[EDIT 13 April 2023: Originally published on Medium in 2019, Hash Ribbons is perhaps the best performing long-term buy signal for Bitcoin. Hash Ribbons uses on-chain data to identify miner capitulations and recoveries. It is a top 50 / 100,000+ scripts on TradingView. Live indicator also on Glassnode.]

When miners give up, it is possibly the most powerful Bitcoin buy signal ever.

In August, I wrote an article on using Bitcoin’s Hash Rate to find major Bitcoin price bottoms based on miner capitulation (you can find it here). Just days before, WillyWoo published an indicator using Bitcoin’s Difficulty to achieve a similar result (here).

In this article, I apply a “ribbon” crossover approach to both Bitcoin’s Difficulty and Hash Rates, using the same moving average parameters for both sets of data. As might be expected, Hash Rate provides a leading indicator over Difficulty at identifying capitulation.

Further, using “Hash Ribbons” to identify bottoms for purchasing Bitcoin yields phenomenal results.

Bitcoin Difficulty & Hash Rate

Bitcoin’s Difficulty is adjusted every 2016 blocks, or roughly every 2 weeks.

On the other hand, Bitcoin’s effective Hash Rate is calculated daily based on the actual number of blocks found by miners each day. Because of this, Difficulty effectively lags the Hash Rate by up to two weeks. Therefore, Difficulty is a somewhat lagging indicator for miner capitulation.

On the below chart, when the ribbons (the green and blue simple moving average lines of Difficulty and Hash Rate) cross each other, miners are “capitulating”. We can also see that there is roughly a two-week lag from when Hash Rate identifies miner capitulation to when Difficulty identities capitulation. The simple moving average (SMA) periods chosen are not overly important, and the same effect can be identifying using different periods.

[Blue: Difficulty Moving Averages, Green: Hash Rate Moving Averages]

However, minor capitulation periods can last for weeks. As a result, the lag between Difficulty and Hash Rates doesn’t have a huge impact on the long-term Bitcoin investor.

The Hash Ribbon Indicator

Because of the effect of negative sentiment and price action during deep bear markets and times of miner capitulation, the best time to buy Bitcoin is typically somewhere in the middle of the “miner capitulation” period. But of course, this cannot be known until after the fact.

A simple 1- and 2-month simple moving average of Bitcoin’s Hash Rate can be used to identify market bottoms, miner capitulation and — even better — great times to buy Bitcoin.

When the 1-month SMA of Hash Rate crosses over the 2-month SMA of Hash Rate, the worst of the miner capitulation is typically over, and the recovery has begun. Buying at these points of time yields incredible results as shown below.

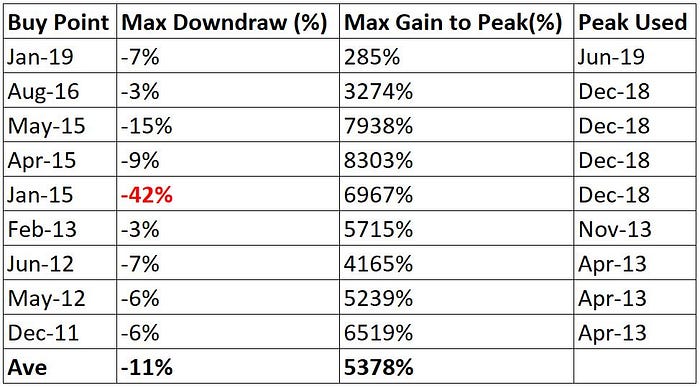

Of the 9 historic buy signals, the average gain to the next market cycle peak (historically less than 3 years away) is over 5000%.

Returns are even greater than shown here for positions held forever.

What is interesting is the downdraw through all time. The average maximum downdraw for each of these entries is just 11%.

These results are achieved without considering any other indicators, metrics or intelligence. Just two simple moving averages on Bitcoin’s Hash Rate.

There is one “bad” purchase. On January 2015 (red text in above table), where a maximum downdraw of 42% occured. Note that this is still considerably less than half of Bitcoin’s numerous 80%+ drawdowns). Nonetheless, the majority of such drawdowns can be eliminated by simply adding a price action indicator. Such an indicator could include the famous Bitcoin 10- and 20-day SMA cross over, as made popular by Mr. Anderson, for example.

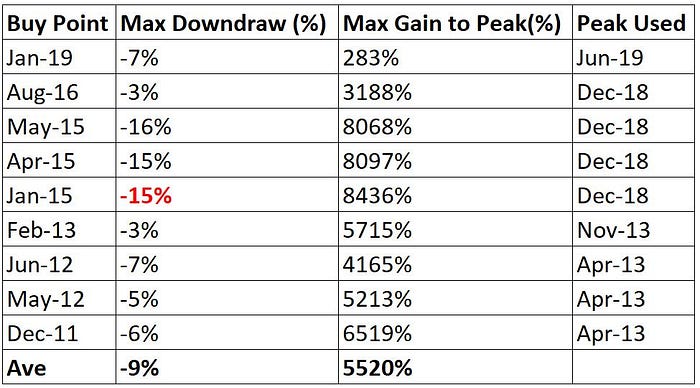

Purchasing during miner capitulation, as the Hash Rates start to “recover” and only once price momentum has gone positive (using the 10–20 SMA cross) yields the results below (termed the “Hash Ribbon” indicator).

As shown, the maximum downdraw is reduced significantly without a reduction in returns. The difference between Table 1 and 2 is made possible with the simple addition of waiting for positive price momentum before purchasing Bitcoin on the recovery of Hash Rates.

You can track a live version of this indicator on TradingView here.

What next?

Miner Capitulation doesn’t happen often, on average just once a year. But it has occurred following each of the last two halvenings. Suggesting we may see yet another wonderful buying opportunity again in mid-2020.

Takeaways

- Hash Rate leads Difficulty in identifying Bitcoin Miner Capitulation

- Buying during Miner Capitulation, when the Hash Rate starts to recover, is a wonderful strategy

- Going one step further, the majority of all draw downs can be eliminated from this strategy by waiting until the 10-day price SMA is above the 20 day price SMA

- Next time you see the Hash Ribbon buy signal, you would be wise to pay attention

Disclaimer on Backtests

Any Backtest performance returns presented represent hypothetical returns and are meant to simulate how a strategy would have performed during the period shown had the strategy been implemented during that time. Backtested/simulated performance returns are hypothetical and do not reflect trading in actual accounts. Backtest returns are provided for informational purposes only to indicate historical performance had the strategy been implemented over the relevant time period. Backtested performance results have inherent limitations as to their relevance and use. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading, such as the ability to withstand losses or to adhere to a particular trading program in spite of trading losses, all of which can also adversely affect actual trading results. There are numerous other factors related to the markets in general and to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results, all of which can adversely affect actual trading results. Any and all of these factors mean that no representation is being made that strategies presented here will achieve performance similar to that shown, and in any case, past performance is no guarantee of future performance.