Under Pressure.

Welcome to Capriole’s Newsletter Update #53. A consolidation of the most important Bitcoin news, technicals and fundamentals.

It’s been a little while between reads, I write this issue as I recover from recent surgery. In our last issue in early July, we noted the growing number of bearish on-chain signals justifying risk management as Bitcoin traded at $62.5K. A lot has happened in the weeks since. Multi-billion German Government selling, Mt Gox selling, the Japanese market melting down and the VIX reaching 2008 levels. But today we find ourselves at $60.5K following 2 months of sideways-down consolidation.

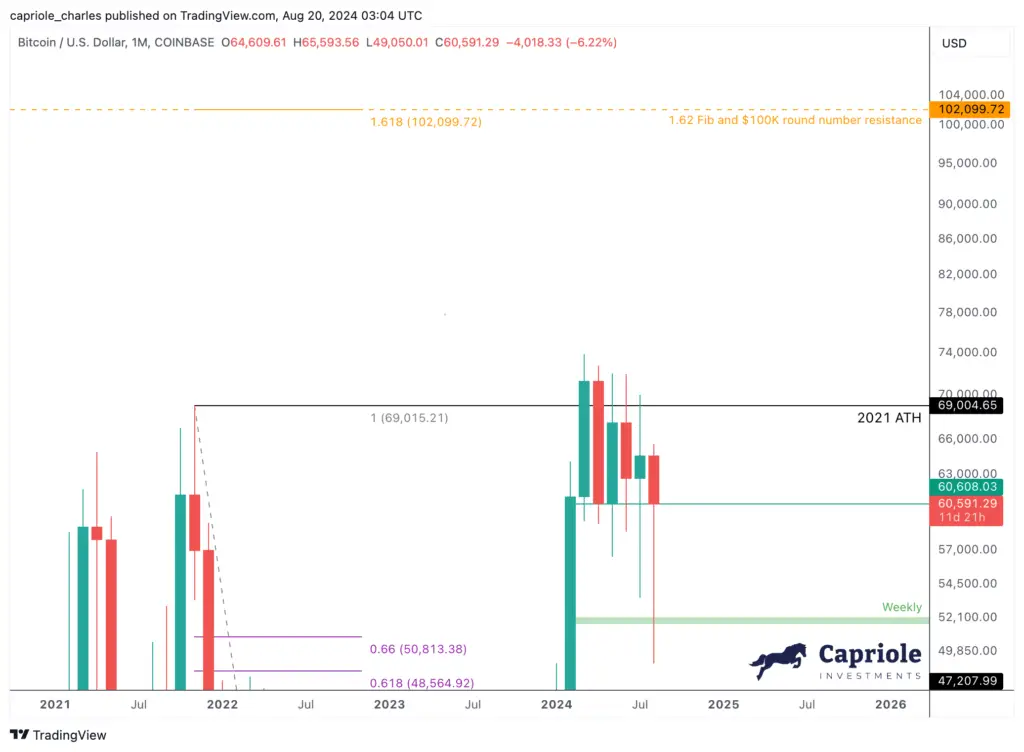

As of writing, Bitcoin has now spent a total of 6 months consolidating at the 2021 all time highs (ATH). Bitcoin is under pressure. This is the longest period of time Bitcoin has consolidated at any ATH, making this period quite unusual historically, and that has been throwing people off. However, volatility compression leads to volatility expansion, and the resulting breakout will be big.

Technicals

In early July, I shared this tweet which highlighted the current similarities between the most comparable point in time in Gold’s history, to Bitcoin today. In 2008, Gold was consolidating at its previous all time high set in 1980, almost 30 years prior. This was Gold’s first significant period of consolidation following its own ETF launches prior. This was also Gold’s first revisit of that all time high and was an agonising 9 month period of consolidation and mostly downside volatility, culminating in a -33% drawdown which ended up setting a generational bottom for Gold. What followed for Gold was a two year 180% rally in an almost straight line up. And this was an asset, much larger than Bitcoin is today.

The similarities to Bitcoin today are uncanny. At $60K, Bitcoin is at its first significant consolidation following its ETF launches. We are also consolidating at the prior all time high, following the first revisit since 2021 and it’s now been 6 months of agonising consolidation. In the tweet I noted that if the Bitcoin structure today is the same as Gold’s then:

“That would be the same as Bitcoin potentially dipping again to around $48K, then ripping straight to $140K with no dips by around May 2025.”

The first part of that statement has now occurred. The July 2024 Bitcoin dip saw a -28% drop to $53K (within 1% of Gold’s as shown on the tweet), and the more recent August 2024 dip saw a -33% drop to $48K (within a mere half a percent of Gold’s final plunge).

Of course, this is just a single datapoint and single scenario and it does not have to happen for Bitcoin. But Gold is the most comparable asset to Bitcoin, and I believe this was the most comparable time in history to today. It suggests we have something pretty phenomenal ahead of us.

The most comparable asset at the most comparable time in its history suggests the bottom is in, and we have a lot of upside to go.

Zooming in just on Bitcoin, we are currently trading at monthly support ($60.6K). Provided August closes above this level, we will be:

- At monthly range lows (technical support)

- Having flushed out leverage with the liquidation runs to $54K and $48K respectively

- Having finished the summer months, where Bitcoin typically performs its worst.

Still 11 days required for Monthly confirmation, but if Bitcoin can close here at Monthly support, having cleared out Weekly support at $50K (and liquidated a lot of leverage), that would be a very attractive technical setup.

Fundamentals

The collective picture as shown through Capriole’s machine learning fundamentals model Bitcoin Macro Index still suggests risk management here, but has a conservative long positioning. This Index includes over 60 of the most powerful Bitcoin on-chain, macro market and equities metrics combined into a single machine learning model. It is a pure fundamentals-only value investing approach to Bitcoin, where price isn’t an input.

Given the massive degree of forced selling from major entities and bankruptcy cases over the last 2-3 months, it’s not surprising that we would see Bitcoin on-chain data suffer here. However, other value opportunities have recently emerged, including:

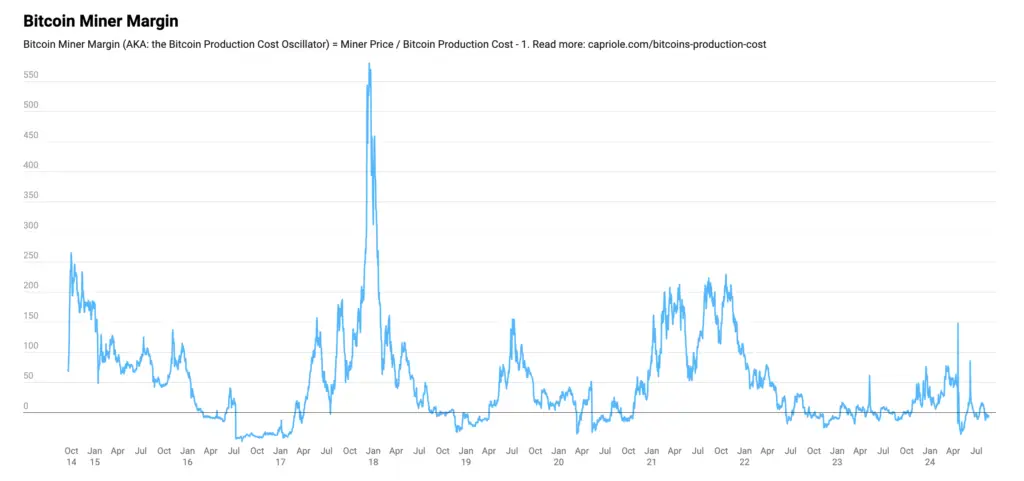

1. Bitcoin is trading back below production cost.

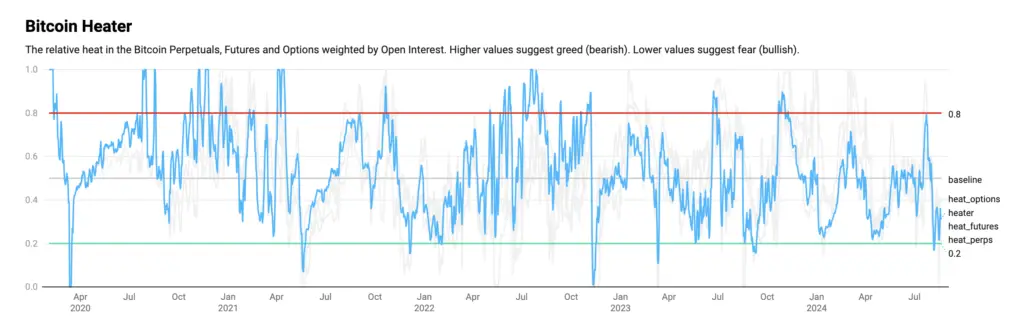

2. Capriole’s Bitcoin Heater suggesting the futures market recently reached very bearish levels, not seen since the September 2023 lows at $25K.

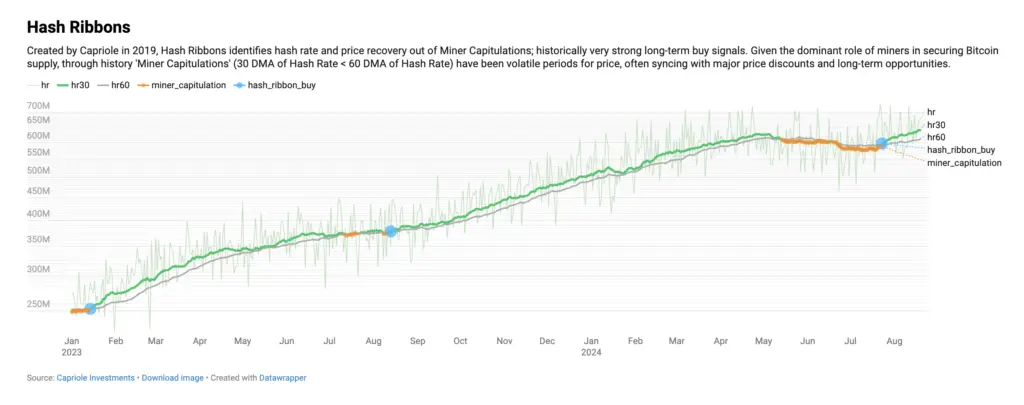

3. A Hash Ribbon buy signal just occured.

…and more.

While I put more weight in the aggregate view given by Bitcoin Macro Index, the significance of recent data points, in the context of the typical Bitcoin Halving cycle and recent world events tend me to believe the 2008 Gold scenario is currently in play. To be determined.

Chart Of The Week

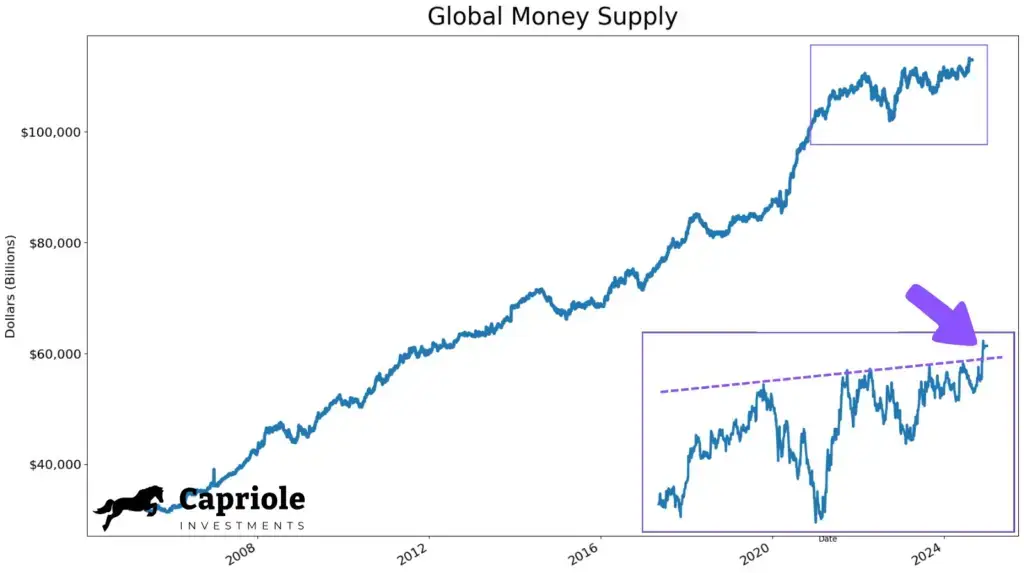

The Global money supply, as represented by the top 30 global countries fiat currency supply priced in US Dollars, has broken out a new all time high after nearly four years of consolidation. Provided this trend sticks, we can expect a lot of risk assets to continue repricing to the upside, especially hard assets like Bitcoin.

You can track this chart live, including its year-on-year variant, at Capriole.com/Charts. We also added four new charts there this week.

The Bottom Line

I believe we are at a significant turning point, and likely putting the worst of this cycle behind us with the recent visit of $48K. The last 6 months has been a very challenging period to navigate. There was a lack of signal confluence we noted last issue, significant world market events, massive forced Bitcoin selling, election uncertainty and general chop. I believe this period of market consolidation is coming to a close as we exit summer, and I maintain strong conviction that the next 12 months will be the best time out of the last 3 years to be allocated to this asset class.

Given we still have some fundamental data signal discrepancies today, and we are still awaiting the Monthly close; the conservative position would be to await further bullish confirmations (and potentially Q4) to fully clear what is typically the most bearish period of each calendar year for Bitcoin and risk assets.

A question to ask yourself:

How have you felt about Bitcoin recently?

If you are like many people today, you will be quite disenchanted from the last 6 months. Perhaps you are questioning this asset class given the relative strength other assets like Gold and Equities have seen, and perhaps you are even questioning your Bitcoin holdings altogether. From experience we each have these feelings (and see it across social media) near major bottoms. This in itself is not a signal to act upon, but it can be a very useful guide.

Charles Edwards