Update #63

Saddle up and welcome to the hard asset era. Is Gold on the cusp of outperforming equities by 500%? What would that mean for Bitcoin?

Update #62

A tide change has just occured. A new Triple Put has emerged to backstop financial markets and Bitcoin has broken out. Here’s what the data is telling us…

Update #61

Both Bitcoin technicals and fundamentals remain in a downtrend. Will the Federal Reserve’s recent policy change see risk asset liquidity bounce back?

Update #60

In the near term, Bitcoin is at a pivot point. On-chain data looks poor, but the market is already positioned accordingly. The herd is rarely correct. We’re in Trump’s hands now…

Update #59

The Trump presidency has kickstarted a wave of speculation about a possible Bitcoin Strategic Reserve. While the depth of it remains uncertain, recent and rapid fire news suggests a growing likelihood of something tangible brewing…

Update #58

With Bitcoin in a peak performing quarter of its peak performing cycle year; will equities and macro support a strong risk-on market in 2025?

Update #57

Slashing deregulation, tariffs, and a hawkish Fed? Here’s what it all means for markets and Bitcoin today and into 2025. Buckle up…

Update #56

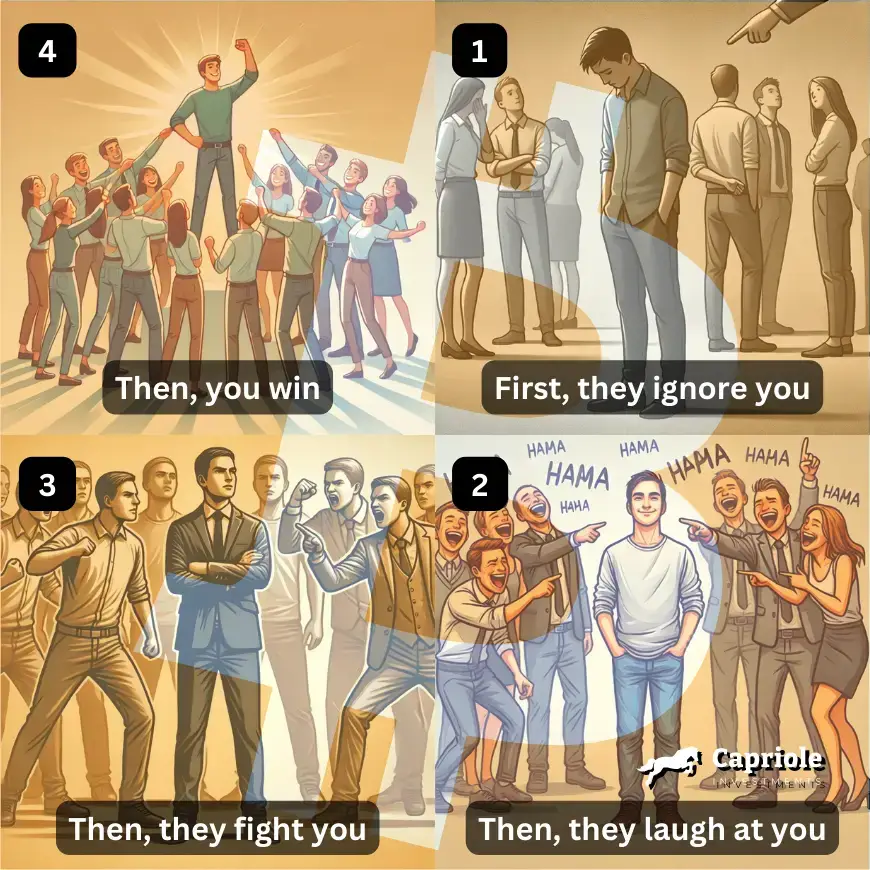

With a president who has already launched multiple NFTs and cryptocurrencies in the past, and has pledged to establish a US Bitcoin reserve. It’s starting to look increasingly likely that Bitcoin is entering the “then you win” phase…

Update #55

Is retail dead? This issue we explore a conundrum that faces Bitcoin today. An apparent lack of retail activity and a trust void that has plagued Bitcoin since FTX…

Update #54

Don’t trust on-chain data. A lot of metrics have been manipulated in 2024, but cutting through the noise we can see we are at a seasonally optimal juncture…