Buying $1 for 50 cents

Welcome to issue 25 of the Capriole Newsletter. We crack open the rarest of Bitcoin value metric readings you can count on one hand every 5 years. We dive into the troubling trend of demand across manufacturing and finally take note of the incredible pace of institutional investment into digital assets that continues despite the combined crypto, equities and bonds bear markets.

Summary

- The Bitcoin Yardstick (new metric) is showing value not seen since $4-6K.

- Capitulation of Bitcoin’s long-term holders has occurred.

- An ultra-rare Bitcoin Energy Value discount has just occurred for the first time since March 12, 2020 ($4K).

- Bitcoin’s long-term holder base is at an all-time-high. Fewer and fewer investors are leaving Bitcoin as years pass by, showing its stickiness as a store of value.

- Growth in economic demand (new orders and production) is in a major downtrend.

- End user supply also shows a concerning downtrend (inventories are up).

- Increased odds of an equities bottom based on 150-years of yield curve stats.

- Strong institutional investments: October saw the best good-to-bad news headlines ratio of all of 2022; with major investments occurring across banking and big tech.

Let’s dive in.

Bitcoin Fundamentals

The Bitcoin Yardstick

Here’s a very simple, but useful valuation method for Bitcoin. We call it the Bitcoin Yardstick. It is simply the Bitcoin Market-Cap / Hash-Rate, and normalized (divided by) the 2 year average.

Similar in concept to a PE Ratio, except instead of stock earnings, the Bitcoin Yardstick is taking the ratio of energy work done to secure the Bitcoin network in relation to price.

Lower readings = cheaper Bitcoin = better value.

Today we are seeing valuations unheard of since Bitcoin was $4-6K

The Bitcoin Yardstick is recording deep value not seen since 2019. Source: Capriole Investments

Long-term Holders have Capitulated

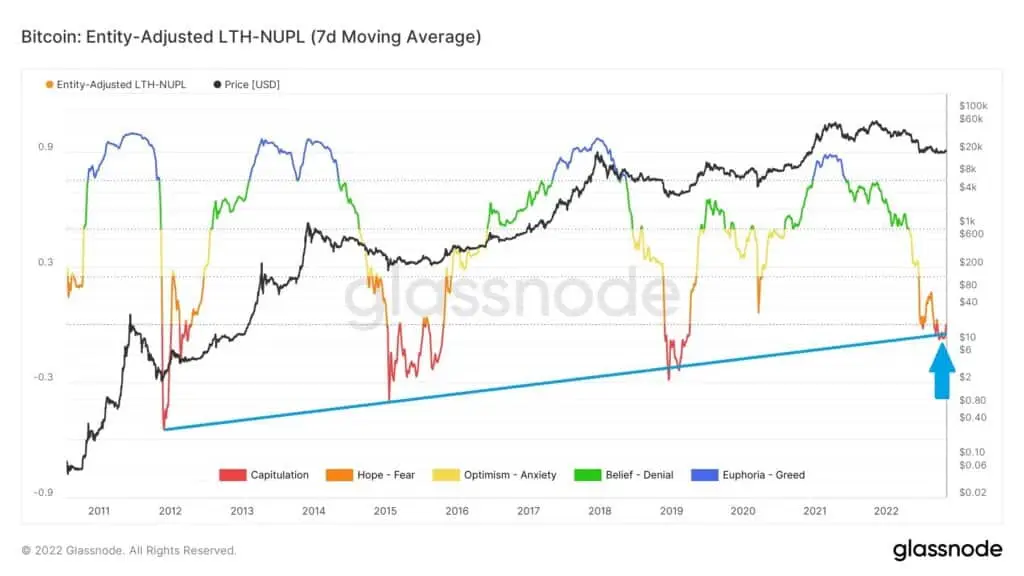

Net unrealized profit and loss (NUPL) is showing a washout in long-term holders. We have entered the capitulation zone (red) seen only once every 4 years in the past.

Long-term Holders are in “Capitulation”, in other words, most coin held today is held at a loss. Source: Glassnode

A 50 cent dollar

Bitcoin’s Energy Value, the fair value of bitcoin calculated by only considering the number of Watts used by the network, is currency $43K. This implies the current price is trading at a -54% discount.

This has only happened on two other singular days in the last 7 years, the massive 12 March 2020 collapse (Bitcoin: $4,841) and on 7 February 2019 at the bottom of the last halving cycle bear market (Bitcoin: $3,360).

There have only been 3 days in the last 7 years where Bitcoin was this cheap against its Energy Value. Source: Capriole Investments

A Store of Value

Two-thirds of Bitcoin has not moved in more than a year.

We see a growing relevance of scarce, hard, digital money in a world where fiat currencies globally inflate and central banks lie about “inflation coming about from nowhere” while at the same time manipulating the money supply. The growing correlation of Bitcoin-to-Gold shows this too, and historically occurs at the most opportunistic moments.

Today represents an all-time-high in long-term hodling of Bitcoin. Despite the worst year in stocks and bonds in centuries, Bitcoiners have never held on to more Bitcoin.

The below hodl waves chart shows the percentage of Bitcoin’s total supply held by long-term holders (held in place at least one year). It shows that once people discover Bitcoin, less and less let go of it over time. Each cycle, the floor and ceiling in Bitcoin held for the long-term has only increased.

Bitcoin is becoming a reserve asset. The floor and ceiling of the percentage of the network held for 1+years has only increased every cycle. Source: Glassnode

The Full Picture

We believe the full picture of Bitcoin’s fundamentals is best consolidated and viewed through the Capriole Macro Index.

The Bitcoin Macro Index, Capriole’s autonomous fundamentals-only trading strategy which uses machine learning to assess and learn on over 35+ Bitcoin on-chain and equity market metrics, remains in a bullish value region today.

Bullish Bitcoin fundamentals are showing strength in a region of value. Source: Capriole Investments

The Macro Index Oscillator. Source: Capriole Investments

Macro Review

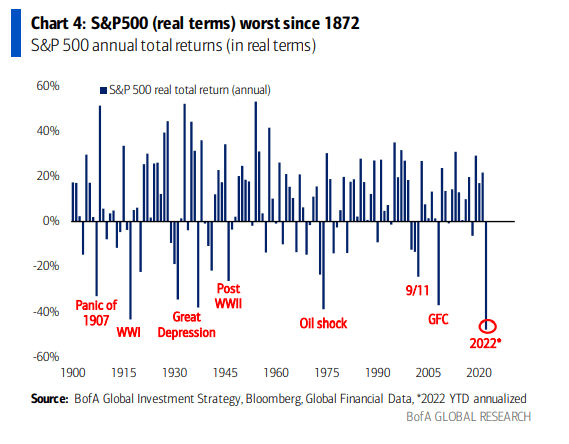

Equities remain in a major downtrend, having seen some relief in October. Nonetheless, 2022 is the worst year for stocks since… the American Civil War.

2022 has been the worst year for stocks since the Civil War. Source: BofA Global Research

Economic health metrics are showing increasing risk of recession (as also reviewed in last month’s issue) and housing continues to show signs of plummeting demand amidst increasing interest rates.

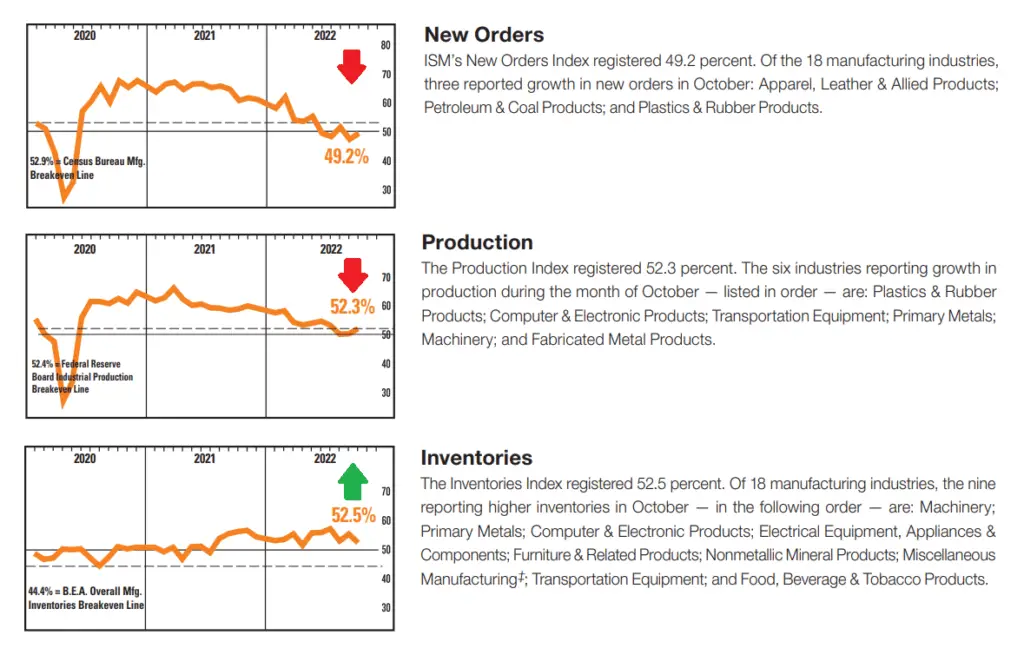

Let’s focus on the Institute for Supply Management (ISM) report for October. The ISM manufacturing index, also known as the purchasing managers’ index (PMI), is a monthly indicator of US economic activity based on a survey of purchasing managers at more than 300 manufacturing firms. It is considered to be a key indicator of the US economy.

In October, the Manufacturing PMI clocked in at 50.2 (out of 100). Values below 50 represent contraction and are a leading indicator of recession. While PMI missed contraction by a whisker in October, it has been in a multi-month growth downtrend highlighting the increasing vulnerability of the economy under the current Federal Reserve regime.

The following three key components of PMI highlight the crux of today’s issue.

Growth in “New Orders” and “Production” (effectively: demand) is in a downtrend since the beginning of 2021. Inventories (supply) is up. These three metrics tell us we have had a major issue in demand ever since quantitative easing appeared to slow in 2021 and quantitative tightening began this year.

If this trend continues; the labor market will be hit, and a Fed Pivot will follow.

It’s just a matter of time.

ISM surveys show growth in demand is in a major downtrend. Fed tightening is shell-shocking the US economy. Source: ISM October Report

But remember. When extremes are this great, it’s often when great opportunities start to appear. There are some reasons to believe the bottom may be in for equities, one such metric is our 150-year yield curve analysis. Confirmation of a recession would increase these odds, as would a Fed pivot. Until then, beware of the major trend.

The Headlines

Here’s the most important news in Bitcoin and crypto this month.

Note the ratio of “Good” to “bad” is the best we have seen all year.

The notable highlights in October are massive integration into traditional banks and the payment giants, Visa and Mastercard. In other words, institutions are continuing to invest in crypto at break-neck pace. This is also shown by multiple consecutive all-time-highs in Bitcoin mining hash rates.

The Good

- Elon Musk acquires Twitter, with a $500M investment from Binance. More

- Hong Kong plans to legalize retail crypto trading. More

- Revolut Bank to allow customers to make purchases with crypto balances. More

- German bank N26 to offer crypto services. More

- French banking giant Société Générale approved to operate digital asset services. More

- Mastercard will help banks offer cryptocurrency trading. More

- Visa is teaming up with FTX to offer debit cards in 40 countries. More

- Visa files trademark applications for crypto wallets, NFTs and the metaverse. More

- Google partners with Coinbase to enable cloud payments with cryptocurrencies. More

- Google Cloud announces blockchain node service starting with Ethereum. More

- Binance launches a $500M fund to provide loans to Bitcoin miners. More

- Twitter will allow users to buy and sell NFTs through tweets. More

The Bad and the Ugly

- Since 2019, 68 cryptocurrency exchanges have been shut down globally. More

- The largest public Bitcoin miner, Core Scientific, says it may seek bankruptcy. More

- Binance confirms BNB cross-chain bridge hack. More

The Bottom-Line

We are in that long, dull part of a Bitcoin cycle where price does not do a lot.

It goes sideways for months, as the typical U-shaped bottom takes shape.

Retail interest has evaporated. Crypto Twitter has put its head in the sand.

No one talks about crypto at the bar and not at the family gathering.

While it seems like not much is happening, it’s times like these that historically offer the highest opportunity. We don’t know how long the macroeconomic situation will continue to look concerning. But we do know that we are seeing rare, once per multi-century downdraws across equities and bonds. We know that Bitcoin, the asset historically considered “too volatile” (an argument increasingly less relevant in a world where stocks are more volatile than Bitcoin), has not put in a new low in the last months but every other asset class has. We know that Bitcoin and crypto are the best performing asset class of the last decade. We also know that the Bitcoin valuations we are seeing today have historically happened only once every few years. These opportunities tend to stick around until they disappear rapidly, as the right vertical of the U-shape completes formation.

Finally, Bitcoin’s value prop has never been more important than today. Increasingly, people see the obvious fallacies and failures of central banks in delivering rational and controlled monetary policy through time.

Psychology is fascinating. Every bear market you are given months to get Bitcoin at a fire sale, yet most rather wait for new all time highs.

Charles Edwards

Founder

Capriole Investments Limited

New Article

We published a new article: Everything you need to know about yield curves. An analysis on 150-years of yield curve inversions and what they mean for investors, including:

- Why they predict recessions

- Why they predict stock losses

- Why we may have seen the bottom

- Why the US yield curve won’t matter very soon.

Read it on Medium here.

In the Media this Month

Charles’ interview with Mark Moss on Market Disruptors in October. We cover the metrics and valuations that tell us whether Bitcoin is cheap or expensive, we explore whether Bitcoin will continue to trade as a risk asset and much more.

4 Responses

Thanks Charles for this awesome analysis

My pleasure! Glad you find it useful.

Fantastic stuff Charles.

Great analYsis! I just signed To your newsletters. Thanks.