Welcome to Capriole’s Update #47. Where we consolidate the most important Bitcoin news, technicals and fundamentals into a 3-minute update.

Market Summary

Massive ETF flows continued to drive Bitcoin up over the last month. Digital asset investment products saw the second largest weekly inflows on record totalling US$1.84bn last week.

This wave of money saw Bitcoin scream 50% higher in the last month, but is the rally sustainable?

Technicals

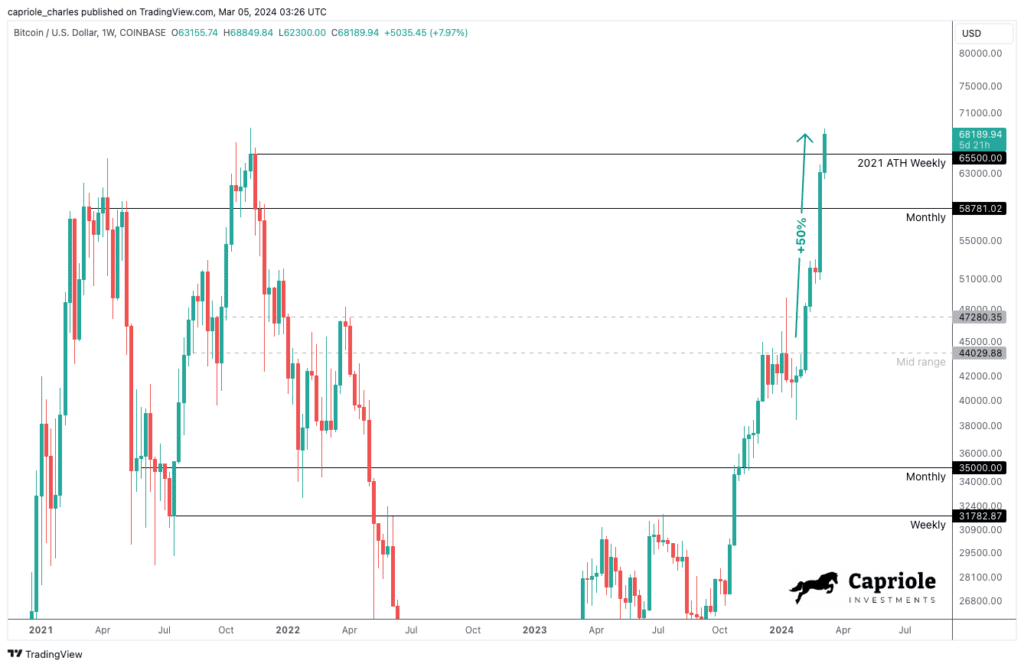

With no sign of a pullback, Bitcoin rallied 50% from our last Update where we anticipated a swift move to range highs. That move is now complete. As of writing, Bitcoin has had a strong daily close above all meaningful resistance levels (Weekly and Monthly levels marked). Technically this is very bullish and suggestive of new price discovery higher. However, we are at the cusp of setting new all time highs ($69000+), which tends to have powerful psychological implications.

It would not be surprising to see a liquidity grab at / into all time highs. That would be a natural point for price to consolidate from (the typical zig-zag structure of a Wyckoff “SOS” at range-highs).

All consolidation above Monthly level at $56K is extremely bullish. It would be uncommon (but not impossible) for price to continue in a straight line up from here. The more likely scenario is volatility and one or more retests of support (56-66K) before continuation. This could happen quickly or we could be here for a couple of months.

In short: technically bullish, but we are currently in a region of expected volatility and consolidation (unlike last Update).

Fundamentals

Fundamentals and on-chain data help us understand which way the probabilities are skewed at important inflections, and were critical to our navigation of this cycle and identification of the bottom at $16K.

We believe the full picture of fundamentals is best summarized by Capriole’s Bitcoin Macro Index, which we publish live with weekly updates here. This Index includes over 50 of the most powerful Bitcoin on-chain, macro market and equities metrics combined into a single machine learning model. This is a pure fundamentals-only value investing approach to Bitcoin. Price isn’t an input.

Bitcoin Fundamentals continue a hell bent rally at the fastest on-chain growth rates we have seen in years. This is very bullish and supports sustained higher prices for Bitcoin going forward. It is clear that the Bitcoin ETFs unlocked fresh demand and so far this demand has broadly been trending up and is reflecting in on-chain growth across a variety of metrics. Today the fundamentals tell us that any price dips are cyclical buying opportunities.

Chart Of The Week

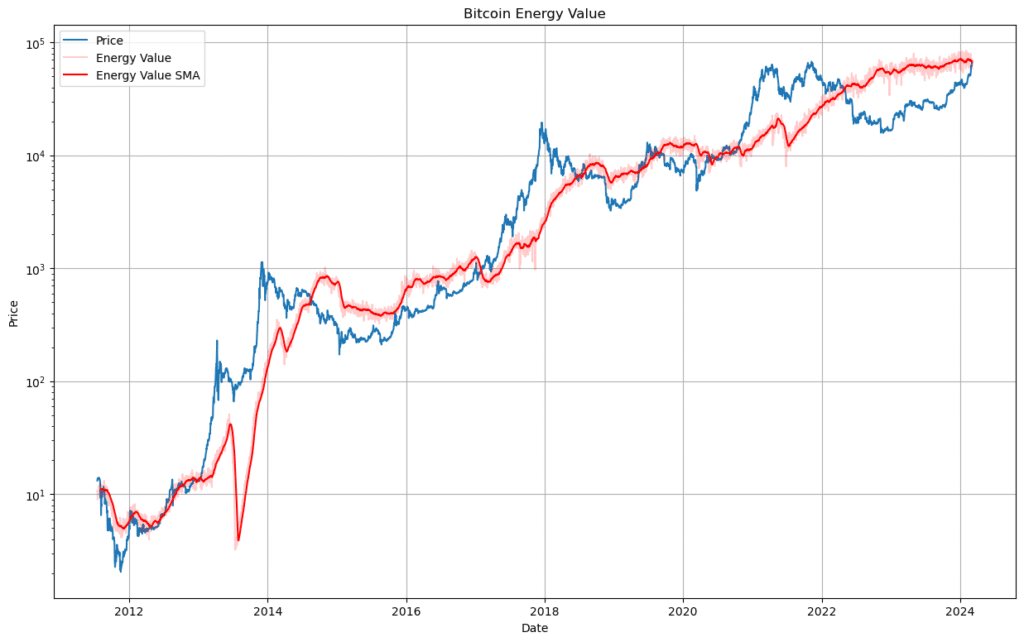

Introducing Bitcoin Energy Value, live with daily updates for the first time, at Capriole.com/charts.

We released Bitcoin Energy Value in late 2019, it is a simple and elegant (if I dare say so) measure for Bitcoin’s intrinsic value that considers only the raw Joules of energy used to mine Bitcoin. The formula is simply energy-in (Joules) * fixed fiat_factor. No exponentials, no power laws, no funky formulas. Very straightforward. We can also measure it quite precisely as all the inputs are quantifiable. Bitcoin Energy Value’s exceptional tracking of the mean price of Bitcoin through history demonstrates that Bitcoin is indeed Henry Ford’s energy standard. You can read more here:

- The Energy Standard (lighter reading), and

- Bitcoin Energy-Value Equivalence (the math)

In publishing this metric live, the only change we have made to the original formula is to index by global energy price inflation since publication in December 2019 (due to the massive inflation we saw in 2020/2021). To do so, we simply used the year-on-year change in the Federal Reserve’s Global Price of Energy Index.

Capriole has collated over 200 Bitcoin mining machines’ details to generate an accurate measure for Bitcoin mining energy efficiency. We maintains the full history of Bitcoin mining hardware, reviewed and updated daily here.

Bitcoin Energy Value is at $69,600 today, making Bitcoin fairly valued for the first time in 2 years. The era of deep value Bitcoin is over. However, as you can see in prior cycles, it is not uncommon for Bitcoin to extend far beyond fair value in the Halving year.

The Bottom Line

A promising daily technical breakout, exceptional growth in on-chain fundamentals and good ETF flows suggest Bitcoin is just warming up for 2024. Nonetheless, at all time highs we would typically expect to see higher volatility here and at least some consolidation in the $60-70K region, before a major breakout trend forms. If such a major breakout does occur before the Halving, it will likely be on the back of strong ETF inflows and perhaps some major announcements.

Pending a daily (or better, weekly) confirmation above all time high ($69K), it would be wise to exercise some caution.

Charles Edwards

3 Responses

HI Charles, if I have 25% cash sidelined in my crypto portfolio, what would be a good price level or support retest level to fully deploy my remaining cash available to BTC?

Hi Billy, unfortunately I can’t give advice like this. I will have a big Bitcoin on-chain thread posted later today on X.com which will give a bit of an idea where I think we are in the cycle and my thoughts on risk/opportunity, but you will need to do the analysis and make this investment decision.

Thank you Charles!