Deep Value Opportunities

Our “caution is justified” in last month’s newsletter has proved sound. The mid-$30Ks was our required technical line in the sand to change stance, but follow through never happened. Instead, Bitcoin plunged -45% in June with the meltdown of the massive (by crypto standards) $10B Three Arrows Capital (3AC) fund. It quickly became apparent that 3AC had suffered position liquidations and defaulted on a number of loans, causing major losses to a series of entities in the crypto space.

Now we now find ourselves in a special juncture in the crypto cycle.

Bitcoin has hit a down draw of -75% since November. More may come, but we are at a rare and historically valuable meeting point of price downdraw, halving cycle timing, and on-chain and fundamental metric discounts. As we outlined in our “Digital Asset Thesis” chart No. 10, we are now in the 6-12month window where Bitcoin halving cycle bottoms usually occur. Historically, investing in crypto assets in these cycle windows generated the greatest returns in hindsight. In addition, most on-chain metrics are at cyclical lows, with extremely undervalued readings which have historically occurred less than 5% of the time throughout Bitcoin’s history. Such times represented deep value opportunities in the past. Statistically, it’s a valuable time to consider investing in digital assets if you have a multi-year horizon.

The News

There are a lot of headlines in the “bad” column this month. The most bad news since we started writing this newsletter nearly two years ago. Likely the most since the Covid crash and liquidation run of March 12, 2020. While it’s awful that many of these events mean a lot of people are suffering, it is not all bad. These events are typical of major crypto corrections, we’ve been here before. It’s the invisible hand of the market at work. This is how markets should behave when they are free to operate without manipulation and with organic pricing. Crypto is one of the only remaining truly free markets in the world today, but those days may be numbered. There are no government bailouts. There is limited regulation. There are no zombie companies. In crypto, you have to deliver and build sustainably or you don’t make it through these 80% downdraws. It’s survival of the fittest. The system is self-healing. Today, the market is cleansing unsustainable leverage from the system and punishing institutions that took on too much debt and risk through the bull market. While these events can hurt in the short-term, they ultimately result in the rapid innovation, metamorphosis and incredible growth that this industry has seen. Remember, crypto is being adopted faster than the internet. In the flames of the crash, great bargains can be found. Just a year ago, BlockFi had a valuation of $3B, today rumors are circulating that FTX is looking to buy it for a mere $25M. As Baron Rothchild once said, “the time to buy is when there’s blood in the streets.”

Here’s this month’s highlights:

The Good

- Deloitte and NYDIG announce alliance to provide banking for all with Bitcoin

- Tether is preparing another audit and rebutts the unsubstantiated FUD against its peg

- 85% of US merchants say enabling crypto payments is a high priority

- Public companies now hold over 7% of Bitcoin in circulation

- PayPal lets users transfer Bitcoin and Ethereum to external wallets

- FTX launches licensed crypto exchange service in Japan

The Bad

- The SEC rejects Grayscale’s request to convert to a Spot ETF

- Three Arrows Capital $10B fund under liquidation

- Celsius lend/borrow platform has a $2B balance sheet hole with lawyers pushing for Chapter 11 bankruptcy

- Voyager’s circa $1B loans to 3AC in default

- CoinFlex exchange suffers concerning liquidity issues

- Bybit slashes its workforce by 30%

- Coinbase lays off 1,100 employees

- Gemini, BlockFi and Crypto.com collectively laying off over 500 employees

- BlockFi lend/borrow platform seeking bailout from FTX or Morgan Creek Capital

- $4B in Bitcoin miner loans are coming under stress

- Musk, Tesla and SpaceX are sued for $258B over alleged Dogecoin pyramid scheme

- Huobi to shut Thailand crypto unit as regulator revokes license

- White House drafting policy to reduce crypto mining carbon footprint [we put this here as Bitcoin mining is already one of, if not the, greenest powered industries globally. So such a policy shows a lack of understanding and potential risk to the industry]

The Rest

- MicroStrategy has purchased an additional 480 bitcoins for $10M

- Crypto staking must be regulated along with Bitcoin, demands Lagarde

- FTX closes in on a deal to buy BlockFi for just $25M

The Traditional Markets

Not much has changed this month except the Federal Reserve’s chair Jerome Powell admitting that he doesn’t know much about inflation. To date, the driving market narrative remains inflation. Until we see tangible evidence (likely multiple months) of CPI moving to the downside, we expect markets to remain in predominantly risk-off mode.

At the same time we are seeing increasing discussion and evidence for recession. The Fed is juggling two very opposing problems. So far they have made it clear price stability is their priority for now (at the expense of risk assets and the broader economy), but as the pendulum of importance slowly shifts from inflation to recession, the hardline hawkish stance will progressively get harder to enforce.

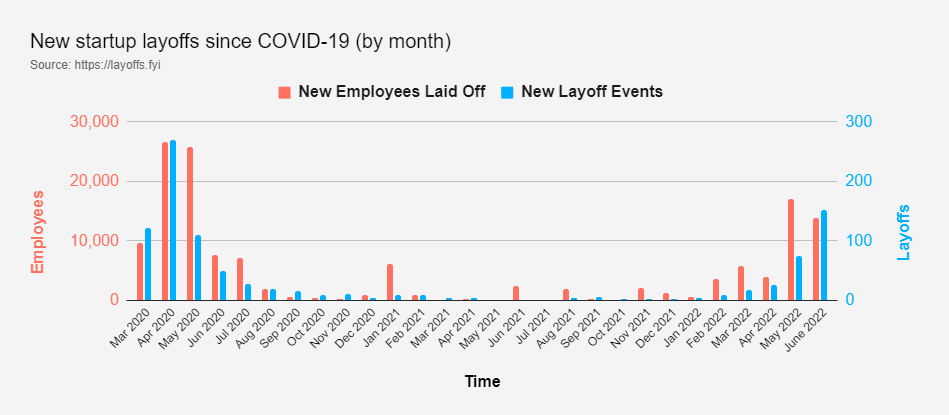

Several early warning signs are appearing that highlight economic stress as a result of aggressive Fed rate rises and balance sheet offloading. The Fed backstop and infinite buy pressure that drove asset prices up the last years is now gone and in reverse. Signs of layoffs are becoming widespread across industries. Monthly layoffs are up 100% in June, and approaching 2020 Covid crash levels.

Layoffs are one of the early signs of a struggling economy and potential recession. Source: layoffs.fyi

Several well respected giants in the space see these issues lasting a lot longer than most expect. That is, well into 2023. The likes of Dalio, Druckenmiller and Bridgewater co-CIO Jensen express similar views. You can read more about their thoughts in the Content we Love section below.

The Fundamentals

We turn once again to the Macro Index, one of our autonomous trading strategies which weighs an array of over 35 on-chain and macroeconomic metrics. We are excited by this model because it does not consider price as an input at all. Pure fundamentals only. Each metric’s weight in the model is recalculated by a machine learning model daily, favoring metrics which explain history better. You can read more about the Macro Index here. Keep in mind that the Macro Index data presented below can change from day-to-day, these scores are just a snapshot as of the date of this publication.

The Macro Index remains in contraction (risk-off) but is getting into very deep undervaluation. The current score is -2.04, such low readings have only occurred in a combined period of about 6 months in all of the last 11 years. In other words, Bitcoin has been this fundamentally undervalued less than 5% of the time through its history. A 1-in-20 deep value opportunity.Some things to keep in mind: we face macroeconomic headwinds today (noted above) not seen in Bitcoin’s mostly bullish 10 year lifespan. We have a unique combination of massive debt, massive inflation, we are coming out of a mostly zero interest rate environment with an aggressive Fed hiking into economic weakness. This means that while we are statistically at a major discount today for Bitcoin; the discount could get deeper. If you have a multi-year horizon, you probably can’t go too wrong collecting some long-term holdings at these levels. Particularly given the timing aligns perfectly with the halving cycle bottom 6-month window noted in Chart 10 here. For us, we trade algorithmically and autonomously, so we will await the fundamental turn. When the Macro Index enters the “recovery” phase, which could occur any day now, this strategy will take a long position.

The Macro Index score is -2.04 as of 30 June 2022, having been in contraction (cash) for the majority of June. Source: Capriole Investments

Another individual chart we will inspect in closer detail is Bitcoin’s Production Cost. We created this metric in 2019, you can read more about it here. The calculation logic remains unchanged. This chart provides a good confirmation of the Macro Index, we are at extremes in undervaluation.

Bitcoin traded below its Electrical Cost in June this year, an incredibly rare event. A year ago, I would have personally scooped up such a price plunge to Electrical Cost with open hands; however I explained in early May why things are a bit different this time given the macroeconomic headwinds.

Trading at the Electrical cost means Bitcoin miners are on average under extreme stress. When this happens, the average miner has to ask themselves: Should I keep the electricity running and mine Bitcoin at a loss (with the assumption that price will rise in the future); or should I turn off my rigs now and stop burning cash?

Bitcoin traded below its Electrical Cost this month. This means the raw electrical cost to mine 1 Bitcoin is not covered by the price per Bitcoin received, causing inefficient miners to capitulate. Source: Capriole Investments / TradingView

Old, less efficient rigs are now being turned off. Revenue streams are thinning while electrical costs have broadly been increasing as the result of rising gas prices from inflation and supply chain constraints globally. This is creating a double whammy for miners. Many have rising electrical bills coupled with revenues which are around 40% lower than just a month ago. We have started to see hash power tangibly decline, miners have also given up over 30% of their coin holdings. This is all a perfect case example of a Bitcoin mining capitulation which typically only happens in this magnitude once every 2-4 years. It was all predicted by our Hash Ribbons indicator at the beginning of June.

Hash Ribbons signaled a miner capitulation on 9 June, when Bitcoin was trading above $30K, miners held 30% more Bitcoin and average Hash Rates were 12% higher. Source: Capriole Investments / TradingView

The fundamental picture is compellingly clear. Through Bitcoin’s 10 year history, we consider this a 1-in-20 opportunity to acquire Bitcoin at such discounts. There is extreme stress within the industry, overleveraged traders are being liquidated, funds collapsing, lending platforms and small exchanges going bust and now miners themselves are facing $4B of debt stress and compressed margins. All of this somewhat qualitative “pain and capitulation” has historically aligned with good long-term opportunities.

A simple yet historically performant approach is to consider the Hash Ribbon buy signal which will likely fire at some point within the next 2-months. We published the indicator free on TradingView in 2019 here.

The Technicals

Last month we noted the bearish technicals following the breakdown of major support at $32K region. Today we are testing $19K support (the 2017 all time high order block, and a point of substantial resistance in November/December 2020) for the second time this month. As of writing, price is trading below support. Being a Weekly level, we would want to see at least a weekly close below $19K, or more time spent in the region of $19-20K to have confirmation this level is indeed broken. That flip may be occurring right now. Trading back above $20-22K this month would present a decent technical bottom signal – at least in the short term. Let’s see where Sunday night’s weekly close lands.

Bitcoin is trading at a major technical support level of $19K, the 2017 all-time high. Source: Capriole Investments / TradingView

The Bottom-line

We are at a rare value juncture, but facing new and uncertain macroeconomic headwinds which have not been seen in our lifetime, let alone in Bitcoin’s short history. Technicals are at a major support level. Under “normal circumstances”, now should represent a deep value opportunity based on Bitcoin fundamentals. However, we want to see some signs of change and improvement before champing at the value-bit. These signs could occur from one or more of several factors, including: a Hash Ribbon buy signal, a Fed change of tone, a confirmed recession (they often mark lows for equities), a measurably lower CPI reading, or other sign of fundamental or technical strength within crypto. At Capriole, we will wait for our portfolio of algorithms to identify a change in the data and make the appropriate position change for us, which could be just around the corner.

Capriole’s latest content

- An introduction to the Macro Index, a Bitcoin fundamentals only strategy

- The Digital Asset Thesis, a birds-eye view of the case for Bitcoin and digital assets in 10 charts. Check out Chart 10 which is particularly relevant now.

Content we love

- Bridgewater co-CEO Greg Jensen on the market implications of the Fed’s dilemma. Jensen believes inflation is sticky, that the Fed will tighten more than most expect, and that the markets are currently pricing in a smooth landing which is unlikely. He notes that the current conditions can lead to lost decades, the deglobalization trend will continue and that the risk asset liquidity hole is getting bigger due to the Fed’s sell program which required ponzi like purchasing to prop asset prices up in recent years.

- Druckenmiller thinks the current bear market has a ways to run, that a soft landing is unlikely, and that recession in 2023 is likely.