Macro Special: The Fed is Building a War Chest

Welcome to Issue #36. We are a quantitative Bitcoin and digital asset hedge fund. We deploy autonomous, risk-managed algorithms that trade to outperform Bitcoin.

In our long-form newsletter we share important industry updates, explore major trends and review the technicals and fundamentals as they relate to markets and Bitcoin. Our aim is to help dissect the noise, distill the most relevant data and help expand the field of digital asset research.

This issue we dive into the Fed’s growing war chest, how global macro markets are positioned and what the macro environment might look like over the next 12 months. This will help set the stage as Bitcoin approaches its most important date ever: the halving in April 2024 that makes it harder than Gold.

Why Macro Matters

Bigger markets drive smaller markets. We see that in crypto as altcoins are highly correlated to Bitcoin and tend to suffer more than Bitcoin in bear markets. In the same way, Bitcoin is heavily impacted by Fed policy and equities markets. Importantly remember this simple rule of thumb: Bonds drive equities, equities drive Bitcoin and Bitcoin drives altcoins.

Let’s dive into the macro markets.

Market Positioning

Equities sentiment today is starting to approach attractive levels.

2023 was the most hated market rally. The world expected doom and gloom. Everyone declared a recession, even though there was none. Markets defiantly rallied incredibly on the back of the biggest technological revolution of our lives: usable AI that actually enhances GDP.

This was an equities market rally we extensively wrote about, and expected. Among several reasons, valuations simply did not justify the bearish case coming into 2023.

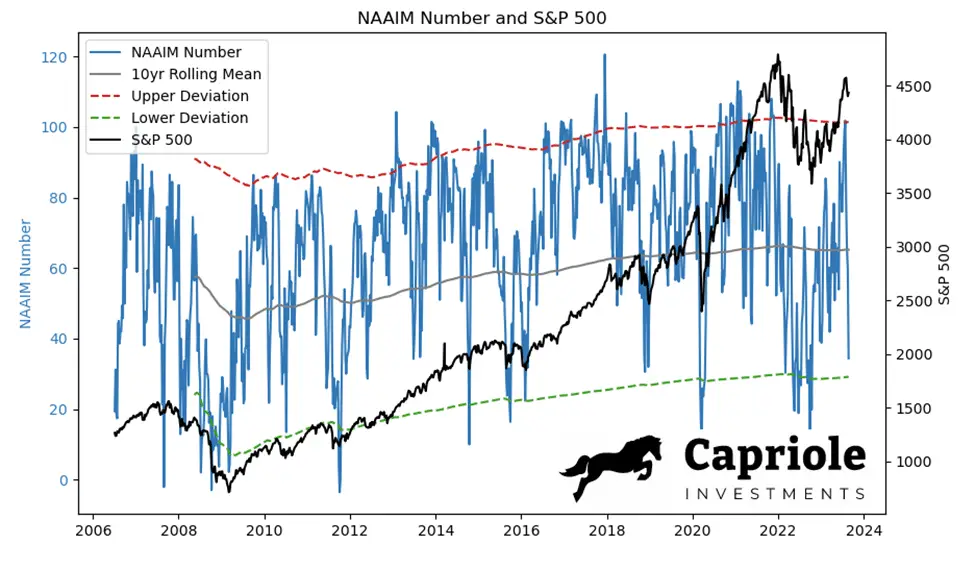

Take a look at the NAAIM Exposure Index below, which maps NAAIM managers equities exposure. Today the NAAIM Exposure survey has a historically low reading which typically is a decent buy signal for the S&P500. Similar readings occurred in June and October 2022, which both marked local bottoms for the S&P500.

It’s worth noting that the AAII sentiment survey results are still more middle of the road. It would be good to see some confluence across these sentiment metrics for a higher conviction signal.

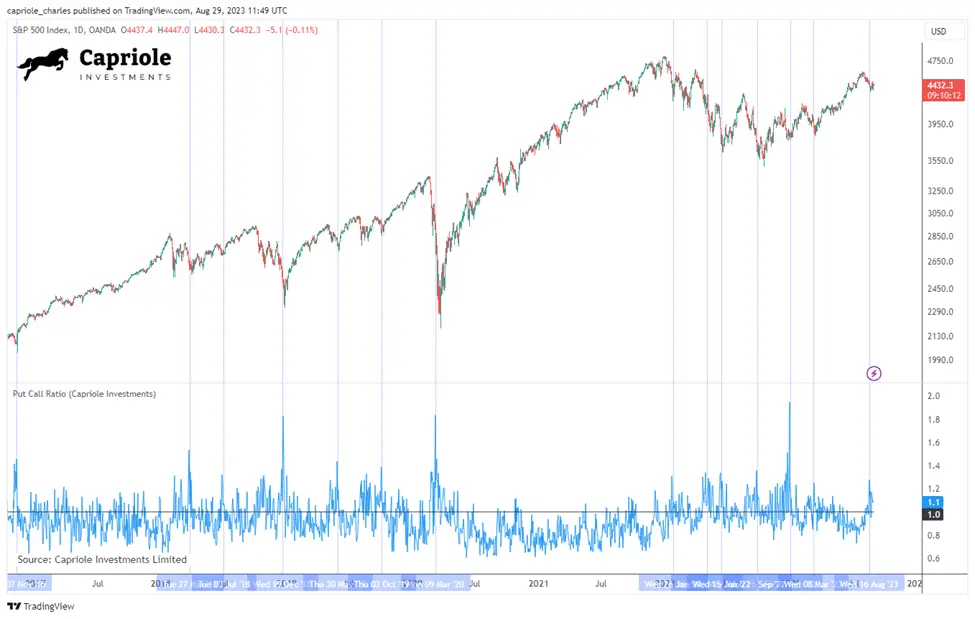

A metric I particularly like for equities is the Put/Call ratio. This ratio shows the relative aggressiveness of shorts to longs in the options market. When shorts are aggressive, the Put/Call Ratio spikes and it’s typically a local bottom in the market. We just saw a substantial spike.

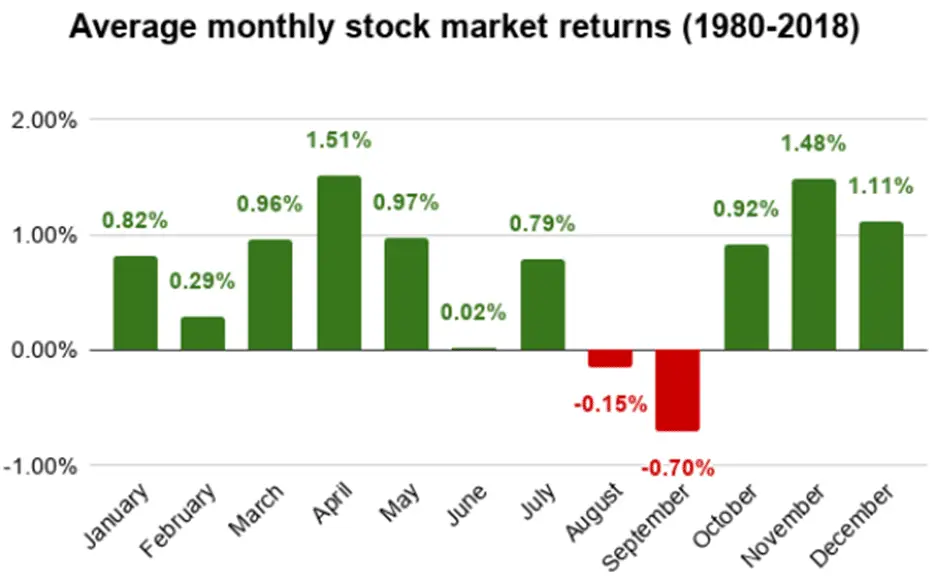

These metrics suggest we are due for a near-term bounce. That argument sits well as we come out of August, a historically poor performing month as the Northern Hemisphere takes a holiday. Though September is historically the worst performing month on record for equities markets, so it might pay to await further bullish confluence.

A robust, line in the sand for confluence may just be waiting for the S&P500 to close back above the important monthly resistance at 4600 shown in the below chart. Time spent above 4600 would invalidate the potential of a “dead-cat-bounce” argument, which will gather increasing weight the longer it takes these highs to be reclaimed.

Macro Fundamentals

The fundamentals picture is a more mixed bag, ranging from average to bad.

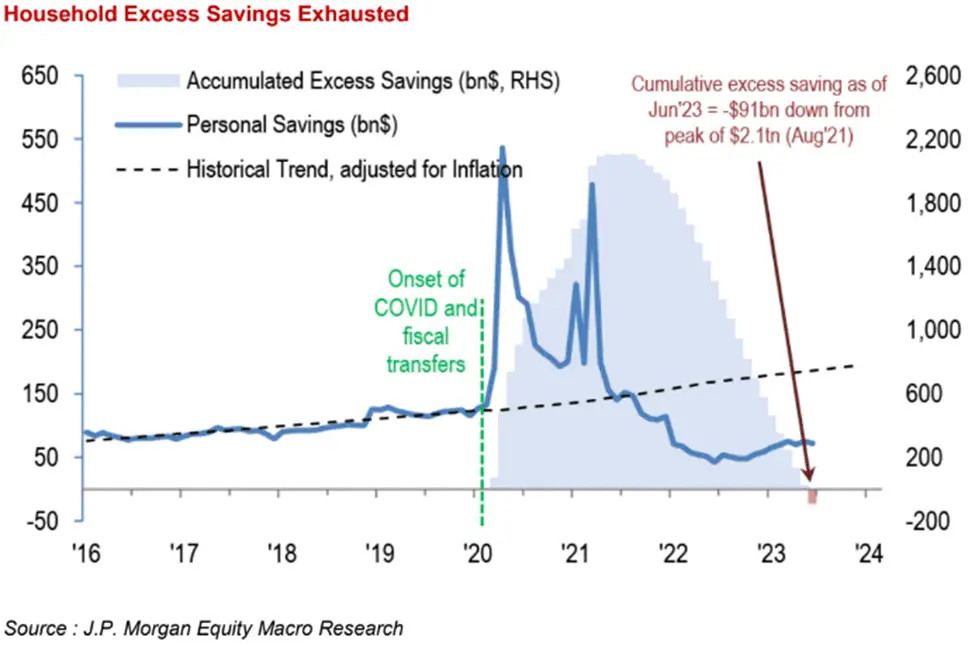

The aggressive, tightening cycle initiated by the Fed is still being priced into markets. It can take 12-18 months and only in the last weeks has excess household savings collected during the multi-trillion-dollar Corona stimulus years been exhausted.

This means that only now might we expect to see belts being tightened on a meaningful level. This will have a knock-on effect on consumer spending.

Looking at Consumer spending, we have just pierced downwards through the 20-year trend average annual growth rate of 5%.

The below chart shows the four most important metrics tracked by NBER (the official body that declares recessions). Two of these metrics look very concerning. We have a collapse in manufacturing which has led most recessions in the last half century, and consumer spending has just crossed under the 20 year average.

In itself, the current level of consumer spending is not concerning, but it’s the rate of the fall that is alarming. If this rate of decline continues as is, we can expect to see consumer spending fears hit the headlines in the coming months.

Also shown on the above chart is the rate of growth in income. At just over 1% a year, that’s multiples less than inflation. Which means on a relative basis the cost of living is rising.

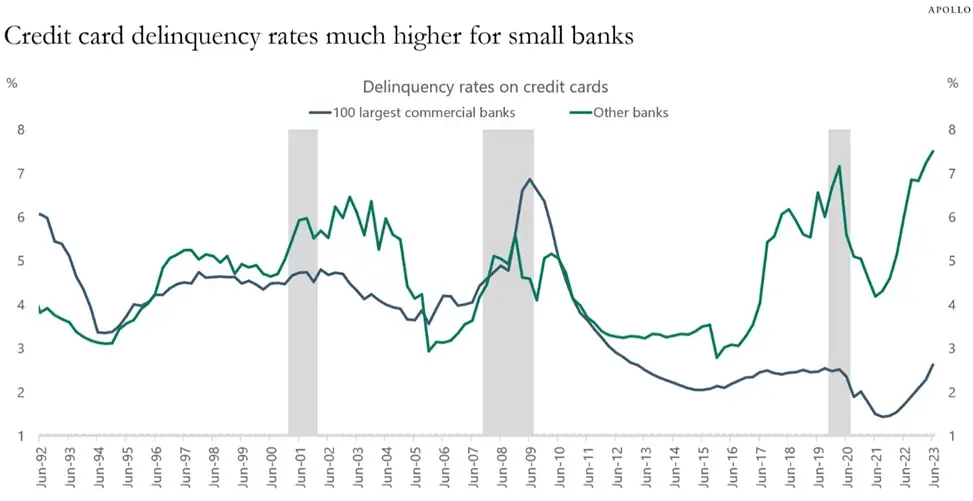

Cash is tight and credit card debt has also hit a new high of $1T, while delinquency rates are rising to new highs at the margins.

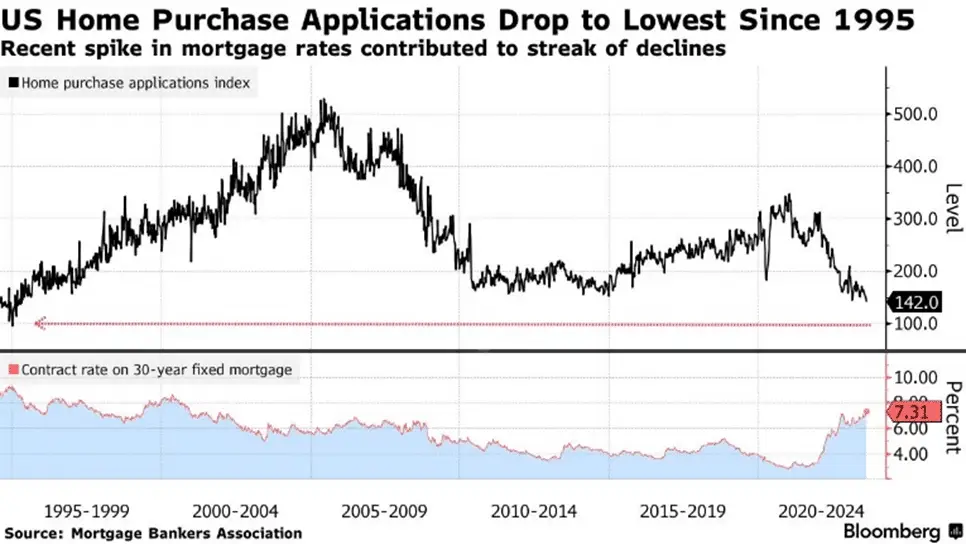

People are also feeling their net worth being squeezed as housing prices struggle amidst falling demand.

Putting the pieces together, we have:

- Maximum employment, unlikely to see any improvement (it can only go one way)

- Excess savings fully consumed

- Falling consumer spending

- Collapsing manufacturing

- Rising cost of living (income isn’t making up for inflation)

- Rising delinquency rates at the margins

- Declining wealth

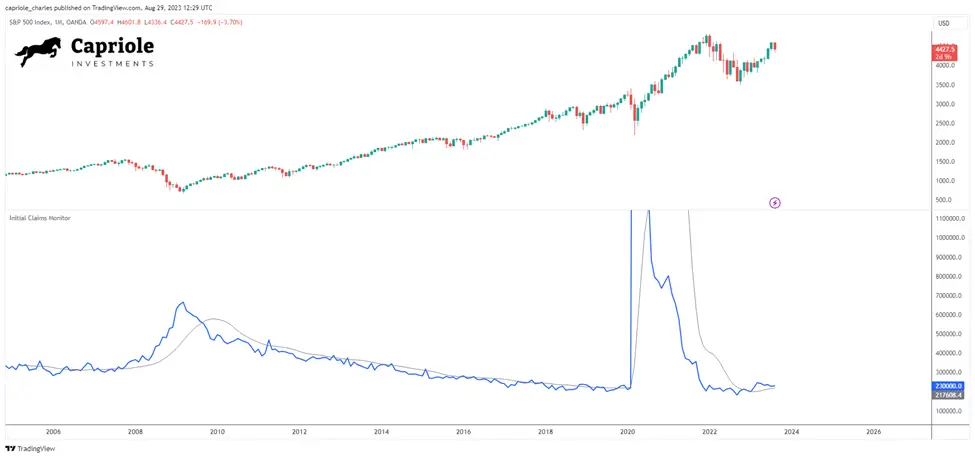

So things are trending in a concerning way, but its hard to declare a recession with employment rates so strong. That’s why “initial claims” is such an important metric to monitor as a lead on unemployment. Initial Unemployment Claims did have a muted spike a few months ago, but nothing to cause any alarm bells to go of just yet. This is perhaps the most important metric to watch in the next 1-6months for a lead on unemployment. Any measurable spike in unemployment would likely trigger a cascade across macroeconomic data to the downside.

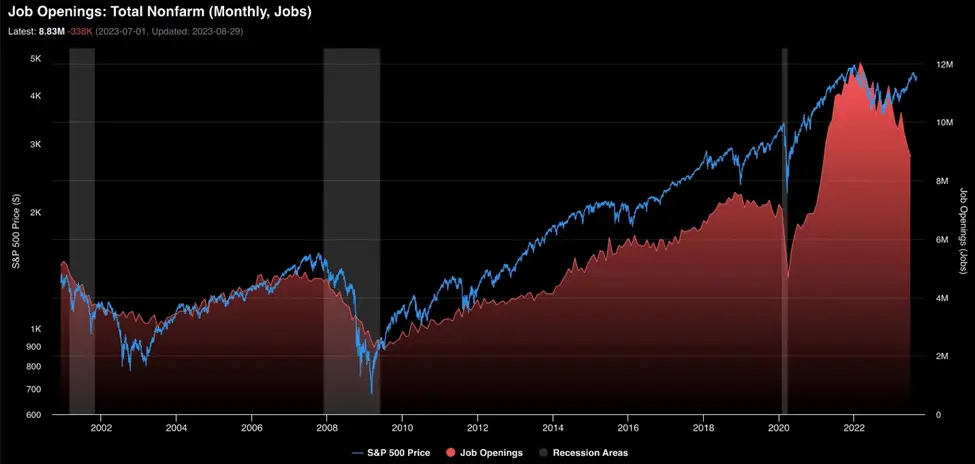

That wait may not be too far off, with total nonfarm job openings falling like a rock in 2023.

I wonder how many of these job opening reductions are the result of AI?

I am personally coding at about a 50% higher productivity in 2023 with the support of AI. I saw Sam Altman (CEO OpenAI / ChatGPT) speak a couple months ago and he stated this is a common (and conservative) performance boost with ChatGPT and Copilot. Sam Altman expects that that productivity boost for programmers will rise to 20-30X in the next couple years.

In other words, one programmer will have the same productivity as 20-30 programmers today in the next few years. Incredible. It’s hard to predict just how drastically the workforce and global output is about to change this decade, but it will defiantly be very significant. The question then becomes will the output / GDP boost offset the workforce restructuring, and will the magnitude of that boost come in time?

We also need to consider valuations. From a value perspective equities are reasonably priced. Not cheap and not super expensive either. Note that the below two charts are global metrics and don’t account for the wide disparity of valuations across individual equities, many of which are cheap and others overvalued.

Though if unemployment takes off, these valuations won’t matter much in the short-term. It’s the data with the extreme readings that is most interesting and relevant in the near-term.

Macro Summary

All of this tells us to stay open minded about the macro picture. Many economic indicators we discussed look poor. Consumer spending and employment being the biggest factors to watch here on out. But neither are at concerning levels yet. This could change quickly, but until it does, we note that the market is not overvalued today, it’s reasonably balanced. Further, we are living through the biggest productivity boost of probably all time with the roll out of AI into the workforce. This information tells us that the current uptrend is logically supported today.

Will these productivity boosts roll out just in time to buffer markets with a newfound strength supporting a soft landing and lofty NVIDIA valuations? Will consumer spending rise again as inflation is increasingly tamed? Or will unemployment spike before these risks can be managed?

There’s good arguments for all of these cases, and the only thing that matters is the timing of each. It’s important we stay nimble, monitor the data and act accordingly. There is an opportunity to navigate out of a recession and engineer a soft landing, but more work must be done to get there.

In short, I am expecting choppy action on the S&P500, but the current trend is logically supported. Large warning signs have emerged which could change things, and being conservative while we trade below monthly resistance at 4600 in the summer months makes sense. At the same time, sentiment metrics and fair valuations provide optimism that we can reclaim the highs. There are many factors at play across fundamentals, but the most important things to watch for now are declining consumer spending and/or rising initial unemployment claims.

The Fed’s War Chest

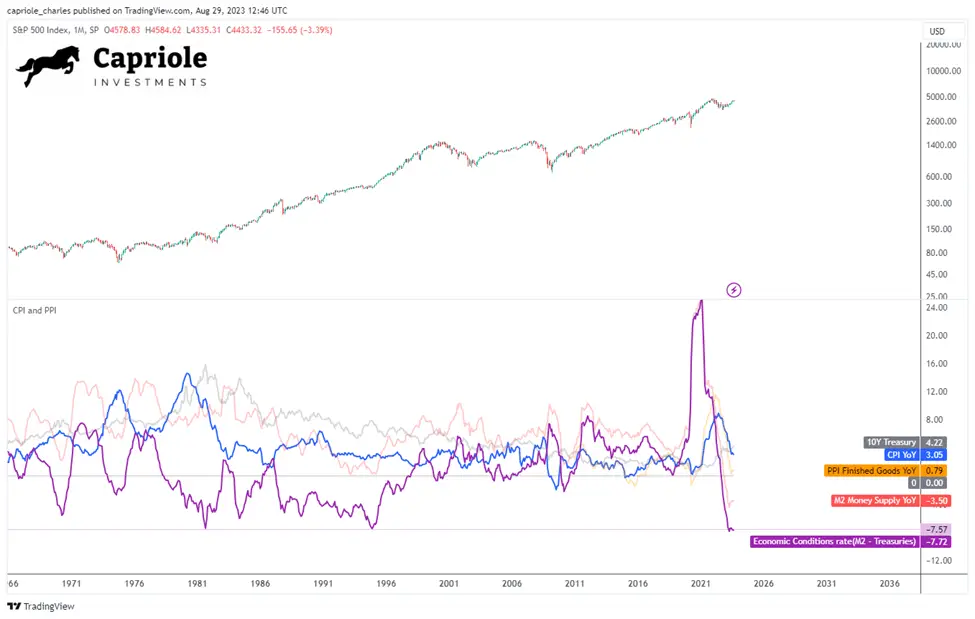

With all that in mind, the Fed can no doubt see mounting risks. At the same time, as every day goes by the Fed’s war chest grows. We’ve seen the most aggressive rate rises ever, with interest rates going from zero to 5% in little over a year. Together with the combined money supply rate of decline, the current economic conditions are the tightest on record, even more aggressive than Volker’s 1980s.

This draining monetary policy is working though, it is crushing inflation.

High interest rates are one part of the Fed’s war chest, as they allow the Fed to cut into crises.

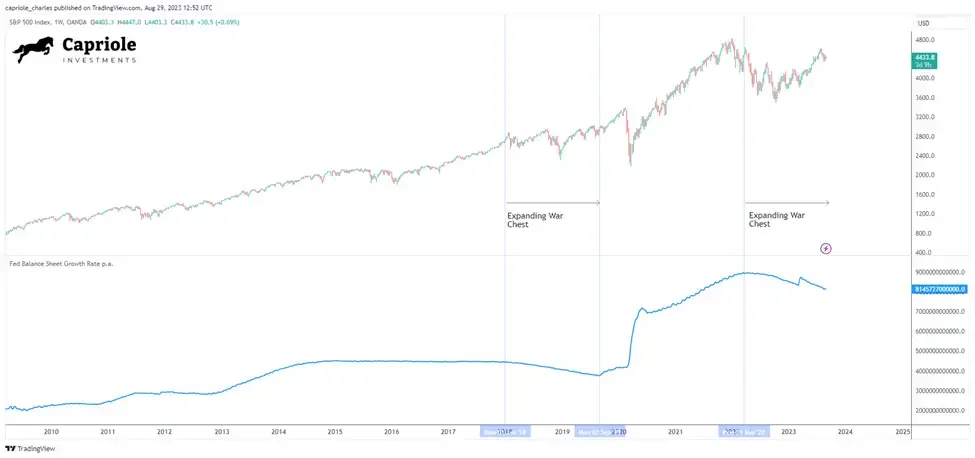

Additionally, the Fed has also managed to successfully clear $1T off of its balance sheet, bringing it down to $8T today. A 10% reduction in 12 months is no small feat and no common event. This level of balance sheet decline is comparable only with 2018/19 period, where stocks mostly consolidated sideways. Something to keep in mind, so far it doesn’t look dissimilar to today.

Higher rates today are bullets in the clip for the next recession. A lighter balance sheet also makes it easier to pump $3T into the markets in three months (as the Fed did in mid-2020). Just as nothing in life is certain but death and taxes, nothing is more certain than the need for a greater and greater capital base to bail out the next crisis and kick the proverbial can a little further down the debt cycle road.

At 5% rates and $1T off, the Fed is starting to get more comfortable with their war chest. When will the next QE round be deployed? That’s hard to say. First, we are highly likely see rates pause this year. That’s already priced in. When unemployment rises or consumer spending declines measurably, I expect the money printer will be quickly redeployed.

We are also rapidly approaching an election year. Incentives will be very much aligned to ease potential pain should it arise in the next 12 months by pressing the liquidity button.

Given we have now seen 90% of rate hikes priced into the market according to the CME FedWatch with just one more hike expected later this year, and given the above macroeconomic situation, we should be open minded to the possible need for the Fed to deploy liquidity in the coming year.

Charles Edwards

Founder

Capriole Investments Limited