Whales are Making a Splash

Welcome to Issue 12!

Last issue, at $47K we noted some concerning metrics, but noted the data remained bullishly skewed into the end of August. Price continued to climb achieving two daily closes above $50K before collapsing through September. We did not expect this drastic a fakeout on claiming $50K.

However, we did note that the stock market remains the biggest risk to Bitcoin today.

We saw that play out in September. Bitcoin moved like a leveraged stock. As usual the downside played out significantly more for Bitcoin, particularly after China banned Bitcoin (yet again).

Refreshingly though, the more damage China attempts to do now, the more positive the future prospects are for Bitcoin in China… as there is only one direction you can go from zero.

The fact Bitcoin has reclaimed a price crash from yet another China ban in just days signifies a powerful turning point.

Bitcoin no longer cares about China.

As bloody September comes to an end, we see fundamentals and sentiment suggest this age old adage bodes well for Bitcoin today:

“Sell in may and go away, come back again on St Leger’s day”

The News

Here’s this month’s highlights:

The Good

- Bitcoin adoption in El Salvador outstrips all traditional banks within 3 weeks of launch

- El Salvador acquires and holds over 550 Bitcoin

- McDonalds and various other multinationals now accept Bitcoin in El Salvador

- Twitter adds Bitcoin lightning tipping

- Morgan Stanley buys $240M Grayscale Bitcoin shares

- Bill Miller buys $45M Grayscale Bitcoin shares

- Dan Tapiero invests more than $650 million into crypto businesses

- Jump capital launches $300M crypto fund

- Two Virginia public pension funds make a direct bet on cryptocurrencies

- Robinhood adding crypto wallets

- Global exchange Bitcoin balances hit lowest levels since 2019

The Bad

- Huobi to close all Chinese user accounts

- Binance ends all trading in Singapore due to regulatory challenges

- More crypto lending platforms issued cease and desist orders in the US (Celsius in Kentucky)

The Rest

- MicroStrategy purchases an additional $240M Bitcoin.

- China bans all crypto related transactions and blocks major crypto sites like CoinMarketCap.com

The Markets

The September Effect

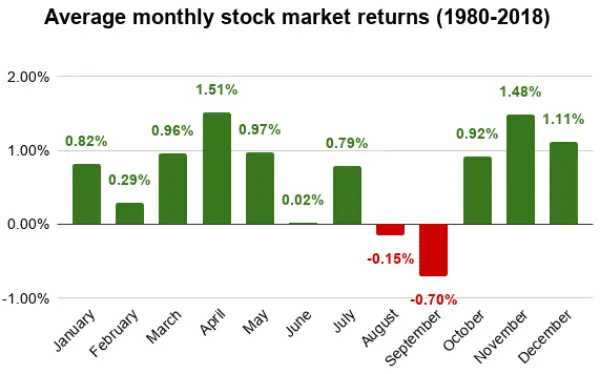

For the last 150 years, the S&P500 has on average had a negative month in September. It’s the only month of the year which has seen consistent negative returns on average. Over the last 40 years, that effect has only increased, with September losing -0.7% on average.

Average monthly stock market (S&P500) returns

In 2021 this relationship held, with the S&P500 down -5.4% in September. For the majority of the month, this also drew Bitcoin down with it and Bitcoin fell as low as -15.6%.

High correlation periods of Bitcoin to the stock market usually goes through cycles of 2-3 weeks.

During these times, most traditional crypto related metrics (technicals and fundamentals) are less effective in the short-term. The crypto market tends to peg with traditionals, making Bitcoin trading more challenging.

This current period of high correlation to the stock market has come to an end for now, but high volatility events can restore the relationship.

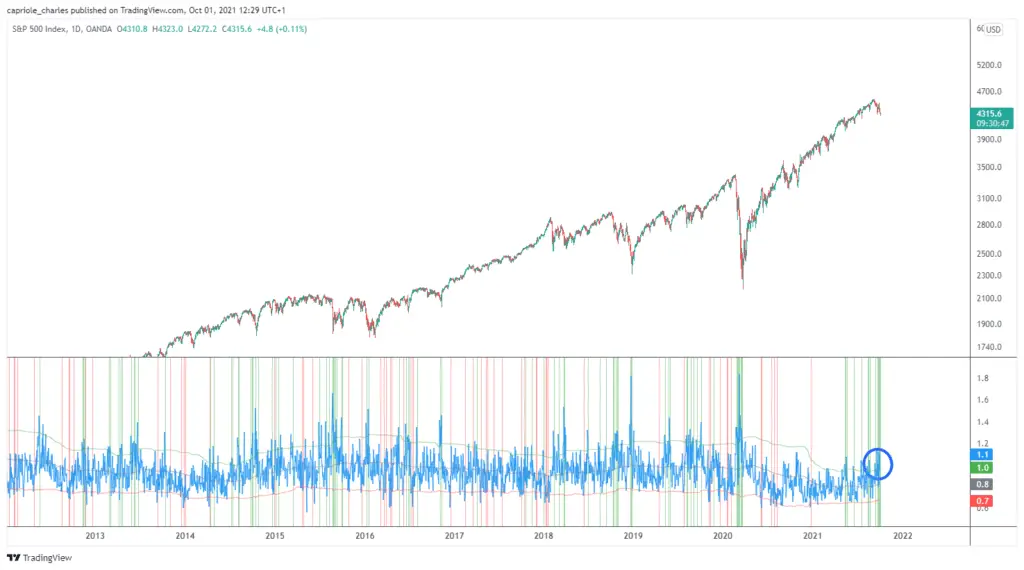

One of the reasons we remain quite positive on the stock market outlook (and therefore Bitcoin too) here is the bullish put-call sentiment. Very rarely does the S&P500 have a significant top without significantly higher call volume.

S&P500 put/call volumes suggest the current dip represents a long term buying opportunity

Of course new events can change the situation quickly, but looking at the data today, history says this period is a stock market buying opportunity.

The Fundamentals

On balance the fundamental picture looks great for Bitcoin in the mid $40K region.

Whale numbers multiplying

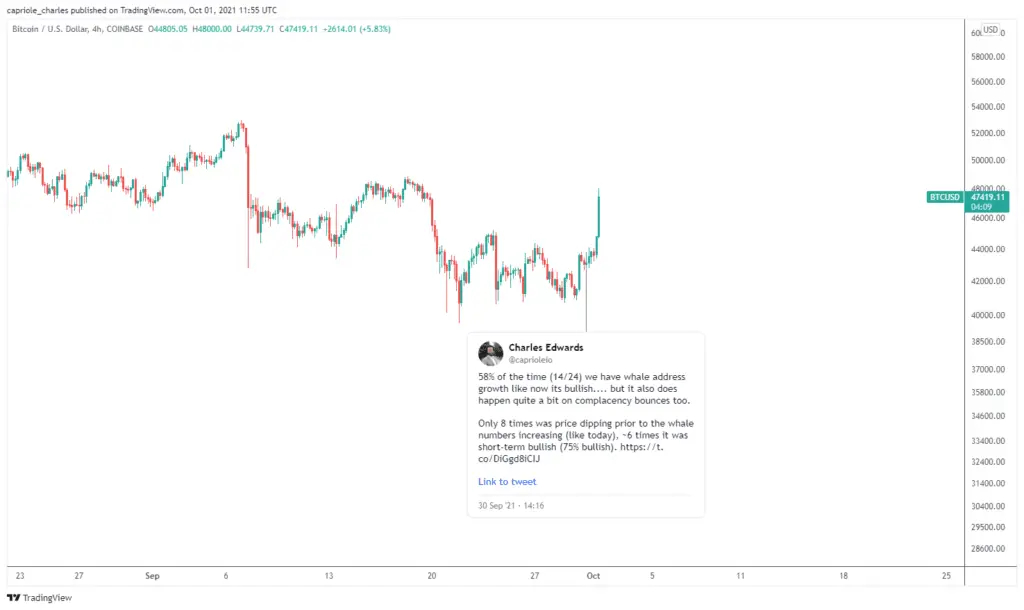

The number of Bitcoin whales (1000K+ BTC) has also finally started to grow following the May crash, which historically has been followed by up moves 58-75% of the time, as noted on Twitter yesterday at $43K.

75% of the time, whale growth similar to yesterday resulted in short-term price appreciation

Whales are buying

Not only are the number of whales multiplying, but the buy pressure from these whales on exchanges is also at the highest it has been since Bitcoin was at $10K over a year ago.

Masses of buy orders on Bitfinex and Deribit set a strong price floor at $40K

Major Sentiment Shift

Perhaps the biggest sentiment shift resulted from China’s total crypto transaction ban. When price moves opposite to the initial impulse and negativity of the news, it often represents a powerful turning point. Bitcoin is now up 6+% just days after China’s total ban.

China crypto ban is fully reclaimed in just days

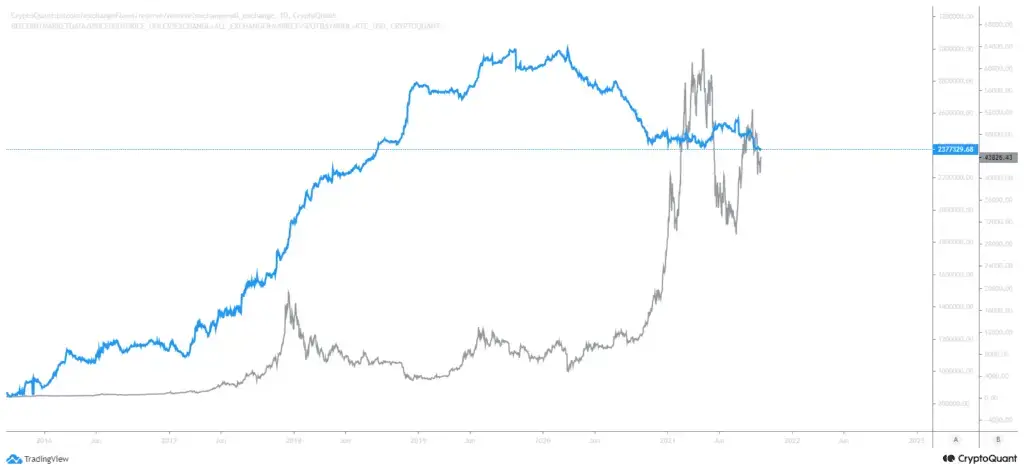

Exchange reserves at their lowest in three years

Bitcoin exchange reserves are the lowest they have been in years. This means there is less liquid supply for selling and buying. A reduction in supply for a similar level of demand is the perfect ingredient for price appreciation.

Through September we continued to see blocks of $1B in Bitcoin being extracted from exchanges like clockwork. Some big institutional announcements are likely to follow in Q4 and beyond.

Bitcoin exchange reserves hit three years lows

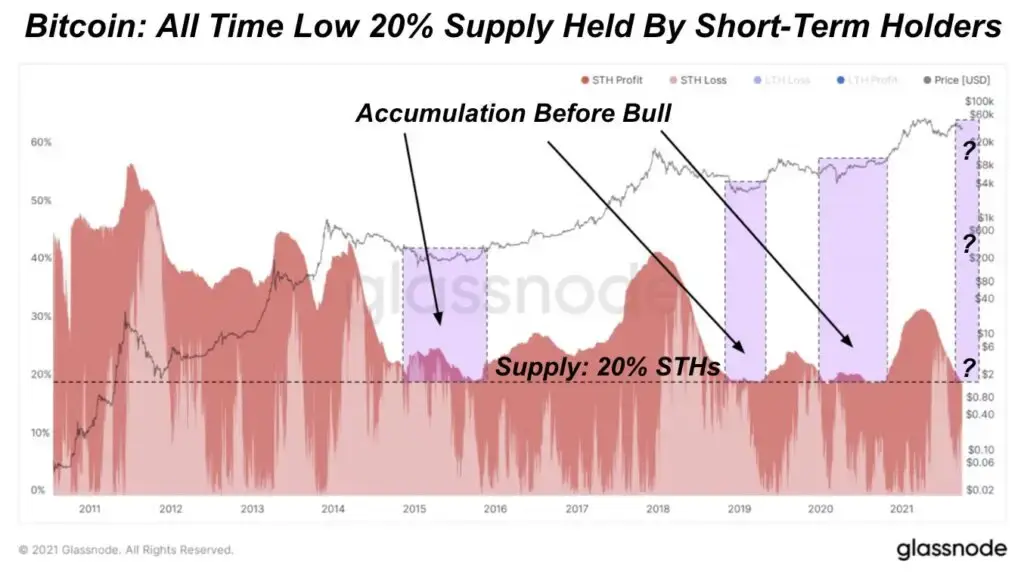

Short-term holder supply thinning out

Short-term holder supply is at its lowest level ever at 20%. Dylan highlights similar times this happened in the past. Typically it is in regions that long term holders are accumulating. This lines up well with what we are seeing in whale numbers, buying behavior and exchange reserves generally.

Bitcoin all time low in short-term holder supply

Downside volatility risk has reduced

Finally, our proprietary volatility metric suggests major downside risk has tapered for now.

Capriole long-term volatility metric suggests major downside risk has reduced

The Technicals

As per last issue, we remain bullish above $40K.

Zooming in a bit, as of writing Bitcoin is running into resistance at the $48K region, which represents the 0.618 Fibonacci level and point of control for volume traded since February 2021. This means that we can expect some resistance/consolidation here.

Holding above daily and weekly support at $45-46K at the end of this week would be a great sign of strength.

The key level to reclaim now is $50K. It is unlikely that daily closes above $50K will represent major resistance the second time around.

So, a weekly close over $46K or daily closes above $50K would be a great risk-on sign for the bulls.

Bitcoin facing some technical resistance at $47-48K

The Bottom-line

Coming into the month, we underestimated the 150 year old September effect. Markets risked off from taper talks, Evergrande fears, debt ceilings, yield curves… you name the narrative, the market sold into it.

It’s almost like the market was looking for something to sell into for September.

All of these macro factors drove Bitcoin down. Add on top of that a few liquidation runs here and there and the China Fud and it was a volatile month.

Nonetheless, major support at $40K held, our technical bullish line in the sand, and we saw whales step in in full force. September saw:

- Step change growth in number of whales, which is historically bullish most of the time

- The highest levels of buy pressure on exchanges from whales since 2020

- A supply squeeze from three year low in exchange reserves

- All time lows in short-term holder supply

- Sentiment shifts as the China effect reversed

In sum, it was a month of short-term volatility, and long-term buying as market movers stepped in.

To see this kind of behavior after a recent -60% decline in Bitcoin, and in the midst of the S&P500s most volatile period of 2021 is a true sign of strength for Bitcoin.

While we expect some near-term consolidation, the stage has been set for a bullish 4th quarter.

Content we like

We are hiring!

Capriole is hiring! We are looking for traders, engineers and machine learning experts. If you are interested in what we do, check out our open positions at: www.capriole.com/join.