Issue 17: Bitcoin in the middle of war

For the past few months, Bitcoin has been driven by macro events like rate hikes and quantitative tightening. This month a new macro event has emerged which is impacting Bitcoin: the Russian-Ukrainian crisis. As Bitcoin is still seen as a risk on asset, we should expect that any negative impact on the S&P will impact the Bitcoin price. Is this a good time to invest in the most volatile asset class? Let’s look at the fundamentals and technicals of Bitcoin.

The News

Here’s this month’s highlights:

The Good

- Grayscale launched an ETF of companies exposed to Bitcoin

- Nasdaq lists Valkyrie’s Bitcoin mining ETF

- Russia plans to regulate crypto as a form of currency

- Bank of Russia approves Atomyze, a Russian startup, to issue tokens backed by metals

- Trust Machines raised $150 Million to introduce Bitcoin in the Web3 ecosystem

- Japan’s largest bank has announced plans to launch a yen-pegged stablecoin

- Sequoia Capital is launching a $500 million crypto fund

- KPMG Canada adds Bitcoin and Ethereum to its corporate treasury

- Compute North raises $385 million to fund new Bitcoin mining data centres

- Uber CEO states that Uber will accept crypto in the future

- Coinbase app jumps to number 2 after Super Bowl Ad

- Luna Foundations raises $1B Bitcoin as reserve for it’s UST stablecoin

- Thailand’s Stock Exchange to allow trading with Bitcoin and Crypto

The Bad

- Jump Crypto bailed out blockchain bridge Wormhole that suffered a hack for over $320 Million

- US couple arrested for alleged money laundering of $4.5B in Bitcoin linked to 2016 Bitfinex hack

- Crypto lending platform BlockFi agrees to pay $100 million in penalties to SEC

- Under Emergency Rules, Canadian banks can cut off protesters’s access to funds including crypto

- US inflation rises to 7.5% as the biggest annual rise for 40 years

The Rest

- SEC has delayed Bitwise’s spot Bitcoin ETF application

- Federal Deposit Insurance Corporation includes in its priorities evaluating crypto-asset risks

- House Financial Services held Digital Assets hearing

- Biden expected to issue crypto oversight executive order to study crypto

The Markets

In the last few weeks, Russia has been building a troop of 190,000 soldiers on the Ukraine border, the largest military mobilization since the cold war. This has undeniably been having a consequence on the S&P and global markets, worsened by the US inflation of 7.5% p.a.

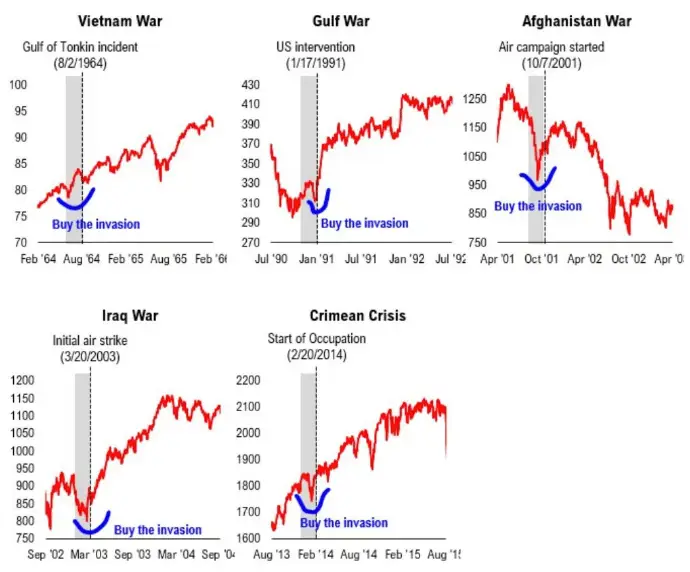

The S&P is in a 10% drawdown and if we reference the S&P price action at the onset of prior wars (see below figure), we can see that the S&P usually goes up in the short-term and also in the long-term (except in case of the Afghanistan war). The news of Russia invading Ukraine has been the talk in the media for the past few weeks and most near-term consequence on the markets is likely already priced in.

However, Russia provides Europe with 60% of its gas needs, and Ukraine is a leading exporter of purified neon gas which is necessary for lasers that design chips. The consequence of supply chain disruptions caused by war likely have not been priced in.

Best case scenario is that following Russia’s declaration of the regions of Luhansk and Donetsk as “independent states”; troops don’t move further. Worst case scenario is full war with Ukraine and Nato intervenes with even heavier sanctions on Russia, in this case global supply chains will be disrupted which will lead to higher commodity prices, further straining equity markets – but also likely straining the Fed’s plans for aggressive rate hikes.

The S&P at price action around invasion events. Source: Twitter

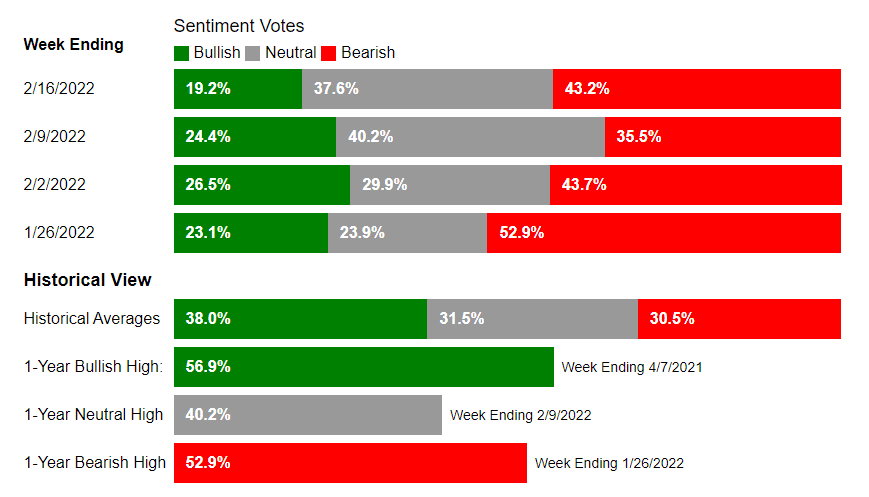

Supporting cause for short-term upside, the AAII Sentiment Survey continues to print bearish readings, with last week showing an extraordinarily low bullish result. Historically, such pessimism has an increased likelihood of being met by short-term market rallies.

The AAII Sentiment Survey has a very bearish reading, which is bullish. Source: AAII

The Fundamentals

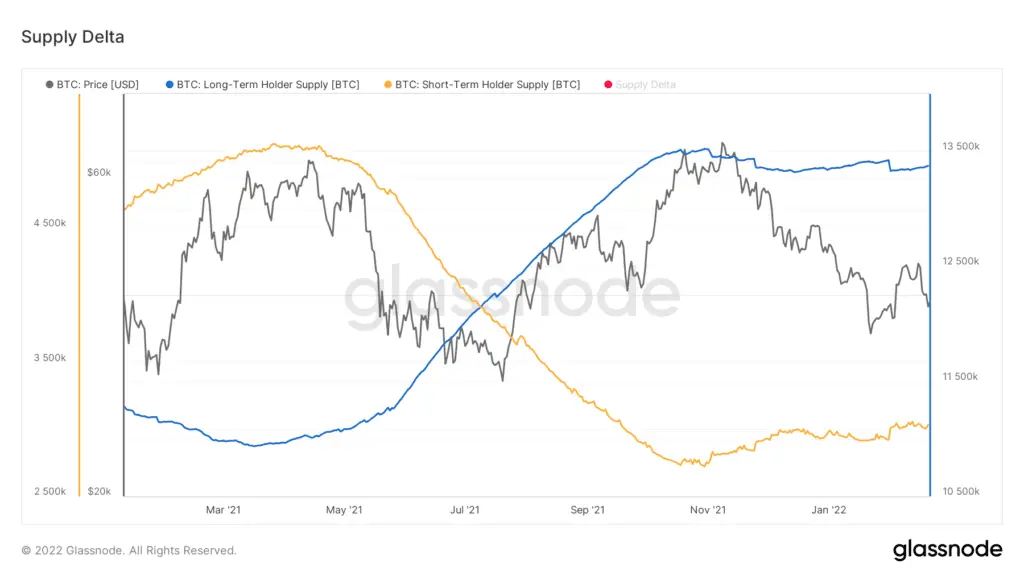

Bitcoin is in a 50% drawdown, however long-term holder supply is only down 0.11% from its 2021 peak whereas short-term holder supply is down 40%. Long-term holders are holding Bitcoin strongly and even accumulating during significant dips. This is bullish for the long-term prospect of Bitcoin.

Long-term and short-term holder supply. Source: Glassnode

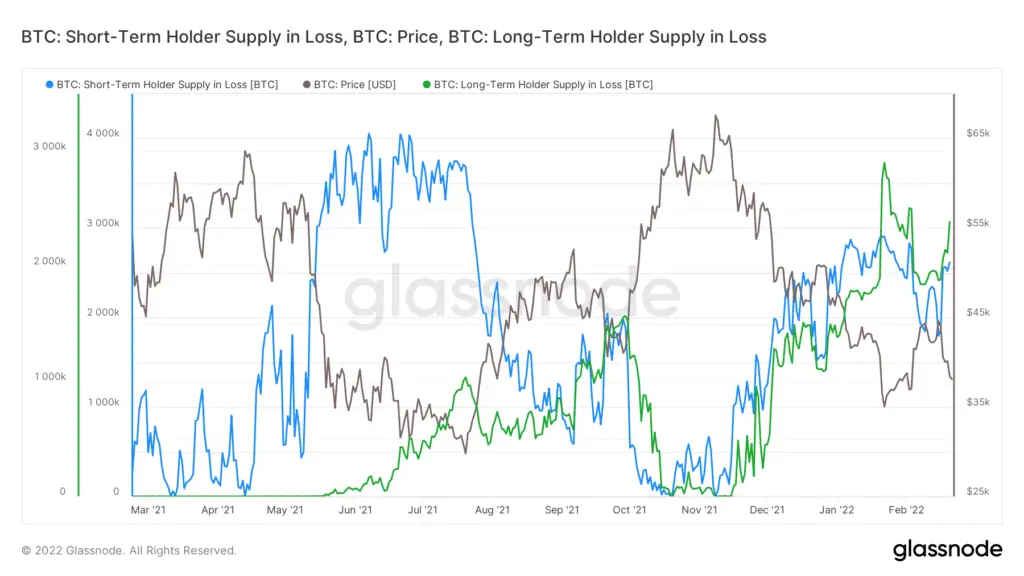

On the next chart, we see short- and long-term holder’s losses. The short-term holder’s losses are around 2.4M Bitcoin and the long-term holder’s losses are around 2.6M Bitcoin. While these numbers are almost the same, the loss of the short-term holders represents 80% of their supply, and the loss of the long-term holders represents only 19% of their supply. Short-term holders are in relatively much more pain and they tend to be the first to capitulate. Price on the short-term will likely be driven by the short-term holders.

Bitcoin short- and long-term holder loss. Source: Glassnode

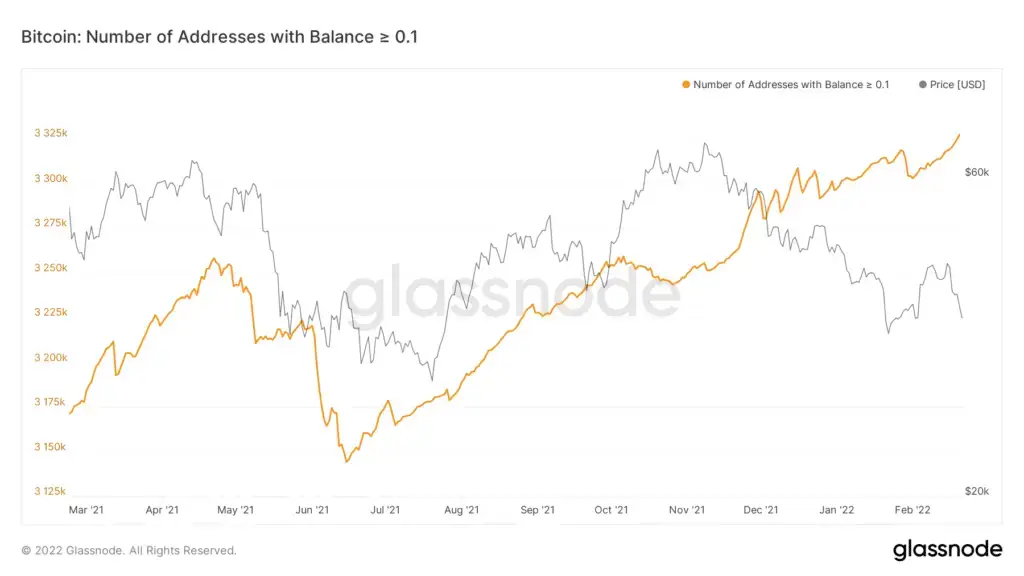

On the other hand, the number of addresses with more than 0.1 Bitcoin are showing an amazing increase. This can only show one thing, that is Bitcoin adoption is rapidly powering ahead.

Number of addresses with a balance more than 0.1 Bitcoin. Source: Glassnode

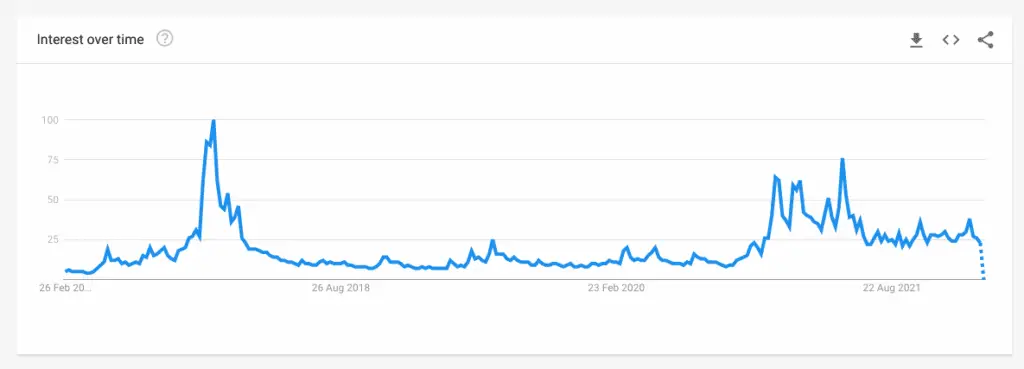

The number of addresses increased by 27% from the 2017 Bitcoin top, while the Google search trends of Bitcoin never reached the interest of December 2017 and instead developed a consistent higher base. This suggests healthier growth and adoption which was not accompanied by a mania phase like in 2017, and also suggests we may not see the same depth of bear market that we did in 2018.

Google search interest in Bitcoin. Source: Google

The Technicals

Again this month, Bitcoin is trading in the $30-60K range. We established last month that 33K was a good risk-reward long opportunity, however Bitcoin was quickly rejected by the 100 daily exponential moving average. This week with the Russia/Ukraine news, price rejected on the lower time frame $38-40K support level.

Generally speaking, support (and resistance) levels which are tested many times, or which price consolidates at for an extended period, tend to break down (out). Should we move back to the mid- to low- $30Ks, as this region is tested again and again, there is increasing risk of a breakdown into the $20Ks. Should this happen, the low $20Ks would be the next major support level (which also aligns with major Energy and Production cost support levels).

Recently Bitcoin did hit over $45K, suggesting a possible change in market structure from this higher-high following the 3 month downtrend. It’s still too early to tell, but a new higher-low (price holding above $33K) followed by a break back above $40K would add increasing weight to this trend change argument – at least in the near-term.

Price is approaching the 34k support. Source: TradingView

The Bottom-line

For the last month, Bitcoin price was driven by macro events. Since global events painted a bearish case for stocks and assets, Bitcoin followed. Short-term Bitcoin price action today is dictated by short-term holders (and liquidations of over leveraged traders) and traditional finance value at risk models. So any external macro events that push the S&P to another -10% loss will also likely push Bitcoin to the bottom of the $30K range, where extended periods of time carry increasing weight for a sharp (but probably short-lived) down move. On the other hand, if the macro market takes a breather from global turmoil (which historical odds suggest is more likely than not), Bitcoin is primed to react to the upside from its bullishly skewed fundamentals noted above and an extended multi-month period of low/negative funding rates.

Content we love

- Russian crisis impact on stocks by Ciovacco Capital

- Preston’s thread on inflation and deflation

- Girolamo’s thread on current market dynamics

We are hiring!

Capriole is hiring! We are looking for traders, data engineers, ML experts and more. If you are interested in what we do, check out our open positions at: www.capriole.com/join