The Christmas Special

Welcome to the third issue of the Capriole Newsletter.

Every month we write a short update on the market. We try to time this around pivotal moments for Bitcoin. Our last issue evolved around the break of $14K, which we deemed significant and incredibly bullish. Our expectation was that Bitcoin would continue the run up, and potentially find major resistance between $19-20K. As it turned out, Bitcoin did face its first major pullback here and corrected to as low as $16.2K.

The night before Christmas, we find ourselves at $23.5K, fresh all time highs in our recent memory. It’s been an incredible year for Bitcoin, but 2021 looks set to shake the foundations of finance to its core.

The News

The news of the last few months has been that of increasing interest and investment from global leading traditional hedge fund brand names. Almost every week in November and December saw multi-hundred-million-dollar investments from major institutions. The large players are putting their money where their mouth is.

- MicroStrategy purchased an additional $650M Bitcoin, bringing their investment to over $1.2B

- Grayscale bought over 69K Bitcoin (approx $1.4B) over the last 30 days

- Ruffer Investments confirmed $744M Bitcoin purchase

- Alan Howard and Eric Peters commit $1B to Bitcoin

- $51B global investment firm Jefferies confirmed selling gold and investing 2.5% portfolio in Bitcoin

- Guggenheim’s CIO set a $400K target for Bitcoin

- CME Ethereum Futures

The Markets

Correlations with traditional markets remain low but increasing through December 2020. While near term risk of a stock market correction impacting Bitcoin are relatively low, it may be the highest risk factor to Bitcoin at present given all other factors discussed later are quite low risk.

The CBOE Put Call ratio is currently at a low level, which can indicate near term tops in the stock market. That said, the major driver for the stock market rally continuing will be how soon and to what extent a stimulus package can be released in the US. Major delays or low value stimulus checks are the risk factor. Through most of 2020, Bitcoin has maintained correlation with the stock market during major moves and periods of extreme fear and greed. At present, the F&G index is neutral (57%), which is a positive sign for Bitcoin.

We still expect major traditional market events to impact Bitcoin. However, the increasingly large positions of institutions in Bitcoin, explicitly as an alternative to gold, provide promise that any major selloff in stock markets likely would not see the same catastrophic collapse in Bitcoin that we saw in March 2020.

Nonetheless, the biggest risk factor for Bitcoin now is likely to be unforeseen regulation, or disappointing stimulus outcomes.

The Fundamentals

Hash Ribbons

December saw the surprising occurrence of a post-halving Hash Ribbon buy signal. This is quite a rare event as outlined in our last newsletter. Given the drivers of this signal, it’s easy to second guess the credibility of it – as there is a strong narrative it was driven by miner relocation in China – not capitulation. Nonetheless, it’s always best to go by the data (not the narrative) which still suggests the Hash Ribbon signals are incredibly powerful.

Hash Ribbon buy signal is already up 26% in just 16 days.

— Charles Edwards (@caprioleio) December 20, 2020

Every single Hash Ribbon signal since indicator release 16 months ago has had minimum 25% return within 3 weeks. https://t.co/02WtG5f1HJ pic.twitter.com/gxUojkms5S

A key ingredient of Hash Ribbons is positive price momentum. So the simple fact we broke out of Bitcoin’s biggest resistance ever at $20K, and into fresh all time highs, gives the December Hash Ribbon buy signal even more validity. Price has now confirmed the fundamentals. Given the Hash Ribbon Signals usually identify multi-month positive periods, even though this signal occurred 3 weeks ago, it still carries a lot of bullish weight.

Institutional Interest

Institutional interest is also observable in the data, with CME Open Interest up over 1000% in 2020 and now at the $1.5B mark.

CME Aggregated Open Interest breaking fresh records in line with institutional news headlines

Short-term Warning flag

While most fundamental metric is suggest long-term bullish bias, a couple are showing signs of overheating, including Dynamic NVT and the Bitcoin Utilization Oscillator. It’s worth noting that both of these metrics can experience extended periods in the “overbought” region during a bull market, and we expect that to continue through 2021. It does mean that some caution is warranted at $23.5K at present though, and there may be an opportunity to catch a dip.

While institutional investment has continued to be a force to be reckoned with, the holiday period may cause a short-term demand suck. We saw a similar dip on Thanksgiving which was very quickly bought up. If a dip is to occur over the coming month, there is a high likelihood that it will occur over the next 7 days during the Christmas/NY break as institutions shut doors and profit taking continues at the end of this tax year. But if this dip doesn’t occur soon, all else equal, it may not occur at all as major institutional demand resumes in January.

Dynamic NVT suggests a short-term correction may be on the cards

The Technicals

High Time Frame

The breakout above $20K is incredibly significant. Contrary to common misconceptions, fresh all time highs (ATH) usually lead to more ATHs. In order words, all things equal, there is a higher probability of upside continuation when an ATH has just been made. This has been studied and written about extensively in traditional markets.

For Bitcoin, fresh all time highs lead to a positive week more than 70% of the time through its 10 year history. In other words, buying high in a bull market where recent all time highs were made is actually much more profitable in general than buying at other randomly selected points in time.

Out of the 129 times BTC hit an ATH in 2013 and 2017, 97 instances were followed by a positive week. That is 72%! Compared to 56% for any random week since 2013.

— Jan (@uytjan) December 22, 2020

Even longer term this works: 2 month return was positive 80% of the times after ath, compared to 59% in general.

Further, having broken ATHs, there is no significant levels of upside resistance from here. From a simple Support/Resistance point of view, the odds are also skewed to the upside.

That said, most ATH breakouts do have re-tests of the breakout. So it would not be unreasonable to see a quick visit to the $20K area.

Low Time Frame

While Capriole is purely an algorithmic asset manager, everyone loves a nice clean chart! If we had to guess, this is what we would expect for the coming weeks price action using old school Wyckoff theory. This should be considered a broad guideline only – our systems trade the data as it is at any point in time, 24/7.

A plausible price action scenario over the holiday period which would complete a Wyckoff re-accumulation structure. The blue line is for visualization only, a dip here could go lower towards the all time high region.

There is a lot of support in the $19-21K region. All time highs, major order book resistance which will now likely form support and major institution accumulation in these regions. Bitcoin Production cost is also around $18.6K and growing.

The above low time frame price action would align well with the overheating we are seeing on some short-term fundamental metrics like Dynamic NVT. While we would not count on a dip, anything between $19K-21K would be a reasonable expectation based on the technicals and likely represent an incredible buy opportunity.

Our 2021 Forecast

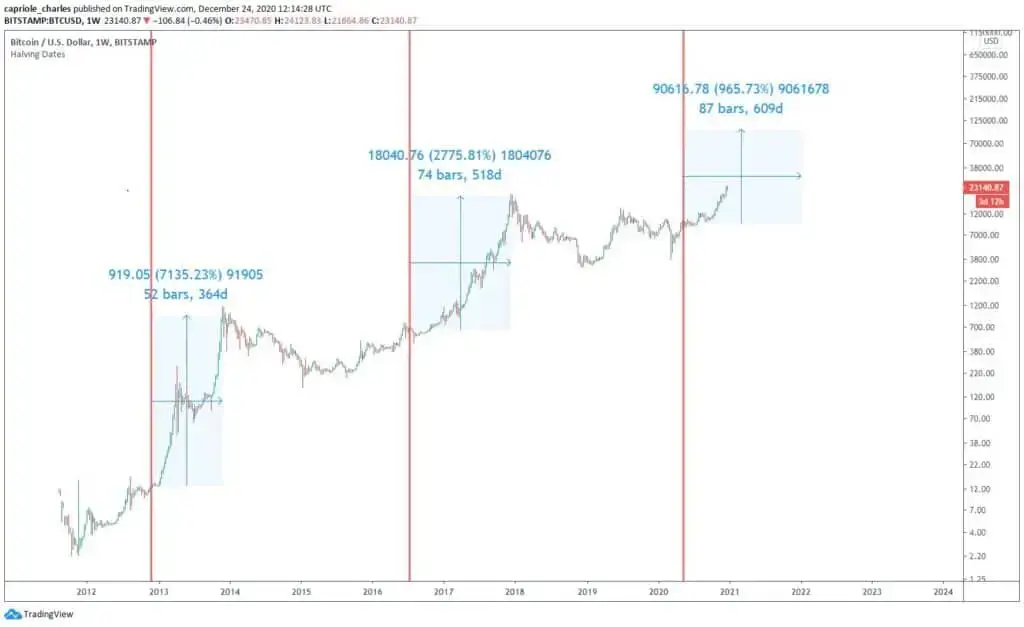

The 18 months following every halving has seen the most violent appreciations in Bitcoin’s price history. So far, the last 6 months have fit that bill perfectly. We go into 2021 with great confidence the next 12 months will be no different. The next year is very special. Make no mistake, this opportunity only occurs once every 4 years for Bitcoin.

We expect to see Bitcoin in the region of $100K-200K in 2021, and would be shocked if it doesn’t hit at least $50K. Even with a conservative assumption of diminishing returns and possible extending time horizons, the return potential for Bitcoin in 2021 is incredible. As with all predictions, it is applicable as of writing. We do not manage our investments based on such forecasts.

The Bottom-Line

The most important metrics we look at suggest a high probability of bullish continuation over the coming months. Major medium-long term fundamental metrics suggest a high probability of bullish continuation. High time-frame technicals also support bullish continuation. When both technicals and fundamentals align, conviction is compounded.

Some short-term metrics suggest a brief pull back may be due and if this occurs, would likely represent a great buying opportunity in the region of $19-21K. But don’t count on it.

The cat is out of the bag. Institutions are flooding into Bitcoin at an unimaginable pace. This is highly likely to continue into 2021 as the opportunity cost for slower traditional funds is too great to ignore now. It’s incredible how the institutional media narratives and fiat hyper inflation is all aligning with the highest returning period in the Bitcoin four year cycle, 2021.

Buckle up and get ready for an incredible year.

Content we love

- The Investors Podcast Bitcoin Common Misconceptions w/ Robert Breedlove

- Unknown Market Wizards Book by Jack D. Schwager a great addition to perhaps the best series of books on trading and investing

- Su Zhu’s predictions for 2021 https://twitter.com/zhusu/status/1341877256696647680

Newsletter Disclaimer

The information contained in this newsletter post is provided to you solely for informational purposes only, and is not to be shared, distributed or otherwise used for any other purpose without direct reference to Capriole Investments Limited or link back to this post.

This newsletter post is provided for education and discussion purposes only and does not constitute an offering. Opinions and projections included in this newsletter are provided as of the date of publication, may prove to be inaccurate, and are subject to change without notice. Prospective investors should not treat these materials as advice regarding legal, tax, or investment matters. No recommendations are made to invest in Capriole Investments Limited nor any other investment. An offering may be made only by delivery of a confidential offering memorandum to appropriate investors. Past performance is no guarantee of future results. Additional information about the Capriole Investments Limited and its performance is available upon request.