The Biggest Attack on Bitcoin

Welcome to Issue 9 – The China Special!

These are unprecedented times. The Bitcoin network has just experienced the biggest attack in its history. 50% of Bitcoin’s security has been wiped out in just over a month as hash rates plummet from China’s mining ban.

Given the technicals and fundamentals remain mostly unchanged (Bitcoin is still trading within the same $32K-$40K range we identified last month) we will focus this month’s newsletter on the elephant in the room – China’s crushing of the Bitcoin network.

Last issue, there was a great deal of uncertainty regarding how swift (if at all) enforcement would play out. China does have a long history of implementing, but not enforcing, Bitcoin bans.

However, the worst case scenario for a China mining ban has now played out. Swift enforcement across major mining provinces has resulted in a peak-to-trough -53% drop in hash rate as of writing.

The News

Here’s this month’s highlights

The Good

- Google lifts 2018 ban on crypto exchange and wallet advertisements

- El Salvador makes Bitcoin legal tender with plan to add $150M to to reserves

- Microstrategy private offering of $400M senior secured notes to acquire additional Bitcoin

- Microstrategy announces $1B equity raise (for high probability Bitcoin purchasing)

- India moves to classify Bitcoin as an asset class (reversing prior ban statements)

- Basel Committee’s proposal gave banks a green light to hold Bitcoin and other digital assets

- State Street, a US custody bank that oversees more than $40T in assets, is setting up a new digital division

The Bad

- China blocks crypto influencers on Weibo

- China mining ban enforced in XinJiang

- China mining ban enforced in Sichuan

- China’s Yunnan confirmed mining ban will be enforced by month’s end

- Max Kieser’s “We’re not fucking selling” at biggest Bitcoin event ever

- Ruffer bought $600M Bitcoin in November 2020, and announced they fully exited in April for $1B profit

- Thai SEC bans exchanges from handling certain token types including NFTs

- The Fed expects two rate increases expected in 2023

The China Ban

This week one of the biggest Bitcoin mining regions in the world, Sichuan, forced 26 large miners to shut down and we saw a -20% drop in hashrate since Friday. Just 1.5 years ago, Sichuan represented up to 50% of the Bitcoin network, and 48% of Bitcoin’s renewable energy usage.

It’s a triple hit. Network security is down -50%, energy value is down -17% and falling and Bitcoin’s per kilowatt ESG impact has worsened.

In 2020, Cambridge estimated that China accounted for 65% of Bitcoin’s global hash rate, split across 10 Chinese provinces.

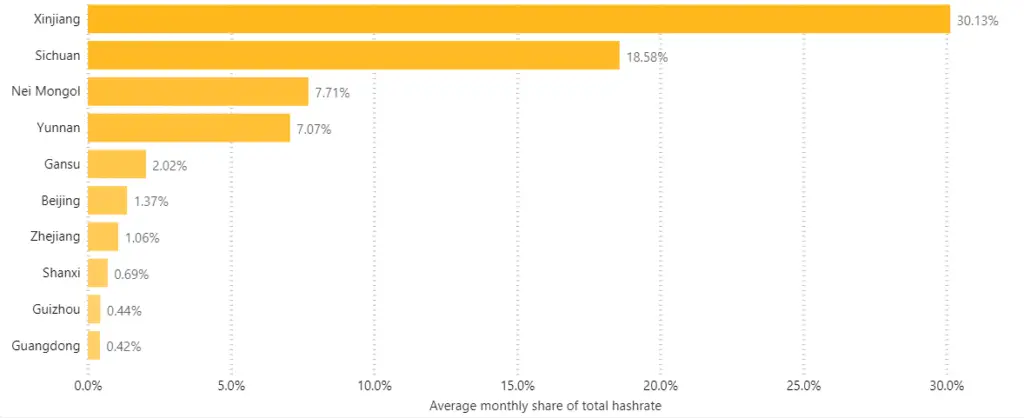

Share of Hash Rate by Province in China, 2020

About 53% of Bitcoin’s hash rate was accounted for in the three Chinese provinces Xinjiang, Sichuan and Inner Mongolia based on Cambridge research.

Over the last three weeks, all of these regions have now enforced the Bitcoin mining ban, and we can see the direct and comparable impact on the Network’s hash rate in the below chart.

China’s 2021 mining bans and their approximate impacts on Bitcoin’s total hash rate

What of the remaining hash power in China?

China likely will not pursue every single region and miner to enforce the Bitcoin mining ban. It would be an almost impossible task. There will always be some small-scale ongoing Bitcoin mining activities in China, so we don’t expect the ban to be 100% effective.

Based on the -53% drop in total hash rate to date, we can estimate that around 80% of the total hash rate in China has already been shut down based on Cambridge’s 2020 data.

The good news is this means the worst of the mining ban enforcement is now behind us.

We also know that China’s next largest mining region, Yunnan, plans to enforce the mining ban this month and Yunnan represents about 8% of Bitcoin’s total hash rate.

So from here, a further drop in the global hash rates in the region of -10%, attributable to the China mining ban is possible but much more would be unlikely.

New growth

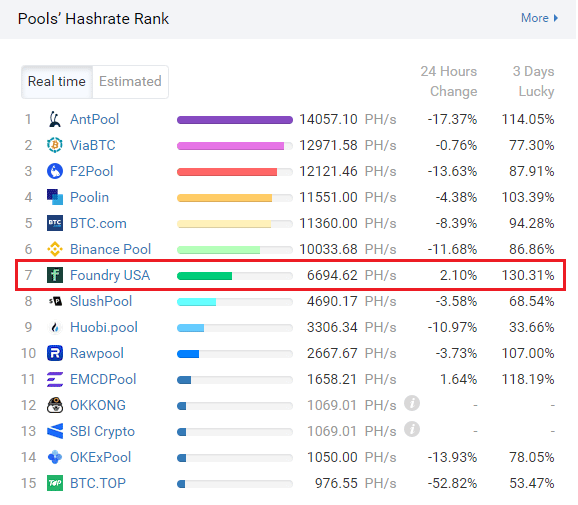

While we have seen a -53% drop in hash rate from Chinese miner shutdowns, some of this has been offset by new mining initiatives overseas. We have seen new pools such as Foundry USA launch, which went from zero hash rate to over 7% of the global network as of writing. Many Chinese entities have also made plans to set up shop in other mining friendly countries.

The BTC.TOP CEO suggests that taking the machines offline means losing 2-4 weeks of revenue producing mining time. So from here we can expect that Hash Rate (from a China perspective) has primarily bottomed, and all things equal, we are likely to see global hash rates start to trend up from July onwards.

The brunt of the force of the China mining bans has been dealt. We are at a point where the network can now start to recover.

Foundry USA Mining pool has gone from zero to 7% of total hash rate this month

Cascading Miner Capitulations

The China ban has led to the first forced miner capitulation Bitcoin has ever seen.

Because Bitcoin’s price is down 50%, other global miners are less profitable. Measured price drops below $30K per Bitcoin, could see price and hash rate cascade further down as less efficient bitcoin miners capitulate. In other words, hash rate can fall further than what China’s total hash rate represents.

The China bans and corresponding hash rate drops have also been driving down Bitcoin’s Production Cost. This means any extreme events can have significantly larger downside magnitude than would have been possible just two months ago.

For now, hash rate drops of more than 10% are not our base case.

We believe it would require significant price drops and/or time below $30K to trigger an additional cascading miner capitulation event.

Historically, hash rate capitulations have happened over weeks and months, more gradual trends. The decisive force of the CCP has meant the China hash rate collapses have happened literally overnight from the moment provinces enforce the bans.

The upside of this is that “ripping off the bandaid” could mean the path to recovery is faster given mining is still largely profitable and the cause for capitulation is not driven by genuine business collapse.

Miner capitulations like what we are experiencing now are not good for Bitcoin, but their troughs usually represent the best buy signals in Bitcoin history.

So while the probability of further hash rate drops today is lower now that the China ban is mostly enforced, the potential downside magnitude of price impact is conversely higher.

The Markets

As we commented last month, tremblings of inflation concerns and an increasing requirement for future tightening are presenting themselves.

The current policy of infinite QE cannot go on forever without management of interest rates or debt reduction at some point in the future. Without at least two (ideally three) of these measures working together, the impact to the dollar reserve and broader markets would be devastating if the current policy was maintained indefinitely.

Last week the Fed finally acknowledged this publicly, and signalled that rates will have to increase twice in the next two years. While this future rate plan might not sound like much, the Fed is signalling to the market that this “infinite money” party cannot go on forever. The Fed also raised its inflation expectation by 41% compared to just 2 months ago to 3.4%. The S&P500 responded dropping over 2%.

Over the last 18 months, major policy changes and S&P500 moves have resulted in comparable but greater magnitude moves from Bitcoin. Despite the narrative, the market still very much prices Bitcoin as a risk asset, so large risk-on / risk-off moves in traditionals will impact Bitcoin.

Now that Hashrate drops from bans have more or less played out, the biggest risk factor for further Bitcoin price plunges is a breakdown in the S&P.

This is a very real and prominent risk to Bitcoin here.

Chris Ciovacco’s weekly video on the market outlines why there are higher odds of a stock market correction now.

Energy Value at a tipping point

Bitcoin’s high timeframe market structure has broken to the downside. A number of signals suggest the top is in for this cycle, while others suggest we are locally oversold and it is too early for a cycle top to be in.

A look at Energy value says we are still 40% above intrinsic value. This is normal in bull-runs and could represent a buy opportunity. But the current situation, a -55% collapse in the network, is definitely not normal for a bull run. These are very unusual times. There is no historic playbook for this scenario.

If the S&P breaks down, it would not be unsurprising to see Bitcoin move a lot closer towards its long-term fair value, currently in the regions of the 2017 high at $21K.

The Bottom-line

Most of the China ban has now been enforced, the worst of it is likely behind us now. We could see further hash rate drops in the order of 10% from enforcement in Yunnan and other regions in coming weeks, but likely not much more.

Entities are already setting up overseas, respawning growth. Chinese miners moving overseas will likely start contributing to the global hash rate again over the next 4-8 weeks. We expect this hash rate growth to continue into the future, and look forward to further developments like El Salvador’s volcano powered miners.

All in all, further hash rate drops from China are no longer the risk factor to Bitcoin, but an S&P breakdown is.

Should the S&P correct significantly here, especially given the Bitcoin network’s current weakened state, it could be enough to send Bitcoin well below $30K and towards its 2017 high.

Conversely, hash rate recovery in the midst of healthy traditional markets, will likely see Bitcoin rally from here.

Like last issue, a breakout of the current weekly range of $32K-$40K will be telling.

The two most important signals to watch for now are an S&P breakdown, and conversely, a Hash Ribbon buy signal.

Content we love

- Chris Ciovacco’s weekly video on the market, and why there are higher odds now of a stock market correction.

We are hiring!

Capriole is hiring! If you are interested in what we do, check out our available jobs on LinkedIn or send us your CV and some sample work to: [email protected].