Goldilocks

Welcome to Issue 31 of the Capriole Newsletter. We are a quantitative Bitcoin and digital asset hedge fund. We deploy autonomous, risk-managed algorithms that trade to outperform Bitcoin.

In our monthly newsletter we share important industry updates, explore major trends and review the technicals and fundamentals as they relate to Bitcoin. Our aim is to help dissect the noise, distill the most relevant data and help expand the field of digital asset research. You can read more about some of our open-source contributions here.

At $29K, Bitcoin’s on-chain fundamentals are not too hot and not too cold. They are just right. Most on-chain fundamentals suggest Bitcoin is fairly valued today.

The hard money narrative persists amid US banking and fiat currency weakness, as we saw this Wednesday from the 10% intraday rally and pullback on regional banking news in the US. Gold’s strength also continues to remain a leading indicator of superior performance by Bitcoin.

With price trading into $30K technical resistance and Bitcoin fundamentals “Goldilocks”, we are open minded to price movements both up and down in May with significant trigger events for a more bullish allocation being (1) a Bitcoin weekly price close above $32K, (2) any pullbacks to the low-mid $20Ks, or (3) any notable US bank collapses or similar policy impact events.

That’s the short term picture.

But the long-term opportunity is quite different.

The Headlines

The most important news in Bitcoin and crypto this month.

The Good

- Gemini opens a crypto derivatives platform outside the U.S. More

- Coinbase plans to launch an offshore derivatives exchange in coming weeks. More

- Tornado cash developer Alex Pertsev reportedly released under surveillance. More

- Hong Kong court declares crypto as property. More

- FTX has recovered $7.3B and will consider re-starting its crypto exchange. More

- Bitcoin financial services firm Unchained Capital raises $60M. More

- UAE regulator to start accepting license applications from crypto firms. More

- London Stock Exchange to offer Bitcoin futures and options. More

- Twitter to let users access stocks and crypto trading through eToro. More

- Shapella, Ethereum’s first major upgrade since the Merge, is now live. More

- Swiss government-owned bank PostFinance to offer customers crypto. More

The Bad and the Ugly

- Terra co-founder Daniel Shin and nine others formally charged by South Korea. More

- Crypto exchange Binance lifts restrictions on Russian users. More

- Binance Australia’s derivatives AFS license canceled by regulator. More

- SEC charges crypto asset trading platform Bittrex and its former CEO for operating an unregistered exchange, broker, and clearing agency. More

The Macro

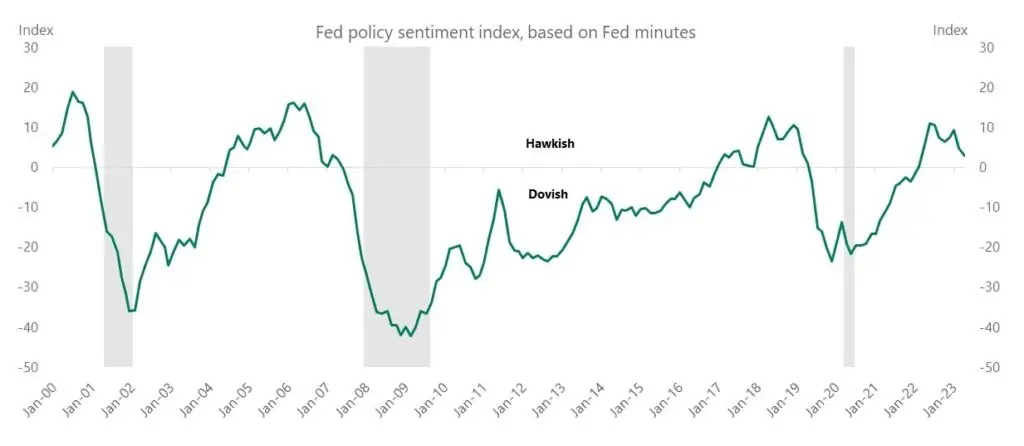

The Federal Reserve’s concern with inflation is declining. Inflation is down 50% from its peak in 2022 and PPI inflation is now below the 10-year treasury yield. With the 10-year yield dropping, and the M2 money supply rate of change slowing, global markets are pricing in a monetary policy pivot amid extreme US banking stress. Bloomberg’s Federal Reserve natural language processing model calculates a hawkish/dovish score for the opening statement of the FOMC meetings. Based on this model, we are near the peak of this rate cycle, and the Fed’s attention is now focused on the negative effects that tightening is causing.

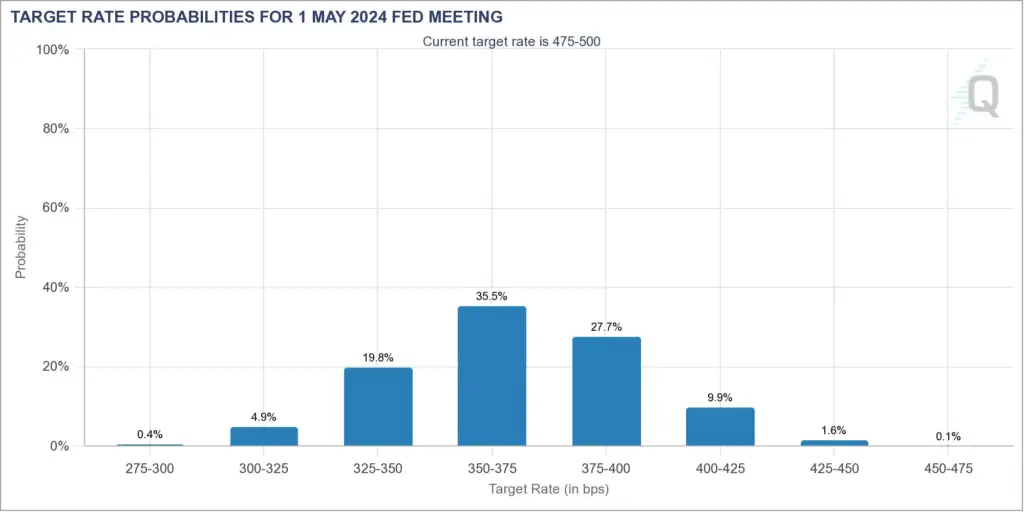

In one year (when the Bitcoin Halving is expected to occur), the market is pricing interest rates to be -1.5% lower than today. That means the market is expecting easing into the exact point in time that Bitcoin will become the hardest asset on earth.

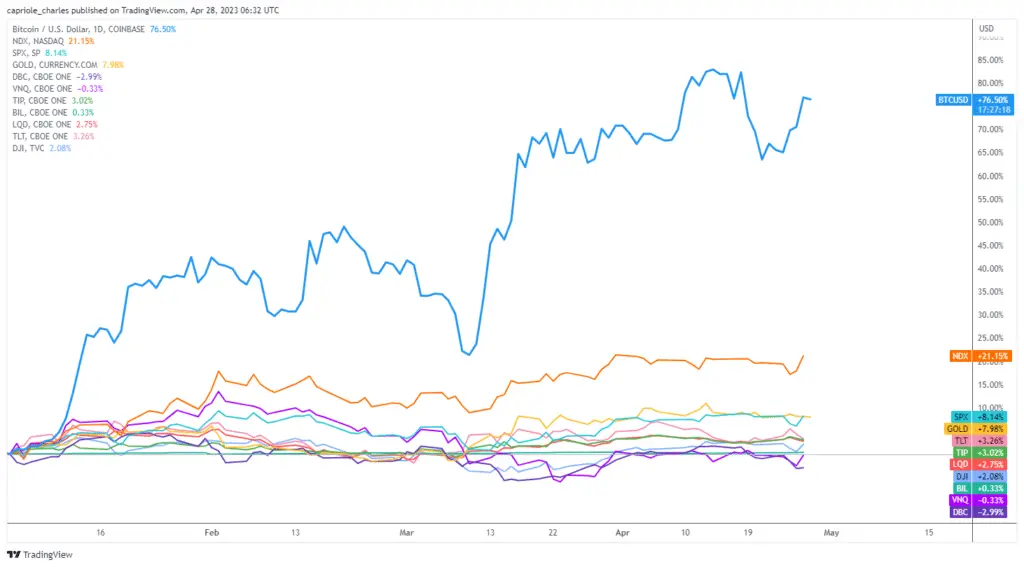

The 200 week Gold-to-Stocks ratio is a classic indicator that tells us when the market favors hard assets like gold to risk-on equity assets. The cycle is once again favoring gold. Bitcoin (and gold) has generated some of its best returns ever during these phases. The Gold chart is also showing rare technical strength.

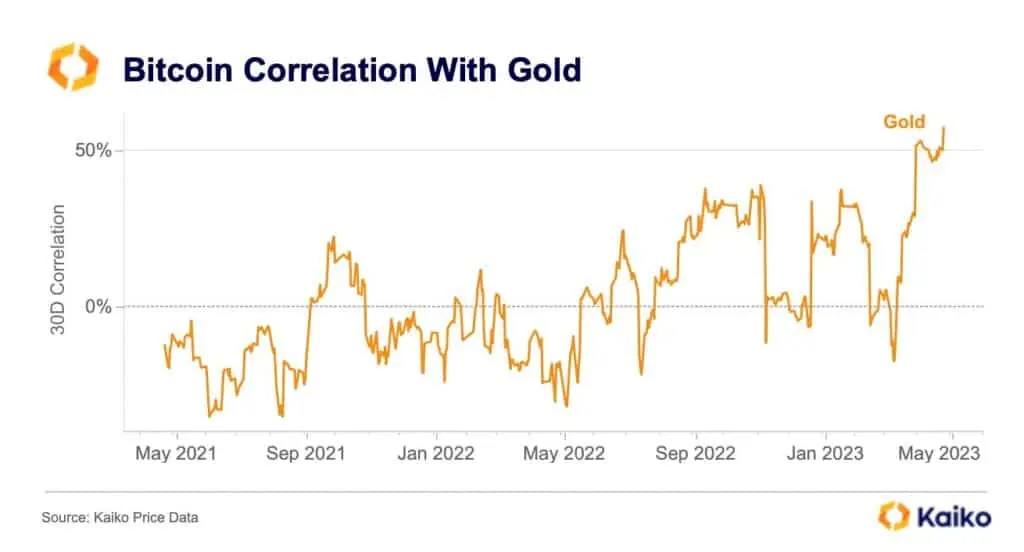

Bitcoin’s correlation to Gold has also increased to a significant level.

Through this period of high correlation, Bitcoin has also outperformed Gold by 10X in 2023 as the preferred storehold of wealth amidst US banking failures.

The Fundamentals

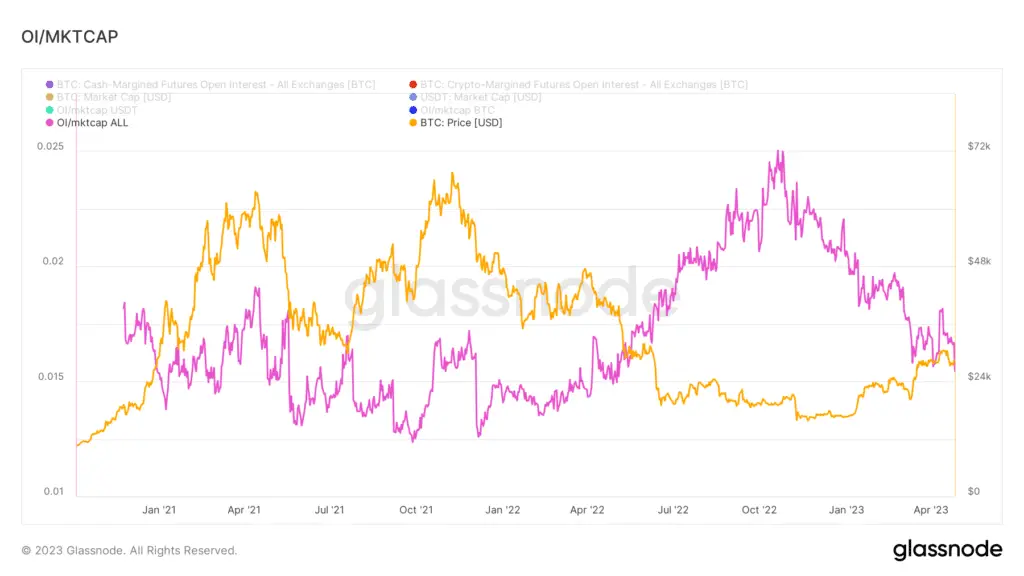

There are several signs that the 2023 Bitcoin rally is organic and spot driven. Total futures Open Interest as a ratio of the total Bitcoin and USDT market cap gives us insight into how leveraged the market is. This metric shows that crypto market leverage peaked with the FTX fraud in November 2022 and has subsequently been on a one-way downtrend despite price rallying over 80% from from $16K to $30K. This means we have seen little speculation this year. Until this ratio spikes, or Bitcoin dominance peaks, we have the foundations necessary for sustainable price appreciation in place.

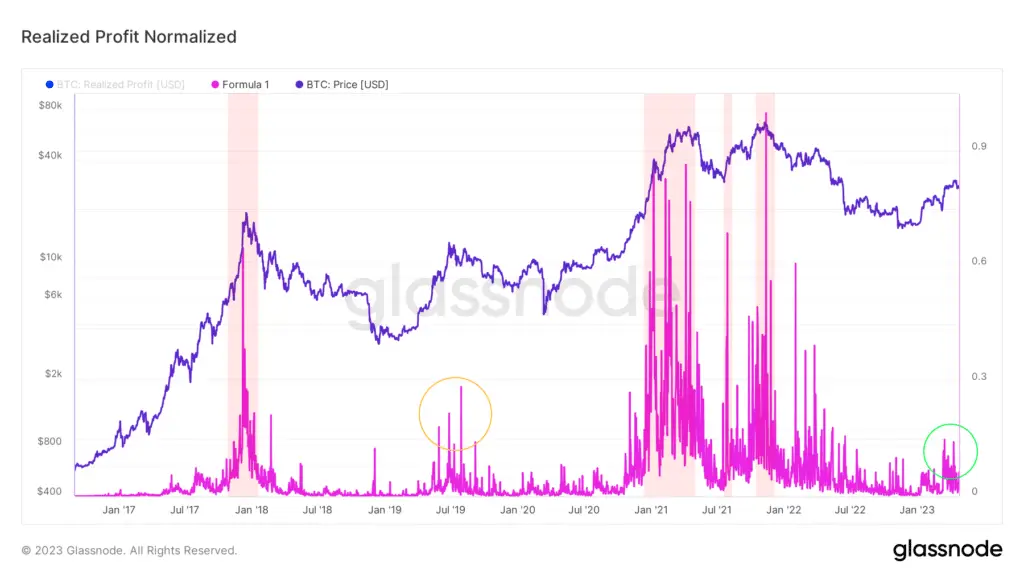

Another gauge for market speculation is realized profit. Realized profit tracks Bitcoin transaction profit based on the prices that coins moved at on-chain. Despite the 80% price rally, the below normalized realized profit chart suggests the current cycle has seen relatively low levels of froth. The current level of normalized realized profit is less than that of the 2019 mid-cycle rally.

The current Supply Delta indicator profile resembles prior bear-market lows. This metric does not provide a long-signal, but rather confirms our macro positioning within the current cycle as still representing long-term value.

The Bitcoin Yardstick has just broken out of the long-term value zone, suggesting we are still very early in this cycle. Though it would be even better to see a price breakout in unison (i.e. closes above $32K).

The long-term holder inflation rate shows us the growth rate in long-term holders, as a percentage of total supply. Today this metric is completely normalized, neither over- nor under-valued. This reading is typical of the majority of on-chain metrics we look at today and doesn’t tell us much about short-term opportunity. Instead it tells us to keep an open mind about both positive and negative outcomes in price in the near-term.

The “Supply per Whale” metric is in a macro downtrend. This chart shows the supply held by ‘whales’, addresses with between 100 – 10,000 Bitcoin. As Bitcoin matures, we might expect this metric to trend down in the long-term, but it’s worth considering that to date we haven’t seen a sustained bull market without Supply per Whale trending positively.

Supply per Whale is in a downtrend, suggesting the ultra wealthy are not increasing their allocation to Bitcoin yet. Source: Capriole / Glassnode

Finally, if in doubt, zoom out. Zooming out, the Bitcoin cycles confirm we have a long-way to go. It looks evident that the floor of this cycle has been put in and we have just started to rise from it. The Green-box in the below chart represents the 12-18 month period where the majority of cycle returns historically occur around the Halving. This is also the period where other digital assets have outperformed Bitcoin by 10X every prior cycle (AKA “Altseason”). By historical standards we are about 6-9 months away from where that zone might be expected to occur again next. Until then, it is normal (and preferred for sustainability) for Bitcoin to lead the recovery out of the bear market lows and set the foundations for this bull run. That is exactly what we have seen so far.

The Technicals

Bitcoin is currently trading into the largest technical resistance block on the chart since $20K. The $30-32K region represents the bottom of the 2021 range and the point of breakdown into the bear market beginning in 2022. It is also a major weekly order block level and Fibonacci extension level from the prior cycle. Finally, $30K is a major round number level and represents a 50% increase from the 2017 cycle all-time-high of 20K and $32K represents a 100% appreciation in Bitcoin since the FTX Fraud bottom at $16K. Due to the significance of this price region, it makes sense to be cautious here. However, following a weekly close above $32K it wouldn’t be surprising to see a new trend carry us into the $40Ks.

The Bottom-Line

Putting all the piece together, we have:

Short-term summary:

- Near-term normalization of many on-chain metrics, suggesting we need to see renewed growth in on-chain fundamentals for value to return, without which it becomes more difficult for the explosive growth rate of the current trend to be maintained.

- Price is currently trading into major technical resistance which means it makes sense to be conservative until a $32K breakout is confirmed.

- Increasingly aggressive positive responsiveness of Bitcoin to any US banking issues or policy weakness, the optimal hard money narrative.

Long-term summary:

- Confirmation of organic price appreciation in 2023, with few signs of speculation in the market. A solid foundation for this bull run and a sign of sustainable price appreciation.

- Various metrics such as Supply Delta, Bitcoin Yardstick and more suggest we are still in the early stages of bull-run with the majority of this cycle’s runway ahead of us over the next 18-20 months.

- Fed dovishness and lower rates are being increasingly priced into the market amidst unsustainable tightening and banking stress.

- The formation of a new bullish trend for hard assets in the classic gold-to-stock ratio.

- The formation of a multi-year accumulation pattern in Gold, with high Bitcoin correlation and Bitcoin outperformance in the order of 10X in 2023.

- The Halving just one year away, and it will result in Bitcoin’s supply inflation rate dropping to half that of Gold’s.

The long story short is we have great cyclical value, at short-term, technical resistance.

The gas tank that drove this 80% rally was incredibly deep value in Bitcoin fundamentals, which we wrote about extensively in our Q4 2022 newsletters. That gas tank is currently running low. It is quickly topped up again by an influx of new investors, heightened on-chain transaction volumes from events like banking failures, or new Bitcoin innovations like Ordinals from earlier this year. We can’t say when, but our expectation is that the tank will be topped up substantially into this year. Until then, and so long as Bitcoin trades at technical resistance, we should remain open minded to price movements both up or down in the near-term. Weekly closes above $32K would confirm a renewed technical breakout.

That said, global macro markets, events and policy actions are all skewed favorably in Bitcoin’s direction today. Any US bank collapse, significant bailout announcement, US government easing action, major bank guarantees, continued dovish Fed action or significantly worsened macroeconomic data will all likely result in substantial Bitcoin price boosts, particularly while global markets are favoring hard assets like gold to most investable alternatives. Bitcoin is hypersensitive to these market events in a very positive way. In such an environment, we think it makes sense to keep attuned to that asymmetry, as there will likely be many more positive market shocks for Bitcoin in the next year.

All in all, it’s been an extremely organic and healthy price run in 2023, which has established sound foundations for a substantial bull market ahead.

Charles Edwards

Founder

Capriole Investments Limited