Welcome to Capriole’s Update #41. Where we consolidate the most important Bitcoin news, technicals and fundamentals into a 3-minute update.

Market Summary

Since our last update, Bitcoin blasted from $34K to $38K in short order, found some resistance and is currently trading at $36.5K. It has successfully cleared the most important resistances on the chart, closing above both weekly and monthly levels ($35K) for multiple days. This puts high timeframe technicals in a very strong position.

At the same time, Bitcoin’s Macro Index shows on-chain fundamentals are now “expanding”. This is the first time we have re-entered fundamental expansion since November 2020.

Together the most important technicals and fundamentals are telling us that we have just achieved a major milestone and risk-reward remains heavily skewed to the upside. In the near-term, the picture is more mixed; with all derivatives markets currently overheated and low timeframe technicals suggesting a small retrace is possible.

Technicals

High Timeframe Technicals: the recent breakout into the 2021 range offers the best high timeframe technical setup we have seen in years. Provided $35K holds on a weekly and monthly basis in November, the next significant resistance is range high ($58-65K).

Low Timeframe Technicals: The expected measured move following the Wyckoff Accumulation we marked up last issue is mostly complete. However, we would still expect the breakout to take us into the $40Ks.

Zooming in a bit, let’s take a quick look at the 4H timeframe, noting this is the least important data element in this issue. We have what looks to be a ‘failed breakout’ occurring on a rising wedge pattern. As long as this remains so (as long as Bitcoin is below $37K); it would not be surprising to revisit $34/35K, which being High timeframe support, would likely be a good long opportunity.

Fundamentals

Fundamentals and on-chain data help us understand which way the probabilities are skewed at important inflections, and were critical to our navigation of this cycle and identification of the bottom at $16K.

We believe the full picture of fundamentals is best summarized by Capriole’s Bitcoin Macro Index, which we publish live with weekly updates here. This Index includes over 40 of the most powerful Bitcoin on-chain, macro market and equities metrics combined into a single machine learning model. This is a pure fundamentals-only value investing approach to Bitcoin. Price isn’t an input.

Bitcoin fundamentals have been growing faster in the last two weeks than they have in years. Capriole’s Macro Index just crossed into Expansion, suggesting strong fundamental growth in the network. The last time Bitcoin crossed from recovery to expansion was 2 November 2020. Before that it was 9 November 2016. Both points preceded massive price runups. The transition from recovery to expansion is simply the optimal time to allocate to Bitcoin from a risk-reward opportunity for this model.

Chart of the Week

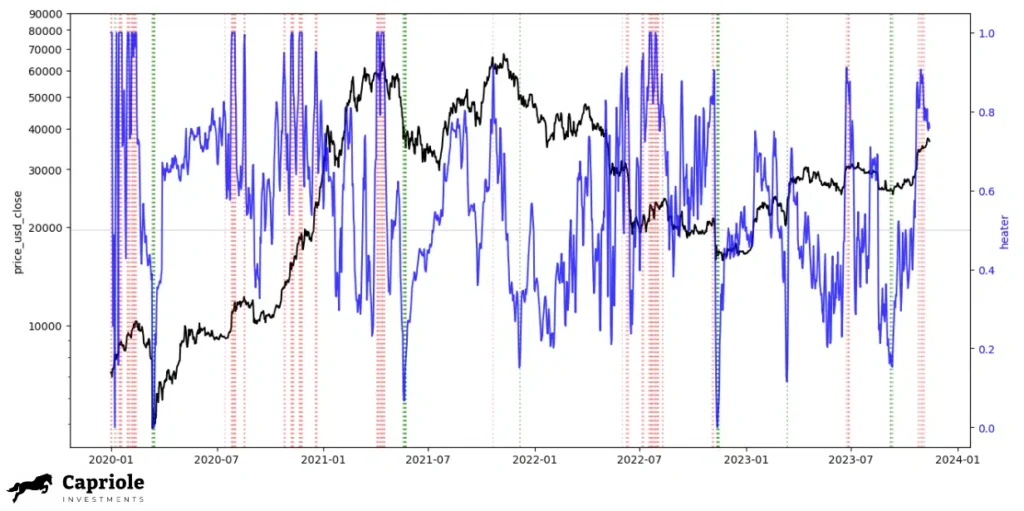

Introducing “Bitcoin Heater” and “Ethereum Heater” metrics. Just released on Capriole Charts today.

These metric aggregate Perpetuals, Futures and Options markets, their relative level of over/under heating, and weights them by their Open Interest (OI) to get a singular aggregate reading for the entire derivatives market for each asset. This tells us when there is relatively high risk (eg. a lot of long positions on perpetual futures) or low risk (eg. a lot of short positions).

The below chart highlights the relatively high/low readings of this metric. As we can see, most of the time when Heater is high (above 0.8), the market corrects/consolidates. But there are large exceptions to the rule: such as the primary bull market rally from November 2020 through to Q1 2021. Given the Capriole Macro Index fundamentals suggest we are in exactly the same growth position as November 2020, it’s worth being openminded to the Heater metric being less informative today. In fact, we should expect this metric to be high more frequently in 2024 (much like Q4 2020 – 2021). Nonetheless, there is more risk in the market when the Heater is high than when it is low (sub 0) and it should be considered in context accordingly.

Bottom-Line

The trend continues and the most important data points we look at say it doesn’t get much better than this. Provided Bitcoin holds support at $35K, and provided on-chain fundamentals continue to grow, it looks like we are at the early stages of some incredible opportunities.

Zooming into the local area, we do see some potential red flags on low timeframes and on the derivatives market, though these are to be expected as the bull run develops. They may be quickly invalidated, but should they eventuate, are most likely great opportunities.

Charles Edwards

Founder

One Response

Thank you for your analysis, it was very good.