Issue 15: The End of the Bull Market

If you have been around the crypto space long enough, you have probably noticed how decidedly un-Bitcoin Bitcoin has been this year.

Post halving cycle not going the way we would expect? Check.

On chain metrics not being as insightful or explanatory of Bitcoin’s price action? Check.

What gives? Well Bitcoin gives… but it taketh away. Because apparently Bitcoin’s 2021 new year’s resolution was to be a child with a magnifying lens over an ant biome. But that’s okay, because we still have the Santa Claus rally to look forward to… just kidding.

In all seriousness though, there are simple reasons that explain this behaviour, and despite the year being rangy and volatile and undergoing a significant shift in dynamic, the year was wholly positive for its natives and the crypto landscape’s long-term future.

In this newsletter, and our soon to be released 2022 forecast, we will explain why that is.

The News

While none of the news announcements this month alone stand out as overwhelming, as you read through the list you will notice they all speak to continued advancement and embedment of crypto into the world. This is what Bitcoin adoption looks like in real time.

Here’s this month’s highlights:

The Good

- Federal regulator says credit unions can partner with crypto providers.

- Goldman Sachs exploring Bitcoin-backed loans.

- Brinks US adds the ability to purchase Bitcoin to their 7,000 ATMs in the US.

- Dan Tapiero’s 10T is raising $500M for a third digital assets fund.

- Facebook expands eligibility to run ads about cryptocurrency.

- Russia’s largest bank introduces the first blockchain focused ETF in the country.

- Switzerland’s largest online bank to launch a crypto exchange.

- Bitcoin mining firm Marathon orders nearly $900M worth of new machines.

- Paraguay’s senate approves a proposal regulating crypto mining and trading.

- HSBC and Wells Fargo use blockchain to settle bilateral foreign currency trades.

- Kickstarter will move its crowdfunding platform to blockchain.

- Fidelity Digital to accept Bitcoin collateral on cash loans for institutions.

- VCs pumped $4B of fresh capital into 120 crypto projects in November.

- Germany’s trillion-euro savings banks considers a crypto wallet.

The Bad

- SEC disapproves the Kryptoin and Valkyrie spot ETFs.

- Russian Central Bank to seek ban on investment in cryptocurrencies.

- U.S. inflation surged to 6.8% in November, the highest level since 1982 (but it’s good news for long-term Bitcoin adoption).

The Rest

- Square rebrands to “Block” – possibly signaling blockchain centric business model.

- The Bank of England will push for tighter rules as institutions embrace crypto.

- Fed announces plan to double pace of tapering to $30B per month and signals three interest rate hikes in 2022.

The Markets

The big news of the month was the Fed confirmed hawkish stance. The base case is now to expect at least a couple rate rises in 2022 as the Fed attempts to tackle the highest inflation in 40 years. The announcement was welcomed by the market as fears and uncertainty were quelled by a clear path ahead.

Rising rates in general are ‘bad’ for markets. Risk assets are priced using risk-free rates. As interest rates rise, the value of risk assets (notably securities) decreases. If the Fed’s plan to continuously hike rates plays out over the next 2-3 years, the impact on the markets would likely be substantially negative in an environment of low growth like today. Course corrections and plan reversals may well (read: likely) be required by the Fed over that period.

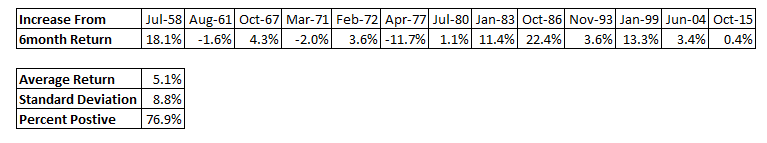

However, history suggests that the early stages or rate rise programs actually result in stock market strength for the ensuing 6 months. There is substantial volatility in this result, but 10 out of the last 13 rate rise regimes had a positive return in the first six months.

If historic averages hold true, we can expect that the stock markets will probably continue to rally in the first half of 2022 (all else equal).

The start of Federal Fund Rate rise regimes have historically been bullish 77% of the time for the stock market over the following 6 months. Source: TradingView

The start of all Fed Funds Rate rise regimes over the last 65 years. Source: TradingView

The Fundamentals

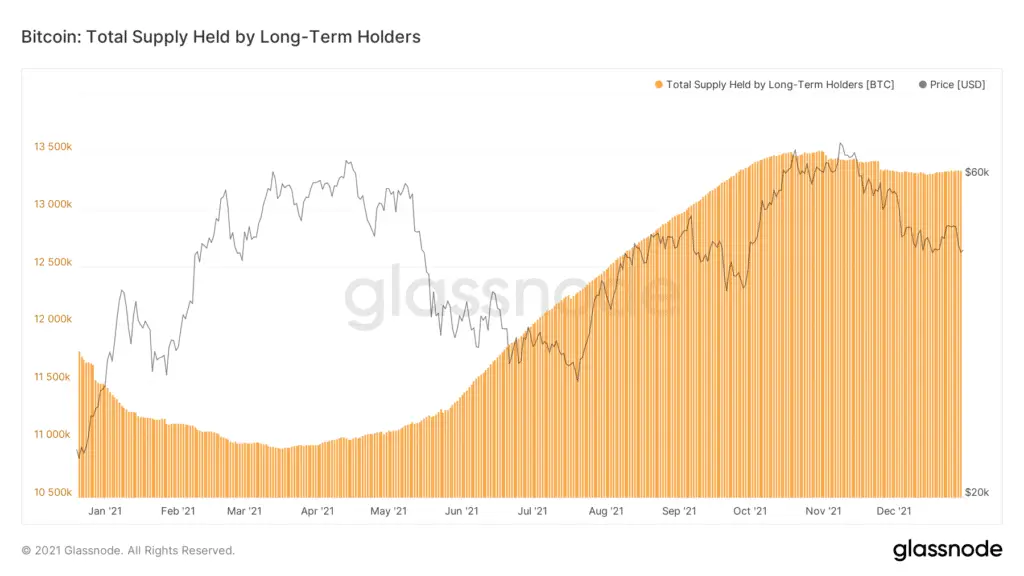

Long-Term Holders continue to diamond hand their holdings.

Despite the -38% drop since November, Long-Term Holders continue to diamond hand Bitcoin. The last time Bitcoin was at $47K, long-term holdings were 10% lower. To date there has been insignificant distribution despite the volatility. That’s bullish.

Long-Term Holders diamond hand their hordes Source: Glassnode

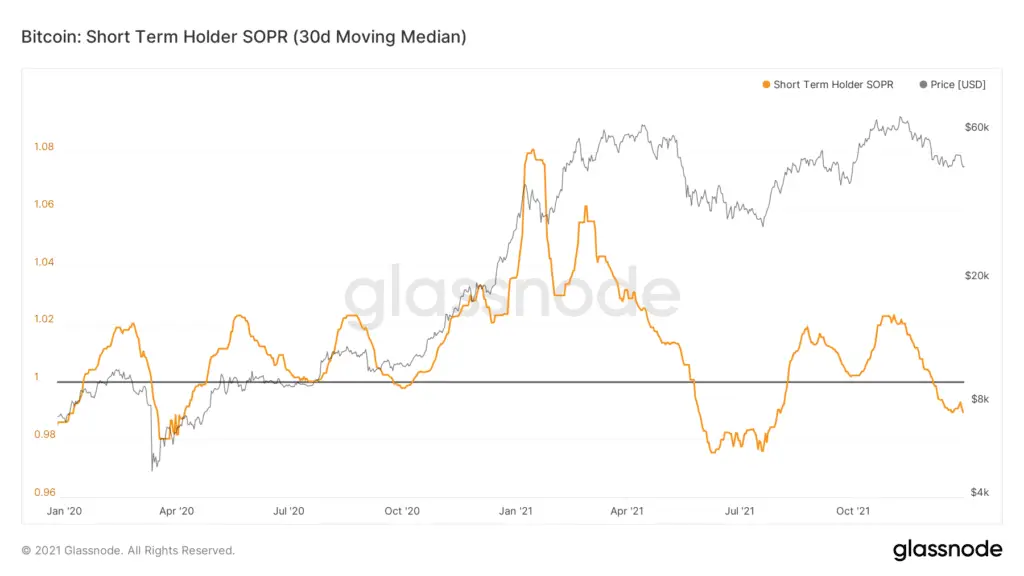

Short Term Holder SOPR

Short Term Holder SOPR (spent profit output ratio) when smoothed over a 30-day period paints a picture of continued realized losses through November starting to slow in the latter part of December. Typically, when this metric starts to bottom and then rise, a more sustainable price trend has begun. The 30-day median is still below 1 (implying that the average price of the coins moved is lower than the price they were purchased at), but signs of life like this after a substantial corrective event suggest we are likely in the latter stages of the current correction.

Short-Term Holder SOPR showing possible signs of life: Glassnode

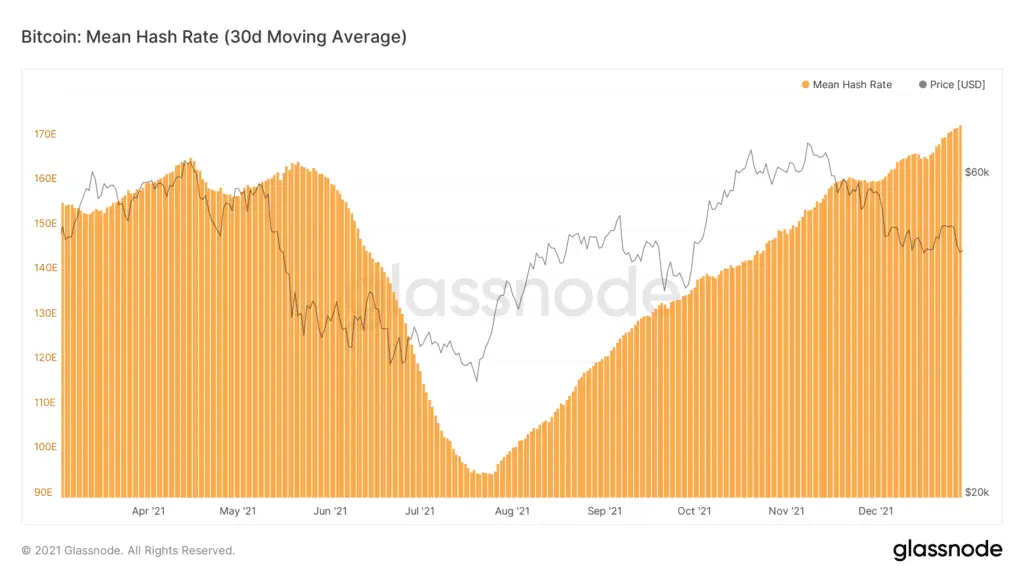

Hash Rates show a robust mining network

Hash rates today are at the same levels as the March/April highs, when Bitcoin Price was on average 30% higher. Metrics like this are effectively old-guard fundamental outlook material and are largely overlooked by newer and sexier methods of explaining price dynamics, supply and demand, but cannot be ignored for their ability to explain institutional and infrastructural support for securing the protocol that at this point effectively underpins the entirety of the crypto economy. It is worth noting though, that despite Hash Rate currently being strong, Bitcoin is still trending substantially above its Energy Value – a price point we would expect to re-visit again in a bear market.

Bitcoin Hash Rate shows strength. Source: Glassnode

Lackluster Active Addresses

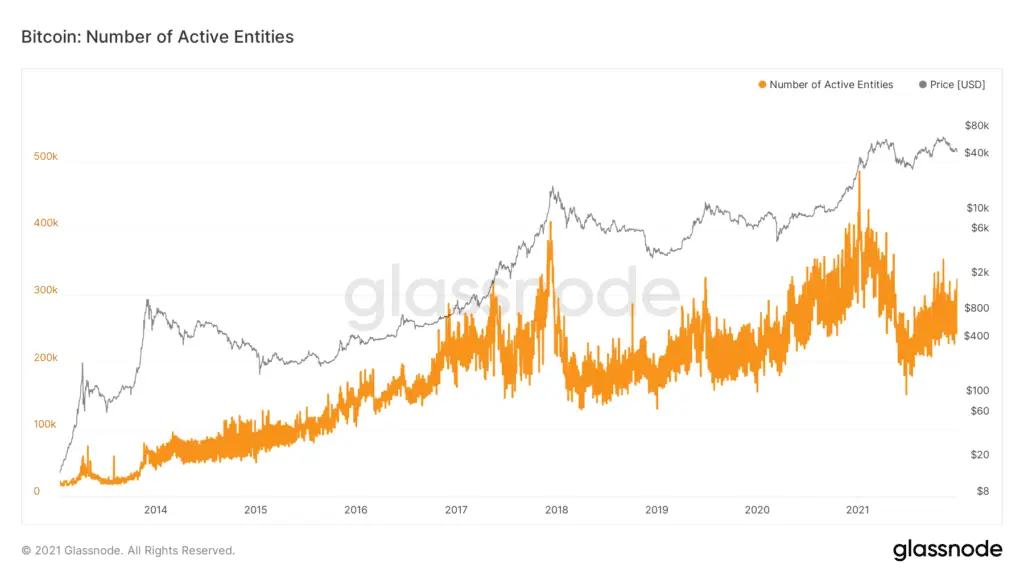

Active addresses, or active entities, highlights the continued weakness in the market we see today. Active entities shows the number of unique parties (people or institutions) in the market. For Bitcoin it topped in January and has been weak since.

Active Entities highlights continued lack of retail interest in Bitcoin, having topped in January. Source: Glassnode

The Technicals

This most recent distribution looks to have largely played out with the recent corrections towards the quarterly open. However, until the volatility has sufficiently dampened and positions in the spot and derivatives markets flattened, the market can be expected to range and consolidate in this region. Price rallies which add significant leverage and Open Interest to the market can be expected to be faded by whales, as we have seen throughout 2021.

Critically Bitcoin fell below the 100D Moving Average and nuked downward towards the 200D Moving Average which has since acted as support. A 200DMA breakdown is a possibility with price now lingering below and the quarterly open ($43.8K) being a potential price magnet.

Locally we are starting to see weakness at the key 100 and 200DMAs. Source: TradingView

On the higher time frames, Bitcoin is stuck in a massive $32-60K range. Based on technicals alone, any dips to the $30Ks are likely to be good buying opportunities, visits to the 50Ks are likely to be selling opportunities. Time spent above $55K will likely result in a breakout – another major all-time high attempt is unlikely to get faded a third time.

We are in the middle of a massive Weekly/Monthly Bitcoin Range. Source: TradingView

The Bottom-line

Quiet, broad adoption of Bitcoin is happening on a global scale. It doesn’t look like much on a daily basis, but the entrenchment is clear. This is what Bitcoin adoption looks like.

Today, the stock market is entering an interesting phase. One where risky assets are expected to be less appetizing, but also where history suggests there is a good probability of continued risk-on rallies for the coming months – generally speaking that is a good environment for Bitcoin.

Today the Bitcoin Fundamentals and Technical paint a mixed picture. Equal parts bullish and bearish. Long-term holders continue to show relative strength. As long as this accumulation continues, and as long as leverage remains neutral to low (like today), we expect the current correction to be nearing its later stages and forming an accumulation base, where price would normally rally from. Bear in mind that accumulation bases are volatile. Conditions today are not dissimilar from June this year. The conservative approach is to wait for a sign of strength, or buy lower.

As 2021 draws to a close, is it the end of the bull market? Are we now entering a bear market? We will share our thoughts and more in our soon to be released 2022 Forecast.

Content we love

- Raoul Pal’s thread on the market today is a great summary of where retail attention has been and overview of broader crypto trends.

- Trading Riot’s Auction Market Theory summary.

- Light’s bullish case for Bitcoin.

We are hiring!

Capriole is hiring! We are looking for traders, data engineers, ML experts and more. If you are interested in what we do, check out our open positions at: www.capriole.com/join