Bullish Complacency?

Welcome to Issue 11!

Last issue we noted the improving fundamentals for Bitcoin following the China exodus and subsequent regulatory attack on Bitcoin. We finished the newsletter noting:

“For now, fundamentals and technicals are skewed towards the upside, and our base case is we will move towards the mid- to high-$40Ks over the coming weeks.”

That move played out exactly as expected, today Bitcoin is 17% higher and we find ourselves at $47.3K.

Bitcoin is now consolidating under round-number resistance at $50K, we have half of Crypto Twitter expecting this to be a “complacency bounce”, and the other half calling for new all-time highs.

The move from here could decide if we get the double-bubble super-cycle or re-enter a typical Bitcoin bear market cycle.

The News

Compared to the explosive news events of the last months, August was a relatively uneventful month for Bitcoin. There was no significant news of outlaw or regulation. Instead we continue to see strong signs of institutional validation for Bitcoin. Regulators are taking it seriously in the US, crypto exchanges are adapting to meet regulatory requirements and institutions continue to either buy Bitcoin or establish purpose built Bitcoin investment vehicles. Just another month of Bitcoin continuing to merge into traditional financial rails.

Here’s this month’s highlights:

The Good

- Wells Fargo offering crypto exposure to wealthy clients and registers a Bitcoin fund

- Coinbase board approved to hold $500M crypto on their balance sheet, and further re-invest 10% of profits each year into crypto

- Google allows crypto ads in US

- JPMorgan launches an in-house Bitcoin fund for wealthy clients

- Circle intends to become a full-reserve national commercial bank

- AMC to accept Bitcoin by end of year

- Walmart seeking crypto product leads

- Blackrock, Fidelity and Vanguard invest in bitcoin mining

- Binance introduces mandatory KYC for all services

The Bad

- Binance starts winding down derivatives products across the EU and Hong Kong

- Poly network hacked (and refunded) for $600M

- Japanese exchange Liquid hacked for $74M

The Uncertain

- NFT market cap reaches $10Bs

- Microstrategy acquires another $180M Bitcoin

- SEC seeking more regulatory authority over crypto

The Markets

Another month, another day, another S&P500 all time high.

The markets processed the Fed’s meeting last week incredibly well with a strong bounce following confirmation that tapering would continue to 2022, and that “substantially further process” is required until the Fed will consider tightening monetary policy. So for now, the stimulatory driven S&P rally looks set to continue.

So why do we care so much about the traditional markets?

Almost every Bitcoin correction in 2021 has correlated with a S&P500 correction of -2% or more. The world still sees Bitcoin as a risk on asset.

Our view of the markets remains much the same as prior issues, likely bullish until Fed policy changes and still the largest risk to Bitcoin today, you can read more on why in Issue 10 and prior.

Almost every Bitcoin Correction in 2021 has been triggered by the S&P500

The Fundamentals

On balance Bitcoin fundamentals remain skewed bullish for now. We think these are the most interesting to consider today:

Hash Ribbons

In August we were fortunate enough to get yet another Hash Ribbon “buy signal”, Bitcoin’s strongest long term buy signal. Historically a Hash Ribbon signal is typically followed by a period of 100s percent returns. It’s bullish.

But could this time be different? Sure. We did have the biggest, forced hash rate capitulation ever in May as a result of the China ban. This recovery is a result of miners relocating overseas, many to the US.

But it still shows resilience of the network, strength to come back strong despite 60% network destruction. Miners are continually committing investment into Bitcoin. With prices above $30,000 they are still highly profitable.

For the Hash Ribbon bullish case to stand, we want to see hash rates continue to climb over the coming weeks and months, as Bitcoin’s Energy Value is still at a significant discount to Bitcoin’s price. Nonetheless, such a V-shape hash rate recovery has in most cases historically been followed by significant price appreciation. Finally, when in doubt it’s best to ignore the narratives and go with the odds. In 100% of the prior 15 cases of a Hash Ribbon buy signals through Bitcoin’s history, price went up a lot more.

Hash Ribbons: there are a number of similarities today to late 2020

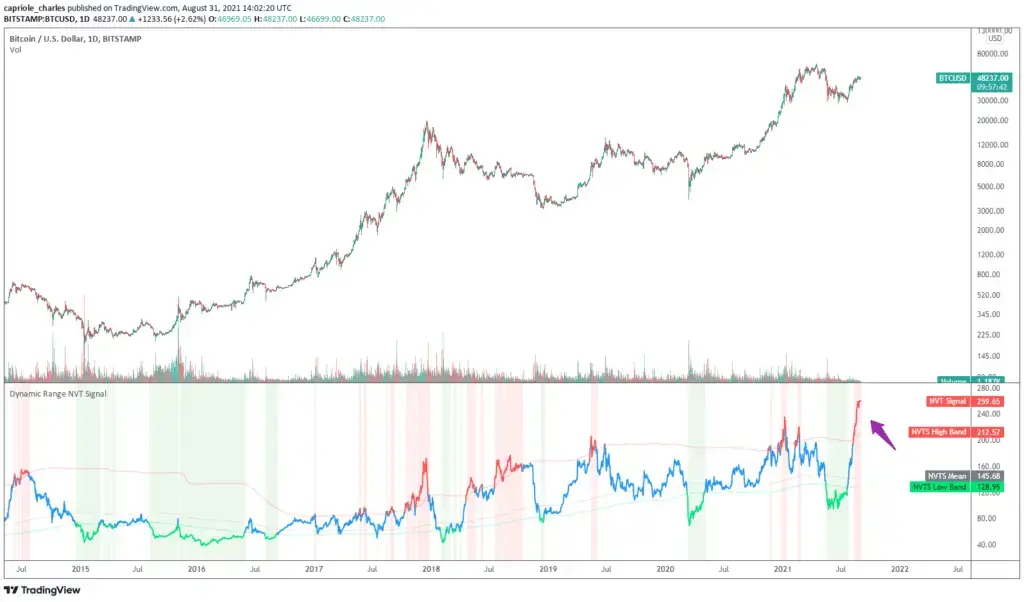

Dynamic Network Transaction Value (DNTV)

DNTV, or Bitcoin’s “P/E ratio”, does give some cause for pause. It is the most overvalued it has ever been. Suggesting that at current prices, Bitcoin’s on-chain utilization is terribly low. Address metrics paint a similar picture. Why might this be?

The retail market was decimated in May 2021. We talked about this last issue, every metric shows retail interest, trading and utilization of Bitcoin has halved and it still has not recovered in line with the 70% price appreciation Bitcoin has seen over the last month. This is somewhat concerning. On the other hand we have strong evidence of institutional accumulation, as shown by the above News, Coinbase flows, and other exchange order book action. We believe more of this accumulation is happening on exchange, in custody and is somewhat less reflected in the unchain DNTV metric. Nonetheless, we can’t ignore how bad DNTV looks. We need to see renewed retail interest to drive sustainable appreciation in Bitcoin from here.

So which is more important, Hash Ribbons or DNTV? Historically speaking, Hash Ribbons has been the more important metric to watch.

DNTV shows Bitcoin as significantly overvalued here

Open Interest and Funding Rates

The final point to consider is that Bitcoin speculation is the lowest it has ever been for prices at these high $40K levels.

Despite Open Interest recovering 40% over the last month, funding rates are near neutral having spent much of the last two months in negative territory. This suggests there are roughly equal participants holding long and short positions (a healthy balance). Historically, funding rates also have not been neutral on “complacency bounces”, giving less weight for now to the dead-cat-bounce argument. Further, Open Interest is still around 20% lower than it was at similar prices in March/April, and instead of being concentrated in Bitcoin futures products, the market currently has a strong preference for stablecoin backed futures products (see chart from last issue which holds today).

The balance between these products (stablecoin backed versus bitcoin backed futures products) tends to reflect general market sentiment, and the market shifts between the two with price movements. In other words, the market is still very cautious here with a high preference for cash. Any substantial price rally will squeeze those with short positions in stablecoins “harder” than those with equivalent bitcoin backed positions and quickly shift the market’s preference towards bitcoin backed contracts. This has the double effect of requiring spot purchasing of Bitcoin to back these contracts (also bullish). Plus it is also cheaper right now to use Bitcoin backed contracts, as stablecoin based contracts have to pay much higher fees for the same effective position. Finally, Bitcoin dominance is near its lows at 43%, suggesting there is a lot of sidelined capital in non-Bitcoin assets. Add all of this together and what does it mean? We can expect compounding movements upwards should Bitcoin breakout to the upside. The same effect would not be as strong to the downside presently. Hence, Bitcoin’s biggest futures market is skewed bullish today.

The Technicals

Last issue we noted the Wyckoff accumulation pattern playing out. It still holds today, though we would have expected a stronger move to the upside, so the breakout has been relatively weak. Nonetheless, from a technical perspective it still holds, as do these other two bullish cases Charles noted on Twitter.

3 reasons to be technically bullish above $40K

More locally, price is currently squeezing between weekly support at $45K and resistance at $49K (neutral).

The Bottom-line

All in all we see Bitcoin today as skewed Bullish. There are some concerning metrics, such as DNTV and general retail usage which we would want to see improved to get confidently bullish. Things to watch closely for to maintain this view are:

- Hash rate continued recovery and growth

- Improved retail metrics

- Neutral/bearish sentiment maintained in the futures markets

Technically things would start to look concerning if we spend time at the $42K handle, as this would invalidate weekly support and the Wyckoff accumulation case. Spending time here would also likely start to invalidate the current evidence for the double bubble.

Our base case is that once Bitcoin achieves one or two daily closes above $50K, it will move swiftly to mid- to high-$50K from there. Likely having the self-fulfilling effect of drawing in fresh retail interest and strengthening some on-chain metrics as it happens (Yes, on-chain is reflexive, sometimes it’s leading, sometimes it’s lagging).

We are hiring!

Capriole is hiring! We are looking for traders, engineers and machine learning experts. If you are interested in what we do, check out our open positions at: www.capriole.com/join