Issue 16: Bitcoin versus ‘the Hawk’

Last month was mostly dominated by macro news much like December, namely the expected rate hikes throughout the year and possible quantitative tightening.

Bitcoin is still considered a risky asset and its correlation with equities is on the higher side lately, which means that the current macro climate is more important than ever for Bitcoin. A reason for this is probably because Bitcoin is more institutionalised than ever. When the new whales, e.g. traditional financial institutions, need to lower their risk exposure it leads to new sources of volatility.

Fortunately we do have some fundamental metrics which give us some guidance as to where we are in this cycle. Let’s check them out!

The News

Here’s this month’s highlights:

The Good

- Thailand to regulate Bitcoin as a payment method

- BTCS first-ever Nasdaq-listed company to offer a dividend payable in Bitcoin

- PayPal explores launch of own stablecoin in crypto push

- Intel to unveil ‘Ultra low-voltage Bitcoin mining ASIC’ in February

- Andreessen Horowitz seeks $4.5B for new crypto investments

- Robinhood begins testing crypto wallet

- Gibraltar looking to launch world’s first stock exchange to accept payment with Bitcoin and crypto

- BlackRock ($10T Assets Under Management) officially files for Blockchain ETF

- Opensea raises $300m in Series C funding at a $13.3B valuation

- Twitter integrates NFT verified profile pictures

- YouTube CEO states they are investigating NFT integrations

The Bad

- SEC looks to be covertly expanding definition of ‘securities exchange’ to encompass AMMs and DeFi protocols

- Crypto.com loses over $30M in Bitcoin and Ethereum due to hack

- SEC rejects proposed spot Bitcoin ETF from First Trust, SkyBridge and Fidelity

- Fears of a Russian attack on Ukraine saw riskier assets worldwide extend their sell-off

The Rest

- Putin sees a future in crypto mining and seeks consensus on regulation

- Biden administration to release executive order on crypto by February

- USDC’s total supply on Ethereum surpasses USDT for the first time

- IMF urges El Salvador to discontinue Bitcoin’s legal tender status

- According to Moody’s does El Salvador’s Bitcoin trading add to its sovereign risk

- MicroStrategy’s Bitcoin accounting to investors rejected by SEC

- Federal Reserve keeps rates at zero, with high probability of first rate rise in March

The Markets

Through January concerns of a more hawkish Fed continued to impact risk markets negatively. As of writing, the S&P500 has seen a -12.5% downdraw, the worst first 16 trading days of a year ever recorded. The Fed has set its targets on inflation, which had its fastest growth in over four decades (a 7% p.a. CPI last December). Satisfied that the economy has sufficiently ‘recovered’ and that employment numbers are strong, the Fed is expected to raise rates for the first time in March 2022.

As we wrote in our previous newsletters, even though many people believe Bitcoin is a inflation hedge, too much inflation is not good in the short-term. At some point the Fed has to react by raising interest rates to meet their mandate of stable prices. All else equal, higher rates lower the net present value of investments, and we have been seeing this get priced into risk markets over the last weeks.

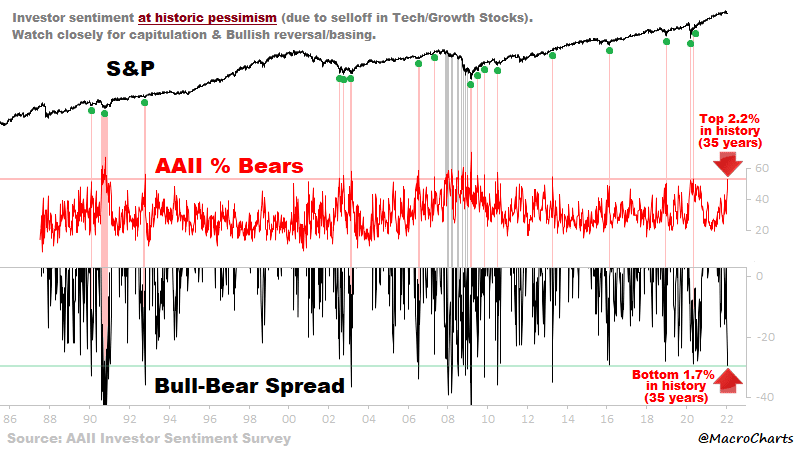

It’s worth noting that a 12-15% correction in the S&P is par for the course in a bull market. In typical crypto fashion, Bitcoin (and of course more so for altcoins) suffered magnified S&P downside. Yet fear has been hitting extremes, which more often than not occurs at a local price bottom.

Investor sentiment at historic pessimism. Source: Macro Charts

The Fundamentals

To date we have seen a -53% downdraw in Bitcoin from it’s all time high in November. It’s quite rare to have had two such 50%+ drawdowns in a single 12 month period, even for Bitcoin (the last time it happened with a new all time high in between was 2013).

Let’s see if the fundamentals can give us some guidance as to whether or not we are near a local bottom.

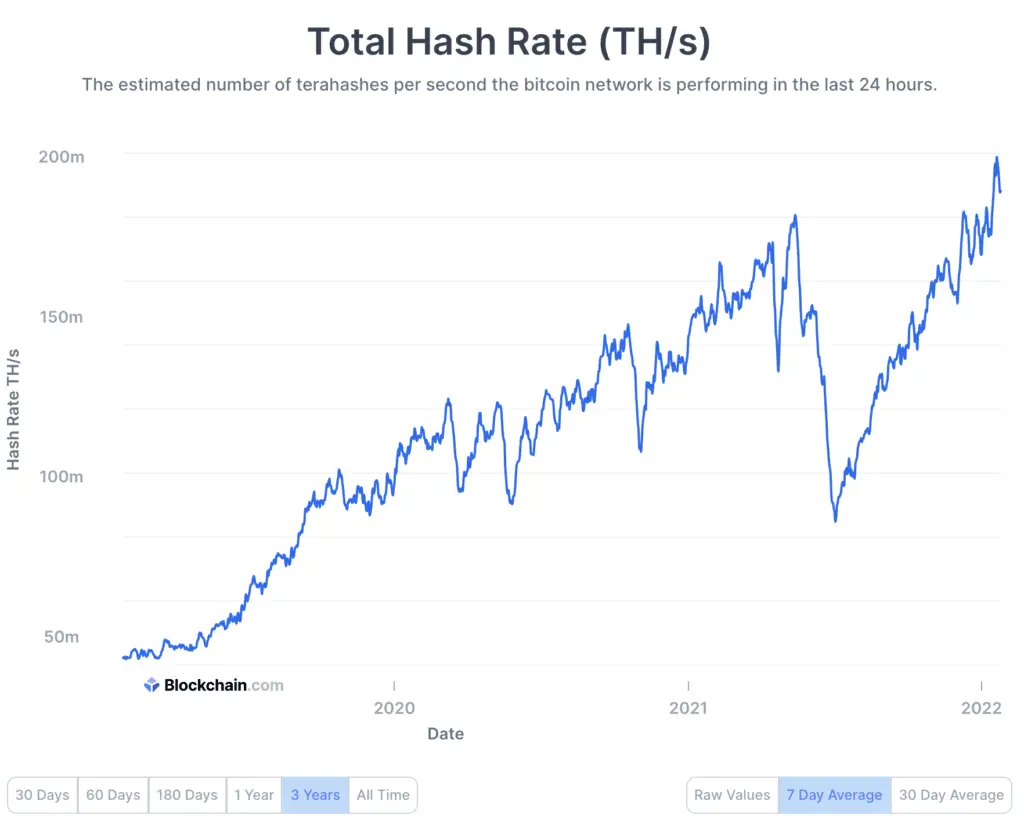

Last month we saw some of the classics in the field of on-chain analysis show promising signals. Perhaps the most classic of them, telling us the overall strength of the network, is the Total Hash Rate. While the Bitcoin price is far away from an all time high, we did have one to celebrate last week – hash rate and mining difficulty showed their highest values to date, making the network more robust than ever.

Total Hash Rate more robust than ever. Source: Blockchain.com

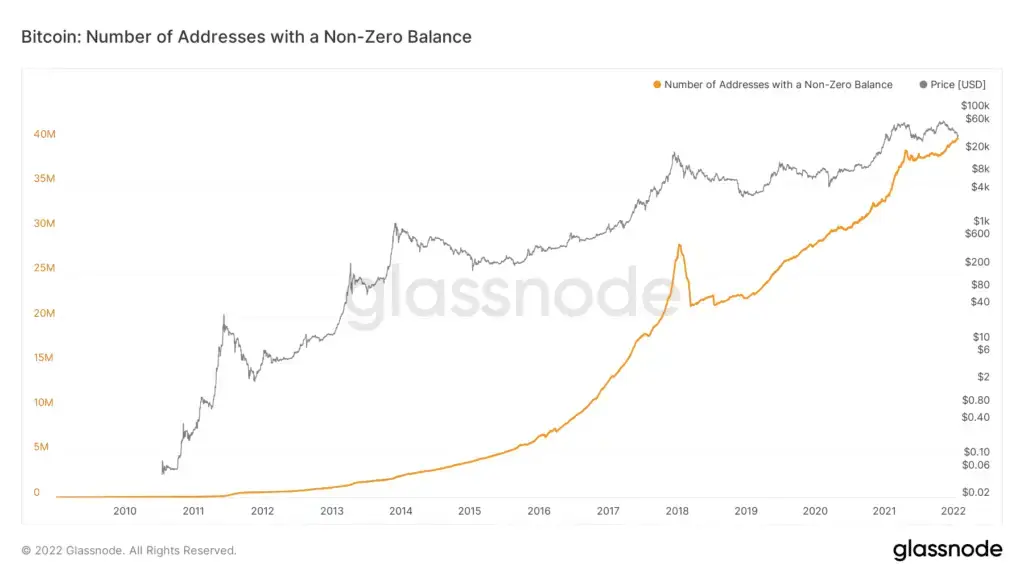

Another all-time high in terms of adoption is the number of non-zero addresses within the blockchain. When we zoom out and think about the concept of Bitcoin as a whole, if adoption is all you care about and is still growing, with Bitcoin its finite supply the price of Bitcoin should increase at some point. So all and all good for Bitcoin in the long term.

Number of addresses with a non-zero balance keeps on growing. Source: Glassnode

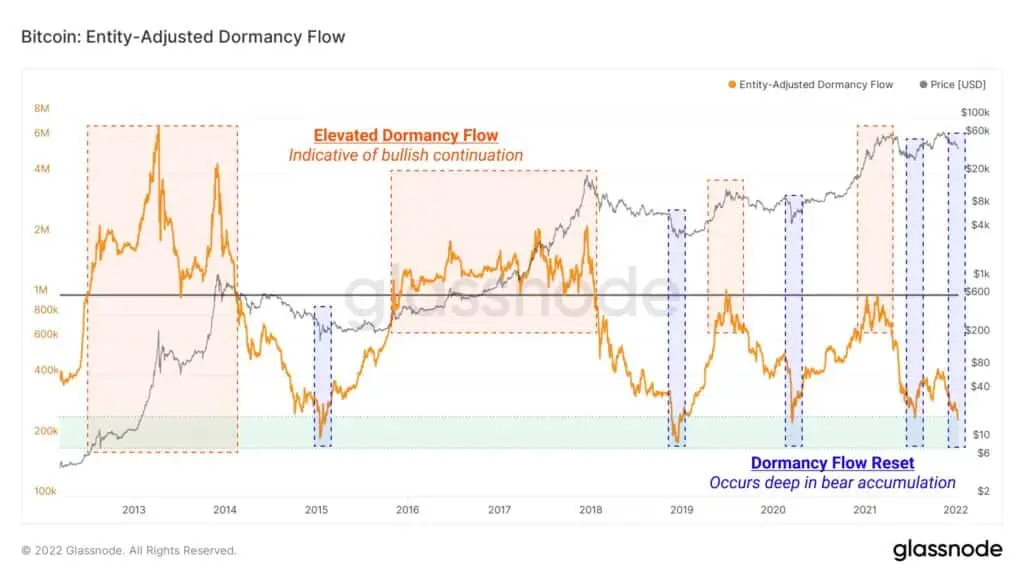

A promising metric showing signal is the Entity-adjusted Dormancy Flow, which is the ratio of the current market capitalization and the annualised dormancy value (dormancy refers to the average number of days each coin transacted remained dormant or unmoved, a gauge of market’s spending pattern). The metric reached its buy zone, a level of which historically bottoms were identified when the dormancy flow is reset, mostly occurring deep in bear accumulation.

The Entity-Adjusted Dormancy Flow metric showing we are in bear accumulation. Source: Glassnode

Another populair metric is also saying we are getting closer to a bottom; the Mayer Multiple. The Mayer Multiple is an oscillator calculated as the ratio between price and the 200-day moving average. Historically 0.8 and below has been a good region to look for long term value.

The Mayer Multiple entered a region which indicated good value in Bitcoin in the long term. Source: Glassnode

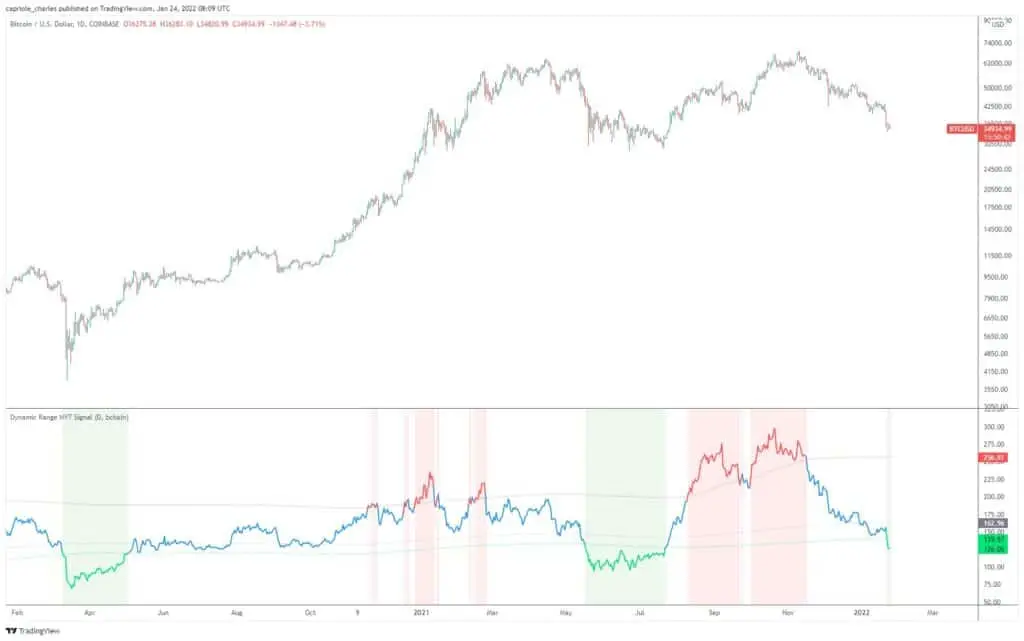

A classic on-chain metric, the Network Value to Transactions (NVT) Ratio, flashed a promising signal this week. The NVT Ratio is computed by dividing the market cap by the transferred on-chain volume measured in USD. Last week Charles highlighted in a tweet that the ratio entered a region where we could say that Bitcoin is oversold, again something that historically identified local bottoms.

The NVT Ratio is flashing green. Source: Charles Edwards

So far only promising metrics, but one metric saying we have not yet bottomed out is Bitcoin Reserve Risk. This metric visualises the confidence amongst long-term Bitcoin holders relative to the price of Bitcoin at a given moment in time. The metric just hit a one year low. Low values like we see now show characteristics of mid-bear to mid-bull cycles, where prices are depressed, but HODLing dominates on-chain. Entering this area may mean we are in the middle of a cyclical Bitcoin bear phase.

Bitcoin Reserve Risk shows we are mid bear. Source: Glassnode

The Technicals

Bitcoin continues to trade in the large $30-60K range. Looking at the visible range volume profile (VPVR), we can see that historically a huge amount of volume has transacted below current prices (in the $30-35K region). From a technical perspective this often serves as a support level. Should the $30K region fail, $20K offers the nearest comparable level of support. On the upside $47K represents the Point of Control (red line) for the entire bull market – it is also the mid-range point for the entire Bull market – a likely trouble zone for price action once we approach it.

In sum, we are nearer support than resistance, which technically offers better value to longs. Those who were lucky enough to snag $33K got one of the best risk-reward long entries for this multi-month range.

Price is trading near major multi-month support, offering greater opportunity to longs. Source: TradingView

The Bottom-line

Macro news has been dominating the markets, and even though the Fed did not raise rates this month they did strongly indicate that it will likely happen in March. We expect more volatility to come from this tougher macro climate for as long as the Fed maintains this hawkish stance (which may not be that long).

Fundamentally the on-chain indicators show promising signs this month, typical of Bitcoin entering a long-term value zone. Entity-adjusted Dormancy Flow, the Mayer Multiple, and the NVT Ratio are showing long-term bottoming signs. Though as always, there are some counter-points; Reserve Risk has not yet bottomed.

For those with multi-year time horizons, these periods of time can offer exceptional opportunities.

Content we love

- Arthur’s January market update

- Hsaka / ARK thread on digital and crypto adoption trends

We are hiring!

Capriole is hiring! We are looking for traders, data engineers, ML experts and more. If you are interested in what we do, check out our open positions at: www.capriole.com/join