The economic fundamentals you need to know to preserve your wealth.

Take-aways

- Money is simply trust. It is not backed by anything.

- The purchasing power of the US dollar reduces by 3% a year.

- Inflation happens when the supply of money and credit in the economy grows faster than economic output. This is happening today.

- The government is incentivised to inflate the money supply to reduce debt burdens (make it easier for them to pay loans back).

- In the long-run the Federal Reserve is powerless. Real economic growth is necessary to maintain an economy. Printing is a short-term solution only.

- Watch your interest rates: if you have cash sitting in the bank in 2020, it is wealth destroying.

- Watch your income: if your share of your employer’s business is stable or growing, you should expect a minimum 5% pay rise every 2 years.

- There are some very simple, low energy ways to beat inflation: consider hard assets and “dollar cost averaging”.

- Take control of your money and your future. This is just the beginning!

The missing link

A critical piece of information is missing from our education system. A clear definition of money.

When we graduate, we are expected to go into the world and work to grow money for our employer, money for our economy and money for ourselves. Yet up until that point, most of us were taught nothing about what money really is. There is a sceptical case to argue that there is a reason we are not taught about money. In 1957 Henry Ford, one of the 20 richest people of all time, is famous for saying:

“It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.”

By reading this article, I hope that you will gain an understanding for what money is, how it fits into our economy and banking system and take away some simple strategies to protect your wealth in a volatile world.

Money is simply trust

When boiled down, money is simply trust. Trust that our time and effort, expended in the past, can be redeemed for goods and services in the future.

Because we can’t normally carry around our personal goods and services, we entrust this capability into a government issued piece of paper.

Our currencies today are called “fiat currencies” because they have no convertibility into any other form of asset. Through history, money has spent much of its time linked to a hard asset like gold which has a known and low inflation rate. Convertibility to a hard asset historically ensured trust. You had a way out of your currency and into something like gold which has historically maintained value for millennia, due to its low and consistent supply growth rate through time.

Today there is no such convertibility, and there is no fixed supply of fiat currency. This is ticking time bomb.

💡A dollar is not backed by the government, gold, army, or anything else. It is simply backed by public trust. Trust that your neighbour will give a dollar the same worth as you. And trust is a fickle thing, particularly when pegged to an asset with increasing supply.

Credit: another form of money

Credit is simply a promise to receive money from a borrower (debtor) in the future. It can be considered another form of money. The difference is credit is much more volatile. It can be created and destroyed in an instant when a transaction is created, completed or defaulted on. For this reason, there is a lot more credit in our economy than there is money.

All currencies die

Our fiat currencies work fine as long as public trust is maintained in the money and as long as the value of that trust does not erode over time. But when the money supply changes too quickly, trust problems arise. This has happened many times through history.

Because governments are incentivised to inflate the money supply and make debt easier to pay back, the critical “trust” component of the money has a non-zero probability of erosion. That means it’s just a matter of time until the currency fails.

There are many examples of currency collapses in recent history, including the German Mark and Zimbabwe Dollar.

As a world reserve currency, the US Dollar has a unique power globally. A significant portions of global trade and debt is denominated in the US Dollar. This gives it a lot more staying power and trust than other fiat currencies. But it is not invincible. It is still subject to the same risks and by historic measures the US Dollar may be nearing the end of its useful life.

💡 In 2020 alone, the money supply in the US has increased by 25%. This means that there are 25% more dollars circulating the world than a year ago. Your share of the total dollars in the world has just reduced by 20%.

It is all about purchasing power

If money is trust, what are we trusting? We are trusting that a dollar maintains purchasing power. Purchasing Power is what you can buy for each of your dollars when you spend them.

Inflation means your purchasing power is reducing, because goods and services get more expensive and you can’t buy as much with the same balance. Deflation is the cheapening of goods and services, meaning your purchasing power is increasing.

Historically, deflation rarely occurs. It typically takes place infrequently and at the end of long-term debt cycles or after monetary collapse, this happens roughly once every 100 years.

But inflation is happening almost all the time. It gives governments an economic lever. We live with an average long-term inflation rate of around 3% p.a.

💡 Since 1950, the dollar has lost 90% of its purchasing power as a result of inflation. Purchasing Power has reduced around 3% a year. With zero interest rates today, cash in the bank will buy 3% less goods and services every year.

What causes inflation?

Inflation is often measured using the Consumer Price Index (CPI). CPI measures the average change in prices over time that consumers pay for a basket of goods and services. While CPI is good at measuring the impact of inflation on daily spending in the short-term, it does not capture the impact of “total inflation” – the economy wide impact of inflation.

Inflation affects asset prices too and therefore your wealth.

As of writing, the stock market (S&P500) is up 16% year-on-year. This is inflation. Make no mistake, the economic output of the US is down near 10% in 2020. While these two are not linked 1-to-1, the cheap money is being used to bid up financial assets.

Inflation, the loss of purchasing power, happens when the total money supply increases at a faster rate than the goods and services produced under that currency:

(inspired by Ray Dalio’s “How the Economic Machine Works”)

The Total Inflation Model represents inflation across the entire economy, including financial assets like stocks and bonds. In 2020, total inflation is rising.

The causes of inflation include:

- Increasing money

When the US Federal Reserve Bank (the “Fed”) “prints money”. Printing takes many forms and encompasses actions which increases the amount of circulating dollars. These dollars are simply central bank database entries and asset-purchase programs (“quantitative easing”), such as when the Fed bought up corporate bonds this year. - Increasing credit

When the Fed cuts interest rates, which drive down the cost of borrowing, and incentivize more debt (credit) to be created. - Decreasing Gross National Product (GNP)

When unemployment rises, tax increases, tariffs are created or government employment programs are wound down, causing GNP to decrease. Don’t underestimate the power of fear if reducing GNP also. Even if nothing changes, if people fear recession, loss, unemployment or other economic crisis, they will spend less and invest in others less. All of which reduces the velocity of money and drives down GNP. Historically, GNP typically grows over time due to population growth (which is about 1% p.a. in the US) and generally rising productivity from advances in technology and combined human knowledge.

There is a trickle-down effect with inflation. The money printing actions of the Fed typically results in capital being deployed straight into financial assets, driving up stock market prices in the short-term. That capital slowly trickles down into everyday goods and services and can then be seen in CPI.

💡 When there is more money and credit available in an economy, for the same amount of goods and services, increasing spending by those with the money and credit supply drives up demand, and results in increases prices of goods and services; thus driving inflation.

Why do we have inflation?

Historically, the Fed targets a 2% inflation rate. More recently, this target has been relaxed to allow inflation to run even higher.

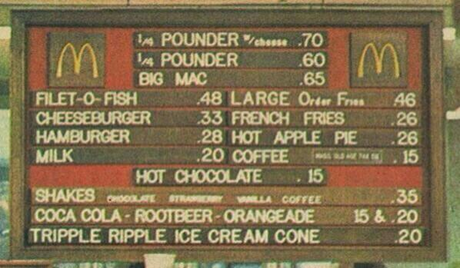

A 2% inflation rate is low enough that it doesn’t hurt people’s purchasing power in the short-term, as its day-to-day effects go mostly unnoticed. It is only when you look back over periods of decades that the effects of inflation become blatantly obvious. Like the low price of a McDonald’s Cheeseburger in the 1970s:

But why target 2% inflation at all? The Fed claims it is to allow for “measurement bias”, “room to cut interest rates” and to “avoid deflation”. These justifications are not the full story.

Here are some of the primary reasons the Fed targets positive inflation:

- There may be a psychological benefit to some inflation

If salaries and incomes are generally rising over time, it gives people and economies a sense that things are progressing and they are “going somewhere”. Psychology impacts economies, this is the power of the positive mindset. - Inflation allows debt burdens to reduce over time

Debt taken out today, becomes easier to pay back in the future if the purchasing power of that debt weakens over time. - Inflation incentivizes spending

If your money is losing purchasing power over time you rather put it to work to try and earn a rate of return. This investment back into the economy should help the economy grow over time. It is another key reason Governments target some inflation. The Fed also has a goal of ensuring “a stable market”. It is for these reasons you often see the most money printing during times of extreme stock market volatility, such as the Corona crash in 2020, as they attempt to incentive spending and prop markets up.

Be warned. This seemingly small number of 2–3% inflation per year, compounded over a generation (30 years), will reduce a bank balance’s purchasing power by 45%. So if you want to preserve the purchasing power of your wealth, do not leave it in fiat currencies. Do not leave it in the bank.

As famous investor Ray Dalio said earlier this year:

“Cash is Trash”.

💡 Keep an eye on your income growth rate. Your income needs to grow at least as fast as the rate of inflation (2–3% p.a.) in order for you to maintain your existing purchasing power. If you haven’t had a salary raise in the last two years, you should be expecting at least 4% raise this year if your share of your employer’s total revenue hasn’t changed. But if you are adding more value to your company as a whole, you should be after a minimum 5% raise. If you are not getting this, make no mistake, you are not being treated fairly — it may be time to look around.

A false sense of security

The ability for the Fed to print and change interest rates gives it a false sense of security. They have a lot of levers to pull in the short-term. But these actions always reach a limit. It is usually once every 100 years that the debt burden becomes too much and a reset is required. Such periods usually coincide with major stock market tops and crashes. A number of renown economists think we are in that peaking phase now.

Market cycles, and the booms-and-busts of the economy and stock market are simply fluctuations around an upward productivity trend in GNP, the cycles mean revert back to the GNP trend. The Fed has proven they cannot stop these cycles. The Fed has been ineffective at predicting and preventing recessions in the last 50 years. Their actions are usually too late, and they frequently tighten immediately before a market top, often triggering a cascading effect downwards itself. Yes — the Fed has triggered the start of a number of recessions.

Inflation adds no value.

Inflating the money supply just delays the inevitable. Markets will crash. Market cycles will always occur and inflation potentially increases the volatility and depth of market crashes. While stimulus (money printing) may seem like an easy fix, the bigger the bubble grows, the harder it comes crashing down.

When the Fed cuts interest rates, it incentivises banks to issue more loans, this results in less credit worthy people and entities receiving credit, which increases risk and, with time, results in more defaults (think 2008). The end result cannot be stopped.

Humans are emotional. Sometimes we are greedy, sometimes we are fearful. We are biased to push things to the limit. Greed causes levers to be pulled too hard and ultimately grows bubble to the point where they cannot be sustained by economic output.

Human volatility cannot be removed from the system.

2020 is the perfect example. In 2018, the Fed tightened and we saw strong warning signs with a 20% stock market correction. In 2019 a near perfect recession warning flag, the “yield curve inversion”, signified a recession was on the horizon and expected within 6–12 months. The market was primed to pop. Fed tightening actions set the charge. All of this happened before any virus was identified. Finally, the Coronavirus was the match.

Once a crisis begins, the power of the Fed to print does help in the short-term. In early 2020, the market crashed faster and harder than we have ever seen before. The Fed responded, with incredible and unforeseen amounts of money printing, which flooded straight back into the stock market. Despite a standstill economy, stocks roared back to life.

But the net result of all of this Fed action is moot.

While the power of the Fed is huge on a day-to-day and month-to-month level, the Fed is actually powerless at driving the economy over the year-to-year and decade-to-decade level . Long-term productivity growth continues, and market cycles stay.

💡 In the short-term the Fed is powerful, in the long-term it is powerless. You can’t escape the need for real economic growth! Over the course of your life, the Fed will have negligible impact on your ability to generate and store wealth, provided you do not keep your wealth in an inflating asset, like the US dollar.

What you can do to protect your wealth

We know that inflation is here to stay. We know that the Fed is incentivized to use it, even if it has no long-term benefit. The key is to understand what you should not do to preserve your wealth. When bank deposit interest rates are less than inflation, as they are today, it does not make sense to leave your money in the bank.

Put your money to work.

A simple approach recommended by some of the best investors, including Warren Buffet, is to simply buy and hold an index of stocks. Historically this would have returned 7–8% p.a. in the long run, well above inflation and well above the majority of paid fund performance. 99% of funds fail to outperform. But you have to be prepared for the swings. This strategy will not work if you sell in the midst of market panic, and it will not work if you buy at the top of a bubble. If you buy, be prepared to hold for 5, 10, 15 years plus to see these returns.

Another approach is to invest in a hard asset. Gold and Bitcoin are two assets with limited supply and known inflation rates which cannot have their supply manipulated. Hard assets have historically performed particularly well in challenging economic times. There is a case to be made to allocate at least some of our portfolio to hard assets in 2020 as an inflation hedge.

Another great way to take the emotion out of the process is to “Dollar Cost Average”. Simply deploy a fixed percentage of your monthly pay check straight into an index, or a hard asset. Set and forget. Follow this process through to retirement and you will do better than most. For example, if you had dollar cost averaged into Bitcoin every week over the last 3 years starting at the Bitcoin peak in 2017 and continuing to today (15 October 2020), you would have returned over 30% per year even though Bitcoin is down over 40% from the top!

These are some simple, effective and low energy ways to protect your capital and maintain your purchasing power into the future.

The best thing you can do is continue the learning and take control of your wealth and your future.

💡 If not getting at least 2%, you are losing wealth. If your investments, including your bank deposits, are not growing at least as fast as the inflation rate, your purchasing power is reducing with time. Put your money to work. Employing non-emotional, long-term strategies has historically outperformed most money managers.

The materials in this article are for education and discussion purposes only and do not constitute investment advice. Opinions and projections included are provided as of the date of publication, may prove to be inaccurate, and are subject to change without notice. No recommendations are made to invest in any asset. Past performance is no guarantee of future results.

Disclaimer on Backtests

Any Backtest performance returns presented represent hypothetical returns and are meant to simulate how a strategy would have performed during the period shown had the strategy been implemented during that time. Backtested/simulated performance returns are hypothetical and do not reflect trading in actual accounts. Backtest returns are provided for informational purposes only to indicate historical performance had the strategy been implemented over the relevant time period. Backtested performance results have inherent limitations as to their relevance and use. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading, such as the ability to withstand losses or to adhere to a particular trading program in spite of trading losses, all of which can also adversely affect actual trading results. There are numerous other factors related to the markets in general and to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results, all of which can adversely affect actual trading results. Any and all of these factors mean that no representation is being made that strategies presented here will achieve performance similar to that shown, and in any case, past performance is no guarantee of future performance.