Metcalfe’s Law has been tried and tested at valuing networks, including Bitcoin. Today, Metcalfe’s Law suggest we are currently in the longest period of overvaluation in Bitcoin’s history. Has Metcalfe’s Law stopped working, or are we in for more corrections?

Metcalfe’s Law

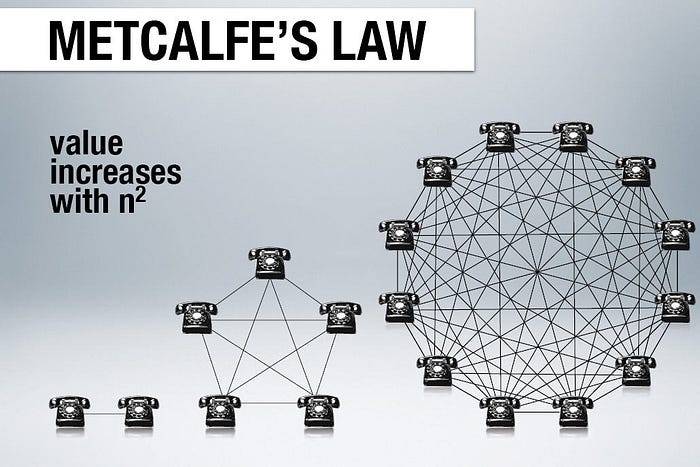

Metcalfe’s Law has been successfully used to value a variety of network effect technologies and businesses. The argument goes that each incremental user in a network adds more than their weight in connection value. Referencing the below image; a 2 phone network can make only 1 connection, 5 phones can make 10 connections, and 12 phones can make 66 connections — you can see the exponential growth of “connection value”. While it may sound purely theoretical, Metcalfe’s Law has been used to value businesses like Facebook and Tencent.

Metcalfe’s Law states that the value of a network is proportional to the square of the number of connected users (“n”):

Metcalfe’s Law: M = A * n²

Where “A” is the proportionality factor relevant to the network under review (it must be fitted to the network’s data).

For Facebook, “n” might be “Monthly Active Users”. For Bitcoin, the closest similar data point is “Daily Active Addresses” (DAA). Calculating Bitcoin’s Fair Value using DAA is termed “DAA Metcalfe’s Law” here.

This isn’t the First Bitcoin Metcalfe Analysis

Quite a lot of work has been done to value Bitcoin using Metcalfe’s Law, particularly in early 2018 by

Clearblockshere and Dmitry Kalichkinhere. Some key findings include:

- Metcalfe’s Law with Daily Active Addresses fits Bitcoin’s Price data extremely well.

- It doesn’t really matter which derivation of Metcalfe’s Law you use; the results are comparable.

But Bitcoin’s technology and usage has changed. Applying DAA Metcalfe’s Law to Bitcoin today yields interesting results.

Bitcoin’s Fair Value Today

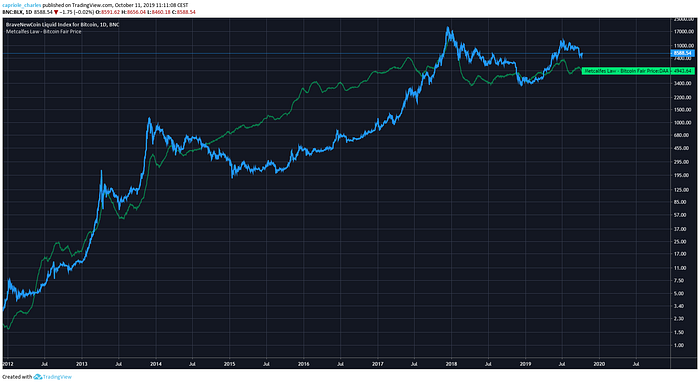

DAA Metcalfe’s Law says that Bitcoin is currently overvalued and has been for most of last 2 years.

On the below figure, when Bitcoin’s Price is above DAA Metcalfe’s Law Fair Price (green line), Bitcoin is considered overvalued.

Historically, Bitcoin has only had very brief periods of overvaluation against DAA Metcalf’s Law. Prior to 2018, every time Bitcoin was above the Metcalfe’s Law Fair Price, a bubble had formed, and price quickly reverted back down to the mean. Nonetheless, since September 2017, Metcalfe’s Law Fair Price has remained mostly below the actual Bitcoin price, suggesting Bitcoin is in its longest period of overvaluation ever.

Is Bitcoin Really Still Overvalued?

There are a couple primary reasons why Metcalfe’s Law is showing Bitcoin as overvalued today (and probably more which won’t be discussed here):

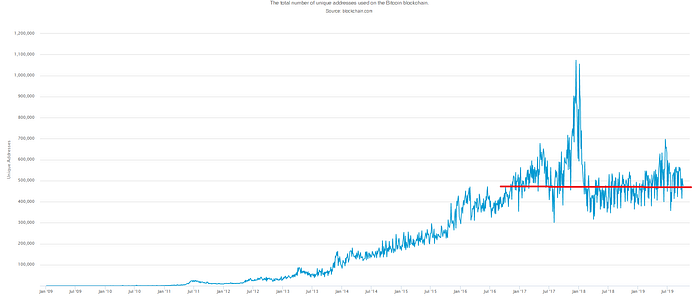

- Bitcoin may actually just be still extremely overvalued. Since the December 2017 peak, Bitcoin has only reverted to the DAA Metcalfe’s Law Fair Price during the December 2018 bottom. Further, over the last three years, DAA values have more or less remained flat (see below figure). If this case is true, there could be further for the Bitcoin Price to fall unless DAA numbers pick up to fill the gap. This would suggest that we are in an unusually long period of overvaluation. While this has never occurred in Bitcoin’s history before, it has definitely occurred in the stock market.

- The introduction of private transactions and networks make DAA Metcalfe’s Law redundant. Off-chain transactions may have fundamentally altered the effectiveness of using DAA to value Bitcoin (as discussed regarding Dynamic Range NVT Signal here). As more daily transactions are completed off-chain, or on large platforms and exchanges which use fewer addresses, the relative DAA figures may be misrepresented and artificially low. If true, DAA as it is reported today would no longer be useful in assessing the fair value of Bitcoin with Metcalfe’s Law and this valuation tool would be effectively useless.

It is likely that there is an element of truth to both of the above statements. The data collected for DAA today is just not accurately capturing the number of daily active users in Bitcoin.

Bitcoin’s Fair Value Today with Transaction Based Metcalfe’s Law

Given DAA may no longer be a reliable metric to assess Fair Value, is there another user based input that can be used in Metcalfe’s law today? The answer is yes, if we alter our thinking.

Another representation of user engagement with the Bitcoin Network is Transaction Value (TV). By using transaction value in Metcalfe’s Law, we assume that it is intrinsically linked to the number of active users.

However, one user can obviously generate multiple transactions. Because of this, the number of daily transactions in a network is probably a closer representation of the number of connections in that network.

This is not necessarily a problem. Another variant of Metcalfe’s Law, based on the exact same principals, is:

Sarnoff’s Law: M = A * n

This law simply does not square the number of users (“n”). ClearBlocks also assessed this law for Bitcoin and found it yielded comparable results to the original Metcalfe’s Law above prior to 2018.

Because transaction value is probably a closer representation of the number of actual connections in the network, it makes sense that we don’t need to “square” its value — making Sarnoff’s Law more appropriate in this case than Metcalfe’s Original law discussed earlier. Calculating Bitcoin’s Fair Value using TV and Sarnoff’s Law is termed “TV Metcalfe’s Law” here.

The results are fascinating.

TV Metcalfe’s Law provides a much better fit to historical Bitcoin Prices. It has also predicted all of the major drops from Bitcoin’s historic peaks. Interestingly, both DAA and TV Metcalfe’s Law approaches suggest Bitcoin is still overvalued today.

Dynamic Range NVT Signal and TV Metcalfe’s Law are fundamentally very similar. Where Dynamic Range NVT Signal provides a range of fair values for Bitcoin (like a “PE ratio”) and allows for some drift in the use of on-chain transactions, TV Metcalfe’s Law tries to provide a more precise figure for Bitcoin’s fair price — while now risking underestimation.

Is Transaction Data More Reliable?

As discussed above, DAA may no longer be an appropriate input for Metcalfe’s Law due to growing use of private networks. A similar argument could be made for Transaction value (TV) data, except that:

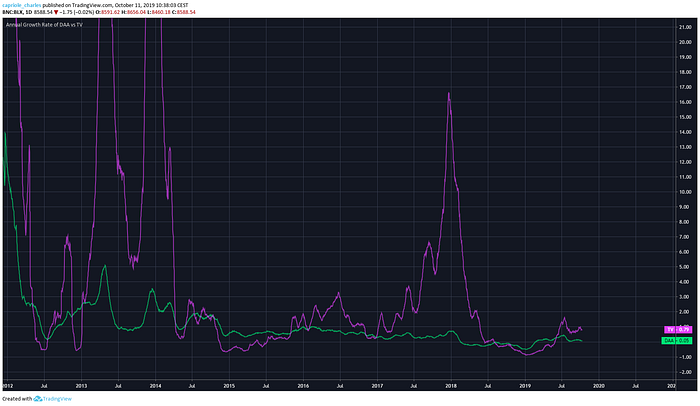

- Transaction value data has mostly grown at a higher annualised rate than DAA (see below figure). DAA growth rate is also showing a clearer downward trend.

- It makes sense relatively fewer daily active addresses could be used to manage a growing number & value of Bitcoin transactions into the future. This will probably occur as more people use private networks, side-chains and, more significantly, start to entrust their Bitcoin with private institutions.

While the crypto community has historically had a stigma against entrusting their Bitcoin to others (and rightly so due to the extent of hacking) this trend is slowly changing as the space develops. Today entrusting Bitcoin is mostly made on major exchange platforms. But is also starting to include private funds, insurance brokers and a variety of lending platforms. Likely a combination of all four in the not too distant future will be commonly termed a “crypto bank”. What does this mean? Relatively fewer DAAs may be required to manage greater sums of Bitcoin making TV Metcalfe’s Law the more reliable of the two.

A good case can be made that since 2018, the gap between Metcalfe’s Law Fair Price and Bitcoin’s price is exaggerated due to the reality of missing user data. This would suggest that Bitcoin is not as overpriced as the metrics suggest today.

Allowing a small buffer above the Metcalfe’s Law prices may give a better representation of fair value.

Conclusion

Neither Daily Active Addresses nor Transaction Value are perfect measures of active users in Bitcoin. But Transaction Value seems to be the most reliable. The current trend in Bitcoin development suggests that the problem of “missing data” won’t get easier to solve either. There is a good chance that more data will become impossible to access and publicly measure. If that trend continues, both DAA and TV Metcalfe’s Law Fair Prices will tend to drift below Bitcoin’s actual price into the future. However, much more time is needed to invalidate them.

To date, applying Metcalfe’s Law to value Bitcoin still provides great guidance. All major dips have (including as recently as December 2018) resulted in a drop below both the DAA and TV Metcalfe’s Law Fair Prices, suggesting a good time to buy Bitcoin.

While this relationship may not hold in the years to come, it is usually a bad idea to say “things are different this time” in investing, until proven otherwise. Finally, this is just one tool to consider in assessing Bitcoin’s fair value and reminds us to have an open mind to all possibilities.

Feel free to watch how Metcalfe’s Law with Daily Active Addresses and Transaction Value proves to be as a measure for fair value into the future by tracking them in real-time here.

Disclaimer on Backtests

Any Backtest performance returns presented represent hypothetical returns and are meant to simulate how a strategy would have performed during the period shown had the strategy been implemented during that time. Backtested/simulated performance returns are hypothetical and do not reflect trading in actual accounts. Backtest returns are provided for informational purposes only to indicate historical performance had the strategy been implemented over the relevant time period. Backtested performance results have inherent limitations as to their relevance and use. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading, such as the ability to withstand losses or to adhere to a particular trading program in spite of trading losses, all of which can also adversely affect actual trading results. There are numerous other factors related to the markets in general and to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results, all of which can adversely affect actual trading results. Any and all of these factors mean that no representation is being made that strategies presented here will achieve performance similar to that shown, and in any case, past performance is no guarantee of future performance.