Saddle Up

Market Update

Last month at $93K we noted the bullish Bitcoin setup and expectation to be “pushing new all time highs on Bitcoin quite soon”. That move played out over the last 4 weeks with Bitcoin up 16% to date. Last month’s setup saw capitulation across all macro sentiment metrics and presented a uniquely positive scenario, so what’s the situation at $108K today?

Welcome to the Hard Asset Era

Since last update, Capriole Australia launched Capriole.com/Charts, a professional tradingview based suite of the most important Bitcoin and Macro metrics. The Capriole Charts suite includes many of Capriole’s proprietary metrics and others that we consider high signal. It’s our job to filter out noise and find the investment signal and we are very excited by this launch, which has seen new charts added every week. Check it out!

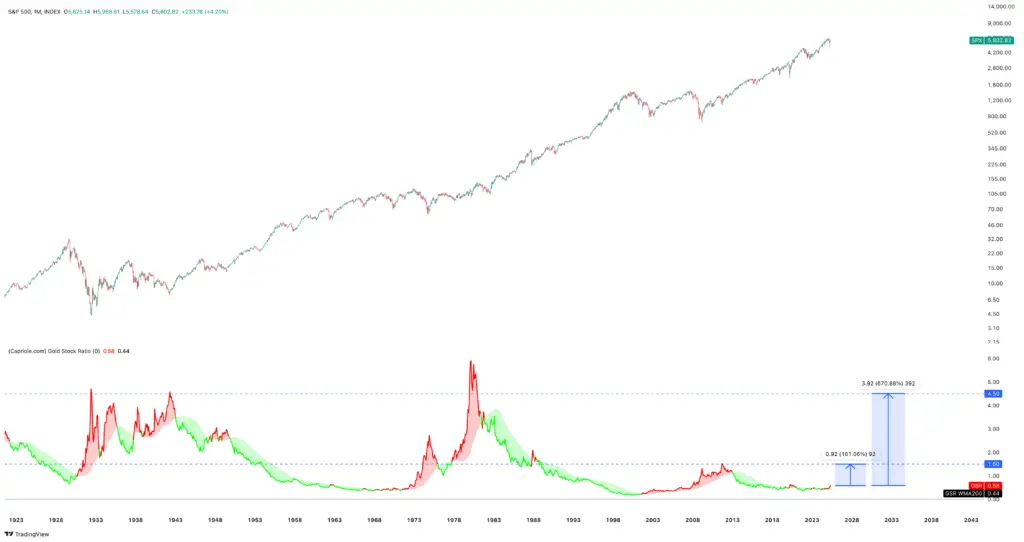

One of those charts which I find particularly promising today is the Gold-to-Stock ratio. If you think Gold has already rallied a lot, think again. Whenever the Gold/SP500 ratio breaks above the 200 week moving average, by definition Gold is outperforming equities. These regimes tend to be sticky, and as long as they last, Gold has significantly outperformed Equities on average. We entered such a regime a few months ago, and the implications for both Gold and Bitcoin are significant.

This may end up being a small breakout rally for hard assets – but if it is a major one – the upside potential outperformance of Gold to equities could be between 150% – 650% based on history as shown on the below chart.

Welcome to the Hard Asset Era: the multi-decade cycle has flipped. Gold is once again outperforming Equities.

Why might this happen? There are a few key drivers spinning the hard asset flywheel today, let’s take a look:

Drivers for Gold

- In 2022, Gold was reclassified as a Tier 1 asset under Basel III, alongside cash and government bonds, under Basel III regulations. This means it can be held as a reserve asset with 100% value recognition by central banks.

- Major financial institutions are now required to fully collateralize their paper gold positions with the physical, these two factors started the process of ballooning gold holdings by financial institutions.

Drivers for Bitcoin

- Bitcoin ETFs launching in 2024, and associated SEC approvals, supported the institutionalisation of this asset class allowing significant capital inflows.

- Establishment of the US Government Strategic Bitcoin Reserve in 2025 with the ambition to grow it marks a major global milestone on the pathway to country level adoption. These above two processes also established clear and wanted regulatory certainty around Bitcoin and digital assets and once again opened up the banking rails to digital asset businesses following the Biden administration Choke Point 2.0*. Not to mention many US states are now establishing their own Bitcoin reserves also.

- The Bitcoin-treasury-arbitrage (BTA) flywheel. The multi-year success of Saylor’s “Strategy” multi-billion-dollar Bitcoin acquisitions in driving shareholder value by arbitraging the traditional finance bond markets against the high returns of a non-inflationary asset (Bitcoin) has now gone exponential and seen many copy-cats emerge, all to date showing success in their own right. While the BTA flywheel could present a high risk scenario in an unwind later in the cycle (if these companies get too levered) as long as that’s not the case, the Bitcoin vacuuming effect of these entities taking supply off the market cannot be ignored.

Drivers for both assets:

- The freezing of Russian foreign exchange reserves in 2022 prompted central banks around the world to increase their relative gold holdings and explore pro-Bitcoin policies.

- High inflation – this one is self explanatory – we’ve all witnessed massive inflation over the last 5 years, devaluing fiat currency drastically and increasing the relative value of hard assets like Gold and Bitcoin.

- Tariff warfare has seen a renewed focus on Isolationism (versus Globalism) which has heightened the relative value of hard assets as interest in holding your neighbours’ unbacked fiat wanes. This is a dynamic very similar to the pre-1940s high tariff era, which also saw outperformance of Gold to Equities.

*Sidenote: Capriole first hand witnessed the effects of Choke Point 2.0 as we banked with Signature Bank (which was found to be completely liquid and profitable, but a $110B business was shuttered for no reason overnight). We later banked with Citizen’s whose directors were “tapped on the shoulders” to unload crypto clients and reduce their digital asset exposure, all for no reasons other than fulfilling the Biden administration’s Choke Point 2.0.

As a result since late 2022, Gold is up over 100% following a massive buying spree by financial institutions and central banks around the world. Bitcoin is up over 500% from its lows in late 2022.

As long as policies remain so, and as long as central banks continue to overprint, these dynamics are likely to remain in play making the Capriole Charts Gold-to-Stock ratio an important metric to follow.

If it’s within reason based on the last century of data that Gold might do a 5X over equities over the next decade, what might Bitcoin do?

As you can imagine, this makes us very optimistic about the mid- to long-term potential for both Gold and Bitcoin.

Technicals

Keeping it simple here with just two lines, the only ones that matter for Bitcoin today. The breakdown to $75K in April out of the $90-100K range was bearish, however “fakeouts” are incredibly bullish for Bitcoin (when the range is reclaimed again) making the $90K reclaim in April a very bullish technical signal which marked the start of a new trend – something we wrote further about last issue at $93K. Fakeouts are a very reliable technical signal for Bitcoin. Today the $104K weekly level is the level to watch. If this new bullish trend is to be trusted, we should easily stay above $104K on a weekly basis and continue to trend higher. If we get a weekly close below $104K, that opens up the possibility of extended rangy price action at best (likely targeting $90K), and a full capitulation event at worst. As long as price is above $104K, this is the most bullish technical setup we could ask for for Bitcoin at all time highs. K.I.S.S.

It doesn’t “Technically” get much more bullish as long as the weekly trades above $104K.

Of further interest is the Bitcoin-Gold correlation model we continue to harp on about (literally for years).

Every time gold has a breakout rally, Bitcoin has followed 3-5 months later. This happened in a major way most recently in late 2024, and it‘s started again in April this year. We see a lot of runway on this metric for Bitcoin to play catch up to Gold on a relative basis – especially as Gold continues to close weekly all time highs.

Both Gold and Bitcoin complement each other well in a portfolio for this reason, they tend to move in pairlike waves as they trend. Having both can at times be a great return enhanced and volatility dampener.

Bitcoin tends to follow Gold trends with a few months lag.

Fundamentals

The collective picture as shown through Capriole’s ML fundamentals model Bitcoin Macro Index remains in bullish growth this issue. This Index includes over 100 of the most powerful Bitcoin on-chain, macro market and equities metrics combined into a single machine learning model. It is a pure fundamentals-only value investing approach to Bitcoin, where price isn’t an input.

We consider this the most important metric on Capriole Charts and as long as its green, that’s great news for Bitcoin.

Diving into some more detail, we can see why the Macro Index looks positive today:

Apparent Demand, a commodity metric used to gauge demand which measures Production (mining issuance) less Inventory (supply inactive over 1 year) has also broken out into positive territory.

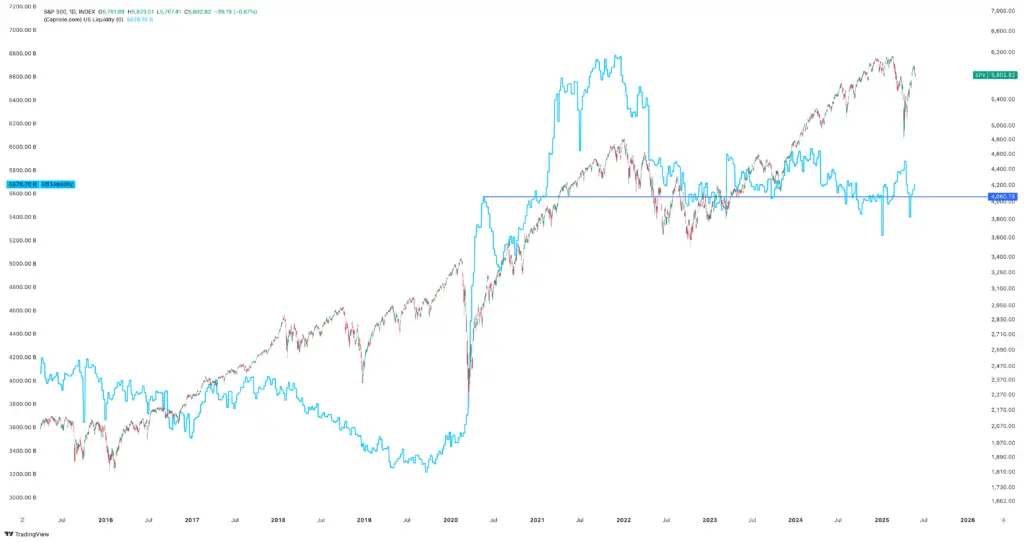

US Liquidity is holding up well, but we would like to see some positive year-on-year growth to support Hard Assets.

Of note, another new Capriole Chart, Capriole’s Volume Summer, a momentum based model with considers relative trading volumes is also positively trending.

Bottom-Line

Today we have strong on-chain and macro data, strong cyclical data (with Gold) and we have strong technicals. As long as this picture remains, the outlook is very bullish Bitcoin, leaving a 50%+ rise over the next 6 months a conservative target based on similar historical comparables. The setup today isn’t as good as last issue (in April) where we also had capitulation across the board on all major sentiment metrics, but it’s still positive.

The biggest risk factors which could derail this rally are primarily policy changes killing momentum. Broadly, according to Trump’s tariff rate pauses we have around 30-60 days to see some good deals locked in between the US and China, the EU and more. Securing a fair tariff rate with China and the EU in particular in that window would give a lot of confidence to markets.

Nonetheless as long as the “Hard Money Era” remains in play, Bitcoin doesn’t necessarily need to see equity strength from here. Finally we have a very convenient technical level nearby at $104K as the first significant early warning sign should the trend unravel.

Until then, saddle up.

Charles Edwards