Issue 14: A thing like too much inflation

Bitcoin started the month of November strong with a new all time high hitting $69K. But the party did not last long. Within a couple of hours the price retraced 5%. More recently, refreshed Covid fear have startled the markets with a flash drop bringing the monthly drawdown to -23%. Thanksgiving has now concluded and we find ourselves back at $57K.

The News

Here’s this month’s highlights:

The Good

- Bitcoin hits all time high of $69K

- The long-anticipated Taproot upgrade goes live

- TIME magazine to hold Ethereum on its balance sheet as part of Galaxy Digital metaverse deal

- PayPal enables crypto payments for millions of merchants on its platform

- Crypto mining platform Bitdeer to go public through $4B SPAC merger

- El Salvador plans first ‘Bitcoin City’ backed by bitcoin bonds

The Bad

- Concerns about a the new Omicron corona variant cause market jitters

- SEC rejects VanEck Bitcoin spot ETF

- House approves $1T infrastructure bill with crypto tax provision

The Rest

- U.S. inflation rose to 6.2% in October, the highest annual rate in 30 years

- MicroStrategy purchases an additional $414M Bitcoin

- Mt. Gox bitcoin repayment plan gains final approval from trustee

- India to ban crypto as payment method, but regulate as asset

- Biden re-nominates Powell as Fed chair, with Brainard as vice chair

- The U.S. Dollar Index (DXY) hits a 16-month high last week

Another failed all time high

Bitcoin’s second attempt at an all time high in November didn’t last long. The volatility started with the release of US inflation numbers on 10 November. These turned out even higher than the high level expected. Bitcoin loved the news, and price jumped 5% within an hour, ultimately hitting a new all time high of $69K. As the new ATH formed, breakout buyers triggered a large increase in coin margin futures contract open interest. Something we have seen more lately around ATHs. Funding rose and then price moved in the wrong direction (down), squeezing these leveraged traders. This resulted in a series of long liquidations driving prices lower. Since then the market has been ranging between $53K and $60K.

The Markets – a strengthening dollar and inflation

One thing we cannot ignore is the rise of the dollar. The DXY index, which is a basket of the largest currency pairs against the dollar, rose close to 3% over the last weeks as investors sought safe-havens on renewed lockdown and monetary policy fears.

Historically we have seen a negative correlation between the DXY index and Bitcoin. This is something we expect, since BTC is typically quoted against the dollar. But in the long term, a dollar which is too strong is normally perceived as not good for the markets. An expensive dollar reduces the purchasing power of every country not denominated in dollars. It can result in less exports in the US economy. Generally, it has a negative effect on risk markets like equities and Bitcoin.

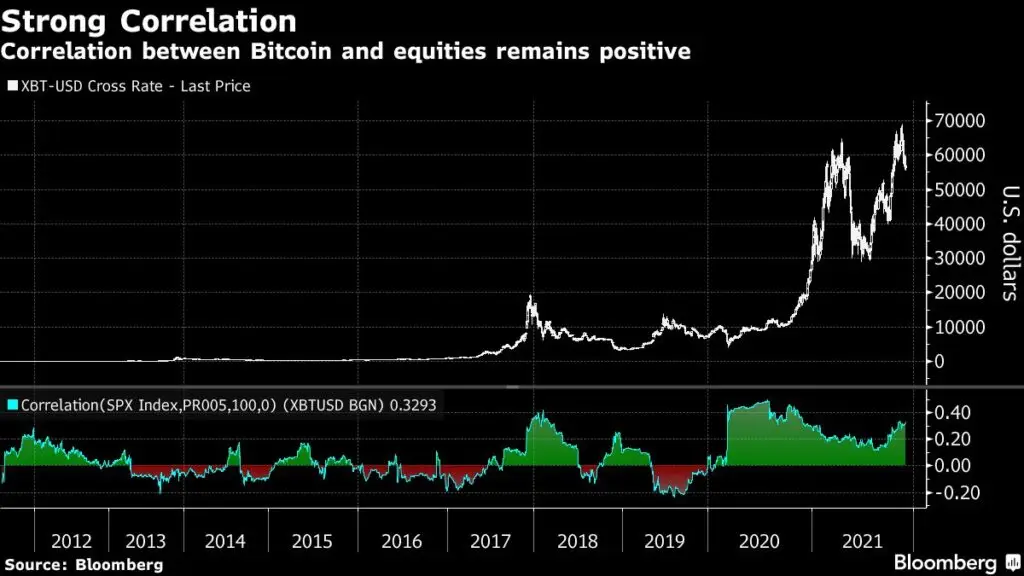

Bitcoin has maintained a relatively high correlation to equities in recent times, so a large correction in the equity markets is definitely a high risk for Bitcoin.

Correlation between Bitcoin and equities remains positive Source: Bloomberg

We also need to consider the recent and rapid rise in inflation. While official inflation is recorded at around 6%, all major commodities are seeing double digit year-over-year price rises. Not to mention the rapid appreciation in just about all asset markets since the 2020 stimulatory monetary policy.

Many people perceive Bitcoin as a great inflation hedge. But one should also be wary of what strong inflation could mean for Bitcoin. When inflation levels end up not being temporary and go from being short-term talking points to long-term problems, the FED will at some point be forced to step in and take action, possibly by raising interest rates. Increased interest rates results in a repricing of risk assets downward (as risk assets are typically valued using those same interest rates). If that happens at a time when Bitcoin is highly correlated to stocks, Bitcoin will also experience similar downdraw, at least in the short-term. Remember too that in major risk-off events, all assets correlate to 1 as people look to dump risk.

While we are not yet in such an event, they can happen quickly. And Bitcoin would be affected too, at least in the short-term.

The Fundamentals

Despite last month’s price action the fundamentals still look bullish overall.

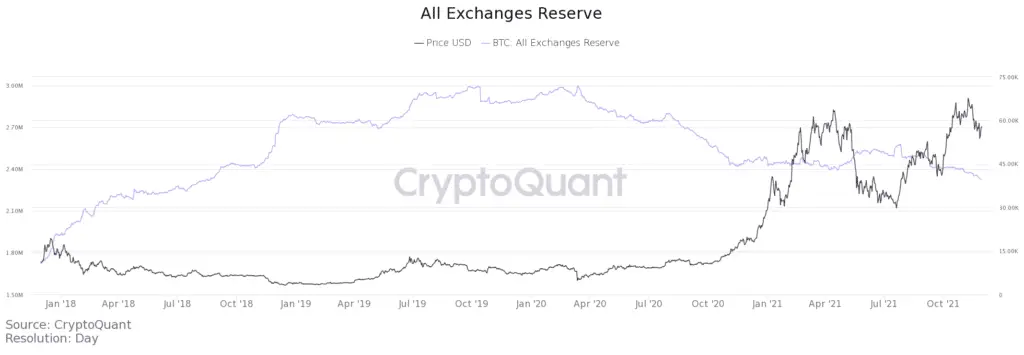

A metric often discussed which keeps showing bullish signs, Bitcoin exchange reserves, has continued to fall hitting another three year low. This aggregate metric is indicative of mass opinion toward the macro outlook of Bitcoin.

Exchange reserves further down this month Source: CryptoQuant

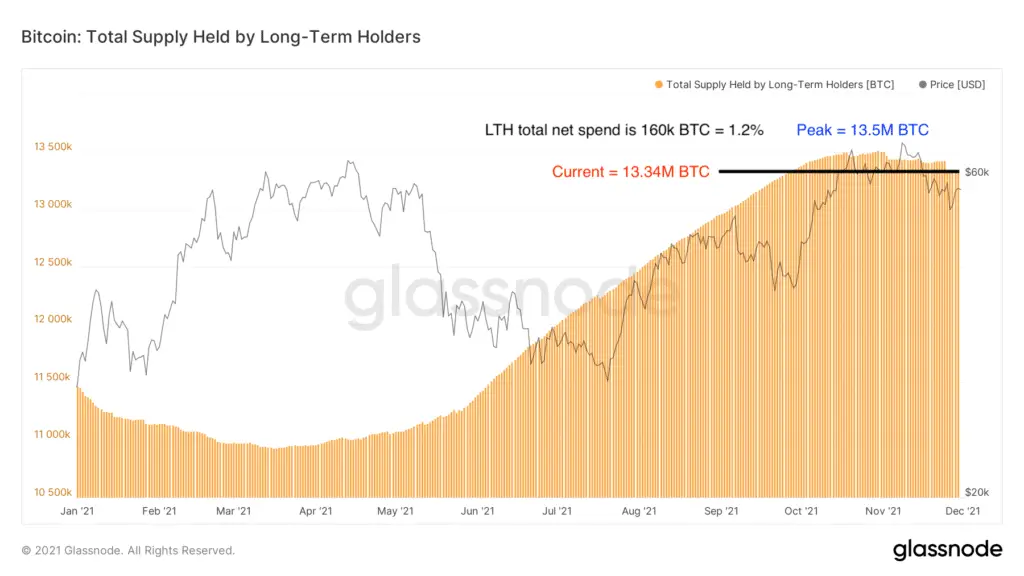

Long term holders (LTH), or the smarter money in Bitcoin, have also maintained most of their holdings despite the -23% drop. There has been some distribution of LTH’s coins (100K BTC over the last month) but this distribution comes to just around 1.2% of their total holdings.

Long term holders maintained most of their holdings Source: Glassnode

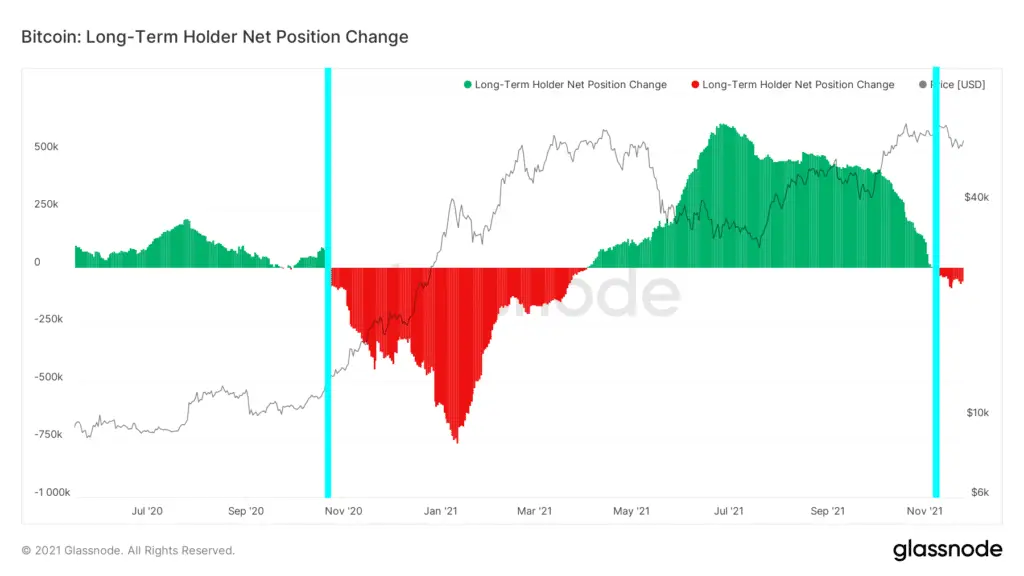

Furthermore, a decrease in LTH supply is not necessarily a bad thing, this is actually a similar scenario of where we were a year ago (when Bitcoin was just $18K): LTH supply delta turned negative just before the big multi-month run up starting in November.

Long term holder net position change turning negative Source: Glassnode

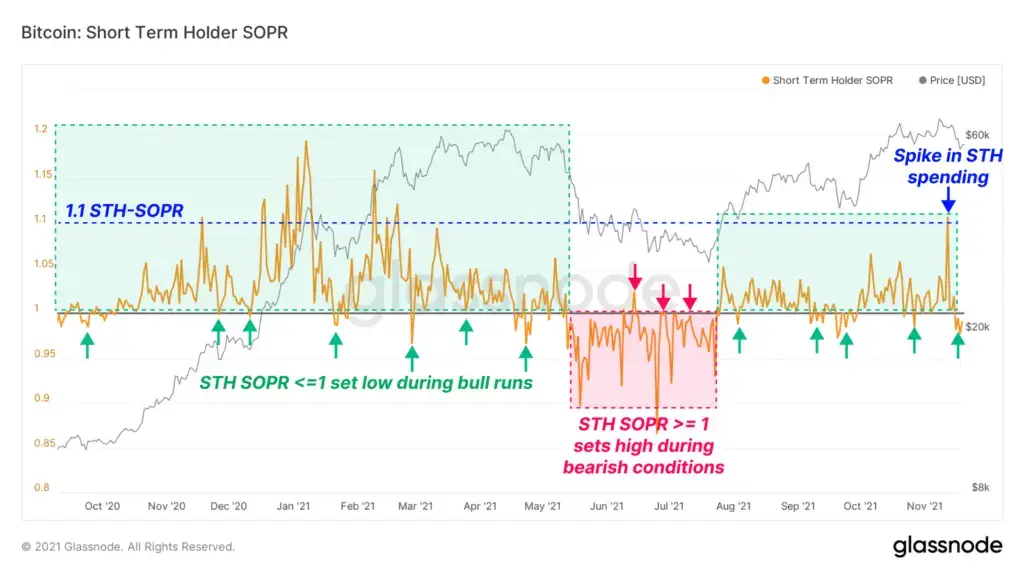

For the short term holders we see that after the ATH there has definitely been some profit taking. This can be seen in short-term holder SOPR, which reflects the realized profit and loss of for all coins moved on-chain that have a lifespan less than 155-days. After the drop in price near the highs there is a steep spike, which normally is not a good sign. However, the indicator dropped sharply again below 1.0 as price broke down to the low $50Ks. Historically, the crossover from below 1.0 to above it has been an indication of a trend reversal. Provided it can hold above 1.0, short-term holder SOPR looks like it has identified a trend reversal here and potential buying opportunity.

Short Term Holder SOPR showing short term holder profit taking Source: Glassnode

Looking at the supply held by whales (those who hold between 100 to 10K Bitcoin), when looking at the 7-day SMA we can see that whales have not been selling and to some extent have been accumulating more during this recent pullback. Furthermore, Bitcoin illiquid supply continues to increase, further strengthening the story of the supply shock, a topic discussed in the last edition of this newsletter.

Weekly moving averages of supply held by whales (between 100 and 10k in size) and illiquid supply. Source: Glassnode

The Technicals

Looking at the daily time frame it still looks like Bitcoin is in an uptrend, we have seen higher highs and higher lows and a clear channel that holds identifying a trend. The current pullback is quite similar to the one we saw in September. Both saw a 20 to 25% decline from their respective tops.

Currently Bitcoin is holding support above its 100-day moving average at $54K. $53-54K also happens to be the same price level as the peak in September and the price level at which Bitcoin is worth around a Trillion dollars. A critical price juncture.

Upward channel and support and resistance levels Source: TradingView

The order book is also confirming strong support at $53K, with considerable bid volume shown from $50-54K (green). On the ask side of the book we see some resistance at $59K (red), a level that also was an important level for Bitcoin in the months March, April and May. We see this as an important breakout level which needs to be claimed on the daily and weekly level for us to back in the race towards a new ATH.

Order book support and resistance zones. Source: TradingLite

The Bottom-line

On-chain wise the story is similar to the beginning of this month, which is generally good. Bitcoin reserves on exchanges are further down and whales are holding on to their bags, but short term holders did take some profit this month.

On the macro level we see some risks regarding the dollar gaining territory against other currencies, inflation and broader monetary policy change impacts. Furthermore, the extra burden of the Covid virus variant puts us on the top of our feet. As scientists do not know how dangerous the new variant is, the risk of new lockdowns and restrictions can change the mood in the markets at the drop of a hat.

We have a lot points to consider for December:

- Positive on-chain drivers

- A volatile macro setting, with inflation and monetary policy driving markets

- A possible ‘Santa Claus rally’

- Bitcoin cycles historically top in December, ending the cycle bull market

- Potentially increased end of year profit taking from institutions and KYCed traders

- Conversely, ‘window dressing’ (where portfolio managers sell their losers and increase their winners) could incentive more Bitcoin hodling

All and all we are conservatively Bullish on Bitcoin. Statistically speaking, Bitcoin cycle-end Decembers have very positive months, but be prepared for large swings. Our conviction will increase when Bitcoin flips $60K and holds it on the daily and weekly timeframes.

We are hiring!

Capriole is hiring! We are looking for traders, data engineers and machine learning experts. If you are interested in what we do, check out our open positions at: www.capriole.com/join.