The end of Tightening

Welcome to Capriole’s Newsletter Update #61. A consolidation of the most important Bitcoin news, technicals and fundamentals.

Market Update

Last issue’s conservative positioning was justified, with Bitcoin subsequently falling over $10K on the back of Bitcoin’s continuing poor on-chain fundamentals. On-chain data continues to weaken and the technical Wyckoff distribution we noted has pulled Bitcoin down.

In the meantime we have seen two drastic changes from a macro perspective:

- The Federal Reserve (“Fed”) balance sheet tightening will be all but ending tomorrow, with the monthly Treasury securities redemption cap dropping from $25B to a mere $5B.

- Mounting Trump tariffs continue to be a drag on risk assets, with Bitcoin maintaining its strong correlate with Equities (not Gold).

The Fed’s recent reduction in tightening is the first (and significant) step towards liquidity normalization, with the market broadly expecting a complete end to official Quantitative Tightening (“QT”) alter this year. We are a whisker away from that event now. When complete, this will bring to a closure the most aggressive Fed tightening regime ever, which began in late 2021. We are already seeing very strong signs of bottoming in US Liquidity; a comprehensive metric capturing the rate of change of US Dollar liquidity flows in and out of markets as a result of Fed Balance sheet tightening, changes in to Reverse Repurchase Agreements (RRPs) and the Treasury General Account. We first noted this two weeks ago and so far the trend in US Liquidity has continued to be up (usually bullish risk assets). Combined with the Fact the Fed Balance sheet tightening will collapse from tomorrow, we can expect to see US Liquidity continue to trend up over the coming weeks (and months). You can track US Liquidity live at Capriole.com/Charts.

March saw a whipsaw of Trump tariffs as policy changes and negotiations resulted in rapid tariff changes day to day. Trump has already imposed tariffs on aluminum, steel and autos, along with increased tariffs on all goods from China. Last week saw the introduction of a new 25% tariff on all automobiles imports. Equities and Bitcoin legged down as a result. Yesterday’s announcement by Trump confirmed that we can expect reciprocal tariffs on all countries from Wednesday, April 2nd which he has dubbed “Liberation Day.” The market continues to brace for volatility in early April as a result.

It remains to be seen how long the tariff uncertainty will remain. It could be days, it could be months. But we can certainly expect quite a bit of action on Wednesday as “Liberation Day” plays out. A 25% tariff on automobiles resulted in a ~6% drop in Bitcoin last week. As has been the case in the last weeks, should Wednesday’s new tariffs be substantial in magnitude, we can probably expect similar sized (or larger) moves over the coming week.

Technicals

The Wyckoff Distribution noted last issue has showed increased strength as the attempted breakout of $91K failed to the downside. Given we are midway between technical support and resistance levels on the chart today, this is not necessarily a good area to be opening/closing new positions here, but rather tells us to be patient and positioned conservatively; open minded to potentially substantial moves lower. Given the significance of recent political events and announcements, it is likely that Trump/Fed decisions over the coming weeks that decide the ultimate technical trend from here.

All else equal, a daily close above $91K would be a strong bullish reclaim signal.

Failing that, a dip into the $71K zone would likely see a sizable bounce.

Fundamentals

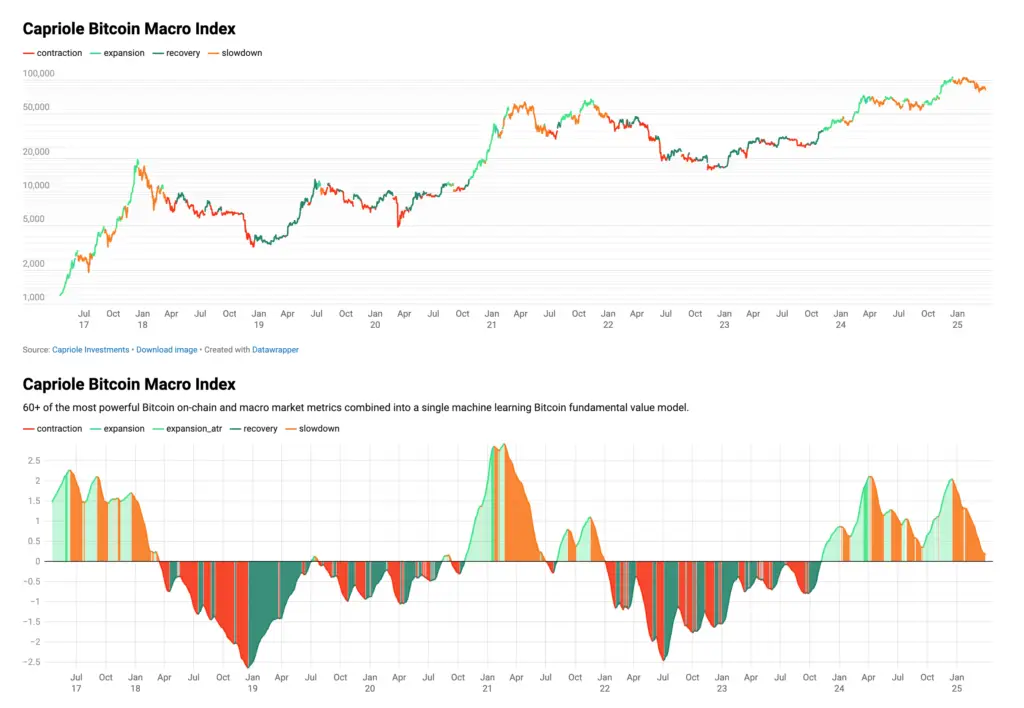

The collective picture as shown through Capriole’s machine learning fundamentals model Bitcoin Macro Index still suggests risk management here, but has a conservative long positioning. This Index includes over 60 of the most powerful Bitcoin on-chain, macro market and equities metrics combined into a single machine learning model. It is a pure fundamentals-only value investing approach to Bitcoin, where price isn’t an input.

As per last issue, Fundamentals have been in contraction since December, but there are signs that liquidity in the US is bottoming and starting to rise which offsets a potential short side weighting for this strategy. Nonetheless, as long as Bitcoin Macro Index trends down, Bitcoin will continue to face headwinds.

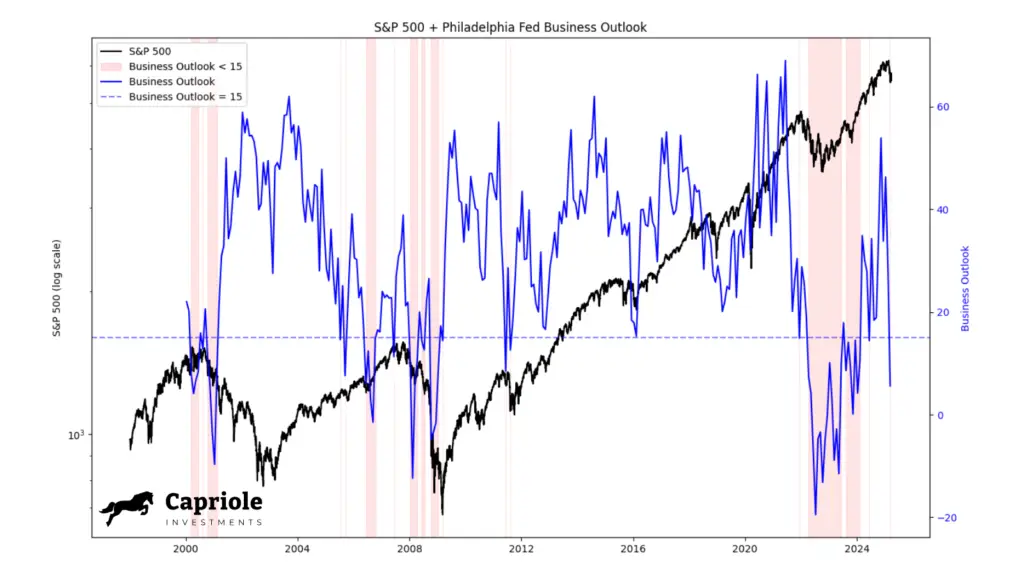

Chart of the Week

The Business Outlook survey, as reported by the Philadelphia Fed, deteriorated significantly over the last weeks. Recently the index dropped below 15. Equivalent readings of poor Business Outlook are highlighted below in red. While no guarantee of the future outlook (this metric does have false signals) this is a data reading we have had before at very high risk zones (year 2000, 2008 and 2022), telling us to keep a very open mind. Especially if the tariff war escalates significantly beyond current expectations or corporate margins start to fall.

The Bottom-line

Much like last issue, key technicals and fundamentals are both telling us to be wary at present. Bitcoin struggles to put in strong performance when the Capriole Bitcoin Macro Index is in a downtrend, and that continues as of writing. For the Capriole Fund, that has told us to steer clear of higher risk assets (effectively all altcoins) for the last weeks. We have a lot of unknowns today with the highly volatile US tariff war continuing to play out. We can expect quite a bit of uncertainty in April (especially this week) with Trump’s tariff “Liberation Day” commences on Wednesday. And one thing is for sure – markets do not like uncertainty.

One logical argument I have seen made is that Trump is looking to take the most economically difficult decisions (i.e. harsh tariffs) early on in his presidency and move towards more pro-market actions later. Actions that he would be remembered by. This strategy makes sense on a number of fronts. Therefore, we might expect the bulk of tariff policy decision volatility to be behind us later in 2025. At the same time, and with much greater certainty, we are rapidly approaching the end of the Fed’s QT. So while fundamentals and technicals look weak today, things can change very quickly. We expect the odds of a promising setup to increase as this year progresses and we remain dynamic to the data at hand.

Charles Edwards