Everything you need to know about yield curves

An analysis of 150-years of yield curve inversions and why they are a great forecasting tool. In this article we will cover: What on earth is a yield curve? Yield curve inversions have preceded every recession since 1956. You should understand them. The information in a yield curve is invaluable to the long-term investor. A […]

SLRV Ribbons

Introducing a Bitcoin strategy which uses on-chain investor flows to outperform Bitcoin. Introduction In issue 23 of the Capriole Newsletter we introduced a new Bitcoin on-chain metric, SLRV Ribbons. This article dissects this strategy and shows the benefits of on-chain analysis for Bitcoin investing. Based on backtests over the past 5 years, a simply long-or-cash portfolio using […]

The Digital Asset Thesis

A birds-eye view at Bitcoin and digital assets in 10 charts A Birds-eye View It’s easy to miss the forest for the trees when considering crypto. It’s too volatile, it’s too risky, it’s speculative. This article takes an aerial view of Bitcoin and digital assets. It’s a combination of historical performance facts we find convincing […]

The Capriole Macro Index

An introduction to Capriole’s autonomous, fundamentals only, Bitcoin trading strategy which analyzes over 35 on-chain and macro market data points Capriole Investments is a quantitative asset manager. While we gain a lot of insight and learnings from visual charts and individual metrics, at the end of the day our assets are managed by automated algorithms which […]

A Simple Metric to Identify Bitcoin Tops

Introducing: Supply Delta Identifying how strong and weak hands accumulate and distribute their Bitcoin provides a good leading indicator for identifying price tops and risk regions. In this article we introduce a simple metric “Supply Delta” which helps highlight when risk of a price top is locally high and may warrant tighter risk management. Supply […]

What is Money?

The economic fundamentals you need to know to preserve your wealth. Take-aways The missing link A critical piece of information is missing from our education system. A clear definition of money. When we graduate, we are expected to go into the world and work to grow money for our employer, money for our economy and […]

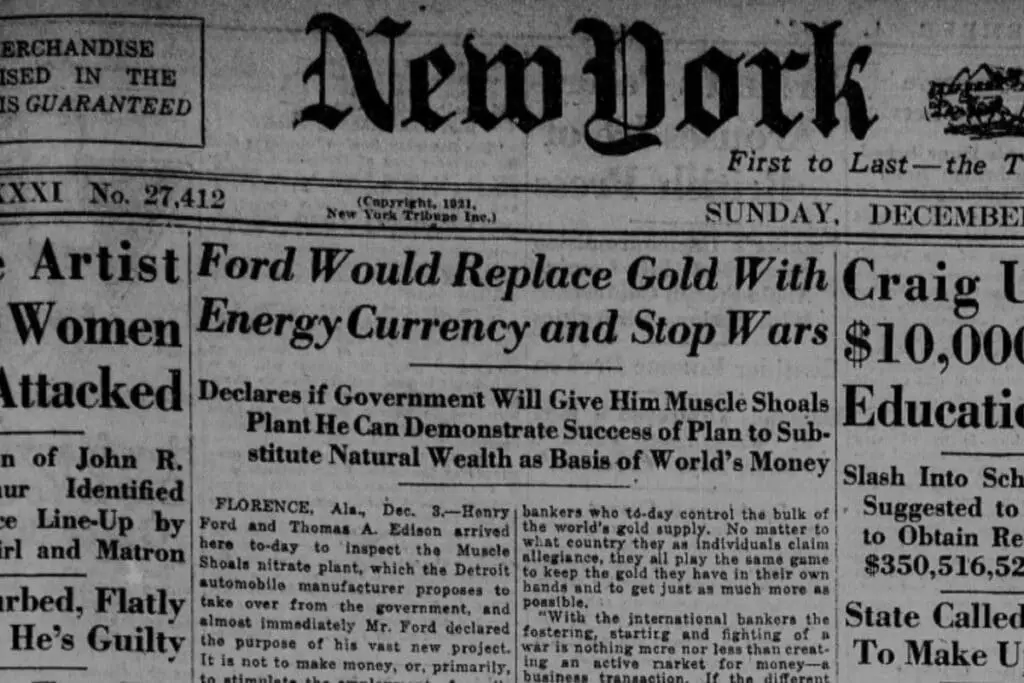

The Energy Standard

Bitcoin is Henry Ford’s Energy Currency Ford’s Energy Currency 99 years ago, Henry Ford, one of the greatest businessmen of all time, planned the development of an “Energy Currency” to replace gold. Ford’s goal was to end wars which he argued were centered around the control of money: “The essential evil of gold in its […]

Bitcoin Energy-Value Equivalence

The Intrinsic Value of Bitcoin as Determined by Energy Spent Take-aways Bitcoin Energy-Value Equivalence In Bitcoin’s Production Cost we observed the relationship between Bitcoin’s Price and Bitcoin Mining expenditure. Variations in Bitcoin’s Production Cost were found to be primarily driven by the level of electrical energy input and energy efficiency of mining hardware, with many other factors […]

Bitcoin’s Production Cost

An Estimate of Bitcoin’s Production and Electrical Cost — a Historic Floor in Bitcoin’s Price. Takeaways This article links Bitcoin’s electrical consumption to the cost of Bitcoin production. In doing so we gain insight into the historical profitability of Bitcoin mining and an indication to when Bitcoin mining businesses are struggling. Over the last 5 […]

Hash Ribbons & Bitcoin Bottoms

[EDIT 13 April 2023: Originally published on Medium in 2019, Hash Ribbons is perhaps the best performing long-term buy signal for Bitcoin. Hash Ribbons uses on-chain data to identify miner capitulations and recoveries. It is a top 50 / 100,000+ scripts on TradingView. Live indicator also on Glassnode.] When miners give up, it is possibly the […]