Welcome to Capriole’s micro update. Where we consolidate the most important Bitcoin news, technicals and fundamentals into a 3-minute update. Two technical charts, two fundamental charts and our chart of the week.

30-second Market Summary

Bitcoin is trading into the most significant resistance on the chart, $32K. Despite a swath of positive news stories over the last month for the crypto industry; from the Blackrock ETF announcement, the XRP legal victory through to presidential candidate Kennedy stating he would back the US Dollar with Bitcoin today; nothing has helped Bitcoin sustain momentum above $31K. When good news like this (probably the best news for our industry in years) can’t transform into sustained inflows and price progression, there is cause for concern. As we wrote about way back in April 2023; until Bitcoin can convincingly sustain price levels above $32K, it makes sense to be conservative in the upper $30K region.

The Technicals

High Timeframe Technicals: Despite a series of perhaps the best crypto news in years, Bitcoin has failed to break out of weekly resistance at $32K. Suggesting a greater area of opportunity on a $32K break or reversion to the mid-$20Ks. Interactive Chart here.

Low Timeframe Technicals: A daily close above $30100 (TBC) could signal a reversion trade to $31K range high. Failing that $24-28K represents better technical value for longs. Interactive Chart here.

Fundamentals and Value

Price is only half the picture. What about on-chain flows? What are retail and institutional investors doing with their capital? Is the mining network and security growing? How can we incorporate macroeconomic changes, equity market risk and broader market sentiment into Bitcoin? Finally, how do all these metrics compare on a relative basis to prior Bitcoin cycles?

We believe the full picture of fundamentals is best summarized by Capriole’s Bitcoin Macro Index.

Over 40 of the most powerful Bitcoin on-chain, macro market and equities metrics combined into a single machine learning model. This is a pure fundamentals-only value investing approach to Bitcoin. Price isn’t an input. Capriole actively trades the Macro Index model on a daily basis, but note that what we present here is updated on a semi-static, weekly basis.

Current score: -0.189 “Contraction”

The Macro Index today remains in a period of relative value (below zero), suggesting decent long-term value for multi-year horizon investors. However, the Index just re-entered contraction. On-chain and macro fundamentals have started to trend down following a 7-week period of recovery which started at $26K in early June.

Our interpretation: long-term bullish, short-term neutral

[If you like the Bitcoin Macro Index, we share a weekly update of the Ethereum Macro Index here.]

Chart of the Week

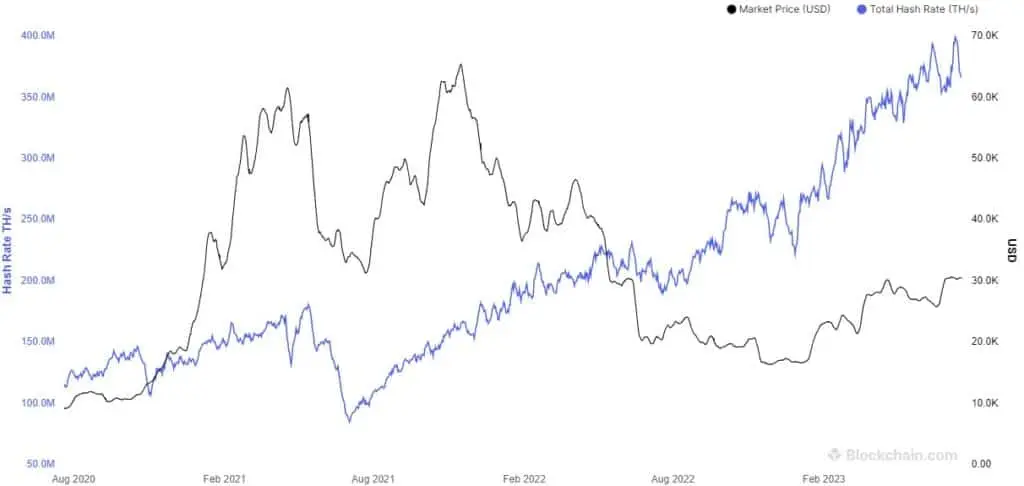

The Bitcoin mining network has grown by another 50% in just the last six months. That means the most powerful computer network in the world is more than doubling in size every year today. Incredible.

The Bitcoin network Hash Rate is growing at an unfathomably rapid clip and there is a strong price relationship with network value. Source: Blockchain.com

Bottom-line

Both technicals and fundamentals are sending a consistent message of caution today. Following a 50% increase in Bitcoin’s mining network in the last six months, long-term value still remains, but now is probably not the time to go all-in. While trade opportunities exist if the range lows can hold on the lower time-frames at end of day; the risk-reward opportunity is not present for high conviction investments.