurped control of Signature, it then proceeded to sell the bank to US Flagstar Bank and required that the deal enforce the closure of all Signature Bank accounts held by legally operating crypto clients (representing about 60% of the banks value). Those legally operating crypto businesses have been given until Wednesday to withdraw all of their assets before they fall into US custody. All of this has gone down in just two weeks.

In addition we have seen a Wells notice issued to Coinbase, a compliant US exchange that has been proactively reaching out to regulators and the SEC for years seeking guidance, and multiple other legal suits have been thrown at an array of crypto companies; just take a look at the “The Bad and the Ugly” section above.

It’s clear we have reached the point of the Bitcoin adoption cycle where “they fight you”.

The end result of the targeted assault on crypto businesses and banking partners is a dollar shortage in the crypto ecosystem.

The biggest fiat rails into crypto (Signature) are officially going off-line on 5 April. That will affect many large crypto entities if they haven’t set up new banking relationships. It is likely most have, but we could see a temporary slow down in capital flows into exchanges over next 1 – 4 weeks as a result.

In many respects, the liquidity crisis “Operation Choke Point 2.0” is the result of the first two liquidity crises. Our expectation is this is merely a speed hump on the freeway to long-term adoption.

Sanctions are an ineffective tool in tackling global trade. Countries are creative and alternative avenues for trade exist, as we have across the global theater in the last years. So too, the closure of US banks will not inhibit the adoption of Bitcoin.

With Bitcoin up 70% in 2023 and outperforming all other major asset classes, the world is also voting with its pocket. This industry can’t be stopped.

The Bottom-Line

The elimination of the biggest fiat onramps into Bitcoin will cause some short-term liquidity issues for legally compliant businesses and as we trade into $30K resistance, April may not be the month that March was. Though that view will change quickly if more banks go down.

My conviction in Bitcoin and digital assets has never been higher than today. There is no other asset class I want to be invested in today, and I am not invested in any other asset class. These tumultuous times; US bank runs, renewed Fed QE and global Dedollarization have only bolstered the long-term value proposition for Bitcoin. These are the exact reasons Bitcoin was created in the ashes of the 2008 Global Financial Crisis, the words “bailout for banks” was printed into the first Bitcoin block on 3 January 2009.

Charles Edwards

Founder

Capriole Investments Limited