The End of the Wild West

Welcome to Issue 10!

Last issue we reviewed the China’s crypto exodus and argued why we believed the Bitcoin hash rate (then at 102 TH/s) was within 10% of the bottom as “China was no longer the risk factor to Bitcoin”. We were wary of S&P breakdown risk while Bitcoin remains vulnerable and noted the $32-40K range as the key levels to watch for.

Over the last month, Bitcoin’s hash rate spent just over a week in the 80-90TH/s region, and has since shown signs of recovery, with the network sitting on 112TH/s at present. Monthly average hash rate is trending up for the first time since May. Bitcoin did break below the range, going as low as $29K for one day before rocketing back up in true failed breakout fashion. Today we find ourselves at $41.5K, with Bitcoin breaking out of the range to the upside last night.

Regulatory clamp down has been the driving narrative of the last month, with Binance in the crosshairs of most major countries. The days of anonymity on centralised crypto exchanges now appear to be a fading memory.

Bitcoin is growing up, and the days of the wild west are numbered.

The News

The theme of July was regulation, regulation and more regulation.

Bitcoin breaking $1 trillion, then followed by a liquidation driven -55% collapse has put it under the regulatory spotlight.

Here’s this month’s highlights:

The Good

- FTX raises $900M, taking its valuation to $18B

- Elon Musk confirms Bitcoin conviction at the B word conference, stating it is his third biggest investment (after Tesla and SpaceX)

- Nigeria to launch digital currency in October

- Goldman Sachs files with SEC to create a ‘DeFi and Blockchain Equity ETF’

- JPMorgan becomes the first big bank to give retail wealth clients access to cryptocurrency funds

- Mastercard enters the crypto payment card space

- ShapeShift corporation to shutdown and fully decentralize itself out of existence, making it the first traditional entity ever to decentralize

The Bad

- Binance commences banning derivatives trading in the EU, targeting Germany, Netherlands and Italy.

- Binance banned from UK by financial watchdog

- Binance under investigation from various countries for illegal operations, including Malaysia, Cayman Islands, Hong Kong, and Italy.

- Binance ceases support for stock tokens

- BlockFi issued cease and desist orders from several US states

- A fake news report circulates that Amazon would accept Bitcoin in 2021

- Uniswap to limit access to some tokens citing “evolving regulatory landscape”

The Uncertain

- Binance and FTX eliminate the infamous Bitcoin 100X leverage trading, capping leverage at 20X

- ByBit and Binance enforce KYC, closing the gap of the last remaining major exchanges which supported anonymity

- US stable coins are under the US regulator investigation. China also warns stablecoins are a risk to global financial systems.

- New bill in Congress proposes to raise $28 billion from crypto investors via new information reporting requirements

- Huobi dissolves its China entity, a significant landmark as all major exchanges exit China

- The EU Commision to tighten rules on crypto transfers

- UK Treasury looking to implement the FATF Travel Rule for tracking of crypto transactions

- Australian regulator seeks feedback on managing ‘risky’ crypto assets

Some of these movements make sense, some are necessary as Bitcoin “grows up”. But taking away opportunity and freedoms from the retail investor (such as Binance’s announcement to take away derivatives trading in the EU) is a saddening and very anti-crypto movement. Crypto has generated some of the most revolutionary and powerful financial products in history, on a level that was never before been accessible to the “little man”.

It’s unfortunate to see some of these freedoms be taken away; particularly when the liquidation engines of exchanges are considerably safer than those in traditional finance. In crypto you can only lose what you put on the exchange. But in traditional finance, a margin call may mean taking more than you have.

The regulatory facade of protection is really about maintaining the status quo of traditional finance, banking and institutional establishment – ala: control. It will be interesting to see how these regimes butt-heads when DeFi and the traditional world lock horns in the coming years.

The Markets

In the near term, a collapse in traditionals remains our biggest threat to a large collapse in Bitcoin. The correlation between the two markets remains high during times of turbulence. At the same time, we cannot ignore the old adage “don’t fight the Fed”. And the Fed actions to date have been continued balance sheet expansion, and this week’s meeting confirmed that it will not be slowing down in the short-term.

At some point, as we have laboured on in the past, we believe this model will not work, But continuing the print is one of the few options the Fed has now. Raoul Pal explains this very well in this great thread on inflation, for now the ”merry game of systematic bailout MUST continue….”. This works great, sending stock markets to new all time highs, until it doesn’t.

The Fundamentals

For the first time in the last few months, the Bitcoin network is starting to show signs of life.

Hash Ribbons look promising, but we’re not out of the woods yet.

As Bitcoins price bottomed at $29K last week, hash rate and Bitcoin’s Energy Value both grew by 8%, setting the first positive turning point in the metrics since the collapse. Hash rate is showing a positive and strong trend, not dissimilar to December 2018, suggesting the bottom could be in. However, Hash Rate can give various false positives during capitulation. This is why we remain cautious until the Hash Ribbon buy signal is confirmed.

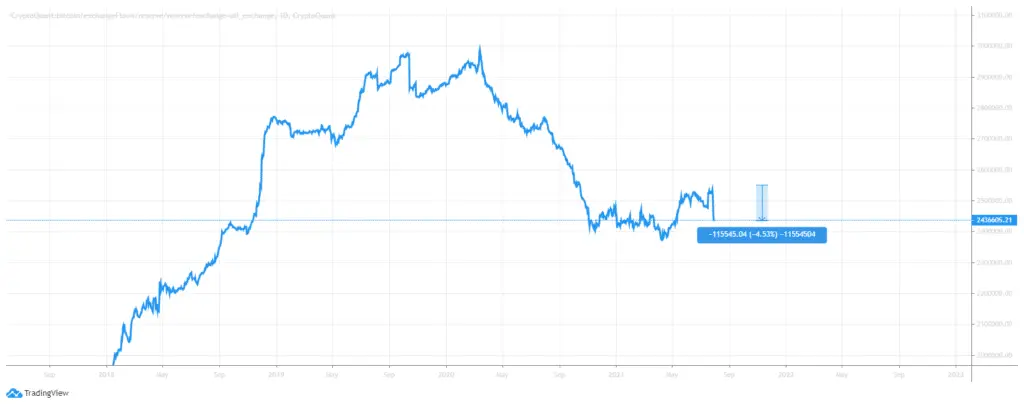

Exchange Flows signify accumulation.

Exchanges showed their first positive outflows since the crash this week, dropping nearly -5% as Bitcoin rallied from $29K lows. While no doubt some is related to Binance’s new KYC requirements, the fact these coins have not yet flowed into other exchanges is a positive indication of market demand. Definitely the sort of characteristic we would like to see more of for a bullish accumulation case.

The first major exchange outflows in months occurred this week. Data: www.CQ.live

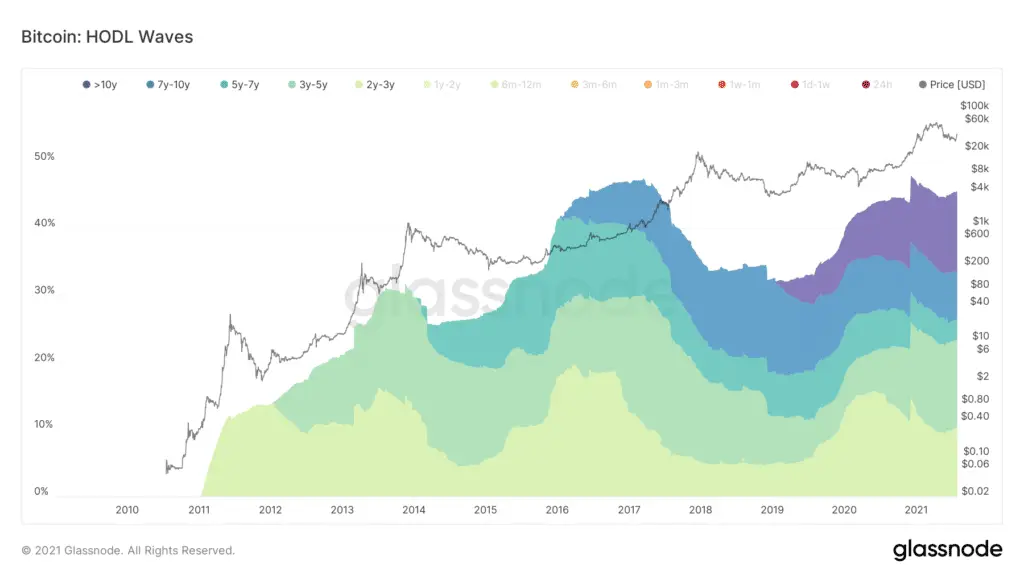

Hodlers are growing, this did not happen at the end of prior bull markets

Our favourite version of HODL Waves, the 2-year plus threshold, shows that as of late May 2021, long-term holders are once again growing their supply. This type of sharp rise never occurred in the early stages of prior bear markets, suggesting that there is a chance the Bitcoin bull-cycle is still intact.

2-year HODL Waves, coins held that have not moved for at least 2 years are trending back up Data: www.Glassnode.com

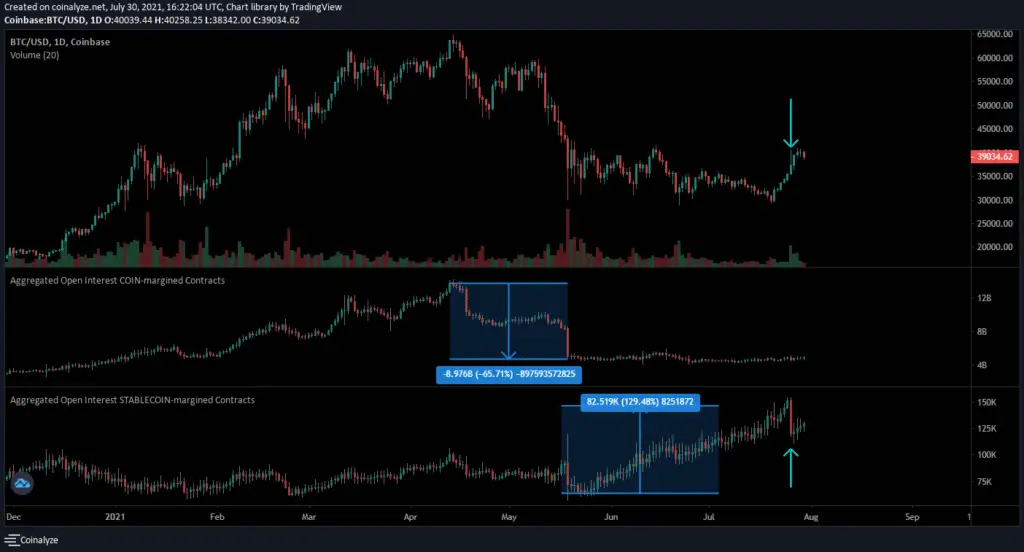

The Short Squeeze

Last week saw a powerful Bitcoin short squeeze from the $29K lows. Often when a breakout is invalidated (a “failed breakout”) the counter-move is swift and powerful. In this case we saw major support fail at $30K, but negligible price follow through to the downside. The market was already “too short” and there were not enough new sellers to push price further down. Bitcoin drifted and quickly closed back above $30K, invalidating the breakdown bear case. The ensuing squeeze to the upside was supported by a heavily short market, with over-exposure to stable-coin contracts. This resulted in a short squeeze over the last week which culminated on the candle highlighted, where stablecoin futures open interest dropped 20% in one day.

The market is heavily exposed to stable coins and hedged short positions

MVRV suggests caution.

MVRV, Market Value to Realized Value shows some cause for concern. While we are in neutral territory right now, the sharp rally we have just seen after a massive collapse in MVRV usually does not result in continuation except in the 2013 double-bubble case.

MVRV Z-Score Metric. Data: www.Glassnode.com

The Technicals

The Bitcoin chart is showing signs of a possible Wyckoff accumulation, with the recently close above $41K high a “sign of strength” (SOS). SOS suggests we can expect some consolidation above $40K, with a higher chance of an upside breakout (towards the $45K region).

A breakdown below $39K would invalidate this in the near-term.

Possible Wyckoff Accumulation forming

Is the bear market over?

Supercycle? Double-bubble? Up Only?

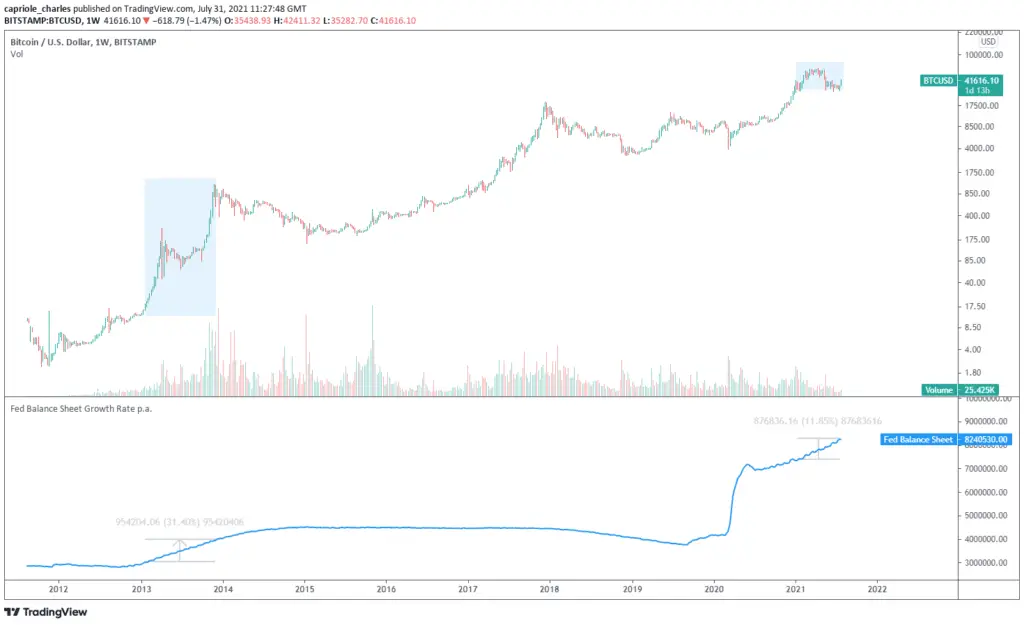

Bitcoin cyclical history would suggest there is little chance of the double-bubble scenario, (making new highs this year, after a comparable major draw down). Only once out of the prior three cycles was this different. Is “this time different”?

One of primary driving narratives of institutional adoption over the last year has been Bitcoin as an inflation hedge. While Bitcoin in 2013 was a very different asset to today, the year of 2013 saw significant growth in the Fed Balance sheet, greater than 2021. Continuation of the Fed printing policy and the inflation hedge narrative could therefore support the double-bubble case. Nonetheless, as is the nature of Bitcoin, we have very limited long-term data as it relates to macroeconomics, so this should not be considered a certainty, but rather something which could sway the tides of a normal Bitcoin cycle and open up the possibility of alternative scenarios.

The Fed Balance sheet saw significant growth in 2013

Bear market in? 80% drawdown?

All prior Bitcoin bull cycles peaked on retail engagement. But retail was crushed over the last three months:

- On chain transaction volumes dropped -50%

- New Addresses and Daily Active address counts dropped -50%

- Coinbase has dropped from No 1 app to under 300

- Google searches for “Bitcoin” dropped -75%

- Contract Open Interest down -60%

These are all factors common to the end of a Bitcoin bull market.

So what can we expect?

In sum, caution should be maintained for now. Bitcoin is a quickly evolving asset. It has gone from $0 to $1T in a decade. It’s gone from retail wild west to company balance sheets, bank funds and regulatory oversight in just the last year. History provides us some insight but we are also in uncharted macroeconomic waters. The long-term outlook for Bitcoin is incredibly bullish over a multi-year period. In the short-term we would like to see significant rebound in at least some of the following factors to confirm continuation for this cycle:

- Renewed retail interest

- New institution adoption / balance sheet acquisition announcements (not from Microstrategy)

- Significant rebound in on chain metrics (eg. addresses, hash ribbon buy signal, new cycle lows in exchange reserves)

- Price reclaiming $55K

Until then, Bitcoin history tells us to be cautious.

The Bottom-line

Over the last two weeks in particular, the Bitcoin network has finally started to show signs of life. China’s damage is primarily done and metrics like hash rate, hodl waves and exchange reserves have ticked up, suggesting growth and a renewed case for possible bull market continuation. But they haven’t reached levels which would undoubtedly confirm continuation of a bull market yet.

Other metrics suggest this is the normal behaviour of a new bear market, such as address activity and MVRV.

The picture now is no doubt significantly more promising than a month ago. But more time is required and Bitcoin needs to continue building strength from here over the next couple months to sustain a bull market.

The pace of regulatory developments over the last month has been incredible. A year ago it was hard to imagine every exchange requiring KYC and every major developed country investigating crypto. As of this month, that world is well and truly upon us. Bitcoin hitting $1T finally caught regulator attention.

The days of Bitcoin’s wild west are coming to an end.

This will open up new and exciting pathways towards further institutional adoption. Regulation is needed to take Bitcoin into the multi-trillion-dollar market caps. We just hope it won’t damage the capabilities of the little guy too.

It’s worth noting that the market’s acceptance of the significant amount of bearish news over the last months, from China to mass regulation, with price closing now above $41K is also very telling. Bad news is finally being eaten up which signifies a major sentiment shift compared to just weeks ago and a possible turning point.

For now, fundamentals and technicals are skewed towards the upside, and our base case is we will move towards the mid- to high-$40Ks over the coming weeks. In the near-term this thesis would be invalidated if we breakdown below $39K. Finally, Bitcoin cycle history tells us to be wary of significant volatility and downside risk until conditions are further improved.

Content we love

- TradingRiot’s summary of Price Action

- Raoul Pal’s thread on inflation

- The latest on the US Digital Asset Market Structure and Investor Protection Act for insight into regulator’s point of view

We are hiring!

Capriole is hiring! We are looking for data engineers, quant traders and machine learning experts. If you are interested in what we do, send us your CV and some sample work to: [email protected]