Welcome to Capriole’s Newsletter Update #60. A consolidation of the most important Bitcoin news, technicals and fundamentals.

In Trump’s Hands

It’s hard to believe we are already in March 2025, and approaching two months into Trump’s presidency. Q1 2025 so far has been largely underwhelming from a Bitcoin and digital asset perspective. Though there are some similarities to the choppy start of 2017 which offers promise for the remainder of 2025. So far Bitcoin has largely mirrored S&P500 volatility, which has largely followed Trump Tariff headlines. Chop Chop slop.

Technicals

Wyckoff Distribution?

The price breakdown from $90K in late February was a substantial sign of weakness which saw Bitcoin quickly flush to $79K. This decline set in play the below potential Wyckoff Distribution structure which would typically suggest the emergence of a bearish trend from here. Now that we have rallied back to $91K as of writing, we are at an important inflection point. If we can close the week above $92K, that would suggest a range reclaim with a high probability move to at least the range high at $100K – if not further. However, as long as we trade below $92K on a daily basis, the bearish case is in play and it is prudent to manage risk accordingly.

A token of promising technical evidence emerged in the last week. Bitcoin bounced strongly on the important 200 Daily Moving Average (DMA) twice suggesting that there is hope for a dramatic resurgence of strength towards $100K, if and when $92K clears convincingly.

The $80-90K Bloodbath

In the $80-90K region we saw substantial amount of liquidations, a collapse in Bitcoin futures open interest and a major altcoin bear market.

It’s hard to believe, but while Bitcoin only dropped -28% from its high, the altcoin market leaders fell largely well over 50% (Solana fell 60% and Ethereum -50%) with other more speculative plays now at typically crypto bear market lows. Trump’s two month old memecoin fell -85% from its launch high. So while the Bitcoin chart doesn’t look too catastrophic today, it’s important to note that significant damage has occured broadly across the crypto sector. Typically not something you would see at the start of a bigger downward move.

This altcoin bloodbath is quite unusual for this point of the cycle. We might expect Bitcoin to be down 40% or more historically for a comparable altcoin decline. It is symptomatic of two key elements this cycle:

- Bitcoin capital flows and strength have largely been upheld by institutions and ETFs, most of who have little interest in altcoins, and

- Altcoin narratives have been particularly lacklustre. The prevailing market leaders this cycle have now roadmap but rather a pure focus on gambling and memecoins.

Considered in this context, it’s less surprising that we have seen the considerable relative destruction of altcoins-Bitcoin ratios through the last quarter.

Trump Crypto Summit

On Friday, Trump will hold the first crypto summit at the White House. The industry is broadly expecting some news from the Trump administration centered on the Bitcoin Strategic Reserve (BSR) and namely, how and when it would be funded. We expect a lot of price volatility through Friday and the weekend on the back of this historic event at the White House. No doubt the market will move up on promising forward guidance by the President, however the stickiness of such a move will hinge on the tangibility of a way forward for the US Government to actively purchase Bitcoin (and other cryptocurrencies).

We saw something similar on the back of Trump’s tweet on 2 March. Positive reinforcing words by Trump regarding the Strategic Reserve resulted in an aggressive bounce that quickly retraced as the market digested the fact there is still no tangible roadmap to this passing through Congress or visibility on where the funding will come from to acquire the digital assets. That may well largely be cleared up this week. However, unless we have some clear timings and a roadmap to BSR approval happening in 2025, the event could be underwhelming.

It’s quite fascinating that Bitcoin is trading at such a key technical pivot point at $91K into this event and it is highly likely that Trump will decide which way we trend from Friday.

I believe a BSR is inevitable, but all that matters now is how far away it is. That I cannot answer. A tangible BSR occurring this cycle (in 2025) is a bit of a coin toss today. Until we get some firmed up guidance, it makes sense to position conservatively in this regard.

Crypto is in Trump’s hands now.

Fundamentals

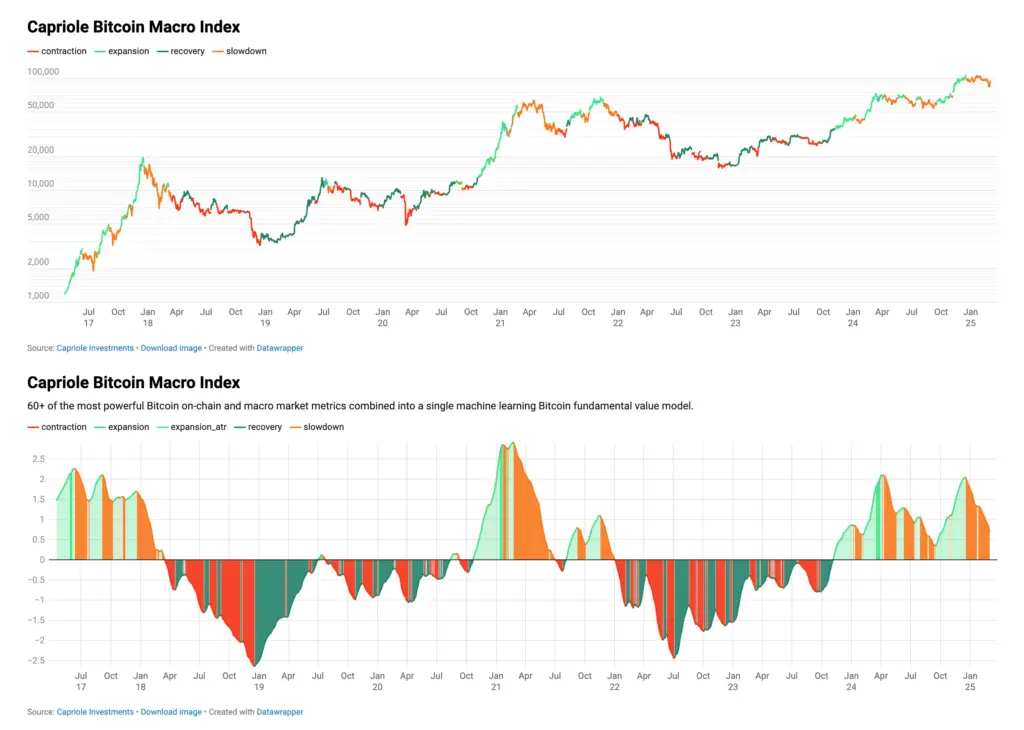

The collective picture as shown through Capriole’s machine learning fundamentals model Bitcoin Macro Index still suggests risk management here, but has a conservative long positioning. This Index includes over 60 of the most powerful Bitcoin on-chain, macro market and equities metrics combined into a single machine learning model. It is a pure fundamentals-only value investing approach to Bitcoin, where price isn’t an input.

Fundamentals have been in contraction since December, but there are signs that liquidity in the US is bottoming and perhaps starting to rise which offset a potential short side weighting for this strategy.

Onchain data is broadly falling…

On net, this is not a great look for Bitcoin, as we would hope to see on-chain strength at this point in the cycle as new users onboard on-chain and utilise the network. Instead we have net outflows of long term holders, negligible on-chain transaction flow, declining dormancy, declining spent volumes, declining long-term holder profits (NUPL) and declining SLRV ribbons. In fact, most Bitcoin on-chain metrics have been declining now for a several months. Not the look you want to see in March of a bull-run year.

Falling into value

The ray of hope here is that the broad decline across on-chain metrics is driving Bitcoin closer to a region of value. In fact Dynamic Range NVT has entered the buy zone.

Energy Value is also telling us that Bitcoin is now trading 15% below fair value at $105K.

These are great discounts for a bull market (the 12-18 months period post Halving). But in the broader history of Bitcoin, we also know we can go a lot lower from here if this cycle is entering a significant period of mid-cycle volatility or approaching its end. For example, we have not yet entered the deep value zone of Bitcoin Production Cost, and we are still miles away from the ultimate dip opportunity that is the historical price floor of Bitcoin Electrical Cost (currently $58K today).

Balance Sheet Bitcoin

The nuance here is this is the institutional Bitcoin cycle. Acquisitions over the last 12 months have largely been driven by ETF growth and balance sheet Bitcoin adoption. Several global companies are now mirroring Strategy’s (nee: MicroStrategy’s) approach to leveraging debt to purchase Bitcoin. This change in purchaser behaviour means we can expect relatively less smaller on-chain transactions, and user growth, and more larger wallets with dormant holdings. We have adjusted our weighting on on-chain metrics to accordingly allow for this somewhat. Nonetheless, by historic standards, these new entrants have not yet managed to offset the broad fall in supply of classic, reliable long-term Bitcoin holders.

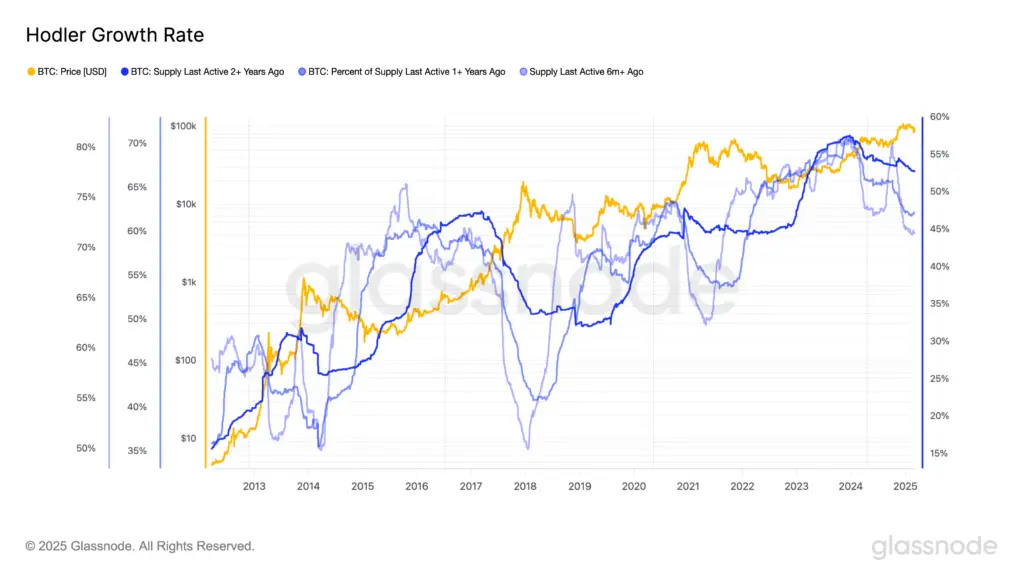

One of our favourite cycle charts is Supply Last Active 2+ Years Ago. When this metric tops and fails to make a new high for several months, the cycle top is usually near (see dark blue line). One might argue that because of the ETFs, this 2+ year metric is not representative of the new long-term holders that have entered the field via ETFs in 2024. Fair point. However, as you can see from the Supply Last Active 1+ Year Ago and 6+ Months Ago, various windows of this metric have all failed to substantially climb since the November 2024 spike. This is all suggestive that we are late cycle and should be open minded to more volatility or at least chop from here.

The Trump Card

The Trump Card here is an active buying BSR. If and when this occurs, we would effectively see the biggest long-term buyer the market has ever seen step into the field. In the short-term this would result in a massive amount of front-running retail and institutional flows, driving price up aggressively. In the mid-term it would see similar political moves across the globe in order to secure a piece of this global reserve asset, much like Gold today. If and when an active buying BSR is confirmed, we would consider the effects similar to a restart of the Bitcoin cycle as of that point in time. That would be a singular datapoint to outweigh all others presented here.

Market Positioning

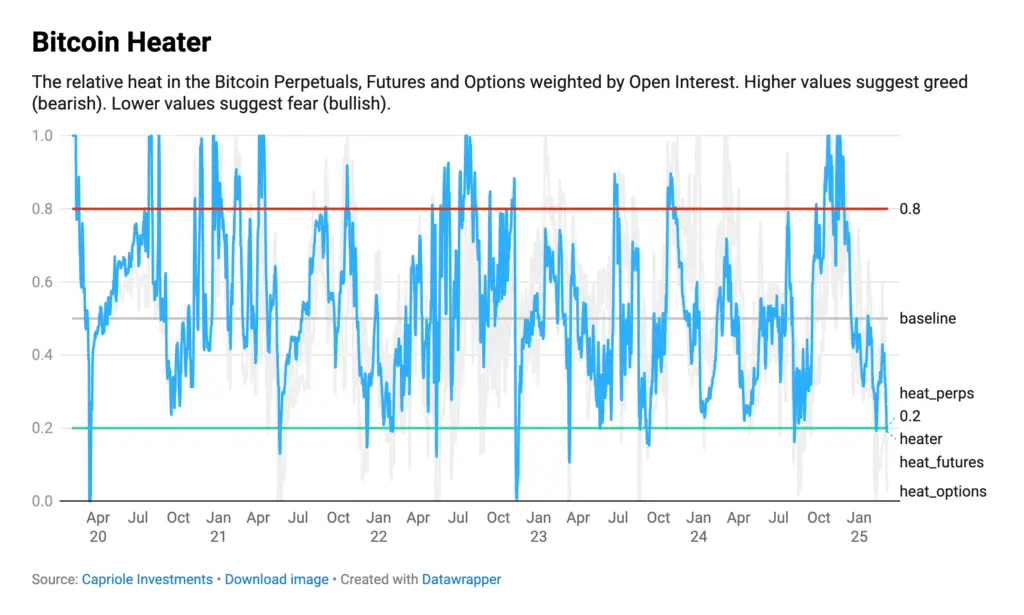

In general market price action (not just in Crypto) is largely driven by market participant positioning, and markets tends to move in the direction that causes the most pain to said participants. There are many metrics to gauge positioning, including; sentiment surveys (AAII), Fear and Greed metrics, Open Interest, Put Call ratios, etc. Possibly the best market positioning metric for Bitcoin (I may be biased) is Capriole’s Bitcoin Heater which aggregates Open Interest across all derivatives markets and allows for the relative positioning in Bitcoin Perpetual Futures, Fixed Futures and Options. Today we have just made a second dip into buy territory. This is not a reading that you would see at the start of a bear market, and suggests we may be due for at least a short term rally following the broad liquidations and bearish positionings that have emerged over the last weeks.

Pending a great disappointment on Friday, this metric alone potentially negates any near-term distribution on Bitcoin until we see some form of mean-reversion bounce at the least.

The Bottom-line

Putting it all together, net fundamentals suggest conservative positioning in Bitcoin today. If 2025 remains a bull market year, this is a historically great dip buying opportunity. -28% is a typical Bitcoin drawdown in prior bull runs and some onchain value metrics like DNTV confirm this. However, if we are in fact entering a larger distribution, price can of course go lower. Given ever increasing ties to macro with ETFs and institutions being the key driver of Bitcoin this cycle, the ultimately decider of this year’s trajectory is likely to be in Trump and Powell’s hands now.

What can turn the on-chain fundamentals above around positively?

Two key levers:

(a) A confirmed BSR with active US government buying (a reset of the cycle), or

(b) A Federal Reserve / US Government liquidity injection (likely triggered by broader weakness in economic data, or a cessation of the Federal Reserve balance sheet tightening).

For long-term holders, the above two events are all we need to look for while Bitcoin on-chain data declines and remains in a bit of a No Man’s Land. Both are likely to occur, it just a matter of when, and how you are willing to wait. Bitcoin can be volatile.

In the nearer term, Bitcoin is at a pivot point. Onchain data looks poor, but the market is already positioned accordingly. So much so, that Bitcoin Heater suggests we may have a bullish squeeze on the horizon. With retail and altcoins “rekt”, and Bitcoin Heater in the buy zone and Trumps Crypto Summit happening tomorrow, it wouldn’t be surprising to see some market relief in the nearterm. Whether or not that carries through into new cycle highs is largely dependant on our two levers above. In the meantime, stay wary of largely insubstantial sound-bite driven news headlines.

Charles Edwards