Welcome to the first issue of the Capriole Newsletter!

What to expect

This newsletter provides our airplane view of the Bitcoin market. It summarises our medium- to long-term expectations for the market. It is not intended for high frequency trading.

This will be a periodic newsletter. We expect to release it roughly monthly, but we are not going to set a fixed timeframe. Why? Because the market doesn’t work on a fixed timeframe and neither do the insights we draw from it. Sometimes we find key insights and identify changing market dynamics every week, sometimes there’s nothing for weeks. So, we anticipate a monthly release, but the timing within each month may be modified based on what we are seeing in the markets. If we see a strong opportunity, we may release the newsletter earlier.

We hope that this newsletter provides you a bit of insight into our thought process, helps clarify your picture of where Bitcoin is today and supports your journey through the cryptospace!

We welcome any thoughts and feedback you have, as we are doing this for you! Feel free to get in touch with us at any time.

The News

Election season is well underway, and the US market continues to drive global markets. As we have also seen more clearly in 2020, it also has a big impact on Bitcoin. A number of concerning news events have unfolded over the last few weeks, but the fact that Bitcoin remains above 10500 (as of writing) is a sign of strength:

- Kucoin hack

- BitMEX lawsuit and arrest

- Trump Corona episode

- Trump Claiming no new stimulus until after the election

These actions had negative impacts on the Bitcoin price but were somewhat more muted than a long-time Bitcoiner might expect. Particularly given the historic size of BitMEX and its impact on the market. While the impacts may not be over yet, this early response is a clear sign of strength from Bitcoin.

Why has Bitcoin held so strong?

The Markets

Market correlations with gold and stocks remain high. Suggesting Bitcoin will continue to be sensitive to both, we see the best evidence of this on major news events, such as when Trump tweets about Corona or stimulus (example).

With elections coming up, anything could happen from here in the stock market. Our base expectation is Trump will do everything he can to keep markets at elevated levels, at least through elections. Nonetheless, he has recently tweeted “no stimulus” until after elections. There is a good chance this is just pre-election game theory. It seems unlikely, he would let his best election asset (the stock market highs) go to waste.

“robust action is immediately needed to avert economic catastrophe from the devastation of the coronavirus pandemic.”

It is probable that under a Trump administration and with the Fed, stimulus will be the standard to keep the stock market afloat and stave off “economic collapse”… as long as possible.

Should Biden win the election, he has made clear that company taxes will be raised from 21% to 28%. While this may or may not be good for the US economy in the long run, a 30% increase to the tax bill will undoubtedly have a “tightening” effect in the short-term. In an economy with ~10% unemployment, recession and all major indicators suggesting “depression” – this would not be good for stocks. We have also seen how the stock market responds negatively to Trump being unwell, and positively to his “recovery”. So in the short term, a Biden win may cause more volatility and potential short-term downside for stocks, and Bitcoin. Nonetheless, the potential negative tax implications could also be offset by stimulatory Fed action.

That said, it is not unusual for this kind of pre-election volatility in stock markets. Following election determination clearer trends often emerge. There are very limited data points for Bitcoin, but post-election “clarity” has historically been positive.

The key level to watch for stocks is 3200 block on S&P500 (see below). As long as we remain above this level, it is unlikely for Bitcoin to spend much time below $10K based on recent responses to this level, correlations and the Fundamentals below.

https://www.tradingview.com/x/NFogeXLK

The Fundamental

Bitcoin remains “dirt cheap” when assessing almost all fundamental metrics today:

- Energy Value ~30% higher than market price and growing. Bitcoin is more valuable than ever before.

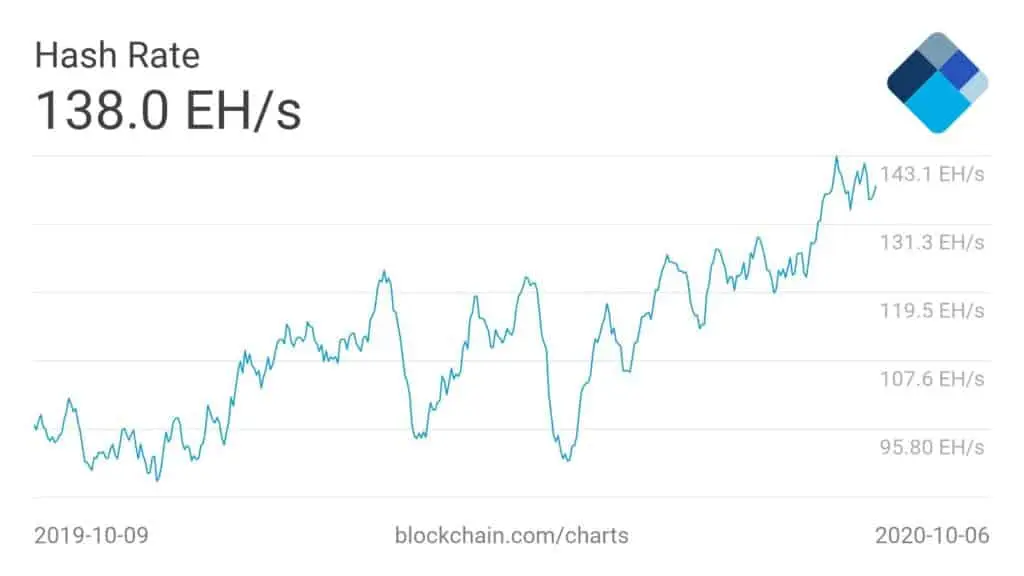

- Hash Rates at all time highs. The network is stronger than ever before.

- Hash Ribbon buy signal in July. The best long term Bitcoin buy signal.

- Price is at Production Cost. A historically good buy zone.

- Tether and USD stable coin market caps at all time highs and growing. Historically Bitcoin has followed major moves in Tether.

- Dynamic NTV is below the mean, suggesting the Bitcoin “PE ratio” is trading cheaply.

Other Considerations:

- Price in the middle of the Power Law Fair value corridor. Suggesting some direction uncertainty.

- Daily Active Addresses recently achieved its highest level since 2017 peak but has since been falling.

Bitcoin Hash Rate has been pushing all-time highs

https://www.tradingview.com/x/NFogeXLK

The Technicals

High Time Frame

High time frame monthly levels continue to look excellent. Price is holding above the key order block and wedge line. This is a normal retest process. Given the monthly time frames, it could take a few months to play out.

Low Time Frame

On the lower timeframe, the picture is more mixed.

We have failed to stay above the key Monthly level at 10761 a number of times now and while we are below it, should be cautious. While the higher timeframes are typically more influential in determining future direction, don’t forget that any downside or trend changes will first appear on the lower time frames.

On the bullish side, futures sentiment is skewed negatively, suggesting a potential bottoming or limited downside in the current move from 12K to 10K. This picture can change quickly. For now, it suggests there is little interest from the market in moving lower.

We are clearly in a period of ranging chop on the lower timeframes. The market is waiting for a breakout decision. The longer we consolidate, the greater the likelihood of a bigger breakout move. The question then naturally become which way will the breakout move be?

Given futures sentiment remains low and negative, and because of the above Fundamental and Technical factors, our bias is to the upside.

https://www.tradingview.com/x/VHCVOxqB

The Bottom-Line

The strong tie to stocks and political events looks likely to continue for the time being as we go into election season. Pending a stock market crash (eg. daily closes below 3200 on S&P), the Fundamentals and Technicals of Bitcoin suggest we have likely seen most if not all of the downside for Bitcoin. Any potential dips below $10,000 would likely be short lived under the current Fundamentals.

The big picture remains incredibly bullish for Bitcoin.

Content we love

A selection of our favorite articles and tweets on Bitcoin and economics:

- Overview of current macro cycle and impact of stimulus on markets by Bitcoin Jack: https://twitter.com/BTC_JackSparrow/status/1313661898504769537

- Analysis of new addresses and a possible change in China’s attitude towards Bitcoin by Cole Garner: https://twitter.com/ColeGarnerBTC/status/1313241882697359362

- An oldie but a goodie. A history of Bitcoin valuation models: https://medium.com/@adamant_capital/a-primer-on-bitcoin-investor-sentiment-and-changes-in-saving-behavior-a5fb70109d32