2021 in Review

A year ago, we published our “Christmas Special” newsletter. We wrote the following for our expectation of 2021:

“We expect to see Bitcoin in the region of $100K-200K in 2021, and would be shocked if it doesn’t hit at least $50K.”

Bitcoin tripled and we saw a high of $69K in November. But it was not the bull-run we expected. We did not foresee Bitcoin effectively topping in April, and ranging side-ways for the following 8 months.

So, what happened?

Just a year ago, let alone in prior bull markets, Bitcoin’s price action was decided predominantly by retail traders and corporate miners playing off one another.

There were no ETFs, no balance sheet holdings, no banks, no country investments, and very limited investment vehicles. Today, we have all the above and more. Sophisticated derivatives markets, crypto backed loan services and a comprehensive suite of financial products and services across the entire crypto ecosystem. Notably, Bitcoin this year has been dominated by institutional trading, not retail.

A New Bitcoin Landscape

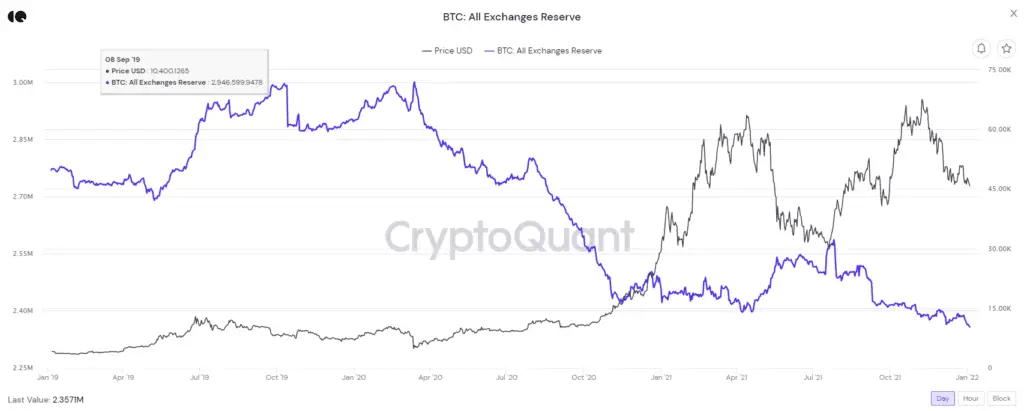

A useful on-chain metric to explain large shifts in sentiment is Exchange Reserves. We cover it quite a bit in our newsletters. Simply speaking, consistent drops in Exchange Reserve suggest less tradable liquidity on exchanges and more long-term holding (bullish), large inflows suggest the opposite (bearish). Yet again in December, Exchange Reserves hit new multi-year lows, which on paper would seem Bullish.

However, this metric has become subject to a drastically changing Bitcoin landscape in 2021. The introduction of custody services in particular has meant that exchange flows are now very different to just 12 months ago.

The custody platforms institutions use (like Fireblocks, Copper, etc) store their coins off-exchange in cold storage. As of 2021, these platforms have also allowed for credit lines to be established between exchanges and custodians. This means Bitcoin can be traded in massive size on-exchange, even though the coins have been moved off-exchange. Only the profit-and-loss needs to be settled between the custodian and the exchange. The necessity to move coins out of wallets in order to make investment plays is now not as critical as it once was.

Bitcoin 2021 has been driven by institutions. If we expect institutional adoption as a percentage of the total Bitcoin market to increase from here, it wouldn’t be surprising to see raw Exchange Reserves reduce with time, as these coins are pooled with custodians and other lending and banking platforms. As long as institutions and whales dominate the Bitcoin space, consistent Exchange Reserve outflows matter less than they did just 12 months ago.

Don’t get us wrong. Exchange Reserves are not useless. On balance we would rather see net outflows than large block inflows (which have continued to precede major price corrections). It just means that the signal of Exchange Reserves has diminished in light of a more complex crypto landscape. Individual movements of coins can be a multitude of things.

Exchange Reserves continue to drop in December 2021. Source: CryptoQuant

Exchange Reserves and the off-exchange custody platforms are just one example of a much larger trend within crypto – an ever-increasing suite of applications, platforms, use cases and their associated more complex coin movements.

The Bitcoin Cycle

If there was no institutional adoption in 2021, and no hyper-inflation, and no diverse altcoin ecosystem, we would conclude with a high degree of confidence that Bitcoin would be entering its bear market today. Bitcoin cycle and time wise, this is usually where the buck stops. But 2021 did happen and the market and its products have changed drastically. Last cycle, if you wanted to sell Bitcoin, it meant going to dollars and those dollars most often were transferred out of exchanges and into bank accounts. The money left the crypto ecosystem altogether.

A Diverse Ecosystem

Today, the crypto ecosystem offers an incredible array of products and services. Low risk stable coin loans, higher risk yield farming, art investing, NFT trading, play-to-earn gaming and much more where you can deploy your capital across both bull and bear markets or simply earn a living just by playing a crypto game like Axie Infinity.

In 2021, crypto established itself as an industry and embedded its claws into traditional finance. What was once laughed at, is now seriously integrating with traditional financial markets.

Next halving (projected for 6 May 2024),we expect it will be almost impossible to distinguish traditional finance and crypto apart – the two will be completely cointegrated.

Banks will offer the same services that crypto exchanges do today. Crypto exchanges will become banks. Stock trading will be done on crypto exchanges, and tokenized stocks and cryptos will be traded on banking platforms. All of these things are happening today, we just expect it to be completely commonplace and harder to draw a logical boundary between the industries by next Halving. All of this means a higher baseline in crypto market cap and usability going forward.

Because of this ecosystem, there are fewer reasons for capital to leave the crypto market now and a reduced chance of massive collapse in major coins (those 85-90% drawdowns of prior cycles). Individual assets will see a lot of volatility and many altcoins will continue to go to zero. But even if we were to see a substantial bear market where most assets declined substantially in value, we would expect a relatively higher baseline of capital to be maintained within crypto than in prior cycles.

Bitcoins Inflation Rate Hits Critical Mass

This cycle, Bitcoin’s inflation rate dropped to 1.8%. That’s roughly the same as gold. For millennia gold has been worshipped as a stable value preservation asset – primarily because of its durability and low inflation rate. Bitcoin has now proven itself. It has come into alignment with gold’s level of asset protection, not just in theory but also in practice.

However, Bitcoin’s inflation rate halves every 4 years. This has great implications:

- It symbolizes a turning point. Gold has now been superseded by Bitcoin. Bitcoin is more fungible, unconfiscatable, harder and in digital format for the 21st century. It is battle hardened and proven by its unrelenting growth and survival against all odds over the last 13 years. In 2020, this 1.8% inflation rate has turned on a tap of capital which will continue to flow with increasing force into Bitcoin.

- The relative impact of Bitcoin miners’ incremental supply on the network is greatly diminished and will further deplete with time. This will smooth out the impact of future miner capitulation events in the coming years. It will deplete the supply shock from halving events and cause the general smoothing of once prominent 4 year cyclical metrics.

The above effects will not eliminate the 4 year cycles completely but drastically dampen their impact. The waves of cycles of Bitcoins past will become shallower and shallower into the future. Broader macroeconomic cycles however will have increasingly large impacts on Bitcoin, whether that be lockdowns, stock market collapse, inflation and one day Hyperbitcoinization.

Paper Bitcoin

The sheer diversity of derivatives and pseudo-Bitcoin products means that capital allocated to Bitcoin is no longer simply concentrated in spot holdings. This creates additional supply, or ‘fake supply’ as Caitlin Long calls it. It’s spread across Billions of dollars of perpetual futures contracts, options, ETFs and other products. While many will argue it is no substitute for the real thing, it does satisfy an element of demand. An example is all of the currently listed Bitcoin ETFs which are simply pegged to CME cash-settled futures. These products didn’t exist 3 months ago, but today there are billions of dollars of institutional money in them, trying to seek exposure to Bitcoin.

As a result, the price pressure once centralized on spot Bitcoin is now distributed across a web of interconnected Bitcoin based products. On-chain analytics does not provide much (if any) insight into these products. These products also mute potential parabolic price advances that Bitcoin used to see, as demand is now spread across a greater supply. Further the greater supply of these products means demand in turn is reduced for the ‘original’ Bitcoin as it chases the Paper equivalents. What does this mean? Unless there is a catastrophic event, causing a run to claim pure Bitcoin, Bitcoin’s price appreciation will be a lot slower going forward than it would have been if there was no Paper Bitcoin.

Bitcoins On-chain Outlook – a Foggier Picture

Treating on-chain metrics with the same kind of predictive or insightful weight as they would have had just a year ago requires caution simply because of the significant change in the crypto landscape this year. These metrics are still valuable and fundamental to understanding supply and demand. However, results and levels cannot be as easily compared to prior years and cycles. More nuance is required in their interpretation with consideration for how the market is storing and using its assets as we go into 2022.

Generally speaking, it makes more sense to look only for the more significant major deviations and long-term trends, and disregard minor day-to-day movements. For example, Exchange Reserves have a lot of noise as a signal, so looking for at least 1% movements (up/down) over short periods of time can provide some guidance for risk management. The latter part of that statement is just as important as the former, where once this signal could have been used as a trade set up it is now almost exclusively useful in informing risk. Where before, in a simpler Bitcoin trading economy, this signal would have been explanatory of coins being moved to and from an exchange in order to set up a trade, it now can be explanatory of dozens of scenarios, many of which have little to do with impending trades.

Today’s Bitcoin on-chain picture is mixed. Here’s a summary of some metrics we have spoken to in our recent newsletters.

Bullish:

- We never reached historical peak/overvalued levels on most on-chain metrics this Bull-run, suggesting there may be more room for price appreciation (though this argument is weakened by the existence of Paper Bitcoin today per above).

- Long-term holders continue to show incredible conviction and accumulation.

- Network security (Hash Rate) is near all time high levels.

- We have seen a consistent downtrend in Exchange Reserves, with levels still at multi-year lows.

Bearish:

- Time wise, a number of on-chain metrics have spent enough time at high levels, to be comparable with prior cycles (e.g. Long-term holder NUPL). This suggests the market may not have reached peak price euphoria, but it may be sufficiently exhausted for this cycle.

- There is negligible retail interest. Address growth is poor and well below early 2021 levels. In sum there are few new buyers in the market. Note that the introduction of more intermediaries and pseudo wallets (PayPal, etc) means that raw Bitcoin address growth is not a 1:1 indicator of user growth, as such the signal from this metric has depleted with time.

- Price has spent 12 months above Energy Value (currently in the high $20Ks and increasing), we expect price to revisit Energy Value as it has in all prior cycles.

Entity Adjusted Long-term Holder NUPL. One example of a metric showing comparable durations of time spent at high levels of Belief/Euphoria. Source: Glassnode

A Maturing Market Needs a More Nuanced Roadmap

As discussed throughout above, the new Bitcoin landscape makes on-chain metrics today less comparable to prior cycles. Given the existence of Paper Bitcoin, knowing that institutions now dominate the market, that retail engagement with Bitcoin was low for most of 2021 and given the sheer size of Bitcoin today as a $1T asset; we can expect price movements and appreciation in general to be much slower and more efficient. It takes a lot more capital to move the Bitcoin price 10% when it’s a $1T asset, as opposed to 2020 when it was just $100B. It’s just a bigger beast.

All of this means we should now expect that the same excessive levels of overvaluation, and those parabolic price runs that were once commonplace in Bitcoin, will occur much less frequently into the future. Some readings will likely never happen again.

MVRV is a great example of diminishing levels of excess in on-chain metrics as Bitcoin matures. We do not expect this line to continuously trend down, we are simply highlighting that more extreme and excess readings of such metrics will likely occur much less often into the future. Source: Glassnode

In our July 2021 newsletter we noted that retail engagement with Bitcoin had been crushed and that it was a key element of prior bull-run price appreciation. But 6 months later, retail has not come back and 6 months later, the price is still in the $40Ks.

On the flip side, a lack of interest from retail today, is future potential demand for tomorrow. It’s when retail interest is at a peak that you want to get out.

As long as the “bullish” on chain metrics highlighted above remain bullish and don’t join the “bearish” list, we see a strong short-term base forming in the $40Ks from an on-chain perspective. Should the above “bullish” metrics decay (large inflows, or long-term holders start to offload their assets for example), which could well happen if the end of cycle narrative plays out over the coming months, price can be expected to quickly unwind in unison.

The Hidden Reflexivity Which Would Bring Fresh Demand

We know, and have highlighted in multiple newsletters over the past 6 months, that institutions have been collecting large $1B blocks of Bitcoin. Surprisingly there have still been no public announcements. We don’t know when these announcements will happen, but provided they happen while risk markets are still buoyant, we expect these events will be a driving force for refreshed interest in Bitcoin – reflexive events which will drive Bitcoin higher – much like the Tesla announcement in early 2021. Depending on when such announcements occur, this could be the catalyst to trigger new entrants and new all-time highs.

Risk Markets Support the First Half of 2022, then it Gets Dicey

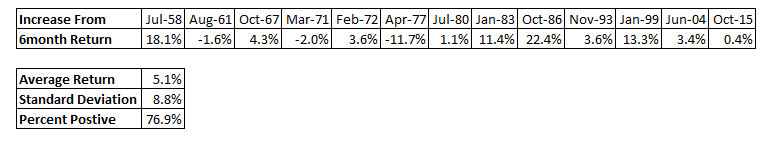

Rate rises are likely to support the share market at least for the first half of 2022. As discussed in our December newsletter, the start of rate rise regimes typically results in a 77% chance of higher stock markets 6 months later – but it’s volatile. A strong stock market is more likely than not to be conducive of a stronger crypto market.

From mid-2022 onwards, things become much less certain. Latter 2022 crypto performance will depend largely on the macroeconomic situation at the time, with downside volatility increasingly possible.

Fed course corrections would not be unsurprising. With flat growth in the US today, it may quickly become impossible to continue increasing rates without damaging the economy. Fears of inflation at this point may quickly pivot to fears of recession as Cathie Woods projects.

A strong dollar and rising rates will reduce institutional interest to “scale along the risk curve” into the world of crypto. Any major shocks to the S&P500 will have equal and worse effect on Bitcoin in the short term, though Bitcoin will also likely recover quickest after the event much like March 2020, one of the biggest Bitcoin crashes ever.

In short – traditional markets are near-term skewed bullish for Bitcoin, but from there it is highly uncertain. For more thoughts on this narrative and possible pathways, see Charles’ thread on Twitter.

The start of Federal Fund Rate rise regimes have historically been bullish 77% of the time for the stock market over the following 6 months. Source: TradingView

The Strongest Case for Bitcoin: Inflation

If you disregard everything in this article, take a multi-year mindset and go back to the basics, Bitcoin is still what it always was – the hardest money in the world and the perfect inflation hedge.

As of December, Inflation is the highest it’s been in 40 years. Official CPI was 6.8% in December, but unofficial inflation measures record in the double digits already. If these high levels of inflation hold for the coming months, that alone could be a driving force for further Bitcoin adoption and a revamped, hi-definition, guns-blazing bull market continuation.

Consistent CPI prints in the high single digits, or possible double digits, which are maintained for 3-6 months or more will likely provide an upward lever to the Bitcoin price. The timeframe this plays over and how markets react in the short-term is highly uncertain though. In such a hyperinflationary market, human nature and central banking actions will likely drive wild swings in all asset prices in the short-term. And when markets risk off heavily, everything correlates to 1. We saw this in March 2020. Nonetheless, inflation as an ebbing force is the biggest marketing campaign for Bitcoin you can possibly imagine. Long-term, this is incredibly bullish for Bitcoin.

2022 Forecast

We came into 2021 expecting a big bull market. Crypto got a big bull market. Bitcoin got a small one.

We go into 2022 expecting a combination of four things:

- a cyclical Bitcoin bear market (bearish),

- shallower Bitcoin cycles (neutral),

- a newfound productive crypto ecosystem (bullish), and

- an incredibly fragile macroeconomic landscape, whose underlying issues promote the very reason Bitcoin was created and encourage long-term adoption (neutral/bullish).

Add these ingredients together and what do you get?

Some call it a “Supercycle”, but picture the last 12 months of Bitcoin. Ranging, volatile, spouts of powerful rallies and rapid downtrends. We expect more of the same into 2022, with likely less upside potential than 2021. Retail engagement could be triggered by time spent above $55K, or from the reflexivity of more S&P500 companies announcing they own Bitcoin. Until then, we expect the $30K-60K price range to be the driving force for Bitcoin this year.

In many respects, our views at the beginning of 2022 are not dissimilar to those we held back in July 2021 when price was $41.5K (only a couple thousand off today’s price too). Here’s what we wrote then:

“We need to see at least some of the same metrics rebound for bullish continuation:

- Renewed retail interest

- New institution adoption / balance sheet acquisition announcements (not from Microstrategy)

- Significant rebound in on chain metrics (eg. addresses, hash ribbon buy signal, new cycle lows in exchange reserves)

- Price reclaiming $55K”

The Road Ahead

The landscape of Bitcoin and the entire crypto economy as a whole has been effectively and permanently terraformed in 2021. Institutions have entered the market in force. The crypto ecosystem bubbles with life and real world use cases, opportunities to deploy capital, enjoy art, entertainment, gaming and more. It’s a world layers deep which simply did not exist in prior cycles. Bitcoin now trades on stock exchanges, it’s owned by companies and countries.

But that doesn’t mean that financial cycles don’t exist. Price will always ebb and flow from relative undervaluation to overvaluation and vice versa. Excess doesn’t last forever and neither does despair.

While the magnitude for potential Bitcoin price appreciation this year is lower than it was 12 months ago. For 2022 we see, and are taking on, more opportunities in the wider crypto space than ever before. The speed of innovation is breakneck. The long-term future for Bitcoin and crypto has never been brighter than it is today and we are excited to be a small part of this journey in worldwide adoption.

We are hiring!

Capriole is hiring! We are looking for traders, data engineers, ML experts and more. If you are interested in what we do, check out our open positions at: www.capriole.com/join