Welcome to Capriole’s Newsletter Update #49. A deeper dive on the forth Bitcoin Halving, Runes, Onchain valuations and macroeconomic conditions going into mid-2024. Here’s what some of the most important data is saying about Bitcoin…

Harder than Gold

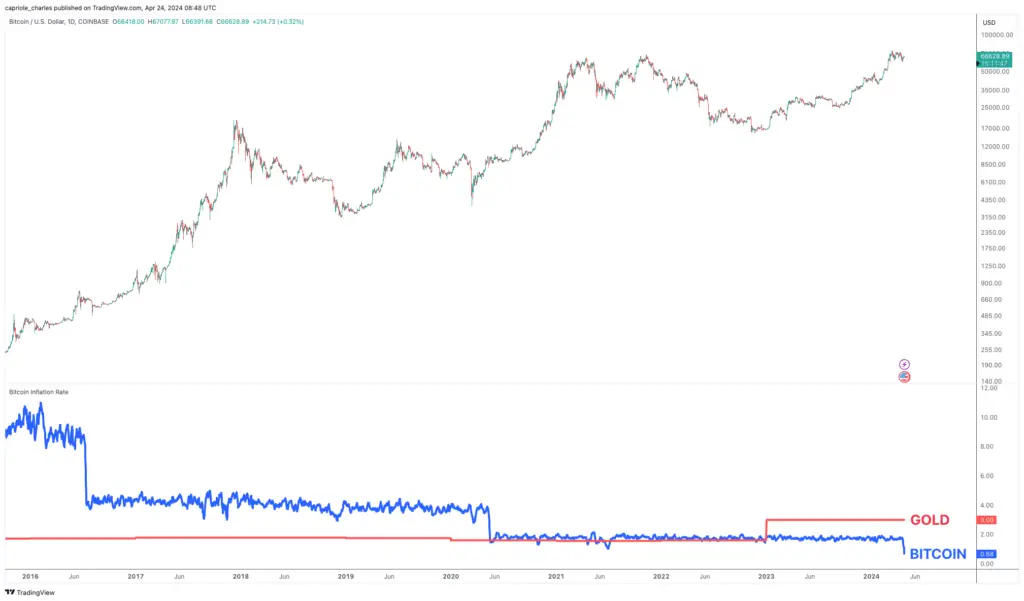

This week was a special week for Bitcoin. With the Halving, Bitcoin’s supply growth rate (inflation rate) dropped -50%. At the same time, Gold’s inflation rate went up +50% in 2023 to 3% p.a. That makes Bitcoin’s inflation rate less than one quarter of Gold’s. Bitcoin is now the hardest store of value. In a high inflation world, with decades of continuous currency debasement, this puts Bitcoin at the pinnacle of global fungible assets for long-term wealth preservation.

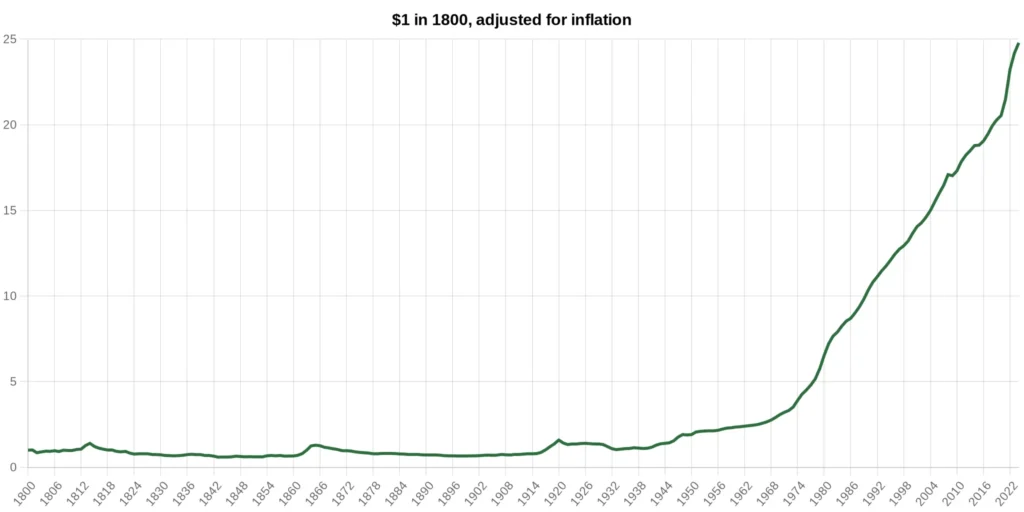

A 100 years ago, the US Dollar was worth 25 times more than it is worth today. With debt-to-GDP near all time highs and growing, the Federal debt burden from high interest payments is overwhelming. This chart will continue to only going one way. Up. It’s easy to see where a hard store of value fits into this macro picture.

If you are looking to sit on one asset for the next decade and do nothing, the above two charts are probably all that matters.

Bitcoin in Transition

The fourth Halving this month is a unique period of change for Bitcoin and the industry. We have several forces at play driven by the Bitcoin mining block reward dropping by half. Typically, all else equal, a halving in the block reward means the revenue stream of Bitcoin Miners drops by -50% overnight. This may not have a huge impact on highly cost efficient miners, but for those with older mining hardware, lower energy efficiency systems or higher electricity costs; it can be a killer. As a result it’s normal to see some consolidation in hash rate (and price) in the months around the Halving as inefficient operations shutter and the industry consolidates.

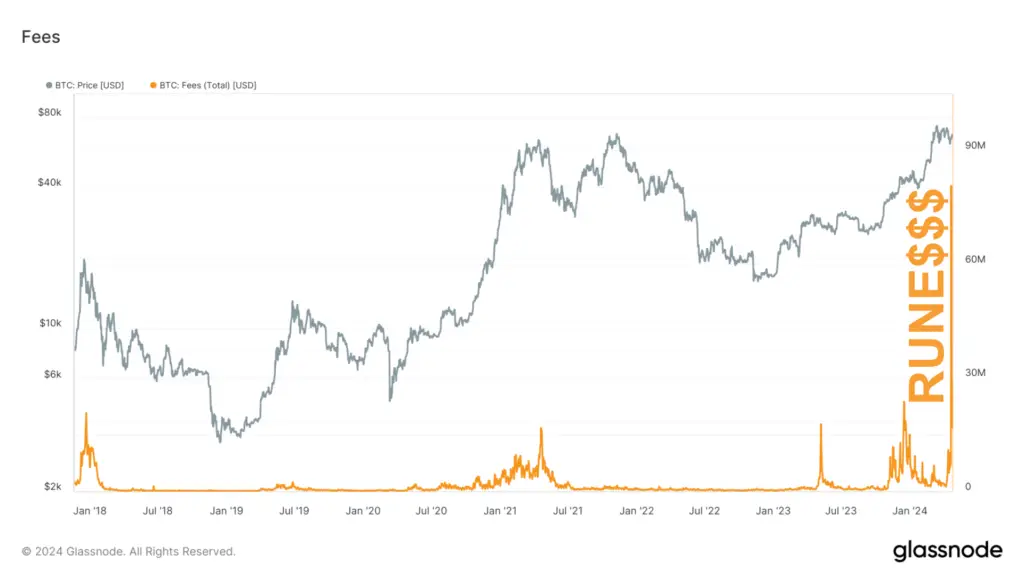

This time though all else was not equal. On Bitcoin block 840,000 a new protocol was launched on Bitcoin, Runes. By all measures the launch was a colossal success, with individual Rune’s having captures hundreds of millions of dollars in market cap in days. Bitcoin transaction fees have skyrocketed to all time highs, making the post Halving era ironically just as profitable for miners as before.

How long this will last? It is hard to say.

But if this cycle’s NFT/altcoin boom on Bitcoin is just half of Ethereum’s last cycle, this will be a massive draw card of attention and capital to Bitcoin. It would incentivize growth of the Lightning network, make mining more profitable and Bitcoin more secure at the same time. It would make Bitcoin more sustainable long-term as Bitcoin block rewards will continue to fall through cycles and need to be replaced by higher transaction fees to compensate miners for securing the network. It is too early to say if Runes will be the protocol of choice to champion this movement, but recent events are a clear foretelling that we can expect to see a lot more alternative utilization of the Bitcoin protocol in the coming years.

As a result, we have to consider a few near term scenarios:

- Runes/ordinals adoption grows and Bitcoin mining revenue remains high. In this scenario we may not see any measurable consolidation in the mining industry and no measured capitulation. At current utilization of these protocols, mining is highly profitable, comparable with (and greater than) pre-Halving levels.

- Delayed miner capitulation as Runes/ordinals utilization fizzles out. Whether this occurs next week or in a few months, this could have a similar effect to the Halving being delayed, as this would be the point at which profit margins would start to squeeze on low-efficiency miners.

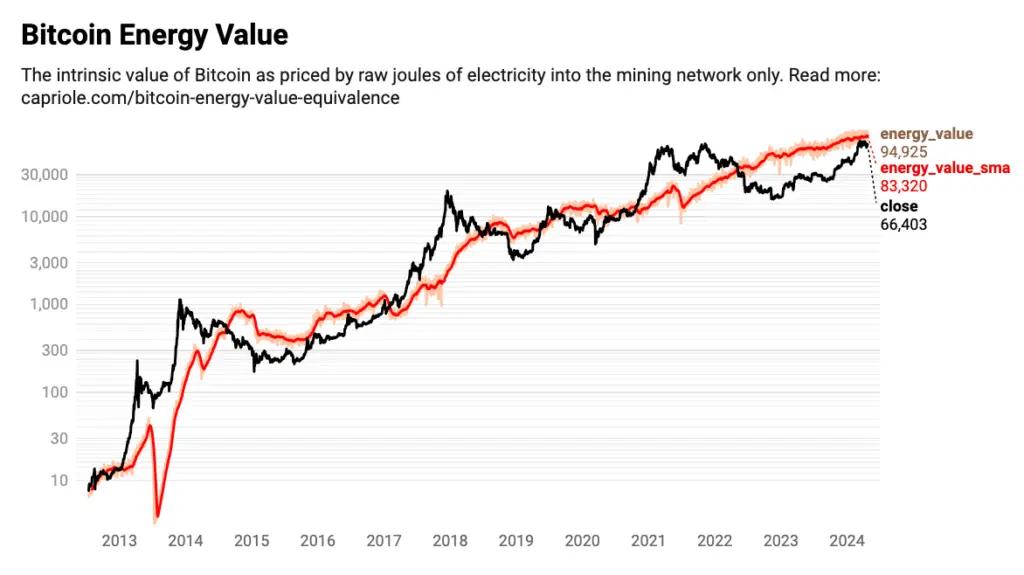

- Bitcoin price marches higher. With Bitcoin Electrical Cost at $70K (the raw electrical price to power mining rigs that mine each Bitcoin), we would expect to see Bitcoin’s price surpass this level considerably. However, there is no urgency for this to happen while Runes related miner revenues remain so high. Miners are highly profitable today. Nonetheless we would expect price to track to- and above-baseline Electrical Cost, as it has 100% of the time in the past.

My expectation is that variations of Runes and ordinals are here to stay. The NFT and digital art industry is here to stay and the memecoin culture is also here to stay. While we will see booms and busts, we can also clearly see a baseline increase in fees on the Bitcoin network over the last year from when ordinals were released in the above chart. We’ve also see a new wave of young money in various memecoins over the last 6 month which is starting to enter more and more into Bitcoin. While fees may not remain as high as they are today to transact on base layer Bitcoin, I expect them to increase in a cyclical nature over the coming decades, much like the Bitcoin price has, with higher lows on each dip.

So for the above scenarios, I think we will see more of (1) and (3) and some of (2) in the coming weeks. I am open minded to consolidation in this transition period which could last a couple months. But I am also cognizant of the fact that Bitcoin can be expected to trade at the 6 digit handle within the next 12 months, and this repricing to fair value could trigger at short notice.

Without Runes, I would have expected something in line with the May 2020 Halving: a period of 2-3 months of sideways, dull price action. But Runes have somewhat reduced this near-term downside consolidation risk in this transitory period.

Deep F***ing Value

As well as Electrical Cost suggesting higher baseline Bitcoin prices, we have Bitcoin Energy Value currently at $83K, which will likely trend into the $90/100Ks in the coming weeks as a result of the lower annualized supply growth rate of Bitcoin.

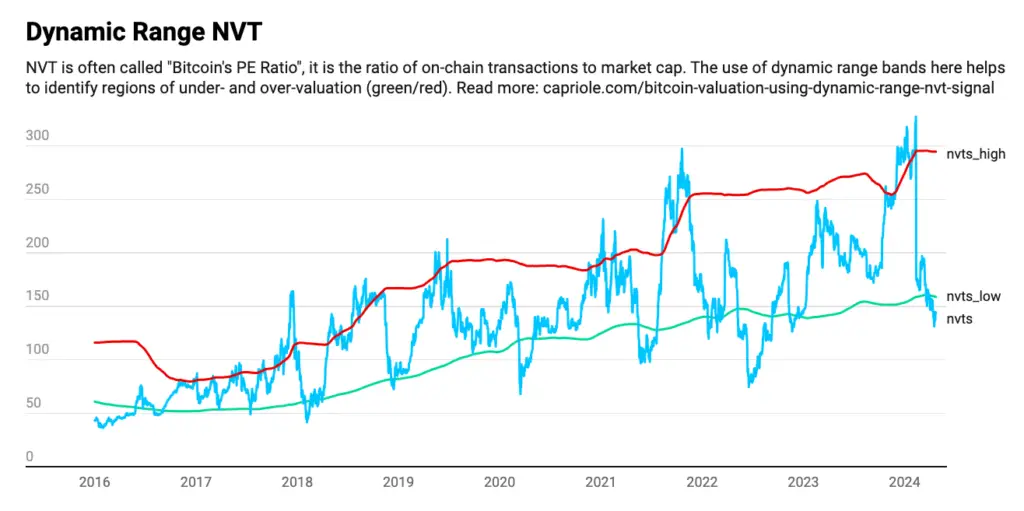

Dynamic Range NVT (Bitcoin’s “PE ratio”) is also suggesting a deep value opportunity today, very much driven by this new era of increased Bitcoin on-chain utilization.

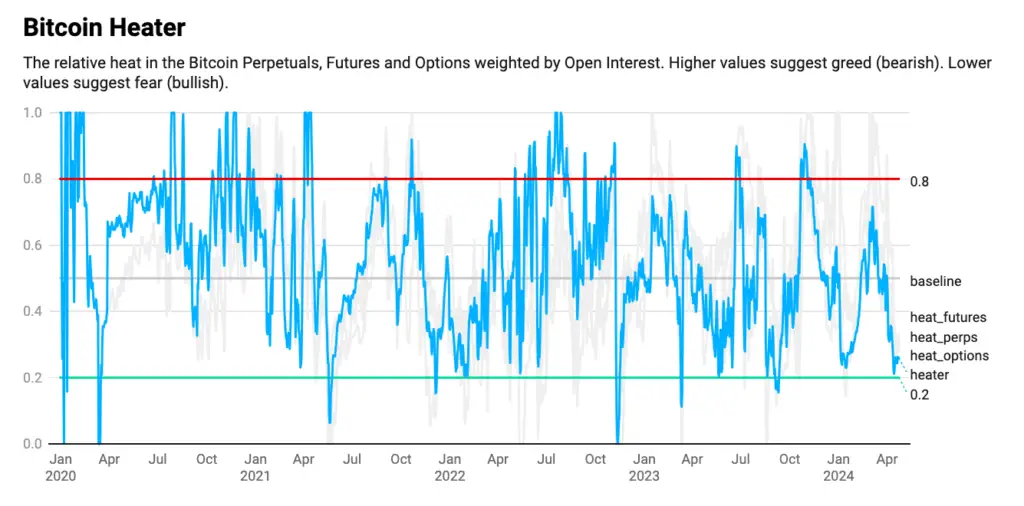

We also have a near reset across all Bitcoin derivatives markets as shown by the Bitcoin Heater which aggregates Perpetuals, Futures and Options markets. This is usually a bullish catalyst.

Headwinds

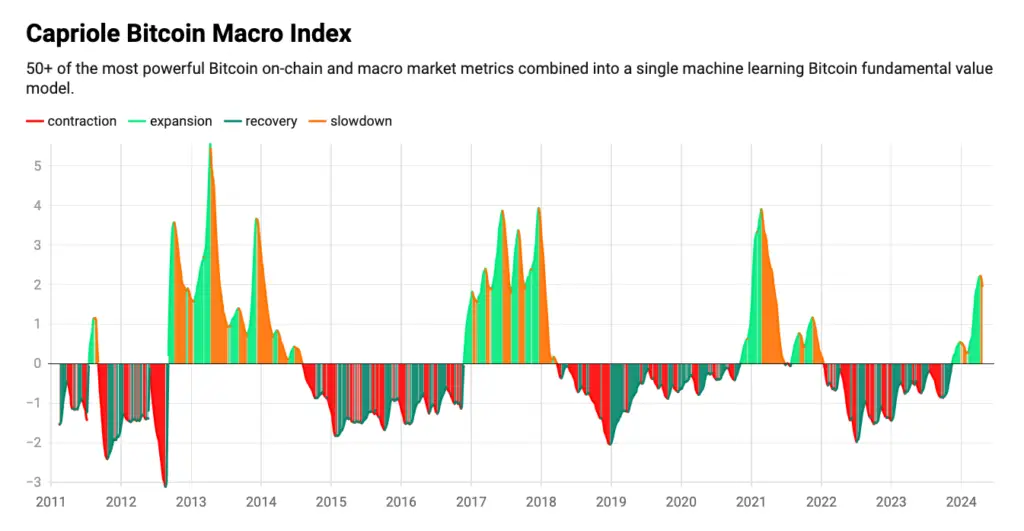

While some of my favourite single measures for Bitcoin’s relatively value shown above suggest a great opportunity, the collective picture as shown through Capriole’s machine learning fundamentals model “Bitcoin Macro Index” is less bright.

On the 13th April when price was trading at $73K, Bitcoin Macro Index marked a top and entered “Contraction” suggesting a new downtrend in Bitcoin onchain and macro fundamentals. While it is still in a downtrend today, a sideways glance shows that these periods of consolidation are normal in all bull runs.

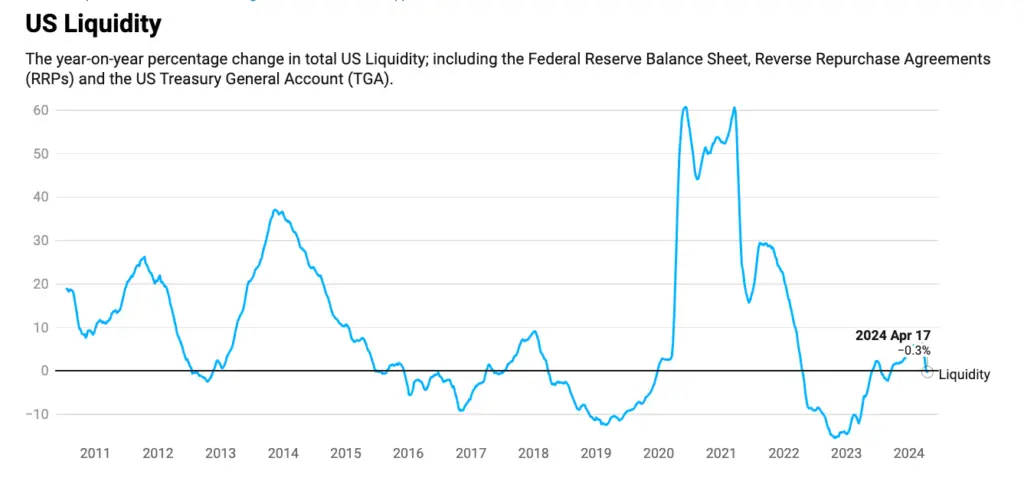

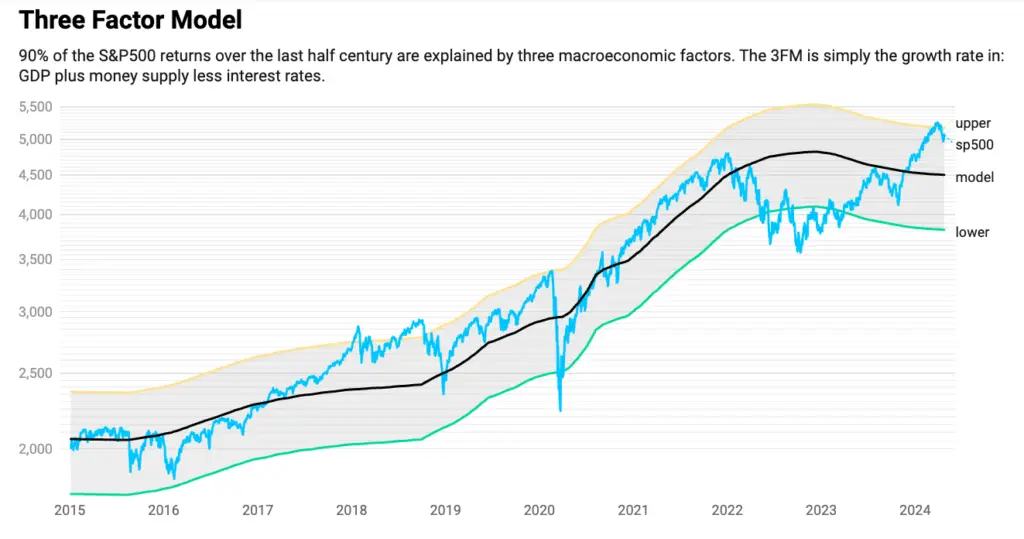

My bigger concern for the current market opportunity across risk assets and Bitcoin is the currently falling US liquidity. US Liquidity is a comprehensive measure of total fiat monetary inflation (or QE) in the US. When this chart is rising, we can expect inflation across all assets, and it is highly correlated with positive Bitcoin returns too (because Bitcoin is the ultimate inflation hedge). However, for the last month US Liquidity has been falling as the Fed, Treasury and Reverse Repo markets effectively tighten their belts; likely as a result of sustained “higher than expected” inflation.

Liquidity is the chart I am most concerned about. Though being an election year, there are several reasons to think this chart may change course in the coming months. And it will almost certainly change course if the US gets a new President in 2025. Sidebar: a change in President would also likely see a much more pro-Bitcoin and favourable crypto environment generally in 2025 given current candidate stances towards the industry.

We also recently saw equity valuations hit extremes and start to correct towards fair value. Too soon to say if this move is over, but I suspect not. More pain may be required. Going into the normal summer months the proverb “Sell in May and go away” comes to mind. Falling liquidity, repricing risk assets from high valuations and summer market lulls… a potent concoction. It wouldn’t be surprising to see equities and Bitcoin have a challenging or dull few months ahead if this equities correction gets serious.

The Bottom Line

The Halving could not have gone any smoother. The deployment of Runes on the same block resulted in the most favourable conditions for Bitcoin miners of any Halving. At the same time it has drawn in a new utilization of Bitcoin. More attention. A new audience. While Runes does not play into the key value proposition of Bitcoin: a decentralized hard asset which is solving the global failings of money; it does bring new eyeballs and life to the asset class in the near-term. This “life” is a fantastic smoother of Bitcoin mining revenue and provides an additional buffer to potential downside risk in this transitory Halving period. While Runes may be of limited scope and value today, it’s easy to see alternative utilization of the Bitcoin protocol growing into a much more massive ecosystem of value across all industries and sectors in the years to come. Runes is just the first or second domino to fall.

Key onchain metrics are suggestive that this bull has a lot further to run. With unusual undervaluation readings across important long-term metrics for this point of the cycle and most notably Bitcoin Electrical Cost suggesting higher baseline Bitcoin prices once transaction fees from Runes have stabilized. Nonetheless the macroeconomic headwinds have started to take a turn for the worse. Interestingly, this turn is happening while no one is talking about macro, as opposed to when everyone and their dog was calling for a recession two years ago that never came. The only question is, how long can tight macro conditions last? Will there be more pain before continuation like the 2013 cycle? With interest rates near 5% on all time high debt, inbound presidential elections and the possibility of falling asset prices, it’s only a matter of time before liquidity rises once again.

Charles Edwards

PS: if you liked the charts, we publish most of them live at Capriole.com/Charts