Welcome to Capriole’s Update #39. Where we consolidate the most important Bitcoin news, technicals and fundamentals into a 3-minute update.

Market Summary

The biggest news of the week is no doubt Israel’s declaration of war. These events are unfortunate and terrible news and we hope that peace will be reached swiftly.

We are no experts on the situation. But from a purely market perspective, how this event unfolds will have impact across assets, the extent and timing of which is relatively unknown. We have just a few data points, including that the Arab-Israel Six-Day war in the 1960s and Yom Kipper war in 1970s both saw equity markets bottom 1 and 5 days later respectively. Though the Yom Kipper war’s end in October 1973 also marked a major top before the Dow Jones collapsed -42% over the following 12 months.

Historically safe bets in times of war include oil and gold. During the short Yom Kipper war in 1973, Gold initially sold off -13% then rallied over 100% in the following year. These datapoints should be taken as anecdotal at best for usefulness today and for modern hard assets, like Bitcoin. We should be open-minded to a range of outcomes here.

Technicals

High Timeframe Technicals: Price is trading into the $28K weekly level we have been following for the last issues. Importantly, this is also the juncture of many popular Daily and Weekly momentum moving averages. In other words, growing tension and resistance at $28K. In our view a strong close above $28K could lead to substantial price appreciation as momentum algorithms kick in and sentiment pivots.

Low Timeframe Technicals: our much talked about Wyckoff structure from Update 4 continues its textbook formation as it slowly approaches resistance. Given price is currently in the mid-range of the Wyckoff structure, there are no quality actionable signals here. Best to wait for Resistance to break (and confirm the structure); or for Support to break (and cause the structure to fail).

Fundamentals

Price is only half the picture. What about on-chain flows? What are retail and institutional investors doing with their capital? Is the mining network and security growing? How can we incorporate macroeconomic changes, equity market risk and broader market sentiment into Bitcoin? Finally, how do all these metrics compare on a relative basis to prior Bitcoin cycles?

We believe the full picture of fundamentals is best summarized by Capriole’s Bitcoin Macro Index, which we publish live with weekly updates here.

Over 40 of the most powerful Bitcoin on-chain, macro market and equities metrics combined into a single machine learning model. This is a pure fundamentals-only value investing approach to Bitcoin. Price isn’t an input.

Bitcoin fundamentals have continued to improve over the last two weeks since they bottomed in Update 5. This is great news and supportive of the bullish case.

Bitcoin fundamentals continue to improve, supporting sustainable price appreciation.

Chart of the Week

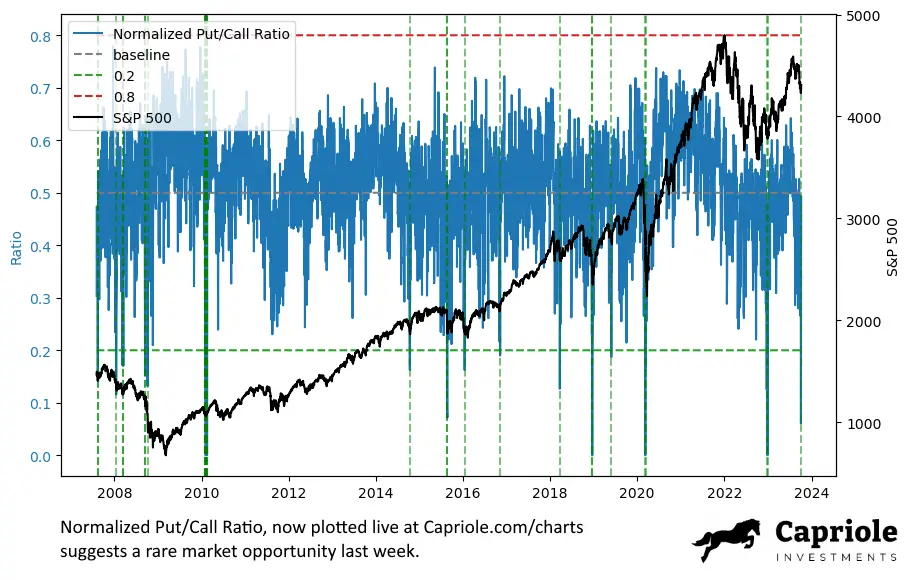

Introducing a new metric “Normalized Put/Call Ratio“; exclusive to Capriole.com/Charts where you can track it live.

The S&P Put/Call Ratio measures the number of traded put options to the number of call options. It gives an idea how the equities option market is positioned. A market with open interest greater than the market cap of crypto, this positioning can be indicative for forward risk asset returns.

Capriole’s Normalized Put/Call Ratio adds some special sauce to the S&P500 Put/Call Ratio and normalizes the metric to highlight extreme deviations.

By normalizing this metric, a relatively low ratio suggests a lot of put hedging in the market (typically associated with bearish sentiment) which can often be a good contrarian long signal for risk-assets.

Just take a look at the incredible historic hit rate since 2006.

Bottom-Line

We have historically rare risk-asset signals appearing, amidst a period of Bitcoin’s relative out-performance and de-correlation from equities markets. In a macroenvironment at the late stages of a rate-rise regime, with plateauing full-time job numbers. At the same time, Bitcoin fundamentals continue to grow into what is approaching the optimal 12-18 month period for Bitcoin performance.

There is a lot to be optimistic about here for Bitcoin. But an important risk management step is first clearing the $28K juncture. We don’t have that technical confirmation (yet). Following that, it wouldn’t be surprising for a Wyckoff consolidation at $30K to lead to substantial appreciating into the $40Ks.

Charles Edwards

Founder