In the palm of Jerome’s Hands

Traditional markets have been taking a beating. Our February Newsletter and analysis of the impact of war on markets suggest that when considering war alone, most invasion events mark cyclical bottoms. So far this has been holding – by an inch. The S&P500 is now just above the lows of February 24th but has also clocked in the worst start to a year for the S&P500 in our lifetimes. There are a lot of dynamics at play in 2022 which means we cannot just consider the war alone:

- This war has a particularly big impact on supply chains globally, especially on oil and gas which power global economies.

- We have generational high inflation and debt.

- We are coming off the back of a massive quantitative easing cycle, into a new rate rise regime.

- Global growth is low, with negative GDP growth confirmed in Q1 2022.

This issue we dive into the macroeconomic details and dissect the current environment and its relationship with Bitcoin.

The News

April saw Bitcoin 2022 in Miami kick off a series of new country and city adoption announcements.

I think we can say with confidence that April 2022 was the biggest month ever for country level adoption of Bitcoin.

Here’s this month’s main highlights:

The Good

- Central African Republic adopts Bitcoin as legal currency

- Panama legislature passes bill regulating crypto

- Roatán, Honduras and Portugal’s Madeira region are both set to “adopt bitcoin”

- Cuba approves cryptocurrency services

- Buenos Aires city to allow residents to make tax payments with crypto

- Bahamas to allow citizens to pay taxes with digital assets

- Fort Worth becomes the first city in the U.S. to mine bitcoin

- Central Bank of Portugal grants country’s first crypto license to a bank

- Slovenia unveils plan for flat tax on crypto transactions

- The state of Tennessee is looking for a contractor to hold crypto on its behalf

- New Virginia law allows state-chartered banks to custody crypto

- Germany’s Commerzbank applies for local crypto license

- The first Bitcoin ETF lists in Australia

- Fidelity to allow clients to invest in bitcoin through their 401(k) accounts

- Goldman Sachs offers its first Bitcoin-backed loan

- Scaramucci’s SkyBridge starts investment vehicle for Bitcoin mining

- Pantera Capital set to close $1.3B blockchain fund

- Mastercard files for more than a dozen metaverse and crypto trademarks

- MicroStrategy buys an additional $190 million worth of bitcoin

- Robinhood releases crypto wallet to 2M users and plans integration with the Lightning Network

The Bad

- ECB’s Panetta labels crypto as a ‘Ponzi Scheme’ and calls for higher taxes due to its energy consumption

- Amazon CEO says not adding cryptocurrency as payment option anytime soon

- Terra Bitcoin acquisition program slows, with no purchases made in the last 3 weeks

- Binance agreed to share data with Russian government agency

- Ukraine’s Central Bank bans crypto purchases in local currency

The Rest

- Elon Musk buys Twitter for $43B

- US Treasury sanctions Russian crypto miners, its first sanction on mining

- EU bans providing high-value crypto services to Russia

- The New York State Assembly passed a bill that will freeze current levels of crypto mining carbon emissions

The Markets

The hawkish rate rise program is already priced in

Over the last 2 weeks we have seen the S&P collapse 10% primarily on bolstered hawkish Federal Reserve sentiment from Jerome Powell. The 2-year government bonds have more or less priced in the next two years of predicted Federal Reserve rate hikes. Over this pricing-in period, we have seen the S&P bleed out.

Government bond rates have already priced in the next two years of forecast Fed rate rises, increasing 1200% in just over 6 months. Source: TradingView

The 2-year government bonds in particular have been a great leading indicator for the damage incurred on growth stocks (and crypto markets). Higher rates mean a stock’s future cash flows are discounted more steeply, making businesses less valuable today. In traditional markets, this has resulted in a capital rotation towards value stocks – whose future cash flows are relatively less impacted by these higher rates.

Bitcoin is behaving like a growth stock

Since the Bitcoin cycle bull-run started in mid-2020, Bitcoin has had a much higher correlation to growth stocks than value stocks. The global financial markets are pricing Bitcoin as a risk asset.

A 16 year down trend in value vs growth stocks (shown here as Vanguard:VTV value index versus Vanguard: VUG growth index) is possibly printing a double bottom, highlighting the recent capital rotation from growth into value. Source: TradingView

But in this environment, where the extreme case of rate rises is being priced in, it’s not surprising to see the Dollar and bonds have a higher relative value to Bitcoin. The former now have relatively higher expected rates of return. While Bitcoiners won’t agree, most of the world also still perceives these bonds as having lower risk too, regardless of whether that is true or false, prices reflect it.

A change of course will come

As long as the Fed’s policy remains hawkish, focused on aggressive rate rises and balance sheet offloading, risk markets (stocks and Bitcoin) will have a bumpy road ahead with constrained growth.

The good news is that multiple years of aggressive rate hikes have already been priced into markets. Futures markets are pricing in a 97% chance of a double rate hike next week. The markets are hurting and GDP is hurting. We are halfway towards the rule-of-thumb definition of a recession: “two quarters of negative GDP growth”. While none of this requires the Fed to change course yet, the probabilities of a softening of the Fed’s stance are increasing significantly with time.

It is likely that the Fed will want to see a reduction in inflation, or growth in unemployment, before it publicizes a change of stance. While the data doesn’t show any of these happening yet, if stocks continue to take a beating and if GDP continues to trend down, companies will continue to make layoffs and consumer spending will drop. All of this means that a change of course is coming, it’s just a matter of when, not if. Our expectation is that before year end, we will see the Fed tone soften.

S&P500 Downdraws suggest greater odds of upside here on out

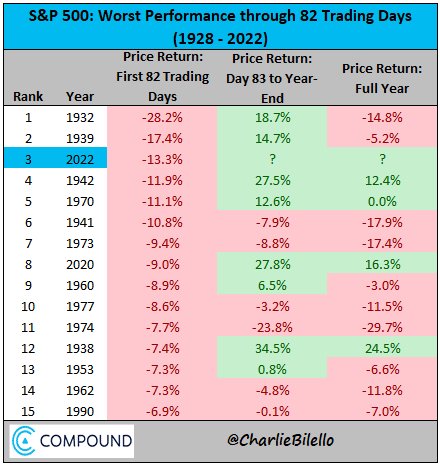

Based on Charlie Bilello’s below analysis considering S&P drawdown data alone, the risk-reward is skewed towards the upside for the remainder of 2022. Though it could take some time to get there, and it could get worse before it gets better.

The S&P 500 is down 13.3% in the first 82 trading days of 2022, the 3rd worst start to a year in history. Source: Charlie Bilello

Balance sheet unloading is the wildcard

Something that isn’t being discussed nearly as actively today as it should is the Fed’s plan to unload its balance sheet by selling $1T of assets a year into an already fragile market. The FOMC is expected to approve the balance-sheet reduction plan this week that will see $60B in Treasuries and $35B in mortgage-backed securities being sold every month. This is a reversal of the last two years of quantitative easing and it’s unclear how much of that sell pressure has been priced into the market today. With the S&P500 at its lows and printing a multi-month distribution pattern, should the Fed confirm this program on Wednesday, it wouldn’t be surprising to see some substantial downside volatility. At the same time, current market conditions may err the Fed to postpone or reduce the magnitude of this sell side program. Like the rate rise program above, the longer balance sheet unloading remains a theme, the longer risk markets will face headwinds.

Signs of hope

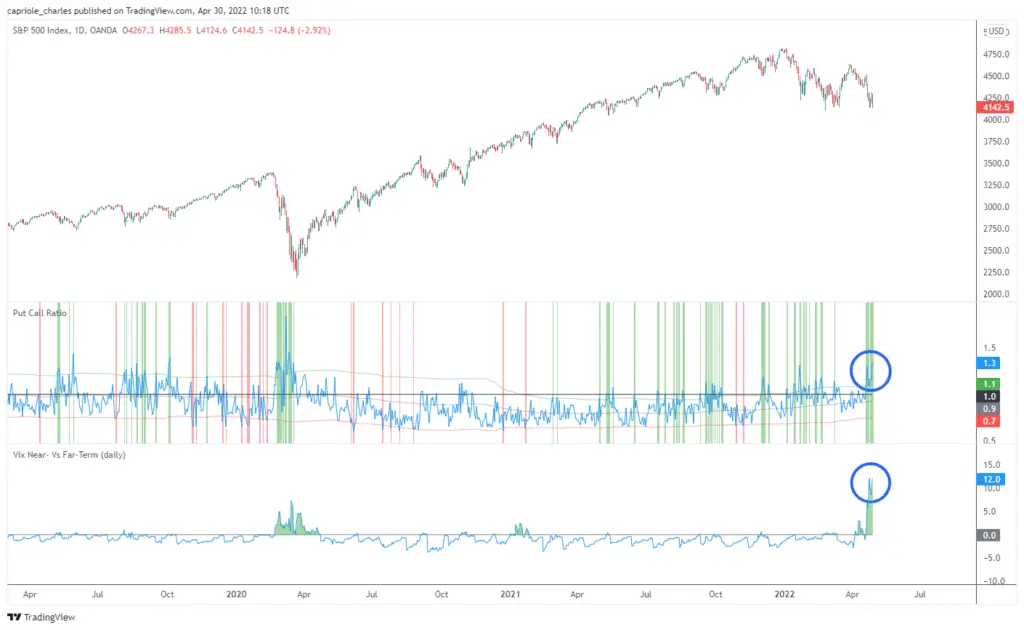

While the S&P500 chart may look awful today there are some strong signs of hope. The Put:Call Ratio is trading at levels not seen since the March 2020 crash, and the VIX near-term to far-term volatility is double March 2020, printing the highest reading on record since 2014.

Both of these are signs that the S&P500 is extremely oversold. This means that market sentiment is so bearish that there is a high probability of a strong bounce or trend reversal in the coming days and weeks. As always, it is possible to continue lower first. But these readings have historically been strong buy signals.

S&P500 signs of hope. The Put:Call ratio and VIX readings suggest we are incredibly oversold today and due for a bounce. Source: TradingView

Wrapping up the markets

We can’t predict when the Fed will change course. But we believe the probabilities of it happening have increased over last month and we expect that they will continue to increase as long as the above data continues on its current course. If the Fed remains hawkish, growth stocks and Bitcoin will likely hurt. As soon as the Fed’s tone changes, those 90%+ pricing-ins of rate hikes will collapse, and risk markets will likely rally.

The Fundamentals

Whale accumulation continues

Whales, those with $40-400M in Bitcoin holdings, are accumulating just as much Bitcoin today as they were at the $3K lows in 2018. It’s worth noting that a whale today has 10X the wealth as the equivalent whale in 2018 in this metric. We still think this is a reasonable comparison as Bitcoin has gone up 10X and it has now been institutionalized.

Large Wallet inflows (without corresponding sales) to addresses with 1K-10K Bitcoin. Source: Whalemap

Volume Profile

A look at the on-chain volume profile shows that Bitcoin is oscillating around a similar high-volume node to that of the 2018 lows. This simply tells us that a lot of coins are changing hands in this region. It provides confluence with the above whale accumulation chart, suggesting coins are rotating into stronger hands.

Volume profile of the price levels at which BTC is being accumulated. Source: Whalemap

Where’s the Liquidation Meltdown?

While the broader on-chain fundamentals like those above suggest current prices are likely to be in a region of long-term value, there are still reasons to think lower is possible first.

Production Cost

Production Cost is our favorite metric in a bear market. It tells you how much it costs on average to create one Bitcoin (you can read more about the metric here). It’s particularly useful in bear markets, as historically it has identified long-term value opportunities when price is below Production Cost (currently around $38K).

However, the ultimate risk-adjusted buys have historically been when price met with Electrical cost (currently around $23K) – the cost at which miners must decide whether or not it’s worth keeping the power on.

If we have a macro market melt down or other major market shock, it would not be surprising to see Bitcoin revisit the Electrical cost, while scary in the moment (people will likely be calling the death of Bitcoin, or for further obscenely low price targets, yet again) such opportunities have only come around once every 3-4 years in Bitcoin’s history and have aged like a fine wine.

Bitcoin is currently trading near its global average production cost. Source: TradingView

Percent of Address in Profit

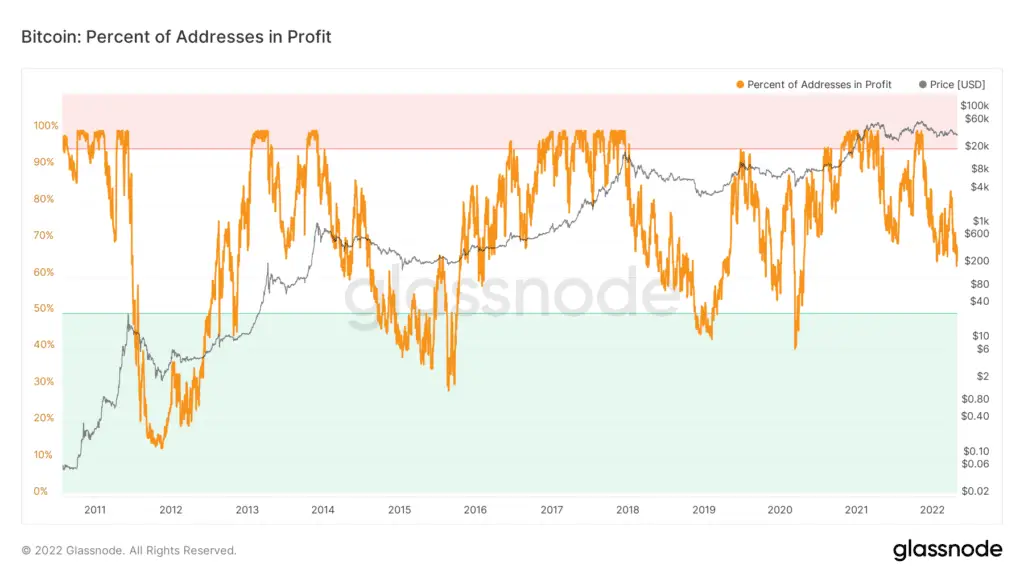

There are some other reasons to think that Bitcoin may not have yet bottomed. Total addresses in profit is at a historically neutral level, but suggests the market has not seen the pain it normally would in a complete Bitcoin cycle. While it’s not necessarily required, it would be historically unusual if we don’t see another flush out in profit-and-loss within crypto. For this to happen, price would need to go lower.

It would be historically unusual if Bitcoin Addresses in Profit doesn’t flush out into the green this cycle. Source: Glassnode

The Technicals

Bitcoin technicals do not paint a pretty picture. Key multi-year Fibonacci levels, as well as multi-year volume profile nodes suggest the inability for $40K to hold is bearish. Diagonals show similar bearish retests, with $34K being a near-term magnet for now.

While the technicals look bleak here, we must consider:

- Bitcoin has outperformed the S&P in 2022, showing impressive relative strength (it is not trading at its lows yet unlike the S&P).

- While technicals are bearish now, closing above $40K will quickly flip that picture.

All else being equal, Bitcoin technicals are bearish. But ultimately, we expect the Fed to dictate the trend next week.

Technical supports have failed so far with Bitcoin trading below $40K. Source: TradingView

The Bottom-line

We’ve focused this issue on traditional markets, because that is what’s driving the market today. While Bitcoin looks decent from an on-chain perspective (today’s prices will likely represent value over a multi-year horizon), it remains highly vulnerable to the whims of global financial markets.

We see the probabilities of the Fed changing course as increasing with time. It could start next week, or it could be several months away. While the current rate rise regime has been priced in, it’s unclear if the massive $1T per annum Fed sell pressure has been. If the Fed confirms its plan to unload its balance as aggressively as forecast this week, we doubt risk markets will appreciate it. We expect risk markets will tread water until a Fed tone change comes and we expect to see that change come at some point this year.

Either way, this week will be very telling. If the Fed confirms a massive sell program after the worst stock market start since 1939, as Amazon and Google have their worst months since 2008 and after a negative GDP growth announcement; it would be a very high conviction hawkish move that would suggest the Fed is willing to accept a lot more pain in the stock market. Such news will probably mean we have a much more prolonged road ahead to recovery. If the opposite happens, it would align well with several multi-year oversold S&P signals and potentially mark a turning point.

In such an environment, we think it’s best to maintain a long-term view. Consider the relative value opportunity today, but also consider the heightened opportunities that may come if short-term stock market volatility exacerbates. Whichever approach you take, be prepared to accept it will likely take quite some time to see those historically juicy Bitcoin returns in this environment.

Content we love

A good disclaimer to the use of on-chain metrics today. We have been saying for some time that on-chain must be considered as a smaller and smaller part of a much larger financial data ecosystem today than in the past. This article outlines some of the reasons why, and presents a case for growing (not reducing) supply in tradable Bitcoin. We still think on-chain has a lot of value, but it can’t be looked at the same as it was 2 years ago.

Footnote: The Bitcoin currency wars

2022 has been shaped by significant socio-cultural shifts. Geopolitical divides today are perhaps more prominent now than they have ever been in our lifetimes. A generation of globalization and relative peace is being tested with war in Europe and widening wealth gaps which are now exacerbated by generational high inflation. Political divides are more apparent and have resulted in economic war: war via sanctions. All of this is unfolding around the late stages of a big debt cycle, where debt is extraordinarily high, and so has been the level of quantitative easing. We are seeing country-to-country trust breaking down. The most obvious example being Russia to the rest of the Western world.

From a financial perspective, the global developments following the Russian invasion are fascinating. Take the following sequence of financial headline events:

- 24 February 2022: Russia invades Ukraine

- 28 February 2022: Ukrainian and Russian transaction volume in Bitcoin and cryptocurrencies skyrocket

- 1 March 2022: A “bank run” starts in Russia, the Russian Central Bank quickly imposes a $10,000 withdrawal limit

- 3 March 2022: Russian access to its offshore reserves in foreign countries is blocked by US sanctions

- 7 March 2022: Russian banks are banned from using the global SWIFT inter-bank system

- 7 March 2022: The Ruble has collapsed 42% in 2 weeks

- 24 March 2022: Russian access to its gold reserves is blocked by a US ban on Russian gold-transactions

- 24 March 2022: Russia states it would consider accepting Bitcoin for international commodity sales

- The US, UK and EU all step up investigations and regulations of crypto, including

- 9 March 2022: President Biden signs an executive order to investigate cryptocurrencies

- 14 March 2022: the EU votes to not pass a proposed ban on Proof-of-Work currencies

- 31 March 2022: EU lawmakers back traceability legislation which would require businesses to collect and share data on all crypto transactions

- 31 March 2022: Putin decrees that all Russian gas exports must be paid for in Rubles

- 2 April 2022: Russia stops gas pipeline to Germany

The above is just 6 weeks of world events, and you can see where it is going.

This is a currency war and Bitcoin is being weaponized.

Bitcoin’s relevance in a “trustless” world has gone through a massive step change in short period of time. Countries can clearly see both the opportunity in crypto, and the threat it poses to their power regimes. To date, crypto developments have been mostly supportive and productive as the world scrambles to integrate this new financial ecosystem into a framework it understands. We believe all of these developments speak to, and strengthen, the core value proposition of Bitcoin and decentralization of finance in crypto.