A birds-eye view at Bitcoin and digital assets in 10 charts

A Birds-eye View

It’s easy to miss the forest for the trees when considering crypto. It’s too volatile, it’s too risky, it’s speculative.

This article takes an aerial view of Bitcoin and digital assets. It’s a combination of historical performance facts we find convincing and a variety of arguments for potential market size growth. This is not intended to be a comprehensive analysis of either market. It does not cover various risks nor the fact that the future performance of Bitcoin and digital assets may not look like the past. Bitcoin regularly draws down more than 80%, and such volatility should be expected into the future.

There are few certainties in life, especially in investing. But if we had to pick just 10 charts to present the digital asset thesis, and why we find this industry compelling, these would be it:

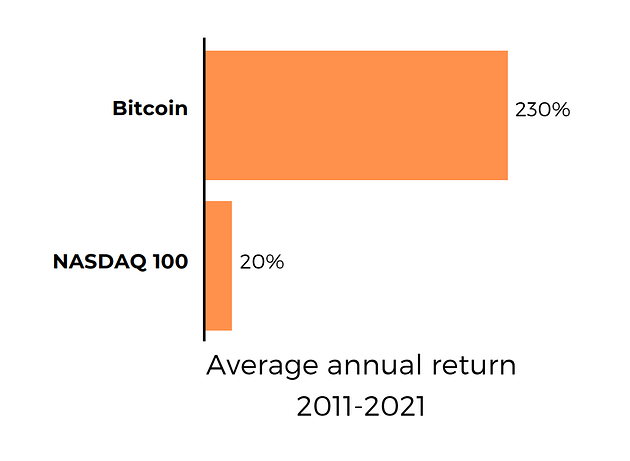

1. High return.

Bitcoin and digital assets were the highest returning asset class of the last decade. Bitcoin returned 10X more per year than the second best asset class, the NASDAQ 100.

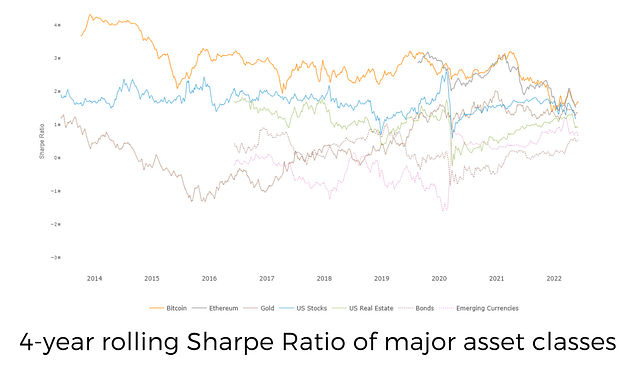

2. The best risk-adjusted return.

Bitcoin and Ethereum had the best risk-return relationship of major asset classes through the last decade based on Sharpe Ratios.

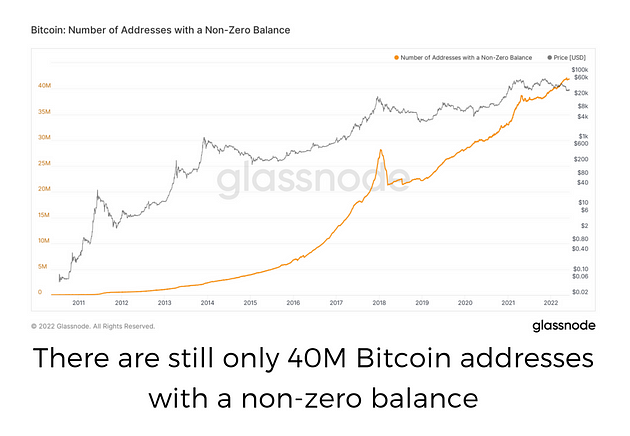

3. Adoption is still in its infancy.

Bitcoin holders represent just 0.5% of the World’s population today.

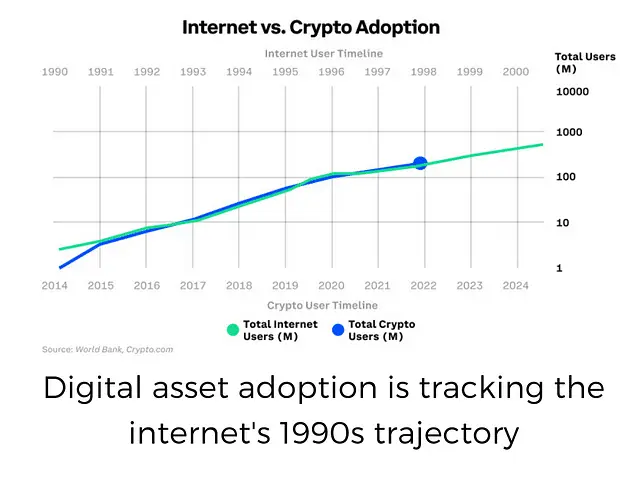

4. It’s still early.

Digital asset adoption is following the path of the internet, but with faster growth. Digital asset adoption is roughly in the same place the internet was in 1998.

“I don’t believe we shall ever have a good money again before we take the thing out of the hands of government. That is, we can’t take it violently out of the hands of government, all we can do is by some sly roundabout way introduce something that they can’t stop.“

Friedrich Hayek (1984)

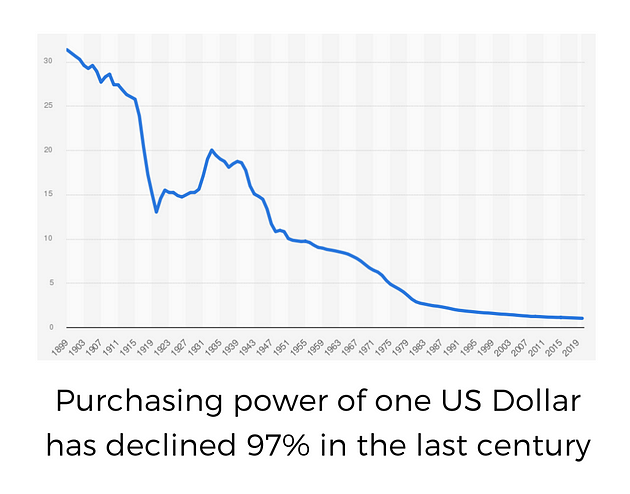

5. Hard as gold.

With Government Debt-to-GDP higher than the WW2 peak, it wouldn’t be surprising for the current multi-decade trend of fiat inflation and devaluation to continue out of necessity. In two years Bitcoin will have a lower inflation rate than gold (2%) and decline exponentially and programmatically from there for the next 100 years.

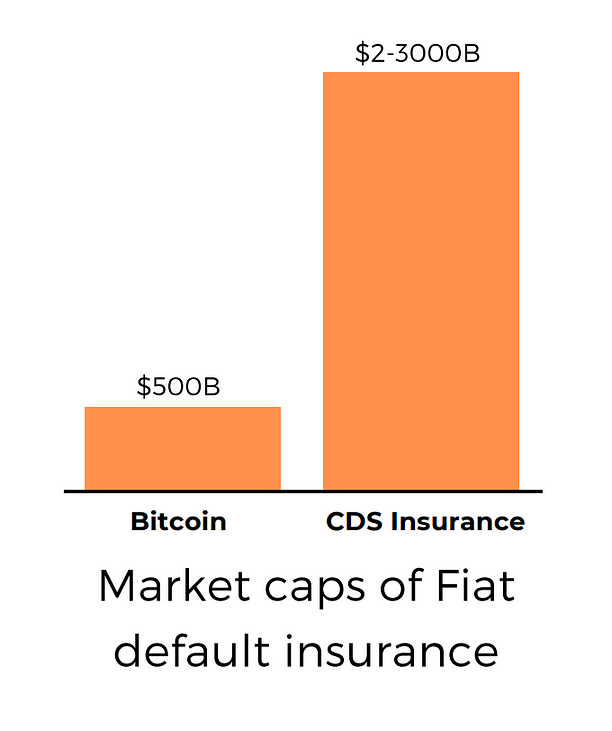

6. Fiat default insurance.

The CDS default insurance market for fiats is valued at $2–3T. Greg Foss makes a compelling case Bitcoin is fiat default insurance. Valuing Bitcoin as fiat default insurance alone puts Bitcoin’s price closer to $150K per coin.

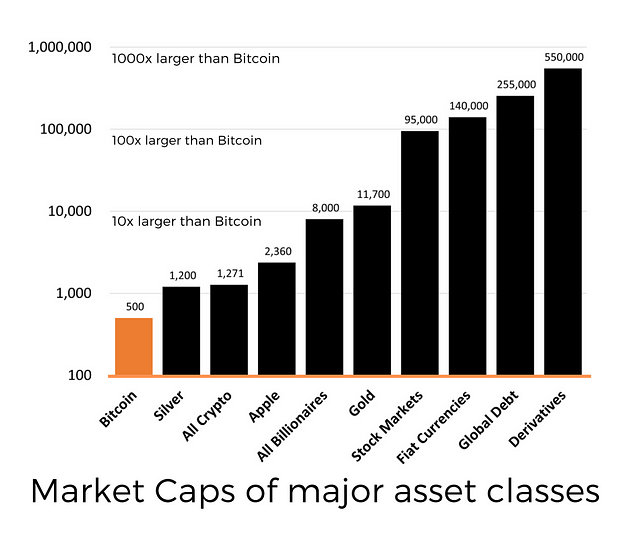

7. Asset market caps are still emerging.

If Bitcoin becomes the global default for hard money or peer-to-peer cash, that would be an order of magnitude increase of circa 10X (gold) to 100X (fiat).

8. Bitcoin is regulated, institutional and sovereign.

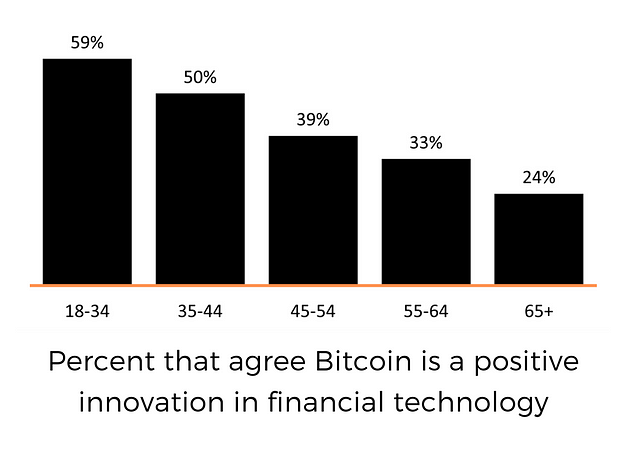

9. Bitcoin is the future.

Younger generations, that are entering their peak income earning years, mostly agree Bitcoin is a positive financial innovation.

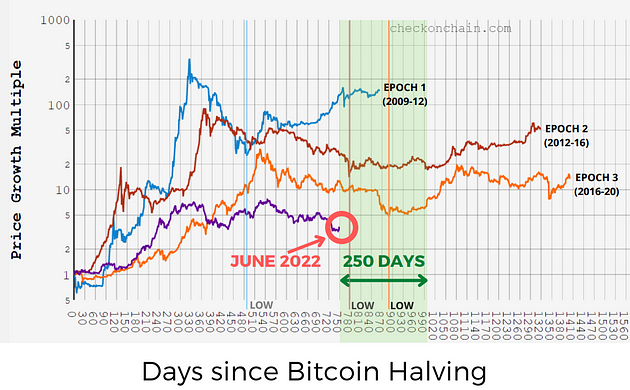

10. Bitcoin’s 4-year cycle provides opportunity.

Since 2012, the best time to invest has been the 1-year period ending 1-year prior to the Bitcoin Halving (now until Q1 2023).

Summary

- The highest returning assets of the last decade.

- The best risk-adjusted return of major asset classes.

- Just 0.5% of the world owns Bitcoin today

- Crypto adoption today looks like the internet in 1998, only faster.

- Inflation is sticky, Bitcoin is hard.

- If Bitcoin is considered fiat default insurance, its market cap should be much higher.

- Bitcoin and digital assets are cheap against comparable asset classes by many multiples.

- Countries and companies are adopting Bitcoin.

- Prime income earning generations today view Bitcoin more favorably than their seniors.

- Bitcoin is in a period in its 4-year cycle where it has historically been cyclically cheap.

Download the full PDF report here.

Disclaimer on Backtests

Any Backtest performance returns presented represent hypothetical returns and are meant to simulate how a strategy would have performed during the period shown had the strategy been implemented during that time. Backtested/simulated performance returns are hypothetical and do not reflect trading in actual accounts. Backtest returns are provided for informational purposes only to indicate historical performance had the strategy been implemented over the relevant time period. Backtested performance results have inherent limitations as to their relevance and use. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading, such as the ability to withstand losses or to adhere to a particular trading program in spite of trading losses, all of which can also adversely affect actual trading results. There are numerous other factors related to the markets in general and to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results, all of which can adversely affect actual trading results. Any and all of these factors mean that no representation is being made that strategies presented here will achieve performance similar to that shown, and in any case, past performance is no guarantee of future performance.