Guardian On-chain Risk Manager

Capriole’s Guardian Risk Manager tracks on-chain exchange risk 24/7. Here’s how it works and how you can use it.

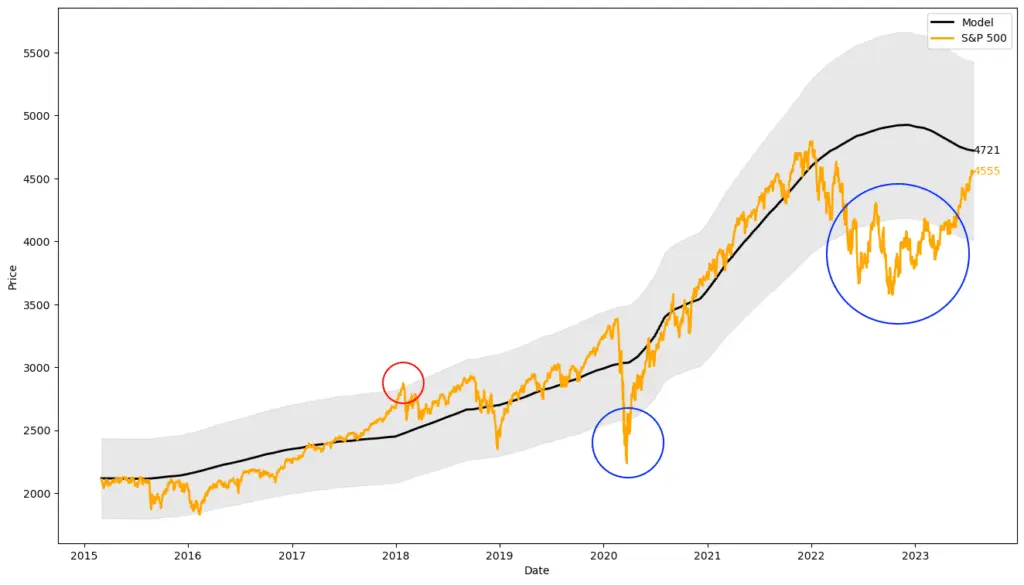

The Three Factor Model

90% of the S&P500 returns over the last half century can be explained by a simple three factor macroeconomic model. GDP, money supply and interest rates.

Why markets are not as overvalued as you might think.

And why the Shiller PE Ratio is broken. Look back metrics for valuing markets say that the stock market is overvalued. But there is a big problem with lagging metrics like Shiller PE (the CAPE Ratio), the growth rate of company earnings has quadrupled over the last three decades. If we allow for the fact earnings […]

Bitcoin Miner Sell Pressure

A new on-chain metric to track when Bitcoin miners are selling more of their reserves than usual. A common leading indicator of capitulations. [Originally published on Twitter here: https://twitter.com/caprioleio/status/1591024605640019968] Introducing: Bitcoin Miner Sell Pressure. A free, open-source indicator which tracks on-chain data to highlight when Bitcoin miners are selling more of their reserves than usual. […]

The Bitcoin Yardstick

A rule-of-thumb Bitcoin valuation tool. [Originally posted as a Twitter thread here: https://twitter.com/caprioleio/status/1587737939588616192] Today we are seeing valuations unheard of since Bitcoin was $4K. Introducing a very simple, rule-of-thumb Bitcoin valuation tool: Bitcoin Yardstick = market-cap / hash-rate, normalized over 2 years of data. Similar in concept to a “PE Ratio”, except instead of stock […]

Everything you need to know about yield curves

An analysis of 150-years of yield curve inversions and why they are a great forecasting tool. In this article we will cover: What on earth is a yield curve? Yield curve inversions have preceded every recession since 1956. You should understand them. The information in a yield curve is invaluable to the long-term investor. A […]

SLRV Ribbons

Introducing a Bitcoin strategy which uses on-chain investor flows to outperform Bitcoin. Introduction In issue 23 of the Capriole Newsletter we introduced a new Bitcoin on-chain metric, SLRV Ribbons. This article dissects this strategy and shows the benefits of on-chain analysis for Bitcoin investing. Based on backtests over the past 5 years, a simply long-or-cash portfolio using […]

The Digital Asset Thesis

A birds-eye view at Bitcoin and digital assets in 10 charts A Birds-eye View It’s easy to miss the forest for the trees when considering crypto. It’s too volatile, it’s too risky, it’s speculative. This article takes an aerial view of Bitcoin and digital assets. It’s a combination of historical performance facts we find convincing […]

The Capriole Macro Index

An introduction to Capriole’s autonomous, fundamentals only, Bitcoin trading strategy which analyzes over 35 on-chain and macro market data points Capriole Investments is a quantitative asset manager. While we gain a lot of insight and learnings from visual charts and individual metrics, at the end of the day our assets are managed by automated algorithms which […]

A Simple Metric to Identify Bitcoin Tops

Introducing: Supply Delta Identifying how strong and weak hands accumulate and distribute their Bitcoin provides a good leading indicator for identifying price tops and risk regions. In this article we introduce a simple metric “Supply Delta” which helps highlight when risk of a price top is locally high and may warrant tighter risk management. Supply […]