90% of the S&P500 returns over the last half century can be explained by a simple three factor macroeconomic model. GDP, money supply and interest rates. These three metrics alone explain almost all the performance of the stock market.

In this short article, we present a simple 3 factor model to determine the fair value of the S&P500.

The Three Factor Model

What drives equities markets fair value and price inflation?

When you boil it down, it’s very few factors.

- How much money the government printing. If it’s a lot, money loses value and therefore the price of goods, services and the stock market goes up.

- How much innovation is occurring. We need to consider an innovation factor to help explain technology improvement, population growth and a general increasing output in human productivity. For this we chose GDP.

- How costly is capital. Finally, the baseline cost of capital is very important. When interest rates are high, it’s expensive to borrow and less enticing for people and businesses to invest in future output expansion. Treasury rates are one of the primary de facto inputs in investment banking models for determining the ‘cost of capital’ and determining the net present value of equities. The 2Y treasury is a great yard-stick for short to mid-term capital costs.

The Three Factor model presented here is very simple. We calculate the daily effective rates of return of each of these three metrics and add them all together as follows.

3FM = Daily effective rate of return of: GDP plus M2 Money Supply less 2Y Treasury Rates.

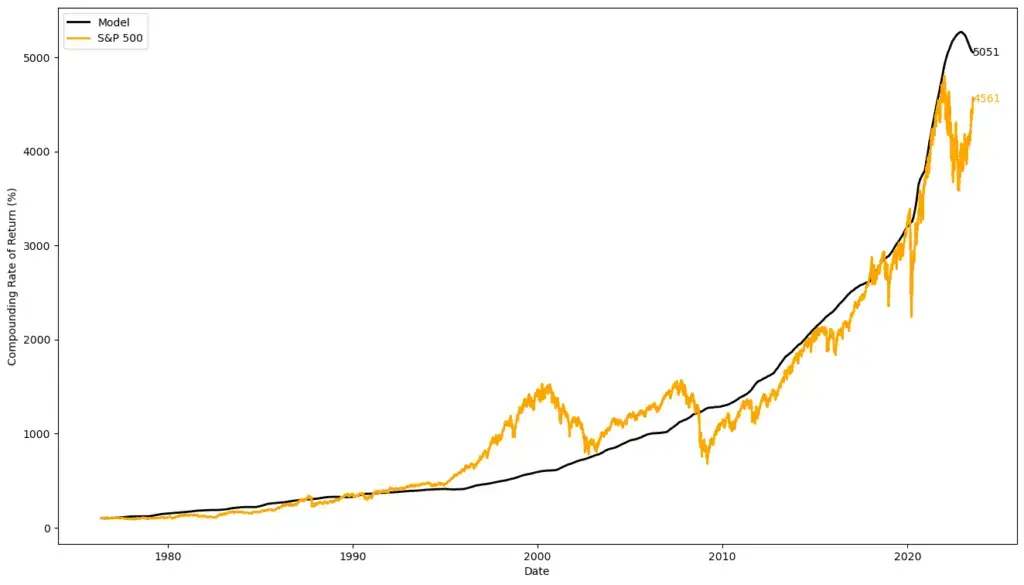

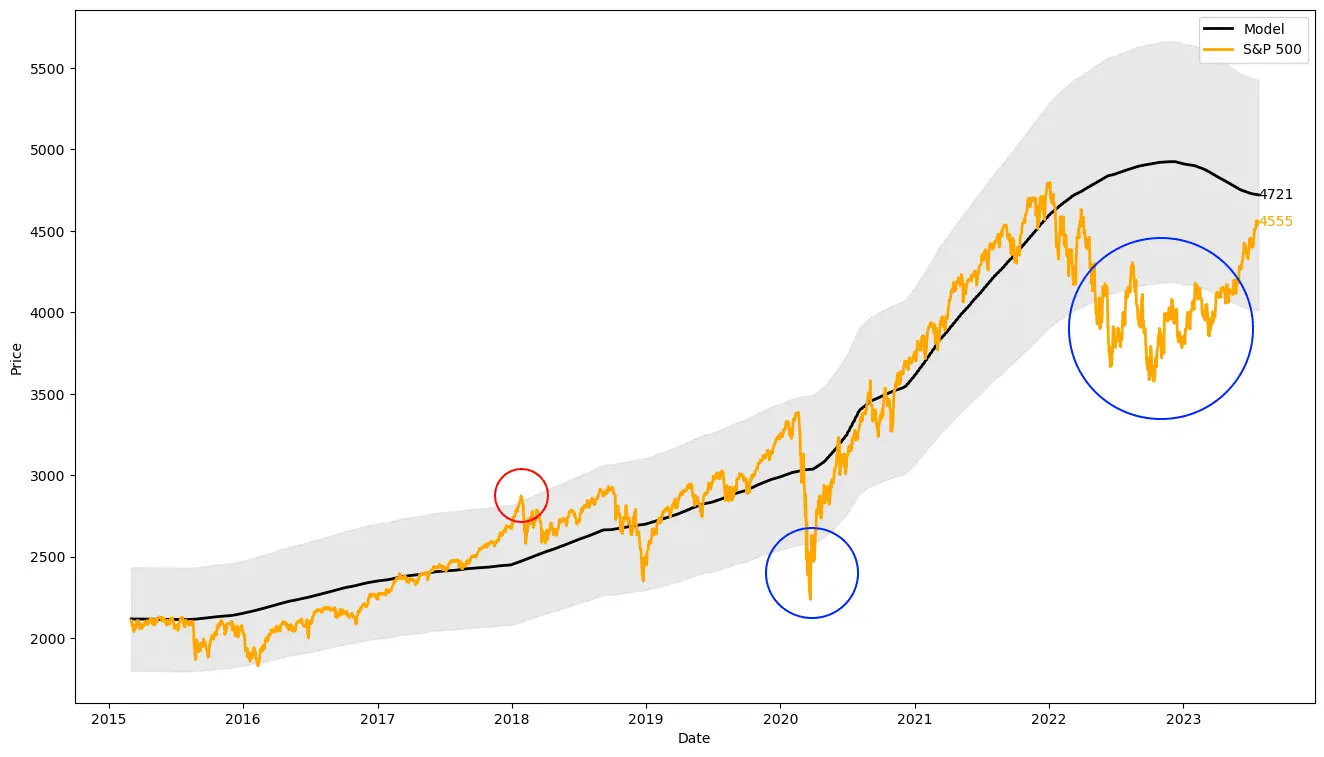

When you compound those daily 3FM returns through time from 1965 you get the following chart.

Voilà

Fitting

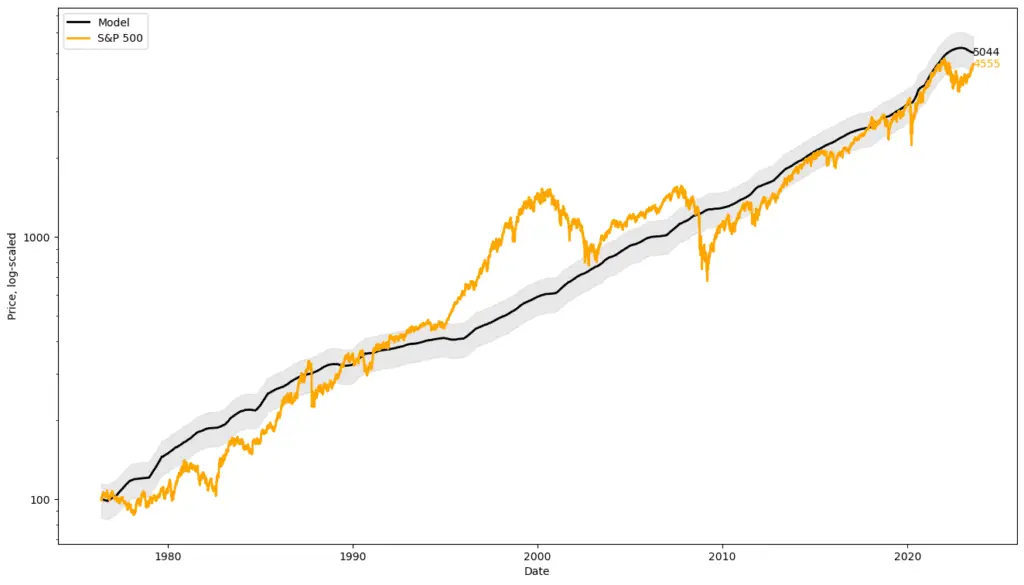

Our data source is the Federal Reserve Bank of St. Louis (FRED). Most of these data sources start in 1965.

The R2 ratio of our Model to the S&P500 is 0.905, suggesting about 90% of the S&P500 cumulative returns over the last 60 years can be explained by this model.

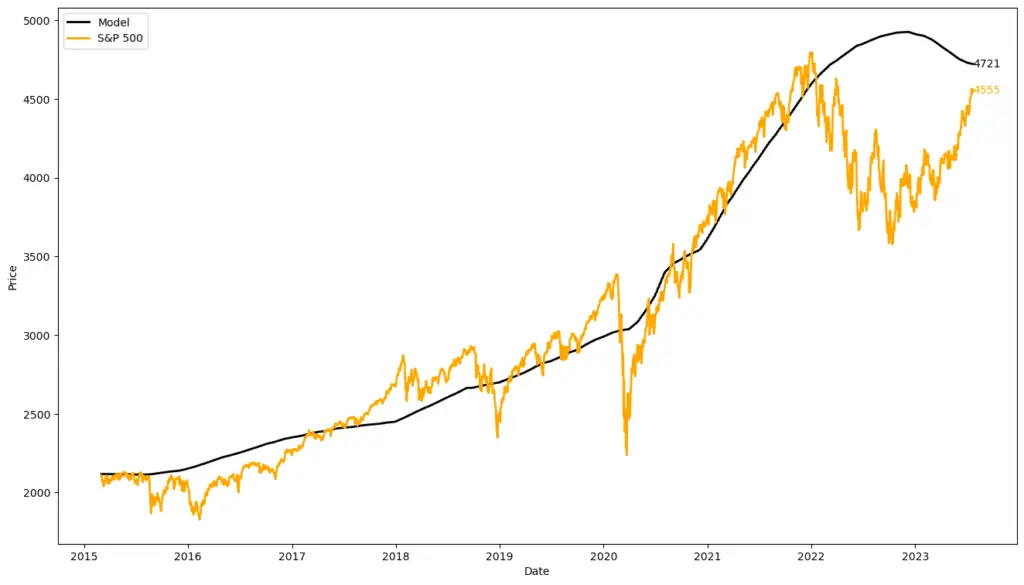

Zooming in, we can see the fit holds well over the most recent decade of extraordinary events.

Use Cases

This is an ultra high timeframe model. Some of the data inputs like GDP are only updated quarterly and with a lag, so we need to be careful how we use it. Nonetheless we can use this model as a broad market barometer to very logically explain where market value lies on a relative basis. In the shorter term, there are many other factors that play into market value that we don’t consider here; including more granular data points, expected future market conditions and more.

Relative Value

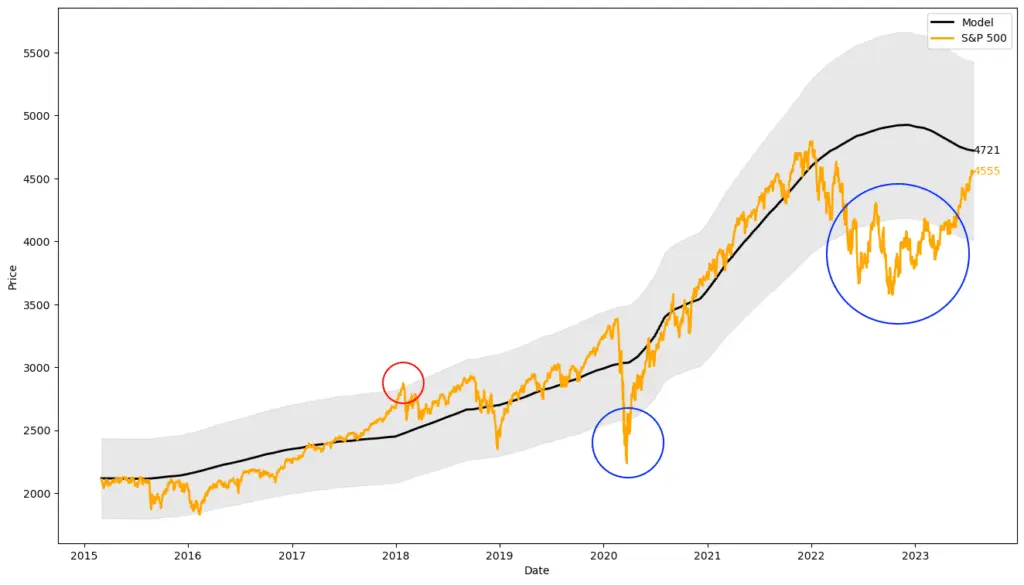

If we are to use the 3FM model for valuation, a generous tolerance band of 15% either side makes sense. Using this, relative periods of market fear and greed become much more pronounced and we can see market returns below and above the fair value band. In the below chart we have normalized to S&P500 prices for easier interpretability.

Note the mid-1990s exceptional ramp up in price to value. This period can be somewhat explained by the 400% increase in real earnings growth rates from 1995 onward, as we discussed here. With this we also saw the additional speculative mania from the tech bubble into 2000, and then the housing bubble in 2008.

Live Market Interpretation

When we understand that the market is driven primarily by these three factors, it also gives us the capability to act with conviction on the day-to-day level when we witness measurable macro changes; such as the Fed’s change of regime from zero rates to tightening, the massive stimulus packages (QE) of 2020 and when we see potential leading indicators of bottom-line under- or over-performance from the tech giants (FANG+) earnings. We are able to more easily interpret how these big events will impact each element of GDP, Money supply and rates, and correspondingly estimate how markets will react in the coming 6-12 months and position accordingly.

Conclusion

Three simple metrics; GDP, money supply and interest rates can be used to build a robust long-term valuation model of the S&P500 market. Simple is good. In this case, three factors alone explain 90% of the last half centuries market prices.

Today, the 3FM model tells us markets are fairly valued, despite the 20% rally that occurred this year.

Interestingly, we have never seen a decline in the model’s fair value in the last 60 years to the degree that we are seeing today. Though the 3FM model is starting to flatten out today, we are in uncharted waters from what is now the most aggressive Federal Reserve monitory tightening regime in history.

2 Responses

can this model be mapped in tradingview so I can add it to favorites

Hi Ongko, we are plotting it live on capriole.com/charts