A rule-of-thumb Bitcoin valuation tool.

[Originally posted as a Twitter thread here: https://twitter.com/caprioleio/status/1587737939588616192]

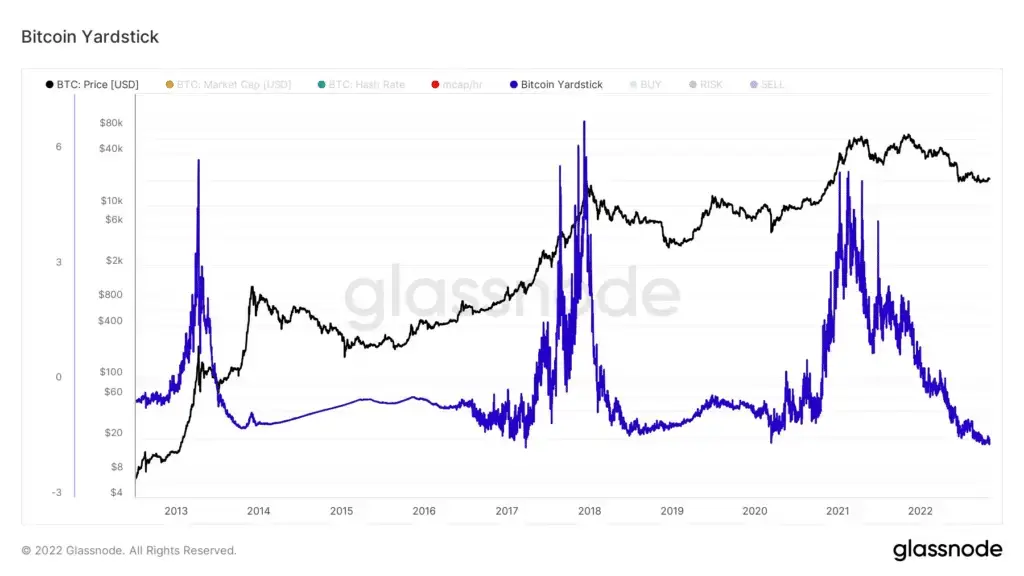

Today we are seeing valuations unheard of since Bitcoin was $4K. Introducing a very simple, rule-of-thumb Bitcoin valuation tool:

Bitcoin Yardstick = market-cap / hash-rate, normalized over 2 years of data.

Similar in concept to a “PE Ratio”, except instead of stock earnings, the Bitcoin Yardstick is taking the ratio of energy work done to secure the Bitcoin network in relation to price.

Lower readings = cheaper Bitcoin = better value.

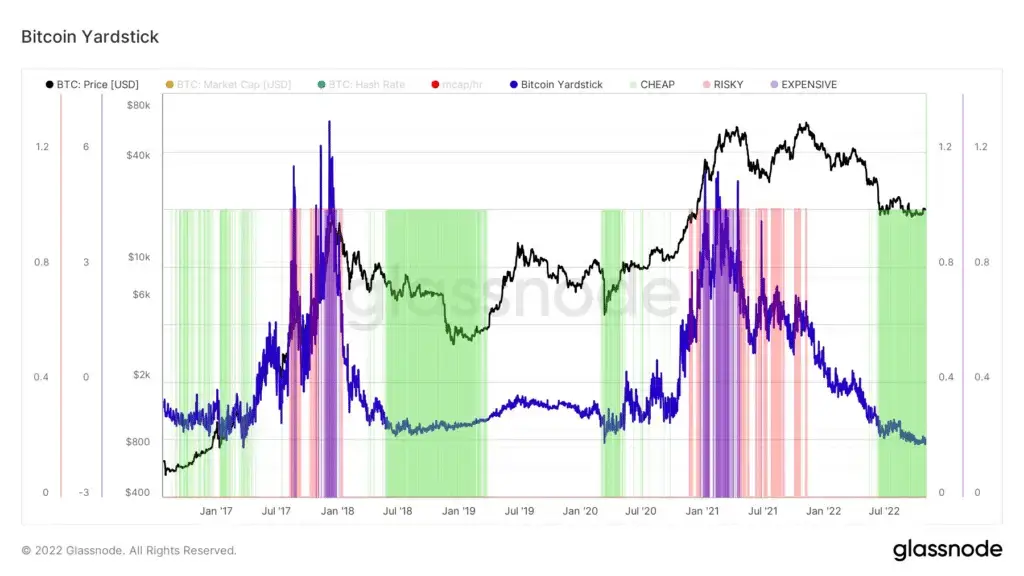

Here’s an application of the Bitcoin Yardstick which identifies when Bitcoin is:

- Cheap: Yardstick > 1 deviation under the mean

- Risky: Yardstick > 2 deviations above the mean

- Expensive: Yardstick > 3 deviations above the mean.

You can track Bitcoin Yardstick live on Glassnode here.

Today we are seeing the second lowest reading for the Bitcoin Yardstick in all of Bitcoin’s history. This means that on a relative basis, Bitcoin is extraordinarily cheap given the amount of energy being used on what is the most powerful computer network in the world.

Disclaimer on Backtests

Any Backtest performance returns presented represent hypothetical returns and are meant to simulate how a strategy would have performed during the period shown had the strategy been implemented during that time. Backtested/simulated performance returns are hypothetical and do not reflect trading in actual accounts. Backtest returns are provided for informational purposes only to indicate historical performance had the strategy been implemented over the relevant time period. Backtested performance results have inherent limitations as to their relevance and use. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading, such as the ability to withstand losses or to adhere to a particular trading program in spite of trading losses, all of which can also adversely affect actual trading results. There are numerous other factors related to the markets in general and to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results, all of which can adversely affect actual trading results. Any and all of these factors mean that no representation is being made that strategies presented here will achieve performance similar to that shown, and in any case, past performance is no guarantee of future performance.