The Golden Gift

Welcome to Issue 27 of the Capriole Newsletter. We are quantitative investors in Bitcoin and digital assets. We deploy autonomous, risk-managed algorithms that trade 24/7 to outperform Bitcoin.

In our monthly newsletter we share important industry updates, explore major trends and review the technicals and fundamentals as they relate to Bitcoin. Our aim is to help dissect the noise, distill the most relevant data and help expand the field of digital asset analysis. You can read more about our open-source contributions here.

This issue we take a look at the decade ahead. The Roaring Twenties. We explore why the Fed pivoted here 100% of the time in past instances of comparable inflation, why hard money is likely to be the best performing asset of the decade, why stocks might flounder, why Bitcoin might perform like gold did in the 1970s (it rallied 2400%) and finally why the fundamentals and sentiment couldn’t be better than today for Bitcoin investors.

Let’s dive in.

The Headlines

Here’s the most important news in Bitcoin and crypto this month.

The Good

- Cryptocurrency bill becomes law in Brazil, allowing public institutions to hold crypto assets. More

- Grayscale will explore returning 20% of investor capital if SEC refuses spot Bitcoin ETF. More

- Jefferies sees recovery rate of up to 40% for FTX creditors. More

- PayPal working with crypto wallet MetaMask to offer easy way to buy crypto. More

- Binance Bitcoin reserves are collateralized 101% according to law firm Mazars. More

- Goldman Sachs on hunt for bargain crypto firms after FTX fiasco. More

- Former US president Donald Trump unveils NFT trading card collection. More

The Bad and the Ugly

- FTX founder Sam Bankman-Fried extradited to US and released on record $250M bail. More

- FTX cofounder Gary Wang and Alameda Research CEO Caroline Ellison plead guilty and cut a deal to cooperate with the FBI. More

- Bitcoin miner Core Scientific files for Chapter 11 bankruptcy. More

- Binance proof-of-reserves auditor Mazars pauses all work for crypto clients. More

- Third-party incident impacts Gemini with 5.7M emails leaked. More

- Canada to prohibit crypto firms from offering leveraged trading to citizens. More

- Hedge fund Fir Tree sues Grayscale to resume redemptions, reduce fees. More

- Crypto lender Nexo to quit the United States. More

The Pivot

We are currently seeing the most aggressive hawkish monetary policy since the 1980s. The M2 money supply year-on-year rate of change is now negative for the first time ever, yet inflation is down -29% from its high of 9% in June this year.

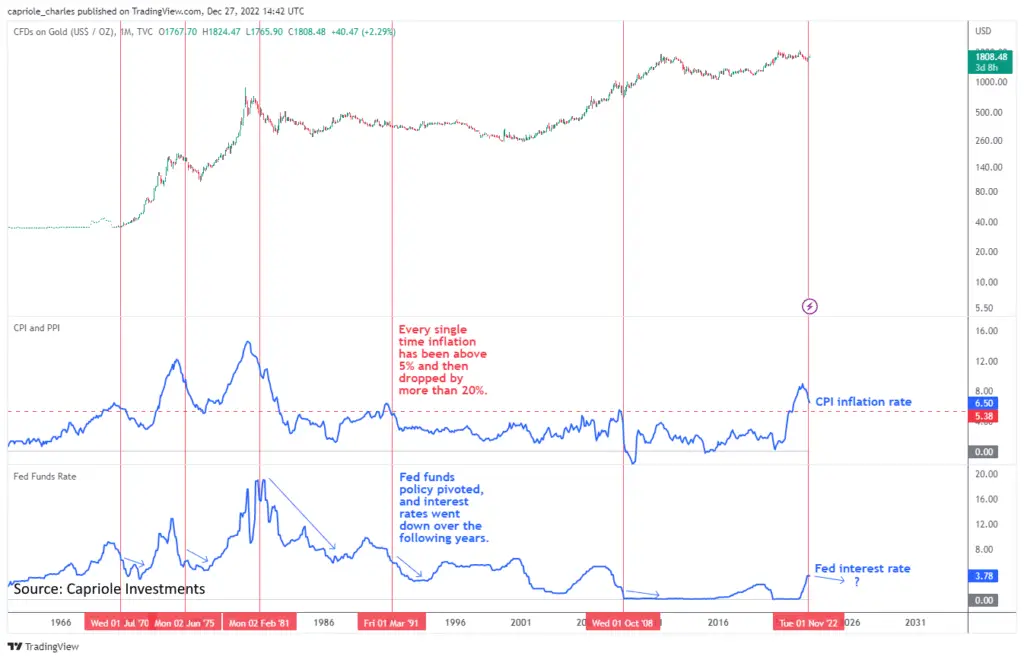

Every single time inflation has been above 5% and then dropped by more than 20% (like today), the Federal Reserve funds rate (interest rates) declined over the following years. In all cases, the inflation top remained in for multiple years to come. In 4 out of 5 cases, inflation normalized into the 2-3% band over the following years while Fed rates also declined. History suggests there is no need for monetary tightening to continue and it is highly likely we see the Fed pivot (rates rises stop or decline) within the next six months.

Every time inflation peaked above 5%, and then dropped more than 20% (red lines), the Fed pivoted, the inflation top was in and the Fed Funds rate declined. Source: Capriole Investments

It is not just inflation that will drive a change of monetary policy in 2023, but significant mounting economic pressures, as indicated by decaying manufacturing indices, mass layoffs across big tech, and worsening housing sentiment.

If the economy falling off a cliff and plunging inflation isn’t enough, there is an even bigger motivator for rates to pause or change direction in 2023: debt.

Debt-to-GDP is around double the post WW2 burden and 3X higher today than the 1970s, a period of similarly high inflation. Federal debt is 400% higher than the 1970s. Higher rates for longer puts significant stress on the US Government to fund its liabilities. From the Government’s point of view, it’s much better to have a higher baseline inflation rate (say 2-4%) which helps to deplete relative debt burden over time. In other words, until Debt-to-GDP is below 100%, it’s in the Government’s best interest to have higher baseline inflation. A further incentive to moderate Fed monetary policy in 2023.

Total US Debt-to-GDP is double that of WW2 and more than triple that of the 1970s inflation era. Source: Capriole Investments and St Louis Federal Reserve

What does all this mean for hard money like Bitcoin?

Gold and Inflation

From the first chart above, the comparable examples to today are the inflation peaks of 6% and 12% in 1970 and 1975. Both periods sparked huge gold bull-runs. From 1971-1975, gold rallied 450% and between 1977-1980 it shot up 800%.

The most compelling examples in recent history to today’s current top in inflation are 1970 and 1975. Both periods saw significant downside volatility in gold, followed by significant bull-runs. Source: Capriole Investments

There are some compelling similarities to these two 1970s cases and today. Inflation peaked six months ago in June 2022 and is currently down 29% as of writing, suggesting the inflation top is in. Through last November, gold had dropped 22%, also quite similar to the 22% decline in 1969 and the 50% decline in 1975.

Not to mention, the gold chart setup looks very strong today. Gold has formed a decade long cup-and-handle pattern and is currently consolidating at resistance below $2K. This is a classic marker for a substantial multi-year move up if a $2K breakout confirms.

The gold chart looks strong with a decade long cup-and-handle pattern suggesting a major move up should a $2K breakout confirm. Source: Capriole Investments

A New Contender

But today we have a new contender for the hard money crown, Bitcoin. Bitcoin is presently down near 80%, in line with all prior cyclical bear markets bottoms.

Given Bitcoin represents just 2.5% of gold’s market capitalization today, its 80% drawdown adds a mere 2% additional drawdown to the combined hard money (gold + Bitcoin) drawdown. Giving a total hard money drawdown of 24% through to November 2022, comparable with the 1970 and 1975 figures for gold.

In 1975, the market capitalization of gold was around $500B, that’s $3,800B in today’s dollars, and represents a quarter of the market cap that gold has now. That means Bitcoin today is just 1/10th the size that gold was in 1975.

Because gold was much smaller in the 1970s (and Bitcoin today is even smaller by comparison), it had capacity to make big moves through a decade of inflation and high interest rates.

That’s one reason why we believe Bitcoin will do the same, and more, this decade.

A Better Gold

Bitcoin has more growth potential than gold because it is smaller. A like-for-like demand in both assets will result in a 40X greater price change for Bitcoin. Bitcoin was also born in, and built for, the internet era. As I wrote about earlier in December, the internet era (from 1995-) has experienced significantly greater growth rates than the prior century, about 400% higher. The Internet era has also seen increasingly fast adoption of new technologies. Today Bitcoin is growing in global adoption faster than the internet did itself.

There are many other attributes that make Bitcoin stand out from gold, such as its equitable decentralization, ability to transfer instantaneously and be used for micro-payments.

But most importantly, Bitcoin is harder than gold.

Bitcoin’s inflation rate, its annualized growth rate of supply, is comparable with gold at 1.6% today. But in just over a year, Bitcoin’s inflation rate is due to drop to sub 0.8%, making Bitcoin twice as hard as gold and therefore a superior inflation hedge. But that’s just the beginning of course. Every 4 years from there on out Bitcoin’s inflation rate will asymptotically approach zero.

In just over a year, Bitcoin will become the hardest asset in the world, with a programmed inflation rate less than half that of gold. Source: Capriole Investments

With each four year halving event, Bitcoin becomes a harder money and better store of value. Every Bitcoin halving has kick started a cyclical bull-market in digital assets. Yet every halving people expect that to be priced in.

It isn’t.

All-in-all, gold went up 24X in the 1970s. Now imagine the 2020s, where the Fed can’t afford to be as aggressive (debt is way higher today) and we have digital, accessible, harder money: Bitcoin.

Changing World Order

The economy and performance of major asset classes can be broken into distinct eras over the last half century. Debt and money supply are the primary driving force of each era.

The current era began with Covid in 2020 and has the most similarities with the “Inflation” era of the 1970s. But there are some significant differences. Today we are at a much later stage of the big debt cycle, debt is 3-4 times higher.

The Inflation era was great for hard assets like gold.

If the current era is like the 1970s Inflation era, we can expect a “lost decade” for stocks (sideways / negligible returns), and an incredible decade for hard money assets like Bitcoin.

Today’s addition of more debt will only incentivize higher baseline inflation over the 20s and suggests prime conditions for outsized Bitcoin performance.

Out of the last half century, the present era is most similar to the “Inflation” era of the 1970s. While there are significant differences (such as higher debt), the differences only increase the odds of better hard money performance this decade versus the 1970s. Source: Capriole Investments

Bitcoin Fundamentals

For on-chain fundamentals, our message in December is the same as November: deep value.

Bitcoin is trading within $100 of the Bitcoin bottom signals thread I published earlier this month.

To keep things short and sweet – if I had to pick just one chart which summarizes the rare value for Bitcoin at this juncture, it would be Bitcoin’s Production Cost.

Bitcoin continues to trade at the Electrical Cost floor. Incredibly rare, deep value. Source: Capriole Investments

Peak Fear

Counter-trading sentiment has been a very effective strategy in the past. Psychology is an investor’s worst enemy. People tend to buy the top (to “fit in” and from fear of missing out) and sell the bottom (because the pain of losing is provably twice as powerful as the pleasure of winning).

The sentiment crater from FTX’s fraud in November has unsurprisingly carried through December. The FTX fraud has opened up rare value for long-term investors. While these periods of sideways can seem to last forever, Bitcoin has a habit of suddenly putting them into the rearview-mirror in classic vertical fashion.

We have seen the 1st and 2nd most bearish readings ever across most major sentiment data, including: individual investor surveys, economist surveys, European surveys, price target downgrades, institutional hedging and consumer sentiment. Something to keep in mind when everything looks like doom and gloom.

You can check out my full thread on sentiment here:

✅ Individual investors 2nd most bearish ever

— Charles Edwards (@caprioleio) December 12, 2022

✅ Economists most bearish ever

✅ Europeans 2nd most bearish ever

✅ Price target downgrades most bearish ever

✅ Institutions 2nd most hedged ever

✅ Investment editors 4th most bearish ever

✅ Consumer sentiment most bearish ever

Volatility Squeeze

Bitcoin is trading at a major low in volatility today, suggesting a major move is brewing. Generally, when Bitcoin breaks out of extremely low volatility, the ensuing trend tends to last.

In other words, don’t fight the trend on the next major move.

Which way might it go? Of course nothing is a certainty, but the on-chain data points to up, halving cycle timing points to up, sentiment points to up and we also believe the Fed policy points to up in 2023.

Either way, don’t fight the next move when it occurs.

Bitcoin’s volatility is at major lows suggesting a big move is brewing. Source: Capriole Investments

The Bottom-Line

We believe the 2020s will be the decade of hard money, much like the 1970s was. For stock market investors, this could be called “a lost decade”. If you agree, then the only question that remains is which hard money will prevail?

Since its release in 2009, Bitcoin has been stealing gold’s market share and stunting its growth. Both assets can be considered hard money but Bitcoin has three distinct advantages:

- In just over a year, it will be the hardest asset in the world with half the inflation of gold,

- Bitcoin is digitally native and instantaneously transacted, built for the Internet era, and

- Bitcoin is 1/40th the size of gold, like-for-like demand will see significantly greater appreciation.

The above three factors, combined with perfect macroeconomic conditions for the Inflation era, prime Bitcoin to be our choice for the asset of the decade.

Charles Edwards

Founder

Capriole Investments Limited

December Content Highlights

- Why markets are not as overvalued as you might think

- Market fear reaches historical peaks

- Bitcoin bottom signals suggest the opportunity today is as good as it gets historically

- Plenty of other reasons to expect Bitcoin to see major upside in the 2020s