And why a gold price over $12,000 makes sense.

[ORIGINALLY PUBLISHED ON SUBSTACK ON 23 JANUARY 2026 HERE]

In 2025, gold went up an astonishing 65%.

How is it possible for 20 trillion dollar asset to grow an additional $14T in one year?

A global central bank structural bid for gold has been unlocked in the last few years.

We have a perfect geopolitical storm, a new pro-gold regulatory framework and retail underallocation which have lit a rocket under gold. What’s more, these drivers have only strengthened in recent times.

Isolationism favours gold

2022, the year geopolitical division began. Russia invaded Ukraine and impact on the world reserve currency, the US Dollar, and gold would soon change forever. Following the invasion, the US and Europe swiftly froze billions of dollars of Russian Central bank funds. This caused a sea change in how countries perceive the value of foreign fiat currencies and the realities of ownership. If can’t trust your trading partners currencies and ownership rights become a question mark, you turn to alternative monies, stores of wealth and hard assets like gold.

Tariffs, onshoring manufacturing, increased global wars and military campaigns are the new trends post-2022. All of these trends are pro-country and con-Globalization. Trust in counterparty fiat is decaying. In such an isolationist environment, as countries turn increasingly inward, commodities and gold takes on a much more strategic and critical role.

Huge demand in China

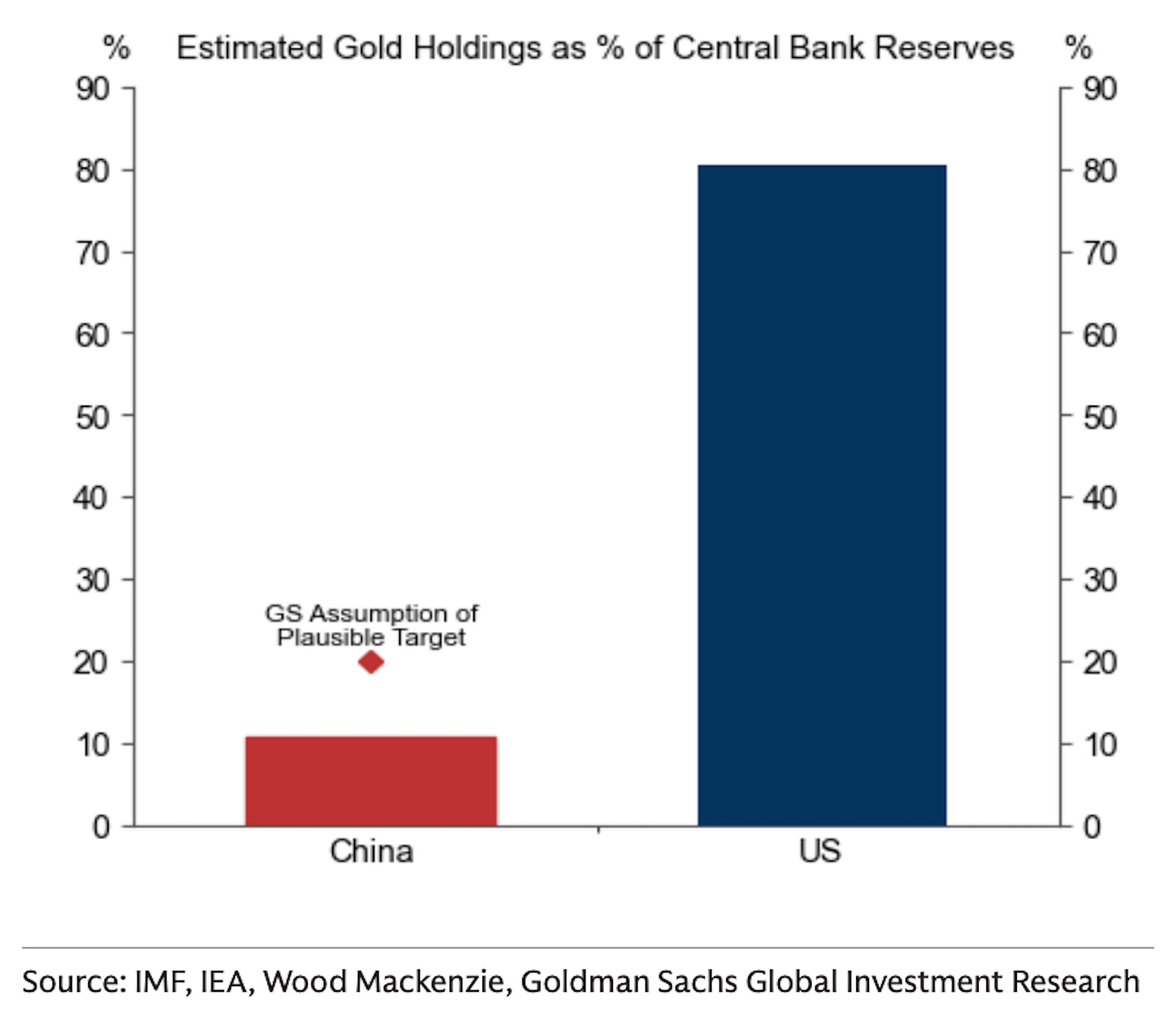

China’s GDP is about 66% of the US. It’s big. But China’s Central Bank gold reserves remains very low versus global peers. Today, just 10% of China’s total central bank reserves are in Gold, versus 80% for the US. This is especially low given China’s ambition to internationalize the RMB. We expect this gap to close.

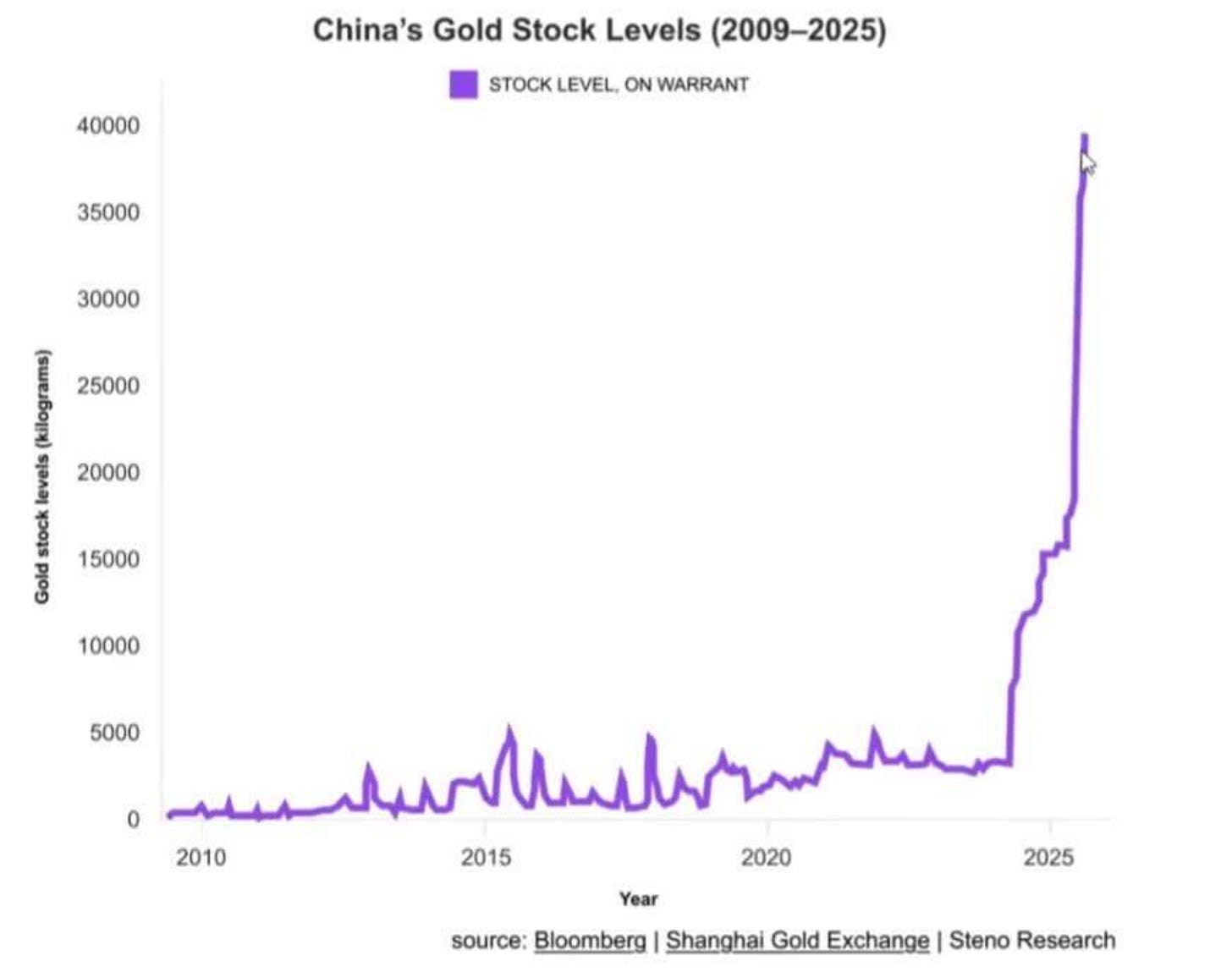

Perhaps that’s why China’s gold stock has gone up 900% in the last two years. The gold

Insatiable central bank demand globally

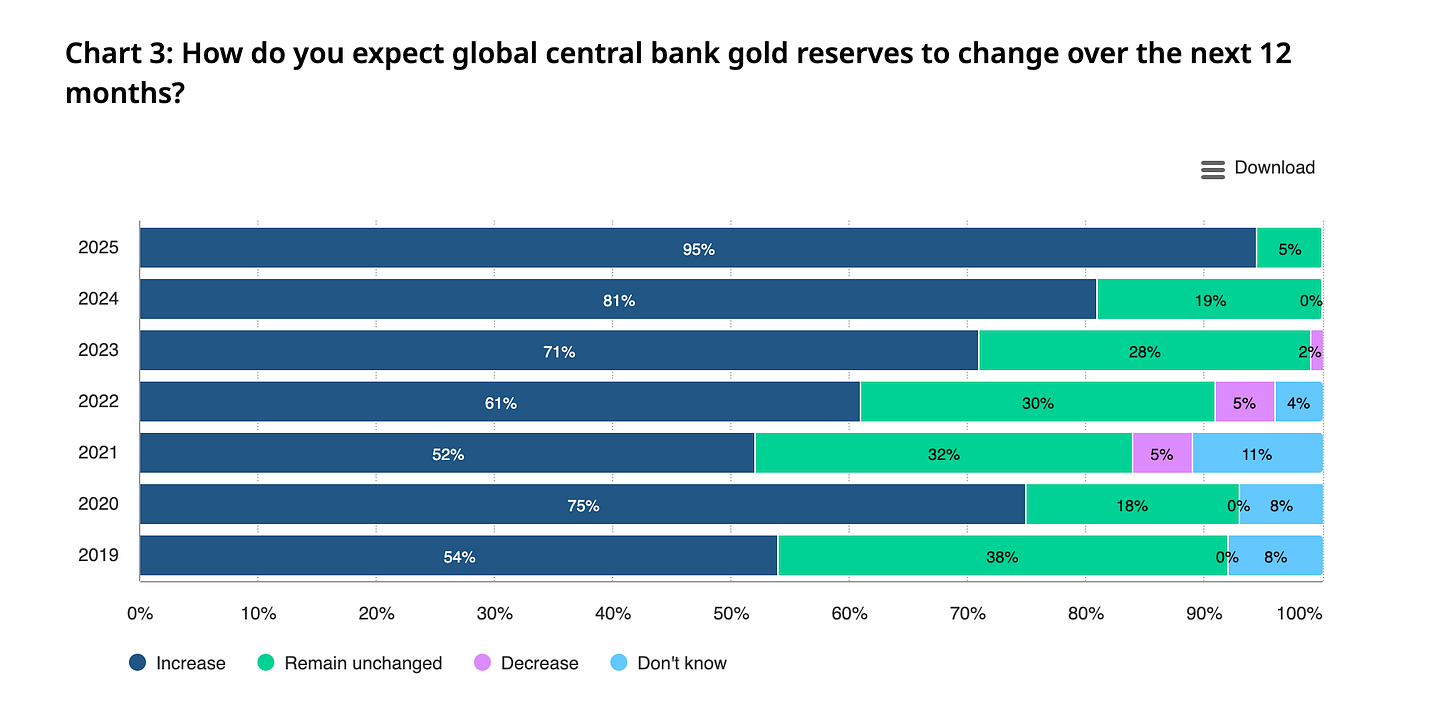

Recent 2025 survey of 73 of the world’s Central banks found a record 95% of Central Banks believe that official gold reserves will continue to increase from here. This finding is particularly notable given the colossal gold accumulation among central banks we have already seen in recent years.

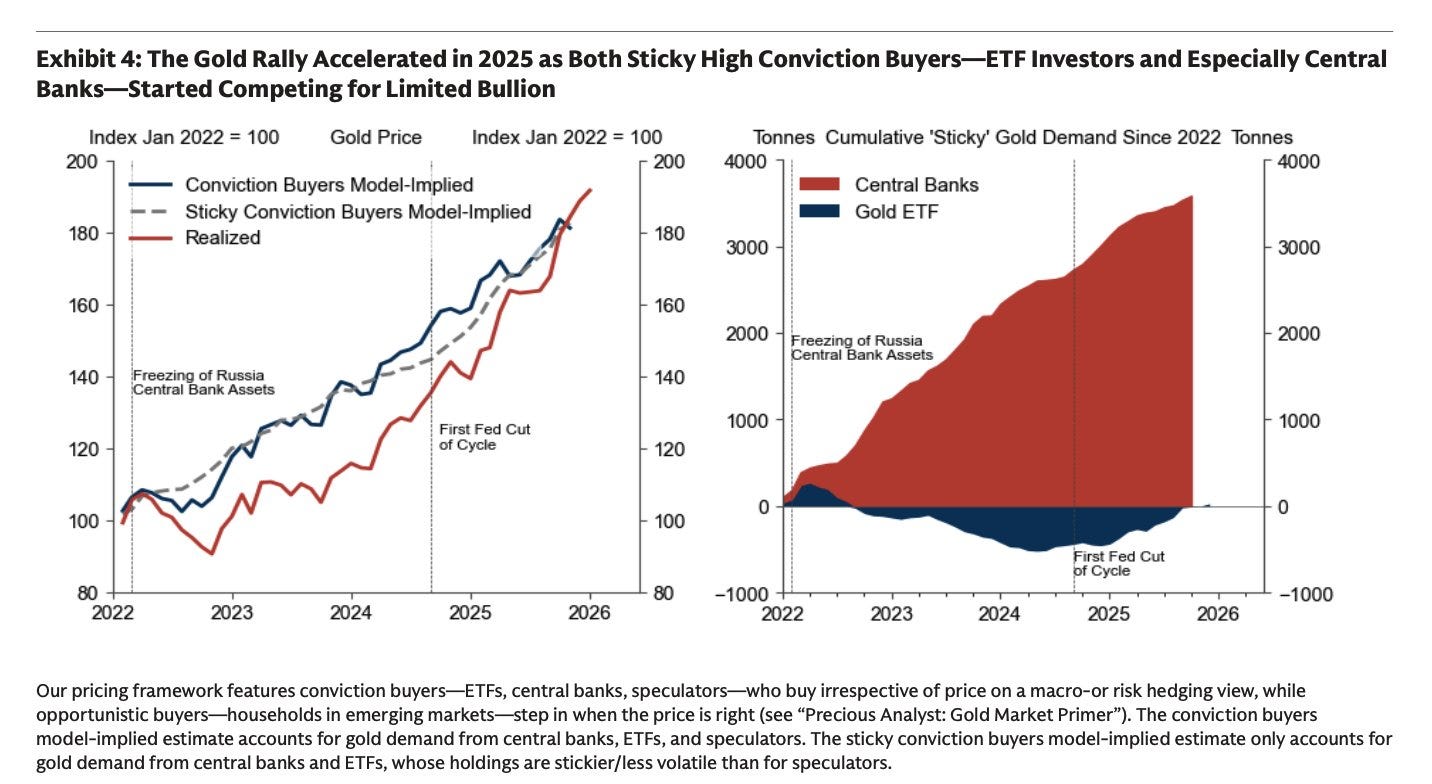

In fact almost all the gold demand from the last few years has been from Central Banks. The below December 2025 Goldman Sachs exhibit suggests limited ETF demand since 2022 and steadily increasing Central Bank demand.

What does this mean when the gold price breaks $5000 and retail ETF interest or FOMO starts to kick in?

Pro-gold regulations: Basel III

In the wake of the 2008 global financial crisis, the “Basel III” regulatory framework was introduced to set stricter international standards for bank capital adequacy, stress testing and market liquidity. Basel III is having a big impact on gold demand. It significantly changed the banking, regulatory, and institutional treatment of gold, effectively promoting the buying and holding of physical gold. The structural changes from Basel III have only started to come into full effect in the last few years for gold, with Basel III Endgame implementation in the US only phasing in over the last 6 months.

What changed under Basel III:

- Gold confirmed as a zero-risk asset. Now physically allocated gold is codified as a distinct asset class with a 0% risk weighting. This means banks do not need to hold regulatory capital against their physical gold holdings, effectively placing it on equal footing with cash for credit risk purposes.

- Exemption from commodity charges: The new rules distinguish allocated gold from other commodities. While standard commodities require banks to set aside expensive capital buffers to cover volatility, allocated gold is exempt from these capital charges, removing the cost barriers to holding bullion.

- The Big one: A Rotation to Physical gold: The new “Net Stable Funding Ratio” (NSFR) introduced a punitive 85% stable funding factor for synthetic or “paper” gold. This made holding paper gold very expensive for banks, driving them to buy the physical asset.

Legs to run

Is the gold rally long in the tooth? Goldman Sachs noted in December 2025 “Gold ETFs account for just 0.17% of US private financial portfolios. We estimate that every 1bp increase in the gold share of US financial portfolios—driven by incremental investor purchases rather than price appreciation—raises the gold price by 1.4%”. Based on Goldman’s numbers, if ETF ownership grows to just 3% of US financial portfolios, that would mean a 5X in the Gold price from here

As Arthur Hayes recently noted, there have in fact been net outflows in gold ETFs in recent years despite the record price appreciation, suggesting we are by no means in a retail FOMO late-stage part of the gold rally yet. This suggests from a retail and ETF point of view, the gold rally has legs to run.

Relative value

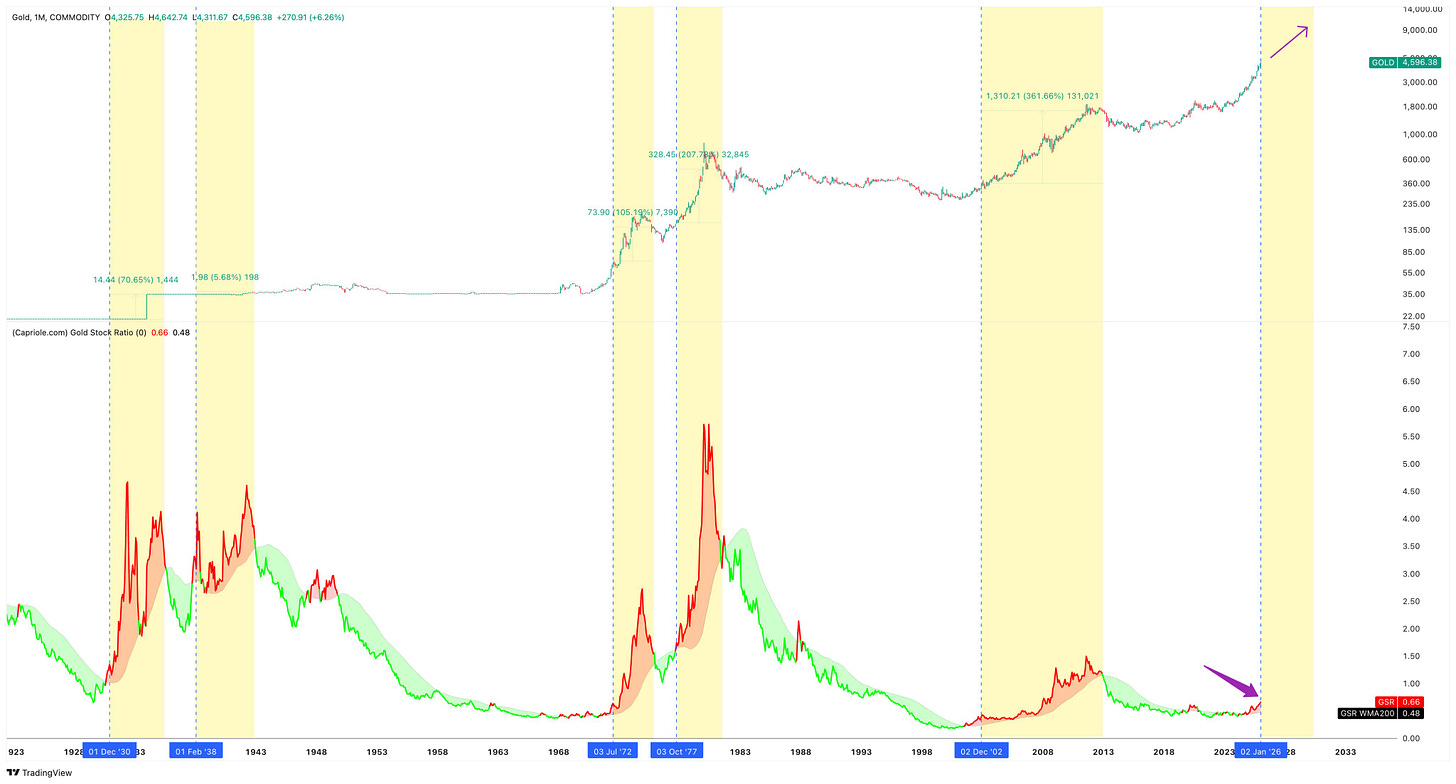

Perhaps the most simple and robust metric to track the relative value and potential for gold today is the ratio of the gold to the S&P 500. With this metric we can clearly analyze all 100 years of gold bull markets. Check it out. You will notice several interesting points.

- When gold moves, it’s a rocket ship. What people miss with gold at nearly $5000 today, is that the Gold/Stock ratio is still only 0.7 (see above chart). In prior gold bull markets (1930s, 1940s, 1970s, 2000s), this ratio often hit 3.5 or even higher. That would suggest a 5X gain from here is still possible for gold relative to the S&P 500. These gold bull markets also captured all of the worst equities bear markets, including a -80% drop in 1930 and -50% drop in 2008. On the other hand, as the chart shows, gold ended all periods higher. If this gold bull market is like the past, the average return from here is +150% in US Dollar terms, which would take gold over $12,000 over the next 3-10 years. If the return from here is the same as the 2000s, that would take gold above $23,000 over the next decade.

- We are only 1.5 years into a gold bull market. Historically gold bull markets last 5 years on average and they can run for 10+ years (the yellow regions in above chart). So we could see gold outperform from now until 2029-2034.

Fiat fuel to the fire

Global money supply grew $11T in 2025 to $115T. Is it any surprise that Gold also grew by $14T (67%)?

Today the annual growth rate in the global money supply is an eye watering 10.5% per year. This is a fiat money inflation rate we have not seen since mid-2020, peak-Covid, just as stimulus checks were airdropped on a locked down population. More easy dollars must flow to risk-on and hard money assets to preserve wealth. As long as money growth rates remain high, we can expect assets like gold to continue to reprice upwards.

All Government policy is pro-liquidity

All US government branches in 2026 are currently pro-liquidity and monetary easing. This is very bullish for hard assets like gold:

- The Federal Reserve

- Cutting rates, with a dot plot target of 3% in 2027

- Started QE, growing balance sheet by $40B / month

- Powell to be replaced by a Trump preferred, low-rate leaning, chair in 2026

- Trump

- He has made it abundantly clear the “Fed should cut rates”

- Ordered $200B MBS buys to lower mortgage rates

- Called for US credit card interest rate cap at 10%

- US midterms elections incoming (Mar – Sep), he needs a strong economic result as voters weigh “economic outcomes” the highest.

- Scott Bessent (US Treasury)

- Fed “shouldn’t delay” further rate cuts

- MBS buys to “match” Fed runoff and ease mortgage pressure

- Expanding buybacks for “liquidity support” in long-end

All of the above means cheaper credit and more dollars sloshing around the system.

I wonder how investors globally will chose to allocate those dollars?

The Dual Mandate is pro-liquidity

The US Federal Reserve is perhaps the most important lever on global monetary liquidity.

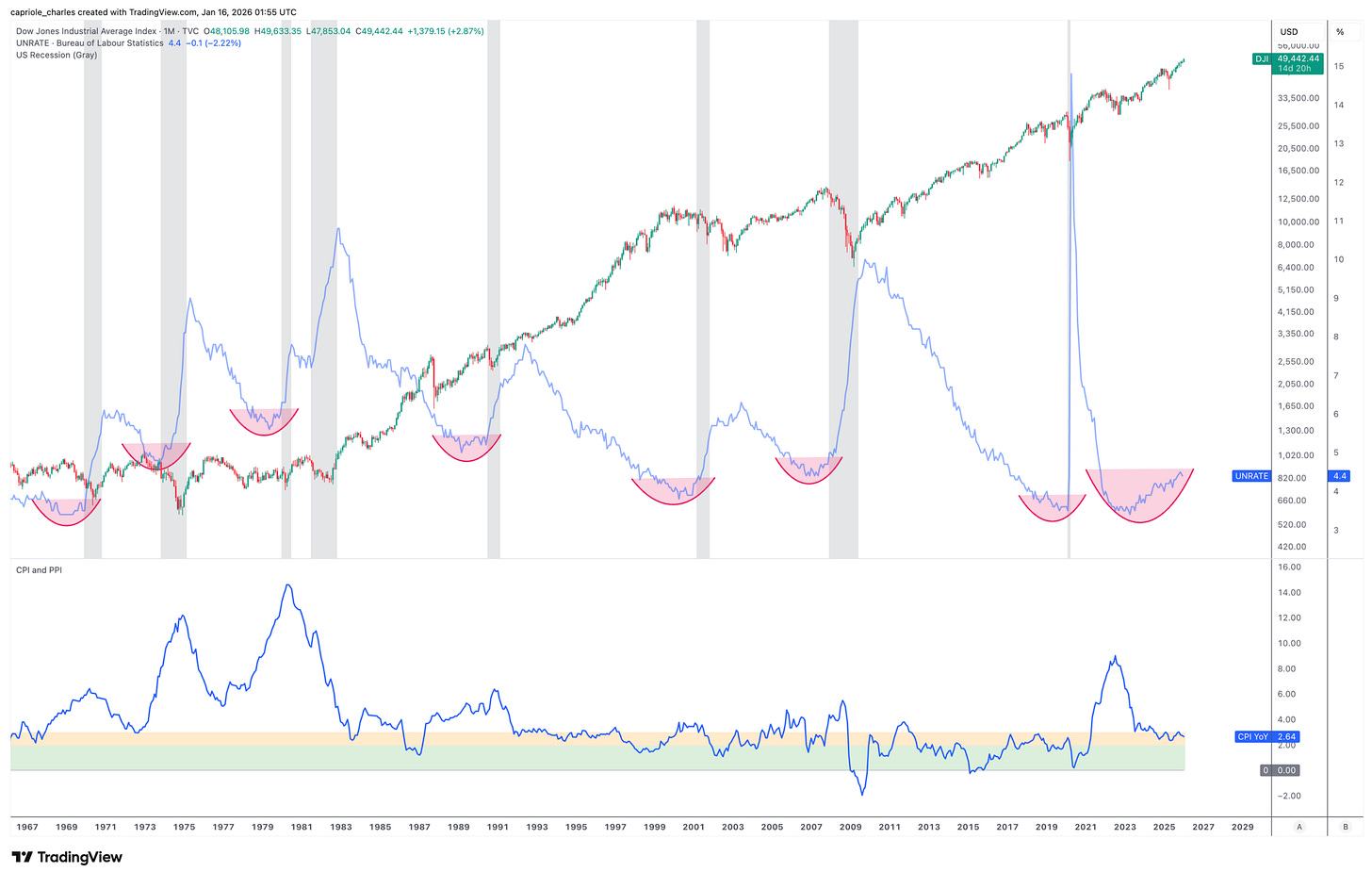

The Federal Reserve has a dual mandate is to promote maximum employment and stable prices. The current priority today is protecting employment (pro-QE), as opposed to lowering inflation (pro-QT) given inflation is largely under control and the employment situation is rapidly deteriorating.

This is a leading driver for more liquidity entering markets, not less. Another rachet to hard asset valuations.

Bottom line

Some of the possible price targets for gold here might sound pie-in-the-sky. As always, any and all of these trends can reverse at anytime. That said, gold trends tend to be sticky. They last 5 years on average. A typically gold outperformance rally runs (on and off) for a full decade. We are just 18 months into the current gold bull market, giving the potential for a lot of runway from here.

We also now have the best pro-gold regulatory framework in place internationally in over 50 years.

We have the US only 6 months ago phasing in pro-gold Basel III legislation.

We have a world that has only in 2022 started to trend away from globalization and towards isolationism.

We have record high Central bank gold accumulation. China has 10Xed their gold stack in the last 2 years alone.

We have an incredible 10.5% fiat money supply inflation per year, ratcheting up asset prices.

We have bottomed and rising unemployment and all US government bodies are aligned on pumping liquidity to devalue soaring debt and fuel the economy.

We have less than 0.2% ETF allocation to gold for US financial portfolios, suggesting a huge runway ahead.

When you consider all of the above, is it really so hard to think that this gold bull market might be something like the last five in the 1930s, 1940s, 1970s and 2000s?

If is, we can expect the gold price to trend to between $12,000 to $23,000 over the coming 3-8 years.

Capriole Investments

Capriole Investments runs a systematic macro fund, utilizing direction long/short models to provide downside protected allocation to the highest growth exponential age asset classes including: Bitcoin, quantum computing and critical commodities like gold. As of publication (23 January 2026) Capriole has a 58% average annual return net of fees since inception in 2019. For more details see Capriole.com