Options and Futures

Welcome to Issue 6!

Every month we write a short update on the market. Last issue, when Bitcoin was $48K we noted:

“Downside looks limited. A flushout of leveraged traders may be required before continuation, in which case low $4X,XXX K would be an attractive region to buy.”

Bitcoin surged on to $58k, and then dipped to a low as $43K, presenting indeed a great opportunity to buy.

Since then, Bitcoin set yet another all-time high at $62K, and as we are writing this newsletter, Bitcoin is consolidating around $59K.

The News

Here’s this month’s highlights:

- Bitcoin reaches $1T market cap

- Microstrategy buys $1B in Bitcoin after another note issuance

- Visa is working to allow Bitcoin to be used wherever Visa is accepted

- Tesla now accepts Bitcoin as payment currency. Further, they intend to HODL it all.

- Multiple Bitcoin ETFs announced, including from Fidelity, Goldman Sachs, SkyBridge, Morgan Stanley/NYDIG, VanEck, Valkyrie, WisdomTree and Bitwise

- Morgan Stanley becomes first big U.S. bank to offer clients access to Bitcoin funds

- BlackRock confirms they are getting into Bitcoin

- PayPal allows U.S. customers to use their crypto to pay merchants globally

It is hard to believe that it has only a month. So much has happened. Several large institutions have announced they are getting into Bitcoin and as the bull market continues, this list will just grow larger.

The Markets

This month the new stimulus checks were issued. Expectations of the markets were high, and a survey even suggested that $40B could flow directly into bitcoin and the stock market. Initially, the expectations were met, as both Bitcoin and the S&P500 set new all time highs. But the last two weeks, stock markets consolidated and Bitcoin took a step back. Currently, Bitcoin is more correlated to the stock market than to gold, which suggested a correction in the stock market could impact Bitcoin as well.

One reason why Bitcoin and stocks moved together recently is the long term bond yields. Bond yields have been low during the last years, which has driven investors to riskier investments like stocks and Bitcoin. But this month, bond yields rose sharply to their highest level since pre-Covid-19. The alignment of the bond yield rise and the approval of the latest stimulus checks is not a coincidence. When inflation expectations are high, the future value of bond payments is worth less. This decreases the value of bonds today and simultaneously drives up yields. The situation was not helped by the FED announcing they do not intend to take specific action to keep rates low. Stocks and Bitcoin were hit hard as investors de-risked into risk-free alternatives.

https://www.tradingview.com/x/Cm0AZMWc/

The Fundamentals

The Network

The Bitcoin network is stronger than ever. We recently saw new all-time highs in addresses with non-zero balance, and the number of active addresses is near the all-time high as well. Miners continue to increase their output, as both hash rate and difficulty level have set new all-time highs in the past week.

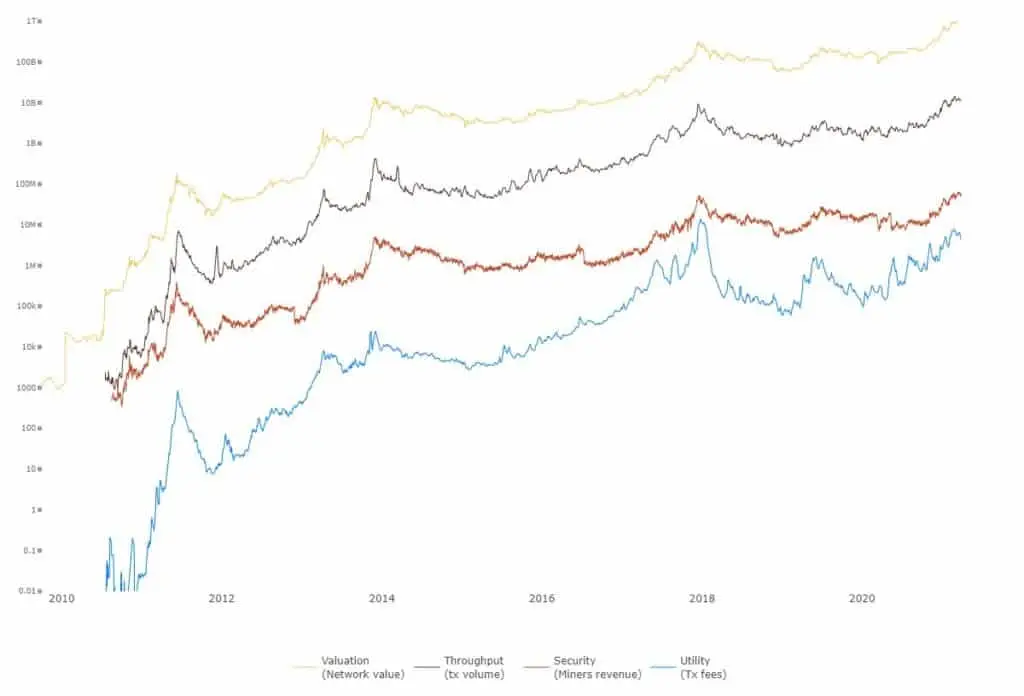

Other interesting network properties to look at are the market cap, throughput, security and transaction fees, as shown below.

Of the top two lines, Throughput (brown) is total transaction volume. It shows how much value is handled by the network and it’s a good indicator of broad adoption. You want to see it grow in line with Bitcoin’s Market cap (yellow). Both recently set all time highs.

The bottom two lines show Security (red, AKA: miner’s revenue) and transaction fees (blue). It’s great to see new highs in miner revenue, which indicates miners, and the network integrity, are in a healthy position. While at the same time the network hasn’t become overly costly to operate. Bitcoin fees are still below 2017 highs, despite the market cap being nearly 200% higher.

All in all – these network metrics are a signal of health.

Bitcoin Network Properties by Woobull Charts

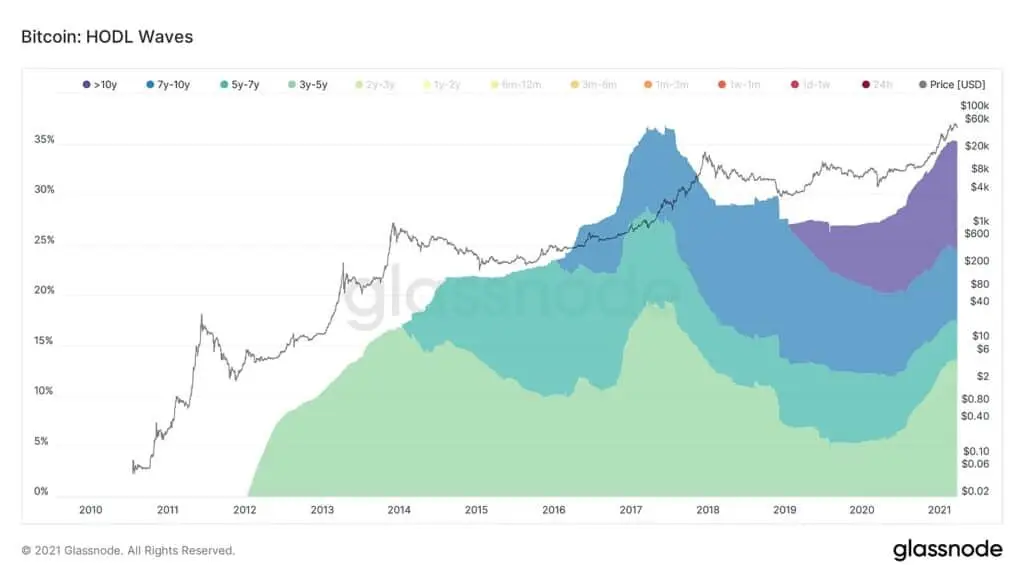

HODL Waves

In our January newsletter, we discussed that the HODL Waves indicated that hodlers of more than 1 year had started to sell their Bitcoin. Hodlers of more than 3 years, however, had been through the previous cycle and knew that it was not yet the time to sell. In recent weeks, the 3Y+ old coins have started moving as well. Looking at the previous cycle, this could indicate that we are about halfway through this bull market.

Options and Futures

On Friday, more than $6B in Bitcoin options and futures expired, marking the biggest expiry to date. The growing interest in these products can have a significant impact on the price of Bitcoin.

Options

A widely discussed theory when it comes to Options is the Maximum Pain theory, which states that the price of the underlying will gravitate towards the price that causes the maximum number of option contracts to expire worthless. Whether this is true, or the narrative is just a self-fulfilling prophecy, we don’t know. The historic dataset for Bitcoin is just too small. But in the past months, Bitcoin has set local bottoms around important option expiration dates. This time around, the maximum pain was at $44K, and indeed Bitcoin dropped significantly in the days leading up to the expiration, bottoming on the day before it. If this theory is true, we could see good upside in the next few weeks.

Futures

In the current bull market, expectations are high. Bitcoin futures are trading at significantly higher prices than Bitcoin itself. By buying Bitcoin and shorting the futures, the delta between those two can be locked in as a risk free trade. Not surprisingly, hedge funds have taken massive short positions in Bitcoin in the recent months. This is a big endorsement for Bitcoin, as it shows that Bitcoin is becoming a serious asset class.

It shows that over $1B is tied up in Hedge fund arbitrage-shorts. This figure is growing fast. And the good news? All these shorts require long-spot positions to hedge risk, so more and more Bitcoin supply is being sucked out of the market just to maintain these short positions. Yet another factor that rachets up Bitcoin’s NGU technology.

Hedge Funds have a significant net short position in Bitcoin. Data by The Block.

The Technicals

[Reminder – we are an algorithmic investment manager – the below provides us insight but charting is not used in our investment strategy]

High Timeframe

On the high timeframe, Bitcoin set a new higher high at $62K, so the strong uptrend continues. However, the correction came soon after and a trendline was broken, causing some downside. After a nice dip into a weekly support, it bounced back up and as we are writing this newsletter, it is trading around the level of the previous all-time high, which coincides with a weekly resistance level.

https://www.tradingview.com/x/4G6kssFi/

Low Timeframe

On the low timeframe, we saw several lower highs and lower lows consecutively. This usually means that there is a downward trend, until the pattern is broken. In the past days we have seen a break of this trend as shown by the closing above the previous local high. This suggests that continuation to new highs is on the table.

https://www.tradingview.com/x/bopegZJM/

All-in-all the both timeframes are skewed bullish. However, that doesn’t mean right now is the best place for a good risk-reward long entry. Until we see closes above daily/weekly resistance (~$60K), or a dip into support, we do not have a clear technical buy signal at 59K.

The Bottom-Line

Bitcoin’s exponential rally over the last few months is showing some wear and tear and healthy signs of consolidation, but the underlying network is as strong as ever. The option expiry on Friday suggests downward pressure has eased for now, and Bitcoin may soon continue its march for new highs. A daily close above $60K will provide a good technical breakout buy signal for the short term.

Historically, April is the second best month for Bitcoin returns. With an average return of over 20%, the 70Ks are on the cards.

In any case, we cannot wait for another month of this Bitcoin Bull Market. So sit back, relax and HODL on!

Podcast

Last week, Charles was a guest on The Investors Podcast – Bitcoin Fundamentals with Preston Pysh. They talked about the Bitcoin market, alternative investments and our newly launched US fund! In case you missed it, you can listen here.

Content we love

- Lyn Aldens post on the third round of stimulus checks and disposable income

- How it started, and how it’s going for anti-Bitcoin companies. It just shows you how quickly the industry has developed. Can’t help but think of Mahatma Gandhi: “First they ignore you, then they laugh at you, then they fight you, then you win”

- The Aker shareholder letter announcing the establishment of Seetee, a company that will invest in exciting projects throughout the Bitcoin ecosystem

We are hiring!

P.S. Capriole is hiring! If you are interested in what we do, check out our current jobs here.