Welcome to Capriole’s Newsletter Update #56. A consolidation of the most important Bitcoin news, technicals and fundamentals.

Then You Win

In recent years, it’s hard to remember a time when we had less overhanging FUD (fear, uncertainty and doubt) on that market than now. Until recently, we have always had the Mt Gox 130,000 Bitcoin distribution lingering above our heads, a fear the market saw resurge nearly every year as a source of potentially massive market selling. Mt Gox supply is now effectively gone. This year also saw the combined US and German Government selling, adding to the market wide sell pressure. Finally, the last 4 years was the most anti-Bitcoin and anti-crypto combative politics in the industry’s history, which brings to mind the classic quote:

“First they ignore you, then they laugh at you, then they fight you, then you win.”

We definitely entered the “then they fight you” phase over the last couple years. Operation Choke Point saw industry wide debanking, baseless SEC attacks and multi-year delays on the spot Bitcoin ETF (despite a futures ETF launching years earlier). Now we have a pro-Bitcoin government entering the most powerful country in the world, with a nominated president who has already launched multiple NFTs and cryptocurrencies in the past, has used and understands the power of Bitcoin and has recently pledged to establish a US Bitcoin reserve. It’s starting to look increasingly likely that we are entering the “then you win” phase.

We’ve been harping on about Bitcoin being undervalued for months now. It’s hard to time breakouts on significant fundamental value. Bitcoin was forced into a very unusual eight months of volatility compression until November 6th, clamped between $60-70K under the duress of massive supply distribution and political uncertainty. This is the first presidential election that has had any significant impact on the price of Bitcoin, and the sweeping Trump victory (election, popular vote, house and senate all won by Republicans) has given a clear path forward for our industry. As a result, the market is starting to rapidly reprice Bitcoin to its fundamentals. Against comparable assets like Gold to which Bitcoin has been lagging. A repricing against gold’s appreciation to date alone suggests Bitcoin in excess of $140K is likely justified.

Of course new risks can and will emerge. Will world order be maintained in Europe and the Middle East? Will exuberance through excessive leverage cut the current trend short? Will Trump’s ability to execute on a Bitcoin reserve be delayed or deprioritized?

Regardless, Bitcoin and crypto today has bluer skies than it has seen in years.

Let’s look at what lies ahead.

In the coming months we will also see the multi-billion-dollar distribution from FTX, new capital going into the hands of many willing Bitcoin and crypto buyers, and the potential for a US government reserve buyer entering the market over the coming years. As the US adopts and supports Bitcoin, all other OECD countries will eventually need to follow suit. Simple game theory.

Microsoft shareholders are also voting in December whether or not to add Bitcoin to the balance sheet. While the result is uncertain, the outperformance of Microstrategy to every S&P 500 stock including Microsoft and NVIDIA will definitely sway some votes. Whether it’s Microsoft or not, sooner or later more Magnificent Seven companies will add Bitcoin to the balance sheet, triggering a domino effect throughout the S&P 500 forcing companies to buy in order to remain competitive.

We also have Microstrategy on track to enter the S&P 500 in the coming months, this alone will see billions of dollars automatically directed to Microstrategy stock as ETFs auto-rebalance their S&P 500 holdings. In other words, forced buying – the exact opposite of the forced selling we have seen through mid-2024. As we know, all of that balance sheet appreciation gets directed by Microstrategy into more Bitcoin buying. It’s a reflexive, ratcheting effect on Microstrategy and the Bitcoin price.

The game theory towards Bitcoins adoption cannot be understated at this point.

Technicals

Bitcoin’s high timeframe technicals have confirmed a clear breakout of the 8 month $60-70K range. An equal size move from the nearest base ($42K) would suggest this current breakout should carry us to $100K.

$102K also represents the 1.62 Fibonacci extension level from the 2021 all time high to the 2022 FTX bear market low. Another major technical level. Finally the “$100K” number is a clearly watched milestone round number. From a technical perspective, this makes $100K the most important level to watch for on the upside. It’s both a magnet and an obvious place for longer-term holders to at least consider some profit taking.

When in price discovery, we don’t have many technical levels to watch for, until new price consolidations create them. A certain level of volatility in price has to be accepted in order to capture the meat of the trend and avoid selling on early dips.

$100K also represents the fair value of Bitcoin, based on Bitcoin Energy Value. Energy Value has a habit of always being exceeded by significant margins in prior bull markets. Given the broader backdrop discussed in this Update, other on-chain fundamentals and comparables across Gold and equities; it would be surprising for $100K to represent a major top. Rather, I expect the $100K region to be a near-term trouble zone, but it wouldn’t be surprising for it to also be quickly exceeded.

Fundamentals

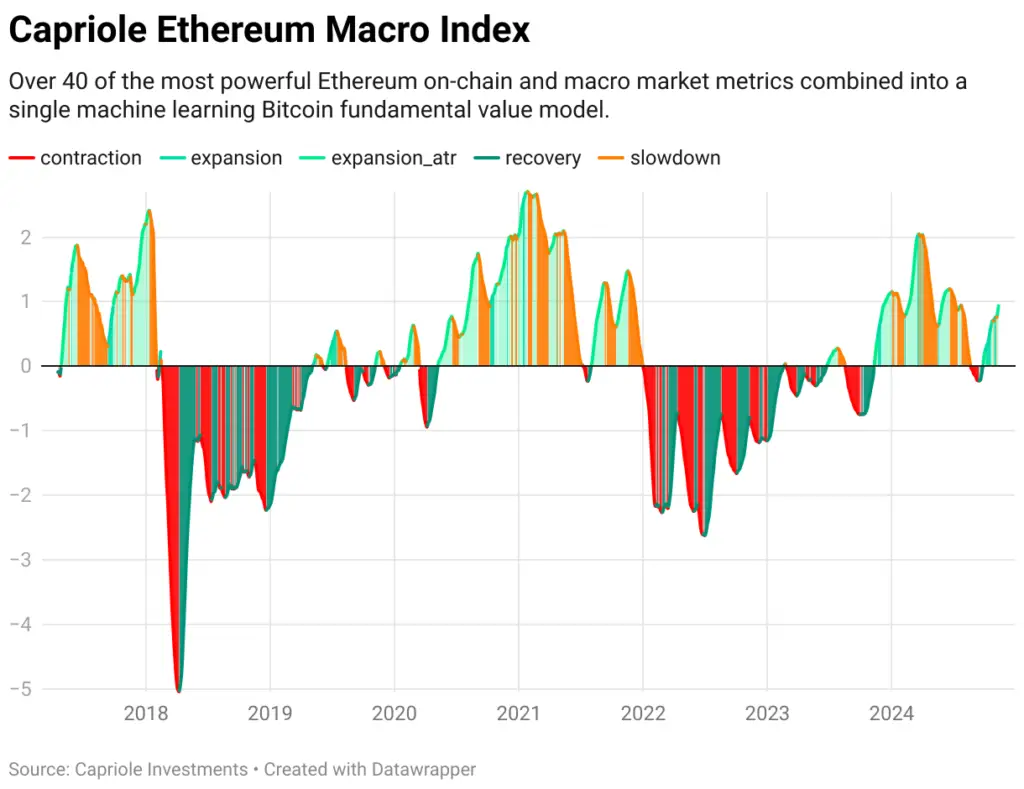

The collective picture as shown through Capriole’s machine learning fundamentals model Bitcoin Macro Index. This Index includes over 60 of the most powerful Bitcoin on-chain, macro market and equities metrics combined into a single machine learning model. It is a pure fundamentals-only value investing approach to Bitcoin, where price isn’t an input.

Following a brief risk off period into the election, the Bitcoin Macro index today suggests continued expansion with on-chain and macro market metrics holistically in a net uptrend.

You can track this metric and more here.

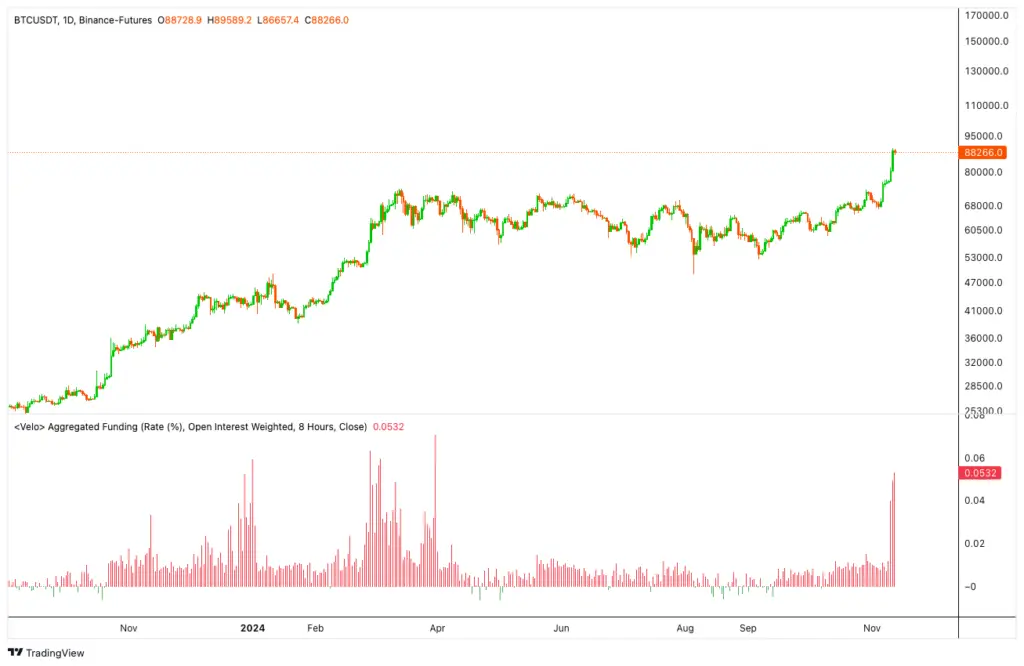

Leverage Risk

When things look this strong across technicals and fundamentals the biggest near-term risk factor is excessive use of leverage which could result in liquidation blowouts. As discussed last update, Funding Rates have had lower signal in recent last years. The usefulness of this metric will re-emerge quickly as retail re-enters the market. It looks like that process has started. It is the extremes in this metric we want to be most careful of. Already funding is getting to heightened levels today, suggesting growing long-side positions as traders seek to double down on Bitcoin’s upside. A good part of this is also from short side positions closing (healthy), but there is also very clearly growing long side leverage occuring (unhealthy). The market can sustain this for some time provided the price trend continues up, but if these elevated Funding rate levels are sustained for weeks and months, we would be concerned and the risk of a significant price flush would be high.

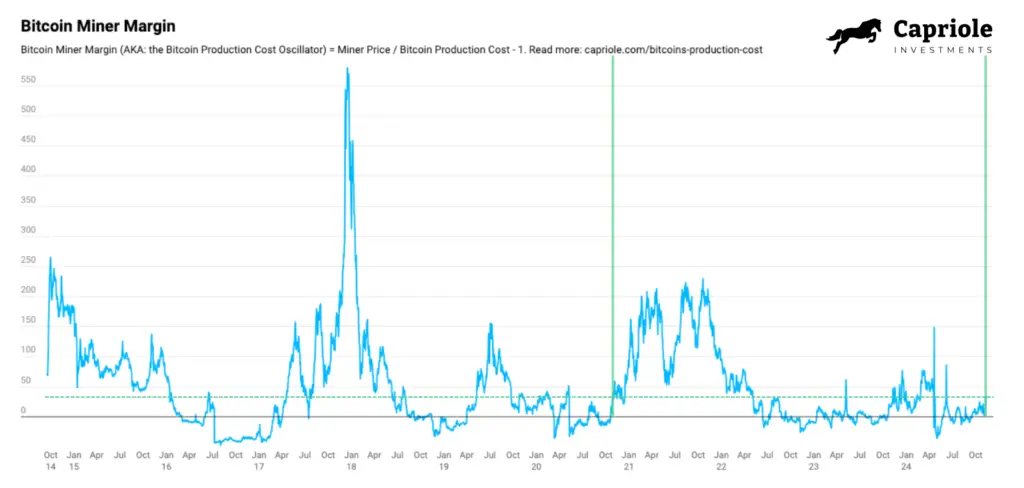

Chart Of The Week

Bitcoin Miner Margin shows the percentage margin Bitcoin miners are making when comparing the Bitcoin price to the market average cost of production. Today’s Miner Margin (Green line) is at the same point as in the October 2020 cycle, which gives us some insight into how Bitcoin is priced to value at $88K today. This chart suggests a promising pathway ahead.

Bottom Line

The bullish Bitcoin and digital asset case is substantially stronger today than it was just a few weeks ago.

Last update we concluded:

“If history is anything to go by, we usually see renewed growth in speculation type activities when Bitcoin trends beyond all time highs. This era may be just in front of us, opening up a more speculation driven environment, stronger retail growth and broader price appreciation across cryptocurrencies. A more “Player-vs-Environment” landscape. That trigger may be increased certainty following conclusion of the US election.”

This has come to pass. Two years ago FTX hurt many people. But price heals all wounds. With Bitcoin above $80K, expect to see fresh and significant new capital inflows from retail investors. This trend will likely turbo charge once Bitcoin takes and holds $100K USD with strength.

We haven’t been this optimistic about our industry in a long-time. What we are seeing today is a mirror image of Nov/Dec 2020. Provided the current trend holds, it is setting the entire market up very well for 2025.

Charles Edwards