The Melt Up

Welcome to Issue 5!

Every month we write a short update on the market. We try to time this around pivotal moments for Bitcoin.

We are writing this newsletter as Bitcoin has just achieved a new all time high of $50.8K and is currently trading at $48K, following the Microstrategy’s announcement they will be raising capital for $600M more Bitcoin.

It’s been under 3 weeks since our last issue. Our call last month that the current dip was characteristic of most bull run dips and generally for buying has turned out quite well, with Bitcoin up another 55%. Last issue also proved that Grayscale premiums under 5% are historically rare, and wonderful buying opportunities.

The News

A lot can happen in 3 weeks in Bitcoin 2021:

The Good:

- Tesla buys $1.5B of Bitcoin

- Microstrategy announces new debt offering to buy $600M more Bitcoin

- Mastercard adding cryptocurrency transactions in 2021

- Miami reviewing deployment of government funds into Bitcoin and paying employees in Bitcoin

- BlockFi officially launches new Bitcoin trust

The Bad:

- India bans investments in cryptocurrencies

The Ugly (if you can’t beat them, join them):

- JPMorgan chief says “we will have to be involved” with Bitcoin (in hindsight, it was inevitable!)

The Markets

At present, the traditional markets have little sway over Bitcoin.

Correlations are low, VIX is low, Fear and Greed is mostly normalised. This is good, because Bitcoin can do what Bitcoin does best (move).

Near-term down side also looks relatively limited, with Biden forging ahead with $1.9T of stimulus ($1400 per individual) and doubling the minimum wage to $15. The House of Representatives is expected to pass the Coronavirus relief bill within the next two weeks. The near certainty of this stimulus is certainly priced into the markets, with the S&P500 breaking fresh all time highs almost every week of 2021.

Stimulus remains the primary driver of the market at present.

Any concerns of a slow down are to be watched and would likely have ugly impacts on the S&P and Bitcoin prices, at least in the short term.

The Fundamentals

Institutional Demand

The primary story for Bitcoin fundamentals in 2021 remains institutional buying. In January we saw huge inflows into Grayscale Bitcoin Trust, a largely one-way transaction and lockup of Bitcoin. In February, this flow has slowed, but has also been picked up by direct institutional buys…

The biggest here being Tesla. Tesla’s buy represents much more than $1.5B of Bitcoin. Tesla’s buy is a greenlight to the S&P500 that it is “OK” to buy Bitcoin, and quite possibly a “good idea”. Tesla remains the only company in the S&P500 with Bitcoin at present, but based on the rate of outflow from Coinbase (around $500M per week), we expect a lot more announcements to follow.

Of all the exchanges, Coinbase in particular is the one to keep a close focus on. It drove the first major corporate treasury buy in 2020 (Microstrategy) and based on outflows, likely drove Tesla’s buy also. Based on communications between Elon and Michael Saylor (Microstrategy), and based on Microstrategy’s recent multi-day conference to help corporate treasuries buy Bitcoin, there’s strong reason to believe many of the next corporations looking to get their feet wet with Bitcoin will follow a similar path and utilise Coinbase.

With Microstrategy’s announcement today, we can expect that another $600M+ of Bitcoin will be scooped off the market by Microstrategy alone over the next 2-3 weeks.

Coinbase Balance (Reserve) – CryptoQuant.com

Reducing Supply

Bitcoin miners are also holding on to double the Bitcoin they were a month ago, suggesting they are confident of further price appreciation and have their operating costs under control. This means there’s even less new supply entering the market. We had the halving just over 6 months ago, and now Miners aren’t releasing fresh coins into circulation!

On top of this, reserves on all exchanges continue to fall, highlighting that Demand outweighs supply, even at $50K per Bitcoin.

Total Exchange Bitcoin Balance (Reserve) – CryptoQuant.com

Add these two dynamics together and what do you get?

Melt up.

When Growing demand meets falling supply, price appreciation can continue even more rapidly.

The Technicals

[Reminder – we are an algorithmic investment manager – the below provides us insight but charting is not used in our investment strategy]

High Time Frame

All higher time frames are bluesky at present. Both Weekly and Monthly timeframes have no clear historic resistance levels and show clear trend continuation. When there’s no historic price information to look at, Fibonacci levels can provide some good insight as to where profit taking can occur. As long as we continue to close and consolidate above the 2.61 Fib extension from the 2017 Bull and 2018 Bear markets,things look positive.

Bitcoin’s Major Cycle Fibonacci Levels

Low Time Frame

The low time frame (4HR) shows bullish consolidation above $42K, but also a small rising wedge (which can be bearish near-term). In this instance, the continued consolidation above $42K is more important than the wedge structure itself.

That said, longs would be better entered on a 4HR or Daily close above $50K for higher risk reward.

If the wedge breaks down, the $42-$43K region shown would likely offer a great deal.

The Easy Dip Buyer Strategy

If you are looking for an easy strategy to buy dips in bull markets, this may be for you.

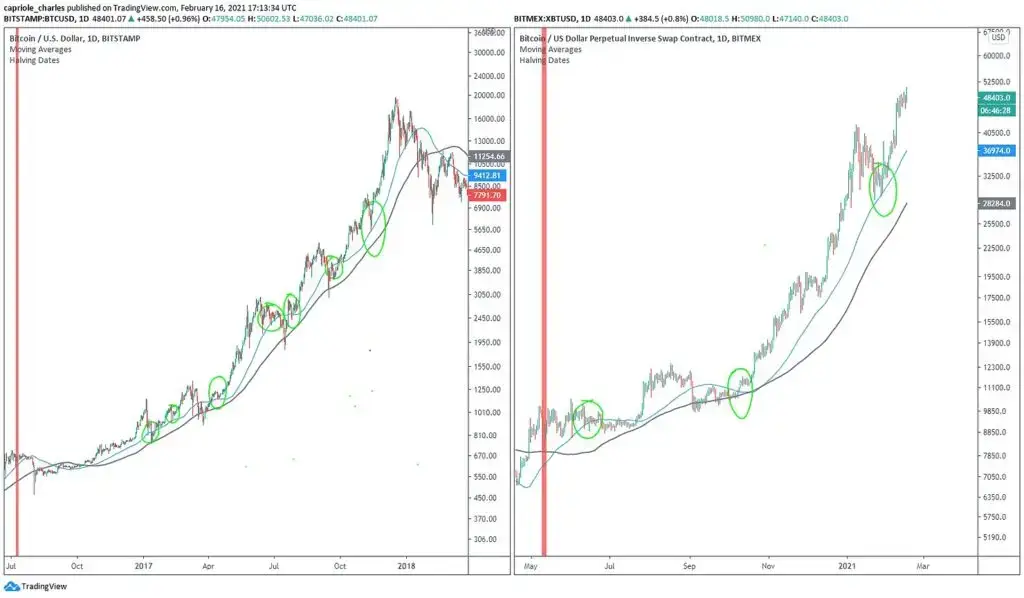

The easy dip buying strategy, based on data from the 2017 bull run, buys Bitcoin when the price crosses over and closes above the 50D simple moving average (SMA) (blue line below). Like all strategies, it’s not perfect, but generally identifies the local bottom in most cases in the 12-18 month period following the Halving (eg. now).

Even better buys are found when price touches the 100D SMA (gray line below).

Such a strategy only performs well in the unique Bitcoin bull cycles, such as in 2021, and is not recommended in periods beyond this time frame. Like every strategy, it’s even better when paired with other concepts. It’s another helpful tool to consider.

The Easy Dip Buyer Strategy (50 and 100 Moving Averages)

The Bottom-Line

Medium term outlook remains positive. Downside looks limited. A flushout of leveraged traders may be required before continuation, in which case low $4X,XXX would be an attractive region to buy.

Given the current demand and supply dynamics, the future remains very bright for Bitcoin.

We are likely not even half-way through this bull-market, and patiently awaiting fresh S&P500 treasury headline announcements!

Content we love

- Bitcoin ownership, concentration and whale accumulation by Glassnode

- Relative volatility and Bitcoin

- FilbFilb and Phil Swifts Decentrader thread on Bitcoin fundamentals