Issue 18: HODLing in the age of uncertainty

The first quarter of 2022 is coming to a close. War in Europe and generational high inflation are our new reality. Markets have witnessed investors looking to risk-off, resulting in an exacerbation of the kind of price volatility that only economic uncertainty can provide. The Russo-Ukrainian war has also helped expedite crypto regulation in some of the worlds’ largest economies. The US President Biden’s issuance of an executive order calling for a multi-departmental effort to construct legal frameworks for reconciling crypto into the US economy is proof positive of this. Yet amidst this backdrop of economic and geopolitical uncertainty, unbroken accumulation of Bitcoin has continued by some of its staunchest supporters. Institutions have continued to raise and deploy capital into the crypto space. None so bold as Terra Luna, which recently committed to a long-term goal of acquiring $10B in Bitcoin to backstop its algorithmic stablecoin, showcasing strength in the Bitcoin community’s belief in its long-term value proposition.

The News

Here’s this month’s highlights:

The Good

- Terra Luna announces ongoing acquisitions of billions of dollars of Bitcoin for protocol collateral, with target of reaching over $10B in Bitcoin holdings

- EU vote to ban Proof of Work tokens does not pass

- Ukraine receives over $100M in crypto donations

- Ukraine signs law introducing crypto regulatory framework

- Lugano city announces plans to allow Bitcoin and Tether to be treated as legal tender

- Zuckerberg announces upcoming plans for NFT support on Instagram

- Thailand offers new tax exemptions on trading done through authorized exchanges

- Sygnum Bank gets in-principle approval from Singapore authorities to deal with and custody digital / tokenized assets

- Exxon considering taking gas-to-Bitcoin pilot to four countries

- Florida will accept Bitcoin for tax payments

- Bridgewater, the largest hedge fund in the world, announces investment into a crypto fund

- Grayscale threatens to sue the SEC if it rejects its Bitcoin ETF conversion bid

The Bad

- El Salvador postpones Bitcoin bond issue

- India passes bill that imposes a new 30% capital gains tax on crypto transactions

- Thailand SEC bans crypto payments

- US SEC delays decision on WisdomTree and One River’s spot BTC ETF applications

- Estonia calls for restricting cryptocurrencies to close sanctions loopholes

The Rest

- MicroStrategy announces new organization “MacroStrategy” which has secured a $205M loan to acquire more Bitcoin

- Russia acknowledges willingness to accept Bitcoin for gas payments

- Crypto ‘citizenship’ inching towards reality with developments of ‘Satoshi Island’

- US President Biden issues crypto-centric executive order to develop policy recommendations

- Ukraine cancels airdrop and announces potential NFT sales in the near future

- Dubai announces new crypto regulator and introduces new crypto laws

The Bitcoin Standard

Terra Luna manages the 4th largest USD stablecoin in the world, with over $16B in algorithmically secured US dollars. Terra’s CEO, Do Kwon, recently announced plans to acquire up to $10B worth of Bitcoin for their reserves, with $3B ready for deployment immediately. Just 7 days ago Terra began acquiring roughly $125M worth of Bitcoin a day.

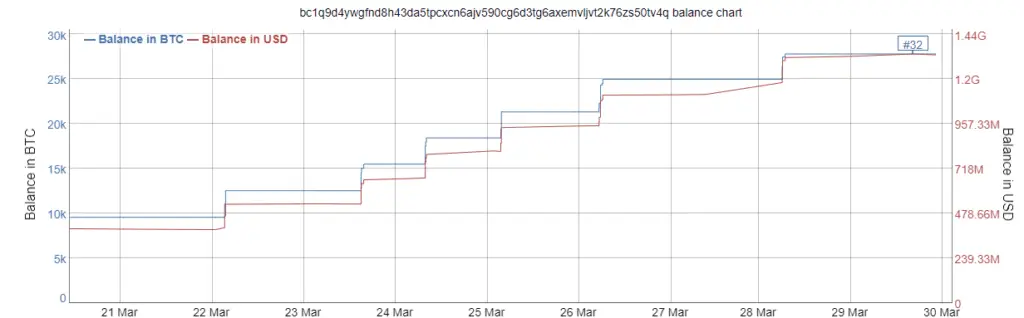

The crypto community was quick to identify Terra’s Bitcoin wallet address, which since Do Kwon’s first tweet, has already conducted 6 purchases totaling over $900M in present value.

Terra’s confirmed Bitcoin reserve wallet. Source: BitInfoCharts

If Terra continues at its current rate of acquiring approximately $125M Bitcoin every weekday, they would reach their $3B target on 22 April 2022.

This assumes an unchanged buy program and equal Bitcoin price; and there is very little likelihood of either of these being true. If anything, one might expect Terra’s buy pace to slow, given the drastic price appreciation we have seen since it began purchasing 1 week ago when Bitcoin was 15% cheaper. Today is also the first weekday where there has been no evidence of a subsequent purchase into their reserve wallet.

Nonetheless, provided Terra is true to their word, we now have the biggest institutional buy pressure on Bitcoin we have ever (publicly) seen, and it is likely to hold for at least the next 3 weeks.

Terra’s current Bitcoin acquisition program. Source: BitInfoCharts

Exactly when Terra will stop purchasing in the near-term is completely uncertain, but if history is anything to go by, it wouldn’t be surprising to see downside volatility after the event. Much like we have seen on the completion of many MicroStrategy Bitcoin acquisitions over the last year.

Why has the price rallied so much, and why might it correct afterward? This is the result of two primarily reflexivity driven reasons:

- When a big buyer steps in (and brings confidence), many other smaller buyers join in unison (small fish following the big whale). This adds to the overall market buy pressure in the short-term.

- At the same time, large sellers often wait until the back end of the buy program, believing that they will be able to sell at a higher price at the back end of the buy program. Whether this belief is true or not doesn’t even matter – the net change in behavior thins sell side liquidity in the near-term which again incentives short-term appreciation.

Both of these factors compound upwards, causing price appreciation (a short-term bubble), beyond what the organic $3B purchase actually justifies – the Bitcoin spot market did turnover more than $64B today afterall, which shows just how little $125M really is. The whole cycle of course can reverse back down the same way it went up.

This doesn’t have to be the case all the time though. If enough time passes during the buy program to reverse bearish sentiment, investor behaviour can stick and self-reinforce to create a new positive cycle. We will just have to see how long the program lasts, and how sentiment turns out at that point in time with regards to broader macroeconomic conditions. It wouldn’t hurt to be conservative at that point – just in case.

Regardless of the short-term price outcomes, the implications of Terra’s decision to use Bitcoin in its reserves, a claimable backstop to an algorithmic US Dollar, is nothing short of monetary revolution. This is the first time we have seen a real utilization of a “Bitcoin Standard” – a currency backed by and redeemable for Bitcoin.

INVEST IN THE CAPRIOLE FUND

The Capriole Fund is open to professional international investors

and accredited U.S. investors (including self-directed IRAs).

We accept new investors once a month.

Find out more

The Fundamentals

Bitcoin has been relatively stable through the broader market’s instability. Despite market uncertainty and price volatility continuing through much of March, investors have continued to show habitual accumulation of Bitcoin, with more addresses month-over-month being used to store Bitcoin off exchange. Glassnode’s accumulation address metric counts any wallet with at least 2 incoming non-dust transfers with no outflow of funds in its history. Wallets tied to exchanges or wallets used for receiving from coinbase (miner addresses) are omitted from the count. And in order to compensate for possibly lost coins in this metric, they omit any wallet that was last active >= 7 years ago.

Number of wallets used to hodl bitcoin continues to increase at a rapid clip. Source: Glassnode

Looking at how investors have deployed their capital in the futures markets we see that open interest of coin margined contracts has continued to decrease, particularly through this most recent price rally. While cash margined open interest has remained dominant with a noticeable spike in response to recent upward price momentum.

Increasing Futures OI through cash margined contracts. Source: Cryptoquant

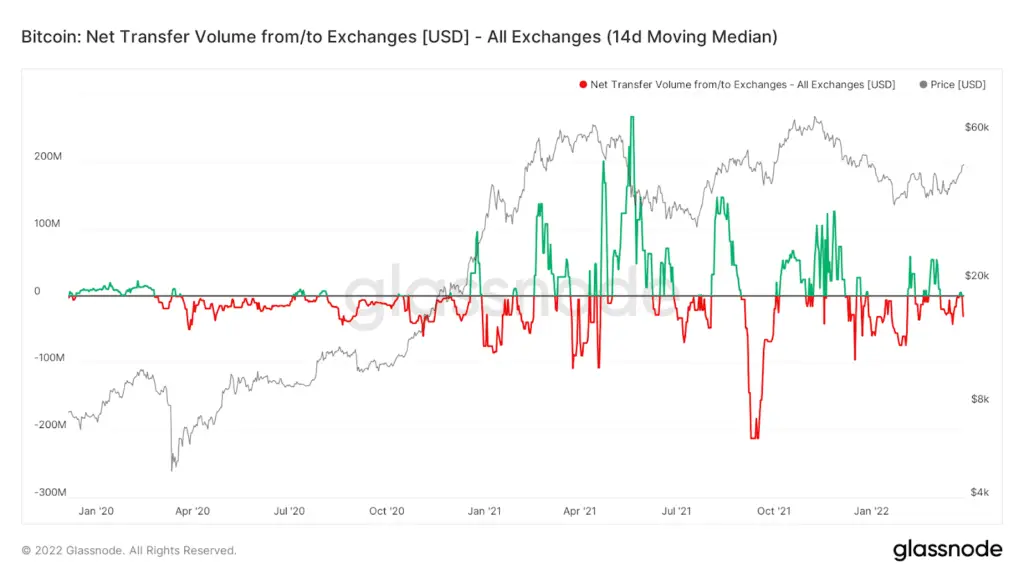

The amount of USD volume flowing in and out of exchanges has been cooling off but is still noticeably net negative. This metric shows little more than a diminishing availability in on-exchange capital, but in concert with the rest of the metrics it shows a market that is primed for larger price movements.

Negative netflows of volume from/to Exchanges. Source: Glassnode

That is because with investors deployable capital still dominantly in cash, coin accumulation trends continuing to show signs of strength, and value continuing to leave exchanges as seen through continued negative net flow of volume; the amount of capital that can readily change hands is shrinking. During market conditions like this, large accumulations of Bitcoin can and do move price noticeably, much like what has happened with Terra’s recent $125M daily Bitcoin acquisitions.

The Technicals

Bitcoin has been printing higher highs and higher lows consistently since March 14, bringing price into contact with the key resistance levels of the previous month’s high and the yearly open. Having cleared those levels now at the tail end of March, holding above the yearly open ($46.2K) will be critical for Bitcoin’s continued upward momentum.

Key Weekly, Monthly and Yearly levels have been broken, giving strength to the trend. Source: TradingView

Further supporting this sign of strength is the mid month claim of the 50-Day Moving Average and now the recent reclaiming of the 100-Day Moving Average. This is largely of interest because the crossing under of the 50-Day, 100-Day, and 200-Day moving averages were the 2021 death nails to Bitcoin’s price that signaled impending and extended price declines from all time highs at just below 70k USD. Locally however, Bitcoin has found measurable resistance at the 200-Day Moving average.

BTC reclaims the DMA50 and DMA100 amidst market chaos. Source: TradingView

The Bottom-line

This last month has been a month of market chaos and uncertainty. Fundamentals and technicals can paint a picture of the near- to mid-term possibilities, and those look generally good (barring local technical resistances). But the most important things to pay attention to are the intangibles presented by the macro-economic shifts that crypto regulation and the changing economic alliances around modern energy resources and storeholds of value will inevitably have on all markets, crypto included.

Over the past decade and in the absence of a structured regulatory framework, the crypto community has sought to effectively ‘regulate’ itself. This allowed for massive leaps in technological innovation, which in turn has invited massive piles of capital into the crypto economy. But that is changing. Countries worldwide are stepping in and putting crypto under the microscope. It will change in ways that are hard to predict today. The union between the way the crypto economy currently functions and the way the old monetary systems need it to function in order for a marriage to make sense is going to be turbulent.

The biggest sign of strength in Bitcoin’s life: the world economy and its fiscal systems are capitulating to the idea that cryptocurrencies need to be acknowledged and reconciled into their current monetary frameworks. We saw measurable volume spikes in crypto trading in both Russia and Ukraine during the invasion. Russia recently acknowledged it would accept Bitcoin for trade. And now we have the first real use case of Bitcoin as a reserve asset to back another currency – characteristically being implemented in the crypto space first, though we expect countries will later follow that lead.

We have passed the institutional buy-in phase; Bitcoin is now a government level asset class. Next stop: governments’ waging the Bitcoin mining dominance war.

Content we love

- Raoul Pal’s thread on Yield and Recession

- Dylan’s thread on equity market capitulation and market cycles

Podcasts

Earlier in the month, Charles from Capriole spoke with the CryptoQuant team and Will Clemente at Blockware:

- The CQ Twitter space (you can relisten to it here) covered the relative value of Bitcoin early in March and included an in depth discussion on Bitcoin mining and production cost

- In late February, Charles and Will discussed the state of the market and covered all things from the macro environment to on-chain analytics

One Response

Great work ryan 🙂